To ensure their competitiveness in the rapidly changing global marketplace, manufacturers in all regions are seeking ways to radically reduce their costs. Maintenance, repair, and operations (MRO) is a critical area. MRO spending, which includes expenditures for services and spare parts, ranges from 0.5% to 4.5% of revenues, depending on the industry. In all industries, poorly managed MRO processes can mean unnecessarily high costs, low plant and worker productivity, poor product quality, and elevated inventory-holding costs.

The savings potential from optimizing MRO spending and planning is—in most cases—significant. For example, a large steel manufacturer reduced its MRO spending by approximately 10% and its transaction volume by approximately 25%. The manufacturer’s initiatives included better planning for spare-part purchases, expanding the scope of individual contracts, buying from aggregators, and sourcing from low-cost countries (LCCs). A pharmaceutical manufacturer reduced the idle time associated with breakdowns through more aggressive spare-part inventory management. The better availability of spare parts promoted a 15% improvement in the throughput of the manufacturer’s bottlenecked equipment.

Why MRO Management Matters

Ineffective management of MRO processes hurts a company’s performance in four interrelated ways.

High Maintenance Costs. Although the parts and services used in MRO processes may seem peripheral to a company’s operations, the associated costs are far from trivial. MRO spending by manufacturing companies worldwide totals more than

$30 billion per year. Heavy-manufacturing industries, such as infrastructure and mining, report the highest MRO spending as a percentage of revenues.

Each of three broad categories of MRO purchasing can generate excessively high costs for a company that fails to manage them well:

- Proprietary. It is quite common for a company to purchase 40% to 70% of spare or replacement machine parts directly from OEMs or a single supplier that is the only known source. A manufacturer’s bargaining power is usually very limited in these exclusive contractual arrangements. Furthermore, reliance on a proprietary source increases the risk of supply disruptions resulting from, for example, geopolitical events or natural disasters.

- Nonproprietary. Many companies do not centrally manage their nonproprietary MRO spending to ensure the lowest costs. Some miss out on the benefits of aggregated purchasing: different plants use different suppliers for the same part, or they use the same supplier but do not bundle their purchases across plants and over time.Many miss chances to buy multiple parts from a single supplier.

- Long Tail. In addition to large proprietary and nonproprietary purchases, companies typically contract with hundreds of vendors to supply thousands of small-scale MRO products and services. Much of this unplanned purchasing—responses to unanticipated stockouts or immediate needs for services—means forfeiting the benefits of high-volume purchasing. The long tail of vendors was evident at one steel manufacturer, where we found that 20% of MRO spending was dispersed among more than 1,600 suppliers, while 80% was concentrated among some 250. It should be noted that some companies purposefully purchase small-scale MRO products and services from vendors near their plants. These companies are seeking to engage with the local communities as part of their social responsibility to create jobs. While such efforts are valuable, they should not be the determining factor for an MRO purchasing strategy.

Low Plant Productivity. Poor management of MRO spending results in the “hidden costs” of low productivity. Productivity is diminished when the unavailability of spare parts causes or prolongs equipment breakdowns in the production process. Companies that lack policies and processes that promote rigorous spare-part inventory management—especially of parts that are critical to production—run a high risk of productivity losses. A mature process for tracking equipment productivity, for example, is essential for tracing downtime back to stockouts of spare parts.

Excess Inventory. At many companies, parts pile up in warehouses long before they are needed. Excess inventories may be the result of not having a rigorous part-purchasing planning process that includes, for example, set stock levels that trigger reordering. In the absence of central coordination, a company’s multiple plants end up duplicating purchases of parts and creating unnecessary inventory stocks. Furthermore, many companies suffer from inadequate data management and IT systems, so they have trouble identifying the right parts to purchase and cannot optimize the quantity and timing of purchases. For example, plants may end up purchasing more than one item to fulfill the need for one specific part.

High Transaction Volume. Companies that fail to adequately consolidate purchases over time or across plants end up with a much higher than necessary volume of MRO transactions. Long-tail purchasing is especially harmful: a high number of unplanned, low-value transactions is typically responsible for a disproportionate share of managerial costs and complexity. For example, at one company, the long tail of more than 1,300 vendors, which accounted for 20% of MRO spending, was responsible for 45% of the company’s purchase orders.

Five Levers for Capturing the MRO Advantage

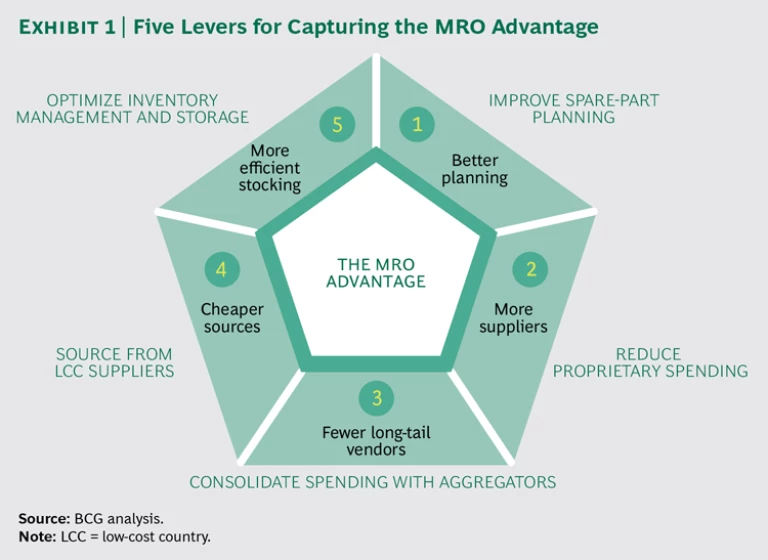

To capture the MRO advantage, manufacturers should apply a comprehensive approach: improve spare-part planning, reduce proprietary spending, consolidate spending with aggregators, source from LCC suppliers, and optimize inventory management and storage. (See Exhibit 1.)

Improve Spare-Part Planning

To consolidate effective purchasing, a company needs accurate estimates of its requirements for parts. These, in turn, allow it to seek volume discounts from suppliers and reduce the number of transactions. Demand estimates also help a company plan for the right levels of inventory and optimize its warehousing capacity. By segmenting demand for parts on the basis of predictability and considering the frequency of purchases and the variability of the quantities purchased, a company can clarify its requirements.

On the basis of demand predictability, a company can apply two distinct planning approaches for purchases of parts:

- High Predictability. Analytic modeling helps determine the future requirements for parts for which demand is highly predictable. The goal is to establish an automated purchasing system for these items, eliminating the need for human intervention. Enterprise-resource-planning (ERP) IT systems can be configured to automatically determine each item’s required safety stocks, the trigger points for reordering, and the lead time required for delivery.

- Low Predictability. An annual planning exercise that links consumption of parts to maintenance tasks helps estimate requirements for low-predictability items. This exercise entails a detailed, bottom-up assessment of the spare parts required to support maintenance teams during scheduled plant shutdowns, routine preventive maintenance, and repairs in the event of a breakdown. Schedules for planned maintenance should include a detailed list of the tasks to be completed for every machine. The goal is to translate each list of maintenance tasks into a list of the parts required to support the maintenance program.

Reduce Proprietary Spending

Most companies can reduce addressable proprietary spending by 5% to 20%. To free itself from OEM dependency for replacement parts, a company should identify component manufacturers that produce either the OEM’s parts or acceptable substitutes. Of course, if an OEM is the exclusive manufacturer of a part, this is not a possibility. In some cases, however, the company is simply unaware of the alternatives, and it just needs to find them. Once the company has identified and qualified alternative suppliers, it can explore options for better deals. (A company should ask its legal counsel to review any plans to purchase an OEM’s parts from an alternative supplier. The company’s contract with the OEM may prohibit the company from purchasing parts from other vendors.)

Better specification management can also help a company extricate itself from proprietary sourcing relationships. By requiring OEMs to provide detailed drawings and specifications as part of its purchasing process, a company can expand its options: it can fabricate parts in-house or source them from a third party. A company should be wary of specifications that require particular brands or part numbers. If it is possible to use other brands or substitute parts, the company can consider a broader set of supplier options.

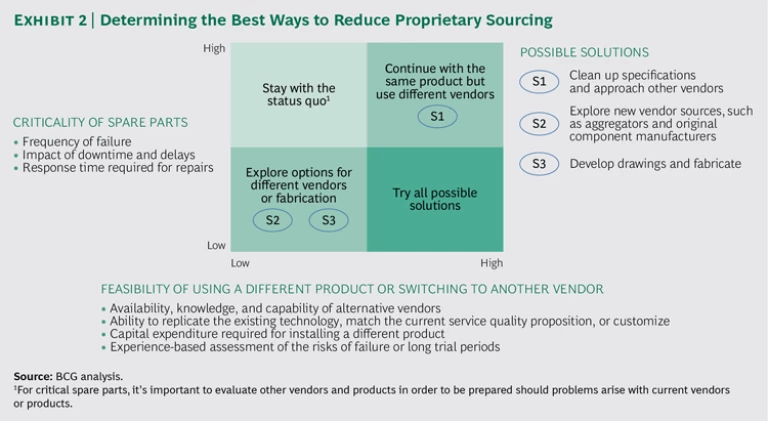

To determine whether a part that the company currently purchases from an OEM or a single-source supplier is a good candidate for an alternative sourcing arrangement, the company should consider the part’s criticality and the feasibility of switching suppliers. (See Exhibit 2.) For parts with high criticality and low feasibility of switching, the company should maintain the proprietary-sourcing arrangement. For all other parts, it should explore alternative-sourcing options.

In addition, as part of its procurement process associated with a capital project, a company can implement a set of measures that will preempt the need for proprietary sourcing. To avoid having to purchase new types or brands of parts, a company should require OEMs to use parts that are already in its installed base. Furthermore, the company can ask OEMs to provide detailed bills of materials so that it can determine whether or not standard parts can be used in place of specially fabricated parts and identify parts that can be sourced from component manufacturers.

Consolidate Spending with Aggregators

If a company consolidates purchases and reduces transaction volume by using aggregators, it can cut incremental costs in the MRO supply chain by 2% to 10%. Leading aggregators, which have operational advantages that enable them to secure lower prices and better delivery terms from global OEMs and suppliers, operate on a worldwide scale, deploy best-in-class procurement processes and management capabilities, maintain high-quality supply chains, and invest in productivity improvements, such as IT capabilities and local stocking. The best aggregators also serve as one-stop shops for a variety of brands, and they have flexible supply chains that can serve multiple plants with just-in-time deliveries. Some aggregators take on responsibility for the procurement and management of specific MRO categories that entail significant long-tail spending.

Senior-level commitment is an essential aspect of a successful transition to aggregators. The company must be willing to invest time to set up a new delivery infrastructure and commit to a minimum purchase volume. In addition, it will have to overcome resistance from its current long-tail suppliers that will resent losing its business.

It is important to avoid dependence on an individual aggregator for a specific category. To leave itself options, a company should develop a panel of qualified aggregators that cover all long-tail-spending categories, and it should require these aggregators to submit competitive bids. In its contracts with aggregators, the company should set out KPIs—such as the percentage of price discounts the aggregator passes on from its suppliers each year and the percentage of on-schedule deliveries. The company should review each aggregator’s performance on the basis of these KPIs and consider its performance in evaluating bids for business.

Source from LCC Suppliers

The well-known benefits of sourcing from LCCs include reducing costs and mitigating supply chain risks that may arise from geopolitical issues or natural disasters. A company typically expands its LCC sourcing in waves, starting with direct materials and moving down the value chain eventually to reach MRO categories. To address the distinctive aspects of MRO sourcing, a company should consider the following:

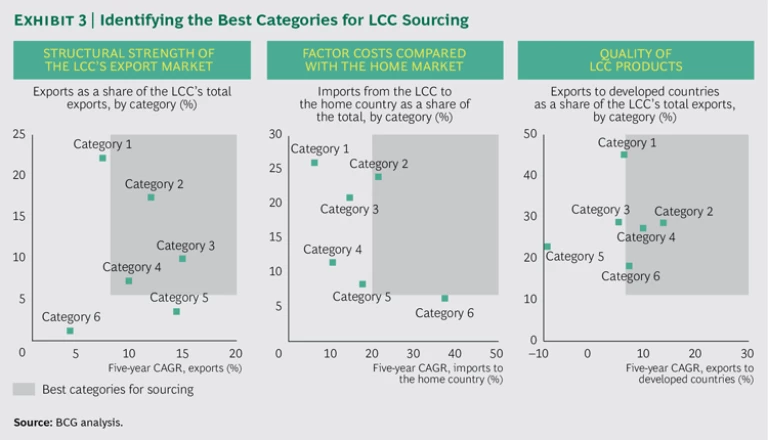

- Categories. A company should not assume that LCC sourcing is more advantageous for all MRO categories. In addition to cost, for each category, the company should consider, for example, the structural strength of the LCC’s export market (as measured by the growth rate of exports), factor costs compared with the home market (as measured by the growth rate of imports from the LCC), and the quality of parts produced in the LCC (as measured by the growth rate of exports to developed countries). (See Exhibit 3.) A company should create a short list of categories for which LCC sourcing is most favorable and then reach out to suppliers in LCCs to explore opportunities.

- Suppliers. Supplier selection should be based on a structured prequalification process. A company should evaluate potential suppliers’ R&D, logistics, and project management capabilities and conduct detailed quality audits.

- Quality. A company should not sacrifice quality in its pursuit of low sourcing costs. It should have comprehensive quality assurance (QA) and quality control (QC) processes that cover each supplier’s entire value chain and manufacturing process. Moreover, QA and QC processes should be designed specifically for each MRO category.

Getting Started

To assess its starting point for a program to improve MRO process management, a company should answer the following sets of questions:

- Planning for Parts. Do we understand the demand patterns for our spare parts? To what extent have we automated the procurement process for parts for which there is highly predictable demand? Have we identified the specific parts required for recurring maintenance processes?

- Reducing Proprietary Spending. Have we reviewed each of our proprietary sourcing relationships to determine whether alternative sourcing options exist? Do we rely on branded parts or specific part numbers even if generic options are available? Have we taken steps to reduce our total costs for capital equipment?

- Using Aggregators. Have we assessed the options for consolidating our long-tail purchasing with aggregators? To what extent would using aggregators allow us to reduce spending for parts and transaction volume, as well as improve quality and avoid stockouts?

- Sourcing from LCC Suppliers. In assessing which MRO categories to source from LCC suppliers, do we consider factors other than cost, such as supply chain complexity and the quality of the parts? Do we apply a rigorous selection process for LCC suppliers? Do we apply our QA and QC processes to each supplier’s entire value chain?

- Optimizing Inventory Management. Are we stocking the right spare parts at the right locations and in the right quantities? Can we identify and reduce inventory levels of slow-moving spare parts that are not critical to production? What is the right spare-part warehousing model given our plants’ infrastructure constraints and consumption patterns?

For many companies, the answers to these questions will point to opportunities to realize significant improvements in cost control and productivity through a more rigorous approach to MRO management. As cost structures for manufacturing operations continue to change rapidly and in all regions, the first wave of companies to capture the MRO advantage will be rewarded with an important competitive edge.

Acknowledgments

The authors thank Rangarajan V and Vijuraj Eranazhath for their insights and support.