Imagine a digital currency that is as easy to share as an Instagram story, or an e-payments platform as ubiquitous as smartphones. Would bank accounts become obsolete? Would monetary policy matter? These futuristic questions have become more salient as the number of digital coins and tokens grows. When these experimental constructs move from the sandbox to the high street, the ramifications—good and bad—will be profound.

Digital currencies, issued and maintained using blockchain and distributed digital ledgers, could overturn how individuals and organizations transact value, eliminating the need for costly payments intermediaries, ensuring greater price stability, and reducing counterparty risk. A digital dollar, euro, or other digital tender could democratize access to financial systems, allowing “unbanked” populations in poor or remote regions to buy, sell, save, and invest more easily than before.

Not all digital currencies are created equal, however. Some digital coins and tokens are likely to deliver only modest improvements to existing payments models, but others could challenge financial systems at their core. The commercial impacts can also vary, with some coins aimed at improving efficiency within a closed system and others aimed at gaining competitive advantage more broadly. The design of a currency and the ripple effects it may cause in society have bearing on its potential value and the risks it might pose for users and those charged with governing its use. For example, since digital currencies are often capped, liquidity risks could rise if there was no ability to mint additional coins.

Although questions remain, the first-mover advantage is likely to be significant. Should a major country, central bank, or consortium accelerate the launch and adoption of a particular currency, other countries and stakeholders would be pressed to follow with a strategic response of their own. While there is no single answer for all organizations, one thing is clear: public and private sector leaders need to begin planning now for the future of money.

An Emerging Digital Gold Rush

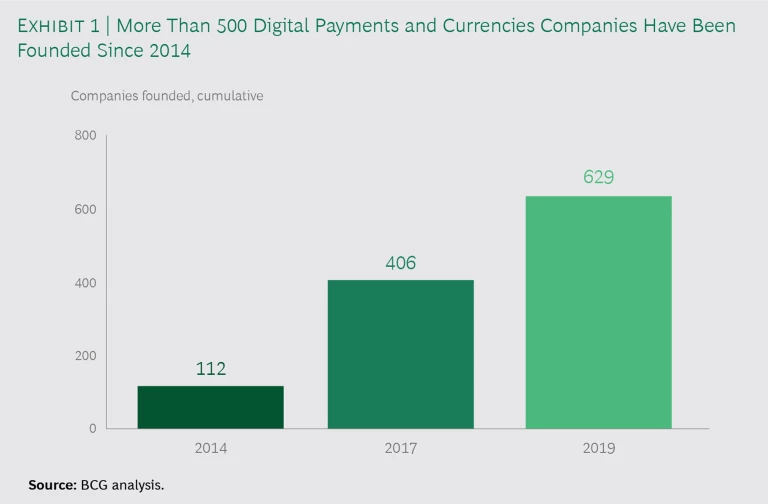

For years, digital currencies such as bitcoin were considered the preserve of black-market traders operating in the shadows of the dark web. Not anymore. Facebook’s planned launch of Libra is just the latest in a string of digital currency initiatives to be released by different businesses, banks, and consortia. (See Exhibit 1.) Far from eyeing digital currencies with skepticism, governments and central banks have also entered the arena, with many planning to introduce their own digital coins and tokens.

Governments and central banks have entered the arena, with many planning to introduce their own digital coins and tokens.

The spike in interest comes as the underlying technologies mature and the potential of digital currencies to ease lingering payments pain points becomes more apparent. Current payments models can be inefficient. Right now, for instance, payments can take days to clear because of complicated national and international gross settlement mechanisms. They can also be exclusionary. Small and midsize businesses often pay significantly higher fees than larger entities because pricing is generally based on volume. Individuals and institutions in emerging markets can also have a harder time accessing international payments networks because of difficulties satisfying traditional requirements, such as having a bank account or a well-documented credit history. Likewise, guest workers often face high costs when transferring money to families in their home countries.

Digital currencies could help address some of these issues. Distributed ledger technologies such as blockchain prevent data from being altered and enable payments to be authenticated. Transactions can be settled in near real time and stakeholders can view the entire transaction trail. These capabilities mean that blockchain-based currencies have the potential to displace intermediaries, such as brokers, settlement agencies, and notaries, that provide independent third-party verification. Blockchain could also minimize the need for market arbitrageurs, price-reporting agencies, benchmark providers, and others whose businesses create value by capitalizing on information asymmetry.

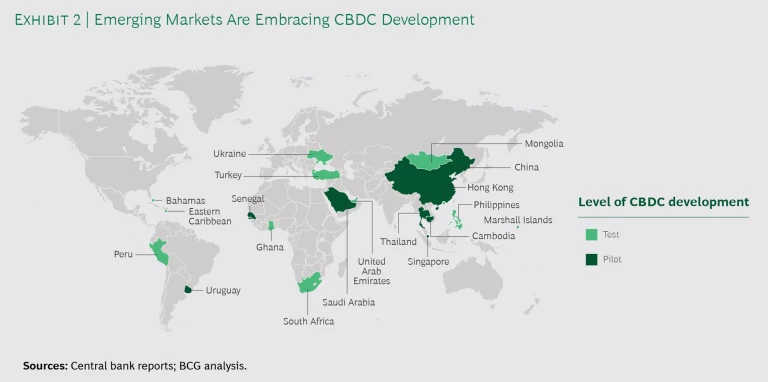

Banks and other financial institutions have been drawn to the efficiency of digital cash because physical tender is expensive to move, store, and dispense. Businesses and governments are also excited about the potential for digital currencies to increase economic inclusion and reduce financial crimes. The World Bank estimated in 2018 that 1.7 billion adults remained unbanked, an issue exacerbated by the limited reach of physical banking infrastructure around the world. Digital ledger technologies could help bring people into the financial system. Although regulatory standards would need to be updated to include this capability, blockchain could allow client onboarding and know-your-customer documentation to be completed on a peer-to-peer basis, without need of a formal banking arrangement. Countries could use digital currencies based on distributed ledger technologies to improve tax collection and traceability. These are among the reasons why emerging markets countries have been some of the most active proponents of central bank digital currencies (CBDCs). (See Exhibit 2.)

A Growing Number of Digital Currency Models

Physical currencies act as a store of value, a medium of exchange, and a stable unit of account. Depending on how they are designed, digital currencies serve some or all of these purposes. For example, some digital coins and tokens are intended primarily as an anonymous means of transferring value. Others are meant to expedite transactions. Still others are envisioned as a virtual banknote pegged to the value of existing national currencies. With more than 50 types of digital currencies in development today, the variety of models can create a confusing landscape. To simplify, we have highlighted the broad categories under which many experimental models are evolving.

Cryptocurrencies. These blockchain-based coins enable transactions, although some are also used as a long-term store of value. The most well-known example is bitcoin, but others include Litecoin, Monero, Dash, and Zcash. Because they operate on a decentralized basis and use cryptography for security and anti-counterfeiting measures, they generally afford a certain degree of anonymity in peer-to-peer transactions. Law enforcement and payment processors have no jurisdiction over bitcoin accounts, yet the anonymity of cryptocurrencies also increases the risk of financial crimes.

Stablecoins. These digital tokens are pegged to a specific asset, such as the US dollar or other national currencies. Fiat-backed cryptocurrencies are the most commonly used stablecoins, but asset-backed coins can also be tied to commodities, such as gold. Most are used as a basic means of exchange for market entry, hedging, storage, and to facilitate transactions between the digital and physical worlds. Examples include USD Coin, Gemini dollar, and TrustToken.

Consortium Stablecoins. Similar to asset-backed stablecoins, consortium stablecoins are issued by groups rather than by individual organizations. Libra is a good example of this. As with other stablecoins, consortium stablecoins enable instant cross-border payments and can be especially appealing for individuals who fall outside the traditional financial system. With Libra, for instance, Facebook and its partners sought originally to create a blockchain-based currency that would be backed by a basket of international currencies such as the US dollar, the euro, and the Japanese yen, in effect creating a supranational currency that would be independent of existing national and international regulatory authorities. Concentrating power in a small number of hands has provoked concern, however. Libra has encountered strong opposition from financial regulators who fear it could threaten national monetary sovereignty.

Corporate Currencies. Primarily used for business-to-business transfers, these currencies take advantage of the transaction speed and efficiency offered by public blockchains while preserving control over the network and the ability to enforce restrictions. Preapproved access can give participants assurance in the network’s legitimacy. Examples of private corporate currencies include Signet and JPM Coin. Some retailers, including Walmart, Amazon, and Rakuten, have also announced the development of corporate currencies to facilitate payments within their networks. Retail banks could also issue corporate coins to replace fiat currencies in debit or credit cards. However, a proliferation of corporate currencies would likely create confusion, making it hard for users to understand the relative value of different options.

Central Bank Digital Currencies. Issued by a central bank, CBDCs are intended to serve as legal tender. Because they are pegged to existing banknotes, they provide a risk-free alternative to private bank deposits. The first generation of CBDC, introduced roughly a decade ago, had limited interoperability and programmability. The next generation, known as CBDC 2.0, will likely work on a national or supranational level (in the case of the European Central Bank). These currencies could help to automate monetary policies, which could mitigate the risk of hyperinflation in emerging economies and reduce purchasing power inequality. Better traceability would allow nations to curb criminal activities, tax evasion, and drug trafficking. China’s central bank is hoping to launch a digitized version of the renminbi, focusing on a centralized, CBDC 1.0 setup. The virtual banknotes, called the Digital Currency Electronic Payment (DCEP) would be partly based on blockchain technology. Sweden’s central bank has announced a yearlong blockchain-based e-krona pilot for 2020. The ECB, Canada’s central bank, and others are also accelerating their research and development timelines.

How a currency is designed can also have societal impacts, which can influence a currency’s longer-term competitiveness and value. As International Monetary Fund analysts Tobias Adrian and Tommaso Mancini-Griffoli noted in a September 2019 post to IMFBlog, “Payments are more than the mere act of transferring money. They are a fundamentally social experience linking people.” BCG’s total societal impact analysis finds that economic, consumer, ethical, environmental, social enablement, and governance factors can impact a currency’s risk and return. For example, CBDCs and consortium stablecoins are likely to open up more sources of value and generate the most positive societal impact, while the more anonymous or closed nature of cryptocurrencies and asset-backed stablecoins raises ethical concerns that can constrict value. (See Exhibit 3.)

What Leaders Need to Do Now

Although we expect it will take another five years before the most promising digital currency ecosystems reach a critical mass, the first-mover advantage will be hard for others to overcome. Whether leaders seek to be among those first movers, engage as a fast follower, or wait until the digital currency market is more mature, they need to invest time now to understand how emerging models will impact their nations and businesses. Here are key actions they can take to begin laying the groundwork.

- Assess the strategic and disruptive potential. Over time, we expect that governments and organizations will use several forms of digital currencies to improve their internal operations, help with domestic and cross-border transactions, and generate new funding opportunities. Because digital currencies and the technologies that underpin them are new, scenario modeling can be a crucial aid in helping leaders anticipate more disruptive risks. We’ve compiled a list of dramatic but plausible situations to illustrate the disruptive ripple effects that could ensue were a digital currency to go mainstream. Even if these particular scenarios never occur, it’s important for leaders and their teams to conduct their own “what if” exercises to understand the potential competitive disruption and the possible impact on financial inclusion. (See “Gaming Out the Future of Digital Currency.”)

GAMING OUT THE FUTURE OF DIGITAL CURRENCY

GAMING OUT THE FUTURE OF DIGITAL CURRENCY

Imagining how the business and operating environment might change can allow organizations to take preemptive actions to mitigate negative risks and take advantage of strategic opportunities. Here are some dramatic but plausible scenarios to help leaders kick-start their brainstorming.

- China fast-tracks a CBDC to flex its monetary muscle. China launches a CBDC as part of a plan to challenge the US dollar’s dominance as a reserve currency with all the strategic benefits that accompany that status (such as lower funding costs and the ability to circumvent or impose sanctions). The US responds with a digital dollar.

- Sweden’s CBDC sets off a cash war. The use of cash declines in Sweden, which goes forward with a CBDC for Swedish citizens. Non-Swedish EU citizens start using SEK, a scenario that while permissible under EU law was deemed unlikely by Swedish officials when planning the currency’s launch. Growing acceptance of the SEK prompts non-euro EU neighbors such as Denmark to respond with their own CBDC, and eventually the ECB goes ahead, too.

- A major economic crisis leads to a radical restructuring of the global financial system. People and politicians demand that there be no more bailouts. The Chicago plan is implemented across the developed world, making central banks solely responsible for the creation of all forms of money. CBDCs are introduced as part of the reforms. Governments use the fiscal boost to introduce a universal basic income (UBI) as the mechanism for creating new money (as opposed to commercial bank-created money in the fractional reserve system). The Friedman rule, which sets nominal interest rates near zero, is adopted, potentially as a set of automated monetary policies in a programmable CBDC. A decentralized governance model is applied to insulate the UBI from political interference in monetary policy in the same way central bank independence does currently.

- A wholesale initiative challenges a national currency. A private sector initiative such as the UBS utility settlement coin, begun as a wholesale operation, gradually gains broader access and filters out into the wider economy. As the coin becomes more widely used, the central bank decides it is threatening the standing of the domestic currency and negatively impacting monetary policy. It responds by issuing its own CBDC.

- National currencies face pressure from a private retail CBDC. A consortium stablecoin takes off, leaving central banks with a choice similar to that in the wholesale initiative scenario. This plays out in much the same way that banknotes first came into existence in most countries: the private sector led the way, followed by public sector.

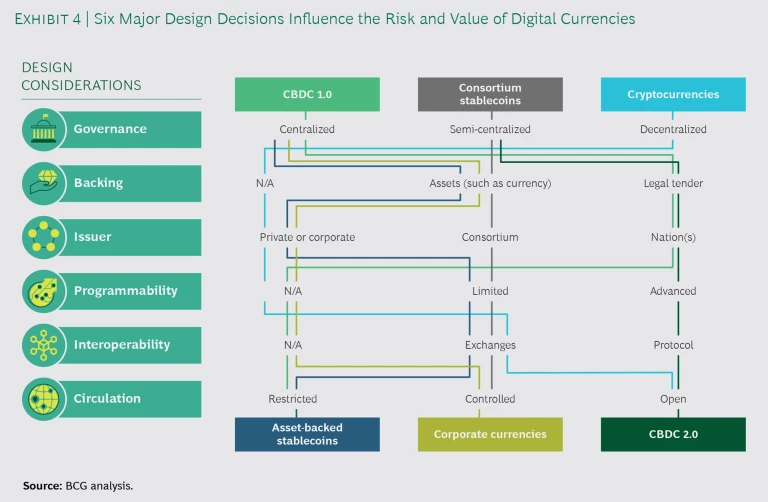

- Create a digital and regulatory sandbox to experiment with promising use cases. Based on their strategic analyses, leaders should identify two or three high-potential initiatives and begin small-scale pilots, such as developing an asset-backed stablecoin or collaborating on a CBDC. Understanding the design choices that go into creating a digital currency, such as governance, programmability, and the type of backing, can help leaders determine which archetypes are most suitable for their needs and which to avoid. Most of these design choices operate on a spectrum, from centralized to decentralized in the case of governance, for example, and from restricted to open in the case of circulation. How currency models mix and match these characteristics can influence their use and value. (See Exhibit 4.) Creating an experimental sandbox, where teams can explore new technologies, digital competencies, and ways of working can reduce error and waste in the long run and help organizations scale proven initiatives faster.

- Run the numbers. As with any initiative, organizations need to assemble a comprehensive business case. That analysis should factor in global expansion opportunities, new revenue from additional services, cost savings from efficiency gains, and network effects around payment infrastructure and compliance. Businesses should also take into account end-user benefits, including decreased transaction fees, greater convenience and speed, and more stable investments. Quantifying downside risks is also important. For example, a CBDC initiative could help a bank expand investment activity to underserved regions. But adoption could also prompt customers to move away from traditional checking and savings products. That insight could help the bank plan for ways to offset the resulting loss in deposit income.

- Develop an effective ecosystem. A currency’s worth grows in proportion to its use. Whether an organization or a central bank is creating its own initiative or participating in a broader ecosystem, digital currencies require scale to succeed. Building a critical mass of early adopters requires committed collaboration among a broad group of participants. Establishing trust, addressing inevitable tensions, and managing cooperative competition, or “coopetition,” among close rivals takes strong leadership. Decision-makers for the group and their delegates must have the clout and expertise needed to push through learning-curve challenges and identify needed partners, data, talent, and other foundational elements. In our experience, organizations that have had the most success with related blockchain innovations build robust partner ecosystems based on a shared vision, a well-defined roadmap, and formalized rules of engagement, with clear roles and responsibilities. Well-designed ecosystems and clear governance protocols give leaders a mechanism for gaining alignment on key outcomes and making important decisions on budgetary requirements, talent, data, and other resource needs. Fortunately, the decentralized, consensus-based governance built into many digital currencies can help minimize coopetition risk and allow all parties to shape and validate decision-making.

Digital currencies are poised to alter our financial infrastructure in profound ways over the next five years. Participants in the financial system should use this time to analyze potential implications, prepare for possible disruptions, and begin actively exploring what role they want to play and what partnerships they need to strike in order to maximize the value of digital currencies and influence the direction of their development.