To be a chief information officer (CIO) at a traditional retail company today is to face a new kind of pressure. The CIO’s job is no longer just to keep the company’s internal systems running and to produce data that management can use for operational decisions. Retail CIOs today are part of a team that faces a “do or die” imperative with digital.

It’s not that consumers have lost their taste for brick-and-mortar retail stores. No one who ventured into London’s Harrods or New York’s flagship Macy’s store in a holiday shopping season in recent years would have come away with that impression. There would have been, in those stores and in other megastores in major cities, the usual crush of humanity. But what matters in retail is not what happened yesterday; it’s what’s happening now and what’s going to happen tomorrow. And what’s happening now is that consumer habits are changing—fast.

With online sales growing at almost five times the rate of traditional retail in the West and even faster in Asia, The Boston Consulting Group surveyed retailers to get a baseline on their information technology activities. We strongly believe that retail CIOs need to find ways to reduce their everyday IT operating expenses and apply the savings to digital innovation. We asked survey participants about both their current IT activities and their plans for doing things in new ways.

Here are our main findings:

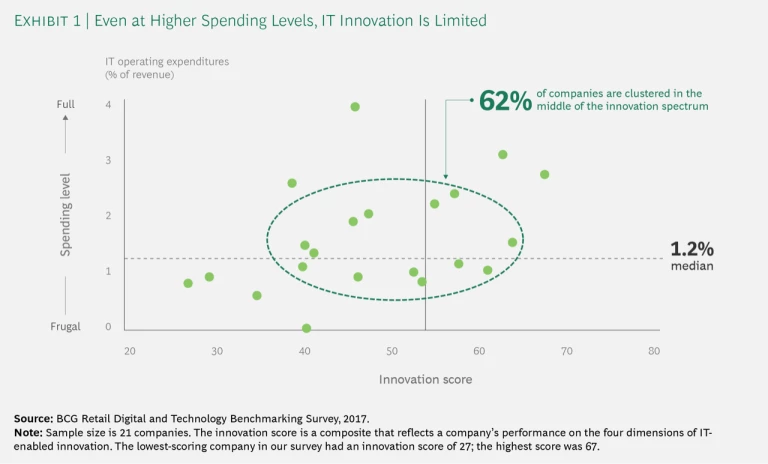

Median IT operating expenses in the retail industry are 1.2% of revenue.

- The 1.2% median represents a rough dividing line between “full” and “frugal” IT spending. Full spenders (those above the 1.2% threshold) have higher ratios of IT employees to overall staff and are apt to keep a larger percentage of their IT staff at high-cost locations, often at or near corporate headquarters.

- It’s the rare retail CIO nowadays who directly controls all of his or her company’s spending on technology. CIOs at full-spending retailers, however, control more of their companies’ technology spending via their IT budgets. This may give them an advantage over frugal spenders in defining priorities and developing centralized expertise.

Retailers’ ability to innovate using IT hinges on their investments in e-commerce infrastructure and on continued development of their omnichannel capabilities.

- Consumers know it when a retailer they use commits to developing omnichannel capabilities like “click and collect” (which gives customers the option to buy something online and pick it up at a store). What they don’t see are the behind-the-scenes investments that support these capabilities—especially the investments in digital supply chains.

- In addition to building omnichannel capabilities, retailers that want to stand out as innovators must use analytics to support personalization. They must also make investments in e-commerce software and infrastructure. Only a handful of retailers practice “innovation discovery,” a fourth measure of IT innovation that is about exposing organizations to new ideas and tactics.

Overall, there is still not enough IT-enabled innovation.

- Fewer than half of the IT organizations in our survey scored high enough to qualify as innovation leaders. The retailers that scored well did so mostly by virtue of their omnichannel offerings and their commitment to analytics.

One might expect that the highest IT spenders would be the most innovative. In many cases, however, retail full spenders don’t exhibit the hallmarks of innovation leadership. And there are some frugal spenders that qualify as innovation leaders despite their relatively small IT budgets. (See Exhibit 1.)

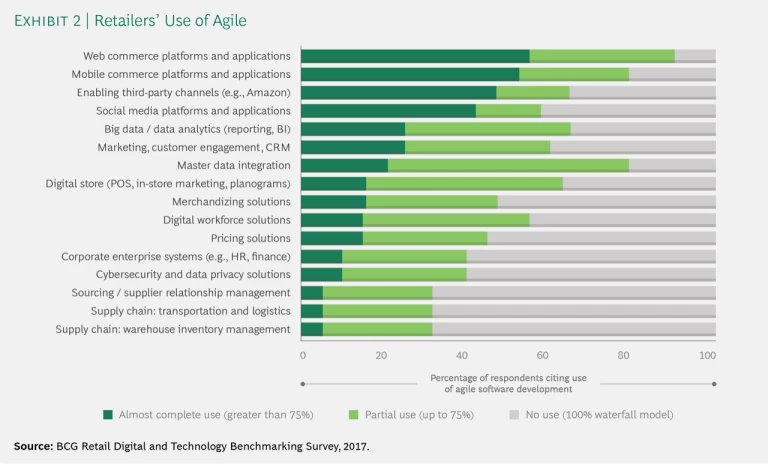

Retailers’ ability to innovate is limited in part by their lack of speed in adopting new tools and approaches.

- Most retailers have been slow to embrace cloud infrastructures and SaaS (software as a service) solutions. Their limited adoption of these technologies has kept retailers from approaches that might trim their IT operating expenses and free up cash for new digital investments.

- Retailers have also not moved quickly enough to agile software development. (See Exhibit 2.)

This means that, in most cases, they aren’t getting the level of business-IT collaboration that they could be getting and are still too slow in releasing essential software.