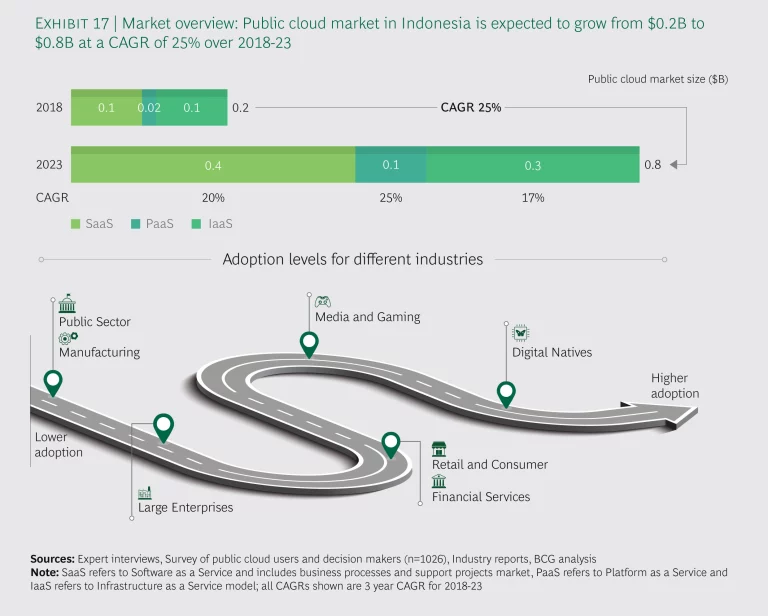

Indonesia’s public cloud market is in its formative stages, with a great potential to grow and add value to the economy. It is currently one of the fastest growing markets in the APAC region, with a projected CAGR of 25% over the next five years, from US$0.2 billion in 2018 to US$0.8 billion in 2023 (See Exhibit 17).

As a result of these high growth prospects, many of the world’s major cloud service providers are considering setting up cloud regions within its borders. The SaaS and IaaS models are the largest segments of the public cloud market today, but PaaS is expected to be the fastest growing segment between now and 2023, with a CAGR averaging 25%.

Digital native businesses are the main forces driving this growth, with increasing traction from media players, financial institutions, retailers and large family run conglomerates.

Industry adoption

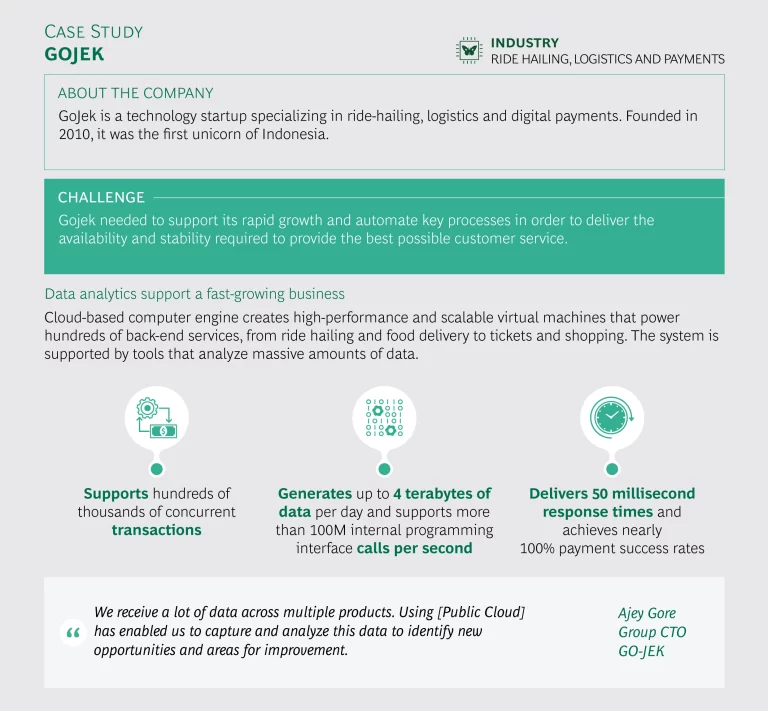

Indonesia currently has four tech unicorns, and these US$1 billion-plus startups have relied on the public cloud to grow and scale their businesses rapidly, powered by such cloud-enabled advantages as faster time to market and the ability to easily harness artificial intelligence and machine learning.

The ride-hailing, logistics and e-payments company Go-Jek, for example, is able to support hundreds of thousands of concurrent transactions over the public cloud, as well as analyze massive amounts of data to identify new opportunities and new ways to improve its services (See Go-Jek case study).

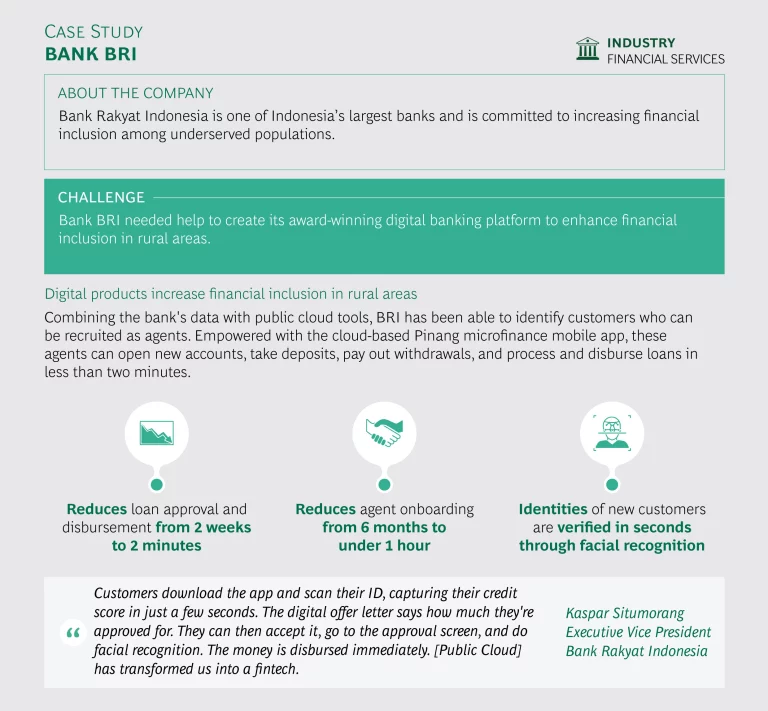

The financial services industry is an increasingly active user. With Indonesia’s unique geography—an archipelago of more than 17,000 islands spanning more than 3,000 miles east to west—there is a large ‘underbanked’ population living in sparsely populated villages. For the past decade banks and fintech firms have been using mobile apps to serve these remote locations, and the public cloud has made it possible to enhance customer engagement as well as ensure reliable mobile connectivity. Bank BRI, one of the country’s largest banks, can now process its microloans throughout the island chain instantaneously over the cloud (See Bank BRI case study).

Local players in such industries as retail and media are seeing the potential uses of the public cloud when it comes to digitizing their product offerings, using advanced analytics and improving productivity.

The largest, most established enterprises are for the most part using private clouds or on-premise data centers out of concerns over cross border data flows and latency, but with entrance of hyper-scale providers, they are already beginning to show some initial traction and interest in this space.

Key benefits

The key benefits identified by users of public cloud include:

Higher team productivity and collaboration. Most of Indonesia’s public cloud users are digital native businesses that have used the public cloud from the outset. They have seen that with the public cloud they can develop code in a standardized environment, which makes for much greater efficiency than on-premise architecture. Moreover, the public cloud fosters efficient internal communication and the ability to focus their organizational resources on the core business rather than on managing IT infrastructure. Large enterprises and digital startups alike said their companies benefited from collaboration tools, which can make coordination between teams easier, and software development faster and more effective.

The retail chain AlfaMart, for example, has found that the public cloud has enabled the company to boost its efficiency and productivity in ways that have reduced costs as much as 15% and accelerated time-to-market by around two weeks (See AlfaMart case study).

Faster time to market for products and services. The public cloud makes it possible to “really crunch development time” using DevOps and leveraging off-the-shelf services, as a CIO at a fintech firm told us. Users appreciate the way the cloud enables them to reduce their R&D time and develop prototypes faster, at similar or lower costs compared to development over traditional on-premise architecture.

Enhanced ability to launch new products and services. Technology startups find the data analytics capabilities they can deploy over the public cloud to be a major factor in a successful product or service launch. Fintech firms, for example, can easily customize their products for a mass clientele. Even traditional family-held businesses value the analytics that help them engage more deeply with their customers, as well as the potential that digitalization opens up for new products and new revenue streams. Examples include Bank BRI’s use of digital apps to increase financial inclusion, Go-Jek’s ride-hailing, and the increasingly popular use of digital payments apps.

Key challenges

The key challenges identified by users of public cloud include:

Gaps in organizational capabilities. The demand for cloud-native talent will outweigh supply as the public cloud becomes more widely available. Many organizations are already struggling with internal team capabilities, and are starting to work with IT consulting firms and systems integrators to develop training programs. One of the biggest organizational concerns is the need to have a stronger emphasis on training and certification programs that are focused on practical training to develop IT specialists who are well-versed in the day-to-day work with public cloud technology. Universities and cloud service providers are running training and certification courses in local languages, but more needs to be done in this area. Businesses look for service providers that can help make it easy to migrate to the public cloud, through hands-on training and easy-to-use systems.

Lack of clear understanding of data privacy features. Data privacy and security remains a concern across Indonesia’s industry verticals and enterprises of all sizes, because users are not always familiar with the security measures that cloud service providers offer them. Early adopters have tested the safety of cross-border data storage by moving non-critical applications, seeking to boost their confidence in privacy and security practices. As hyper-scale CSP infrastructure becomes available in Indonesia, some of these concerns should ease.

Lack of robust network infrastructure. Although Indonesia has the Palapa Ring Fiber Optic Upgrade Plan under construction to enhance archipelago connectivity with undersea cables and increase fiber optic speeds, its communications infrastructure is currently not strong enough to support critical applications over the Internet. Public cloud users might experience latency issues due to this lack of a robust core infrastructure—a situation that can also result in users having concerns about performance, especially when dealing with critical applications.

The economic impact

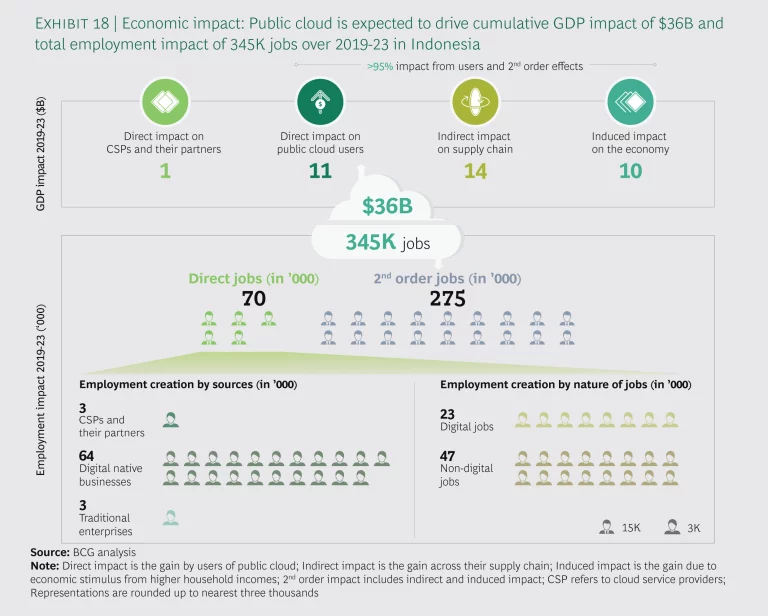

The overall cumulative economic impact from direct, indirect and induced sources between 2019 and 2023 is expected to be US$36 billion, if public cloud growth in Indonesia continues at its present rate (See Exhibit 18). When annualized, this is a sum equivalent to 0.5% of the annual GDP, and similar to 25% of the annual economic impact from the palm oil industry or 10% of energy mining. Over 95% of the impact will come from gains to industry verticals, and no more than 5% will be from the direct gains experienced by cloud service providers and technology services in this still-nascent public cloud market.

Of the direct gains to industry, a major percentage will come from enhanced business revenues. A total of US$11 billion will be the result of revenue uplift, while another US$0.3 billion will come from productivity benefits and US$0.1 billion from IT-related cost reduction and avoidance.

Public cloud usage stands to create 70,000 direct jobs over the next five years, which is equal to 0.6% of all new jobs created in the previous five years. About 47,000 of the direct jobs will be in non-digital roles such as sales, marketing, human resources, finance, logistics and operations. Another 23,000 will be digital jobs, 3,000 of which will be with cloud service and IT system providers and the remaining 20,000 within industry verticals, representing 1% of the current information and communications technology workforce.

The second order effects are expected to influence another 275,000 indirect and induced jobs, bringing the total potential jobs that are offshoots of public cloud use to 345,000, which is equivalent to 0.3% of the current workforce. A large proportion of these jobs will likely be taken up by the existing workforce after their retraining and upskilling.

Two alternate scenarios

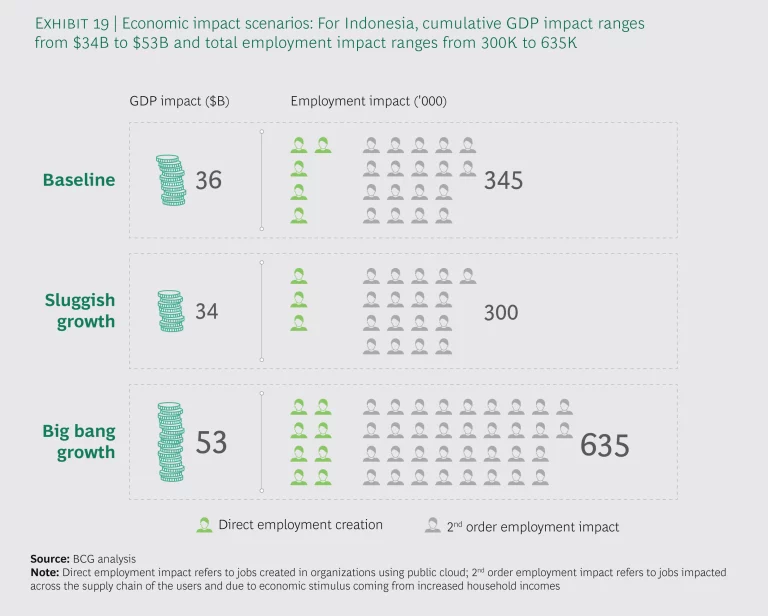

The economic impact we have assessed above is the Baseline Scenario, but we have drawn up two additional scenarios. The Big Bang Growth Scenario and the Sluggish Growth Scenario show the economic impact that would occur if the forces that shape the public cloud market cause growth to either speed up or slow down. If either of these scenarios were to unfold, the full cumulative economic impact of the public cloud could vary by a difference of around US$20 billion between 2019 and 2023 (See Exhibit 19).

The Big Bang Scenario. Growth would accelerate if a combination of forces in Indonesia were to help potential users overcome the challenges discussed above. The government would need to adopt international best practices on data and digital policies, including a campaign to promote public cloud adoption among government agencies. Cloud service providers would step up their investment in user education and practical on-the-job training. Large enterprises would increase their efforts to train and develop cloud-savvy digital talent and accelerate their deployment of the public cloud, while entrepreneurs would continue to start digital native businesses at a rapid rate.

If these factors come together, a CAGR of 37% would lead to a cumulative economic impact as large as US$53 billion between 2019 and 2023, or 0.7% of the GDP. About 125,000 jobs would result from the direct impact with another 510,000 influenced by the second order effects, for a total of 635,000 jobs, almost double the number in the Baseline Scenario.

The Sluggish Growth Scenario. This is what could occur if the current challenges to growth became more adverse. If the government were to adopt less cloud-friendly policies for security, data classification and cross border data flows, or there were limited cloud products on offer and limited user adoption, growth would slow. There will also be constraints on growth if IT and cloud talent gaps widen further, or if the supporting infrastructure is not significantly improved so that the public cloud can be fully scalable.

In this scenario, current growth would stagnate and Indonesia would fall behind other markets in the region when it comes to achieving a sizeable economic impact from the public cloud. A Sluggish Growth Scenario would bring only about a third of the direct jobs that a Big Bang Scenario could produce.

With growth led by some of Indonesia’s most successful tech startups and financial services firms that stand to develop a vast rural customer base through the use of digital apps, the public cloud market in Indonesia has strong growth potential. In initially developing the market, the country would miss a prime opportunity to build an upskilled workforce if it were to let the Sluggish Growth Scenario unfold. On the other hand, it has much to gain economically from stepping up efforts to encourage growth, and the jobs that would result when the business sector expands its use of the public cloud. With a strong government push for regulatory reform, especially if combined with a public sector cloud-first policy, upgrading of the supporting infrastructure, and a joint effort on the part of CSPs, government and users to provide practical training to create more cloud specialists, Indonesia could experience an additional US$20 billion of GDP impact by 2023, and yield almost twice the number of jobs that will result at the current growth rate.