Life insurance executives have long been aware that their industry is behind the times. Now, our research indicates, they are ready to do something about it.

“Change management” ranked as the greatest internal challenge facing C-suite life insurance executives in the most recent biennial global survey by Boston Consulting Group and LIMRA, a global research and consulting organization that serves insurance and financial services companies. “Customer experience” came in a close second. These responses indicate a shift in mindset from previous surveys. In 2015 and 2017, for example, life insurance leaders listed issues such as talent management, technology, and distribution as their top challenges.

Why the heightened sense of urgency for change and better customer engagement? One reason is that headwinds facing the industry—such as low interest rates, lagging consumer interest in life insurance products, and looming competition from digitally disruptive new entrants—have intensified. Out-of-date sales practices and processes, such as lengthy handwritten applications and long waits for approval, make it harder for life insurers to compete for customers who are now accustomed to engaging digitally.

To future-proof their business and maintain long-term competitiveness, life insurance executives need to make their organizations more agile.

Life insurance executives recognize that, to future-proof their business and maintain long-term competitiveness, they need their organizations to become more agile. They need corporate cultures that fully embrace and sustain change. And they need people who can adapt to new ways of working and deploy new technologies such as artificial intelligence (AI) and automation to better engage customers and improve the efficiency of distribution networks.

How Insurers Prioritize Their Challenges

The emerging focus on change came out clearly in our research—one of the largest efforts of its kind—to understand what is foremost on the minds of the life insurance industry’s leaders. BCG and LIMRA surveyed C-suite executives in 62 nations on the greatest challenges they face and the most powerful external forces affecting their business. Of the 508 respondents, 98 were CEOs and presidents. We also interviewed two dozen respondents across all regions and job titles to enrich the quantitative analysis with qualitative guidance.

“Change management”—defined as a set of actions that equip companies to successfully manage any kind of transformation, with a focus on people, processes, and technology—was the top challenge, cited by 32% of executives worldwide. (See Exhibit 1.) Sorting the survey results by job function reveals that this issue is on the minds of executives at all levels, regardless of their business area.

“Customer experience” was the next-most widely cited challenge, at 23%. Among CEOs and presidents, customer experience tied with change management as the number-one challenge, at 27%. The final top-three challenge for global executives overall was “growth.” Although it is no longer the highest-ranking priority (as it was in 2015 and 2017), “talent management” remains a top-of-mind issue, cited by 20% of CEOs and presidents. Executives understand that having the necessary talent is essential if they are to successfully change their organizations.

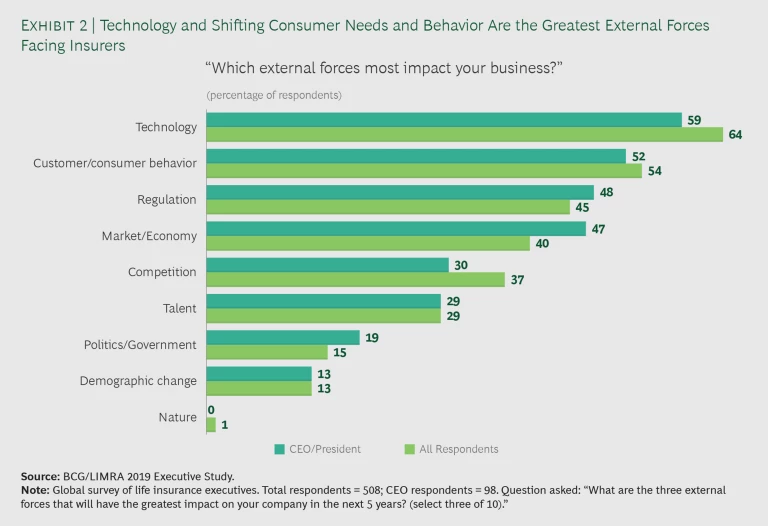

Many of the most difficult challenges that life insurers face, however, are caused by factors beyond their control. When we asked respondents to name the external forces that have the greatest impact on their business, 64% of executives worldwide (and 59% of CEOs and presidents) cited “technology,” 54% named “customer/consumer behavior,” and 45% pointed to “regulation.” (See Exhibit 2.)

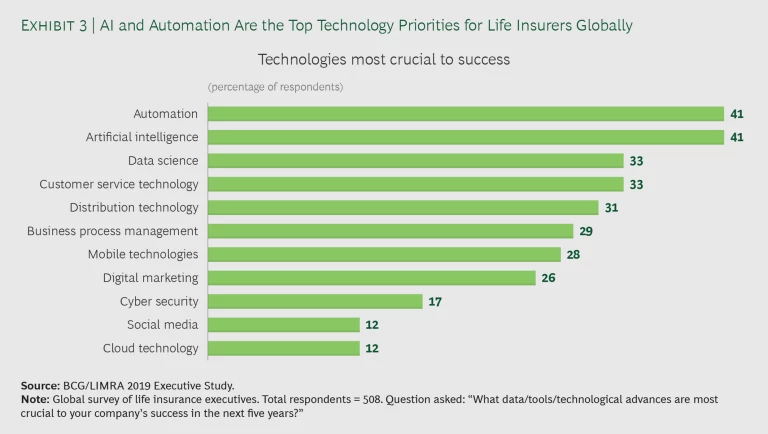

When we asked executives which technologies, tools, and data they regard as most critical to their success, Automation and AI topped their list, both cited by 41%, followed by data science and customer service technology, at 33 percent each. (See Exhibit 3.)

What the Findings Tell Us About Insurers’ Plans

The findings in this year’s executive study reveal areas that life insurance leaders are likely to focus on in the years ahead. We explore three of these topics—change management, customer experience, and technology—in more detail here.

Change Management. Change management’s rise to the top of executives’ list of concerns reflects widespread recognition that strategic transformation has become critical to helping companies continue to succeed and grow in the face of mounting external uncertainties. Ownership of conventional life insurance policies is at a historic low in many countries. Low interest rates are depressing investment earnings, returns on guaranteed products, and returns on spread businesses such as annuities. Tighter capital requirements designed to strengthen economic solvency in many markets have placed further pressure on shareholder returns and are affecting the competitiveness of insurance relative to other financial products.

Talent is another obstacle to change. A recent LIMRA study found that the average age of life and health insurance agents has risen from 37 years in 1983 to around 56 years today. More so than in many other industries, life insurers tend to have long-tenured employees who have little experience with new ways of working, such as using agile practices. Such agents and financial advisors often do not adopt new technologies such as electronic applications that enhance the customer experience, and they are reluctant to change their selling practices.

A recent study found that the average age of life and health insurance agents has risen from 37 years in 1983 to around 56 years today.

In our interviews, several executives said they believe they must create an organization-wide culture that supports change management and sustains it over the long term. But thus far, as our survey results indicate, change-management initiatives have been difficult to implement. Moreover, the industry has struggled to attract younger talent that is more open to new ways of working.

Customer Experience. Although the concept of customer centricity is hardly new to the industry, it may be new to some individual life insurance companies. The issue of customer centricity is becoming increasingly urgent as shifting consumer behavior and demographic change alter the market for life insurance. Advisors typically encourage people to purchase insurance at “trigger points,” when life events such as marriage, the birth of a child, or a home purchase introduce risk. But people are marrying later, having fewer children, and postponing home purchases. And when planning for long-term financial security, consumers increasingly are opting for instruments such as mutual funds, IRAs, and contribution plans such as 401Ks, which are much easier to understand and may yield higher returns. What’s more, most life insurance providers require applicants to fill out long paper forms by hand—and then, in many cases, wait a month or more for a decision.

Some providers—such as China’s Ping An Insurance—are racing into the digital age by offering consumers holistic, one-stop financial services through their platforms. But most insurers continue to focus on traditional life products. And because life insurers tend to sell their products through intermediaries, such as independent agents and financial advisors, carriers have fewer opportunities to collect and act on direct consumer feedback to improve the customer experience.

Executives in our study cited a number of specific challenges, such as growth across new customer segments and the need to master new digital technologies, that relate to the perceived need for a more customer-centric organization. Executives recognize that understanding the needs and experiences of all customers—and creating a streamlined digital experience for them—is vital if their companies are to remain relevant and valuable over the long term.

Technology. Life insurers around the world are investing in technology—including in domains such as AI, automation, and data analytics—but they are doing so less than other financial services sectors are. On average, insurers globally spend 3% or less of their annual revenue on technology, according to the market research firm Gartner, compared with up to 10% by leaders in other financial service sectors. That 3% benchmark simply will not support transformation that industry incumbents must achieve to unlock value for all stakeholders.

On average, insurers globally spend 3% or less of their annual revenue on technology; leaders in other financial service sectors spend up to 10%.

The heightened focus on technology that the survey reveals suggests that industry leaders may have reached an inflection point. Their strong interest in AI, automation, customer-service technology, and data science also underscores the high priority they now give to improving their understanding and engagement with distributors and consumers by offering more personalized products and value propositions and enhancing their cross-selling capabilities.

An Agenda for Change

Our research indicates that C-suite executives have developed a clear idea of what will be required of the life insurance company of the future. We offer the following thoughts for industry leaders to consider as they realign, reimagine, and transform their companies for tomorrow:

- Instill a pro-change culture. A corporate culture that embraces change is a prerequisite if life insurers are to make their businesses meaningfully more customer-centric. That begins with having the right people across the organization—be they specialists in data, analytics, or digital technologies—who can thrive in a company built around responsiveness and flexibility.

To improve the customer experience, insurers must instill a customer-first culture and clearly define who the customer is for each organization.

- Focus on the customer. To improve the customer experience, insurers must instill a customer-first culture and clearly define who the customer is for each organization. To better understand clients’ needs, insurers must regularly monitor customer journeys to determine what is going well and what needs to improve. They should use these insights to develop innovative solutions that can create a competitive advantage.

- Make the technology strategy more ambitious. Although many life insurance companies are exploring opportunities to digitize the customer experience, automate back-end processes, and use AI and automation to generate leads and calculate risk, implementation remains a struggle. Insurers tend to focus their spending budget for IT on running the business, rather than on driving innovation. To realize the innovation and change they seek, however, leaders need to make technology a central pillar of their strategy. Prioritizing technology can be costly, but the industry needs the courage to spend more than 3% of revenue on IT—not only to make up for past underinvestment, but also to keep pace with evolving consumer needs. By making technology central to business strategy, life insurers will achieve the high-quality digital experience and operational efficiency they desire and will create opportunities to gain competitive advantage.

As life insurance companies navigate an increasingly complex landscape of economic, demographic, technological, and regulatory challenges, they need organizations that not only adapt to change but also thrive on it. Executives have long acknowledged that their companies need to offer a superior customer experience and must harness the full power of advanced technologies. Our research indicates that they are now ready to embark on the journey to transformation.