The COVID-19 pandemic has exacted an enormous professional and personal toll on health care professionals (HCPs) and is changing the way they work. Some of these changes are likely to be permanent. For biopharma companies, this means interacting with HCPs very differently in the post-COVID-19 reality.

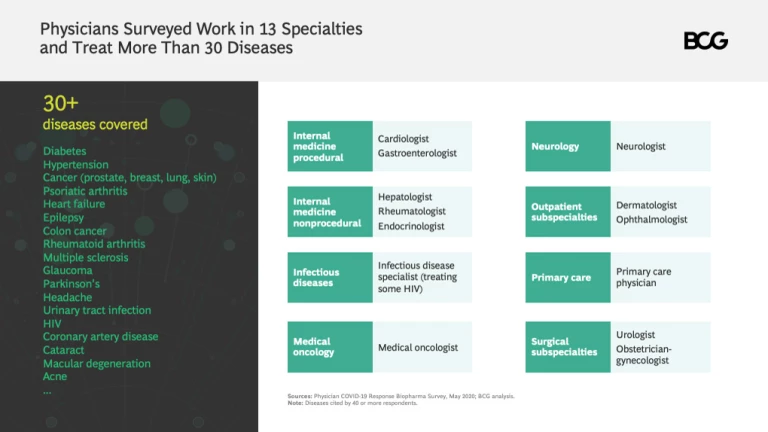

BCG recently conducted a survey of more than 1,300 MDs in seven countries: the US, France, Germany, Italy, Spain, China, and Japan. (See “About Our Survey.”)

About Our Survey

The COVID-19 crisis is constantly evolving. The experience of physicians is shifting on a day-to-day basis and varies greatly across the country. Readers are encouraged to consider the survey and its findings within this evolving context.

Here are the headlines:

- Doctors expect long-term changes in how they engage with patients. HCPs in most countries and most specialties anticipate that a growing number of patient interactions will be virtual, even if a vaccine is developed.

- Looking ahead, doctors also see long-term changes in how they interact with biopharma companies. More than 95% of all contact now takes place through virtual channels, and over 75% of physicians say they want to either maintain or increase this shift—even if a vaccine is broadly available. Only about 25% would like to increase the share of in-person interactions if a vaccine is widely in use.

- The perceived effectiveness of virtual engagement has dramatically increased. Four out of the five engagement channels now considered most effective by doctors are virtual (such as webinars with key opinion leaders or virtual trainings on new therapies). In-person visits from medical scientific liaison experts rank fifth out of the top five.

- HCPs are looking for new practices and new models of cooperation with the biopharma industry. Physicians continue to have high levels of interest in clinical data, and more are interested in learning how biopharma companies can support patient care through digital tools and engagement. But they also complain of insufficient time to read the digital material from the biopharma industry—and an excessive amount of it.

- The ways that HCPs want to engage with biopharma companies vary across specialties and geographic areas. For example, while roughly 85% of neurologists in Europe would like to maintain the currently high share of virtual interaction, only about 70% of cardiologists and gastroenterologists feel this way. The channels that doctors use, and the content they want to engage with, vary at a doctor-by-doctor level.

You can explore the most significant survey findings in the slideshow. We also discuss our conclusions and their implications for the biopharma industry below.

Implications for Biopharma Companies

Biopharma has historically relied on in-person customer engagement models for sales, account management, and medical education. While we recognize that our research reflects opinions at a single moment in time, we believe the results indicate that companies need to evolve these models in order to meet changing customer requirements with respect to both marketed products and new product launches.

Most biopharma companies need to radically accelerate virtual engagement with MDs, integrating online and offline journeys in preparation for less in-person engagement in the future. Digital and other technologies are key to enabling this, including the latest-generation virtual call technologies, webinars, and HCP support platforms.

Personalized customer engagement will become a key driver of success. Doctors are already overwhelmed, so leveraging analytics and data to understand the right content, right channel, and right timing of delivery will be critical to optimizing outreach and engagement. Understanding the topic, channel, and content preferences of physicians is critical. Using advanced analytics to determine when and how to push content into the field (not overwhelming reps, keeping it simple) will be new success factors. Companies that get this right will leapfrog competitors.

Rapidly generating digital-first content for personalized campaigns and managing the balance between global and local delivery will be important supporting capabilities. Over time, personalizing outreach and engagement may move biopharma companies away from the traditional annual brand planning cycle to a more agile marketing operating model that involves several targeted campaigns throughout the year with quick deployment and a test-and-learn approach.

Medical science liaison and key account management (KAM) techniques will likely become more important. MDs are craving more scientific information, and as call planning becomes increasingly adaptive (and health care practices and facilities potentially consolidate), the KAM role will be critical to support account-level sales strategies.

As the use of telemedicine for patient interaction continues, biopharma companies must think through updated patient journeys to ensure that they can help doctors support patients in the most effective ways and that the companies are part of the care-giving ecosystem in an environment characterized by many fewer personal interactions.

Companies must also think through alternatives to the traditional customer sales and service models, integrating inside sales teams and customer support hubs with the frontline sales function. They need to be more nimble and adaptive in call planning, monitoring customer restrictions on in-person visits and moving reps to where they can be most productive.

COVID-19 continues to have a profound impact on the health care sector. The biopharma companies that are first to embrace the new reality have a substantial opportunity to accelerate their commercial performance.