The global nonlife-insurance market is likely to remain challenging over the coming decade. Greater price sensitivity, a lack of differentiation among carriers, and record-low interest rates have constrained top-line growth for most insurers. The uncertain pricing environment has added to these woes, squeezing margins and contributing to low equity returns. On top of that, a spate of catastrophic events has elevated loss ratios in recent years.

With growth in developed markets expected to remain sluggish, some insurers have turned to rapidly developing economies (RDEs), but this approach has proved no panacea. Although RDEs post much higher growth rates—averaging 16.2 percent since 2003—strict regulations and strong domestic competition have made the barrier to entry both high and costly in favored destinations such as China and India.

Despite these challenges, property and casualty (P&C) insurers can carve out premium growth and greater profitability. But they need to have a clear strategy, and they need to take action now. In our view, P&C insurers that adopt all or most of the following six initiatives can lift return on equity by 4 to 8 percentage points by 2022.

Get out of the commodity business. P&C products have become commodity like, with low customer engagement and high price sensitivity. The opportunities for meaningful customer exchanges, the kind likely to inspire loyalty, are, in most cases, limited to low-frequency events such as when customers are shopping around for a new policy or they are renewing coverage. From the customer’s perspective, claims and other activities that involve more interaction seem transactional, making for a relatively bland experience. That may explain why a recent survey conducted by The Boston Consulting Group shows that consumers are far less loyal to their P&C providers than to their other financial-services partners. For instance, consumers are about twice as likely to search for cheaper auto- and home-insurance options during the course of a year than they are to switch bank accounts or investment advisors.

To change that dynamic, P&C carriers could take a page from other, formerly commoditized, sectors. A few decades ago, for example, very little distinguished the coffee brands sold on store shelves or poured in the corner shop. Coffee was coffee, a commoditized product and the victim of price wars. Then, Starbucks entered the fray and changed the perceived value, sourcing high-quality coffees, implementing strict standards, and customizing both the product and the in-store experience. The results revitalized a once-stagnant market and allowed Starbucks to command a price premium three times that of its competitors.

Some insurers, such as State Farm Mutual Automobile Insurance and Admiral, have begun to experiment with similar approaches. State Farm has made the customer-agent relationship a key point of differentiation. The company has also launched a high-concept offering in Chicago in the form of the Next Door café—a no-pressure environment from which it dispenses free advice on insurance and other financial products. Admiral has found success by creating brands that target specific segments. Its Diamond brand, for instance, is directed at women and offers add-on coverage for such items as handbags and car seats, and its Bell brand focuses on the needs of young drivers, with offerings such as telemetry-based auto insurance. Such differentiation has helped both State Farm and Admiral outperform their peers.

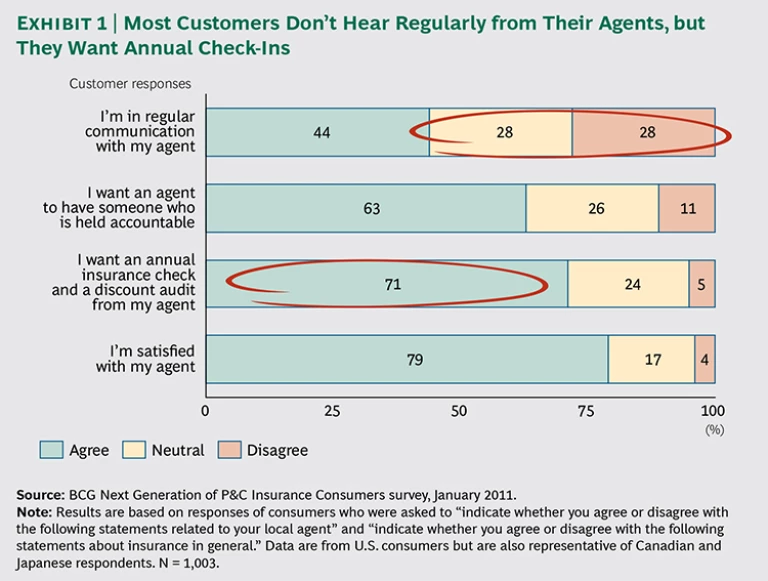

Increase customer engagement through the agent channel. BCG survey data reveal a strong correlation between high agent interaction and high customer satisfaction. (See Exhibit 1.) This finding shows that it is especially problematic that most customers do not have regular contact with their insurance agent.

To improve the quality and frequency of agent-customer interaction, insurers should arm their agents with tools and resources that can help personalize their outreach. Those tools can include a breakdown of the most common customer needs and analytics that detail when to reach out to a customer and how to tailor the offering. Increasing the number of agent touch points also goes a long way. These touch points can range from relatively simple strategies, such as customized year-end reviews and satisfaction surveys, to more complex and innovative offerings, such as cafés and storefronts that add new sources of value.

BCG analysis shows that by improving the customer experience, an average-size U.S. insurer can improve gross written premium growth by as much as $75 million to $150 million per year.

Go direct with small commercial-enterprise customers. Insurers have the potential to take some of their small- and midsize-enterprise (SME) business direct—an approach that could shave costs, broaden the customer base, and create more opportunities for customer engagement. Furthermore, it’s a move that SME customers seem willing to embrace. A recent BCG study found that, depending on their location, 20 to 30 percent of SMEs would consider buying directly from their commercial insurer.

Tapping into this market, however, will require changes to the existing direct-to-consumer sales model. Although small commercial-auto policies, for instance, are similar to standard personal-auto policies and include many common prepackaged coverage options, SME customers have more complex requirements and need more assistance in selecting the appropriate coverage level. For the direct-to-SME model to work, therefore, carriers will need to supplement the approach with dedicated advisors. To avoid channel conflicts, carriers will need to sell through a different brand in markets where they already have agent distribution. Those factors notwithstanding, going direct has the potential to be a far more cost-effective distribution model than selling through brokers and agents. And from the customer’s point of view, the direct model can, in many cases, be much faster as well. We have seen application-to-bind cycle times that once lasted a week being reduced to less than a day.

Some insurers have already begun to test the waters. We anticipate that others will follow and that the direct commercial SME market could reach $25 billion by 2022.

Make smarter RDE bets. Not all RDE opportunities are created equal. Although many see China as the first port of call for multinationals seeking to gain a toehold in Asia and other high-growth markets, extensive regulation, strong domestic competition, a complex local-distribution structure, and the need for on-the-ground expertise can dampen the cost benefit and make it hard for multinationals to gain traction. In fact, China, India, Russia, and Thailand have proved less favorable markets for insurers to enter because of restrictive regulations, challenging combined ratios, and entrenched domestic players.

But opportunities remain in underpenetrated RDEs. Of these, Brazil, Mexico, Turkey, and Malaysia are especially attractive: they offer less regulation, fewer restrictions on foreign ownership, previous multinational success, and high premium and profit potential. We expect RDEs to add more than $400 billion in incremental premium revenues through 2020, with these four countries contributing nearly one-quarter of that total. By factoring in all the soft and hard costs, P&C insurers can determine which locations offer the greatest ROI potential.

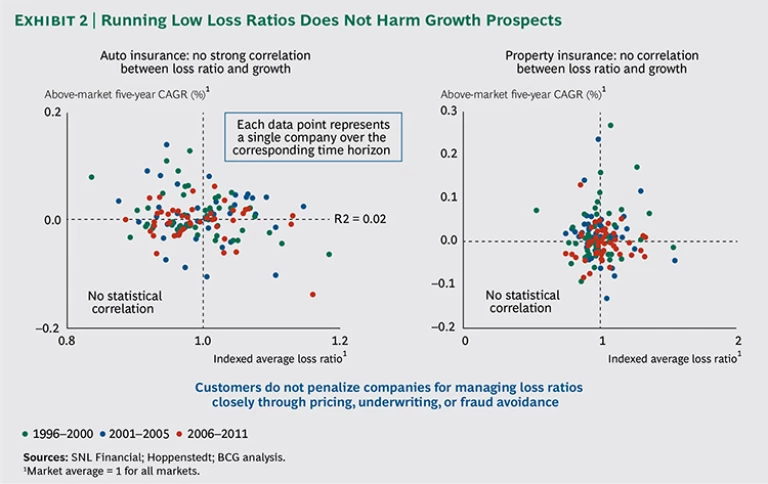

Use analytics to drive down loss ratios and improve pricing advantage. Global loss ratios have inched up more than 2 percent over the past 15 years, a period that also saw an explosion in data analytics capabilities and raw computing horsepower—precisely the sorts of tools that can help insurers improve their ability to calibrate pricing, underwrite, and detect fraud. Nonetheless, insurers have been slow to adapt to these technologies, owing in part to a lingering misperception that low loss ratios come at the expense of growth. Our research, however, shows little to no correlation between loss ratios and growth performance in either the auto or personal sector, suggesting that customers don’t think that quality and service have suffered as a result of loss ratio improvements. (See Exhibit 2.)

To bring their loss ratios down, market leaders are applying big-data analytics to do everything from targeting low-risk customers to developing highly granular pricing schemes and more intensely data-driven underwriting. Using analytics in this way can help insurers sustain their loss-ratio improvements despite changing market conditions.

Downsize operating and claims costs to stay ahead of the accelerating cost curve. Expense ratios in developed countries are on a downward trend. BCG expects the global average to fall to 20 to 25 percent in developed markets over the next decade, driven by, for example, technology improvements and consolidation. That reduction represents a 300- to 500-basis-point improvement for the average insurer. That high bar (the equivalent of roughly $450 million for an average-size insurer) means that laggards will find themselves at a competitive disadvantage.

To keep up with the field, insurers should focus on scale and efficiency—the characteristics that define all top cost performers in the P&C sector. The cost-lowering initiatives that offer the greatest ROI potential include modernizing policy administration and claims systems and standardizing operating procedures with specialized roles for complex tasks. Insurers should also consider establishing shared-services centers for standard operations such as underwriting, claims, and policy administration, and they should look for opportunities to improve active-claim management.

Some of these changes don’t require massive investments. A number of insurers have centralized their support functions without adding to their expense base simply by streamlining processes and making better use of existing systems. Because efficiency solutions cut across functions, however, putting these solutions in place has as much to do with organizational behavior as with technology. In light of that, insurers need to align key performance indicators with incentive systems to drive companywide improvements and put more focus on executing the changes required.

Although the global P&C market will continue to exert pressure on margins, the six initiatives presented here could, by 2022, be worth $250 million to $575 million in underwriting profits for the average top-20 insurer. Moreover, they lay the foundation for a more sustainable business model.