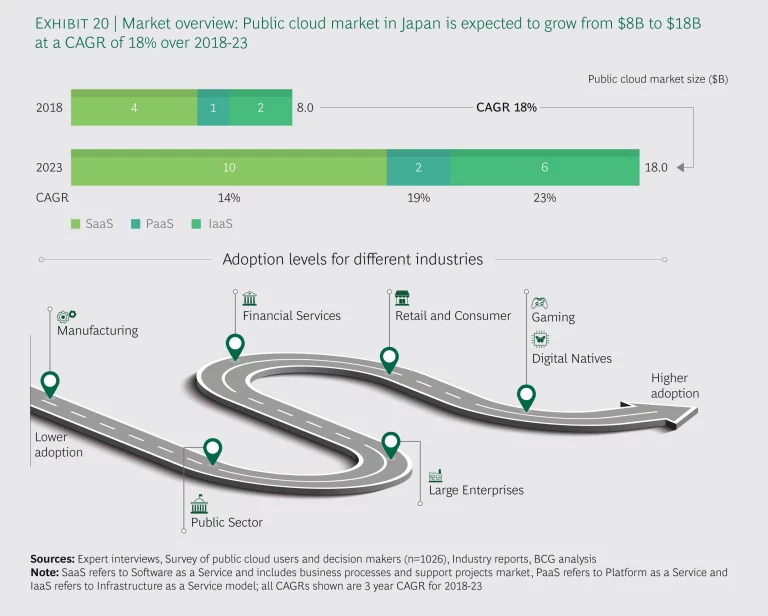

Japan is one of the largest public cloud markets in APAC, and is expected to develop further, from US$8 billion in 2018 to US$18 billion in 2023, with a compound annual growth rate of about 18%.

Japan continues to expand its uses of more advanced public cloud technologies. A number of key sectors are now looking beyond the basic functions and considering migrating their core applications. As that happens over the next five years, IaaS and PaaS are likely to become the fastest growing segments, surpassing the growth of the SaaS model, which currently accounts for more than 40% of the market and has been a key growth driver of public cloud migration.

Among the industry verticals, retail and consumer products companies, along with media and gaming players, are the most advanced users of the public cloud in Japan, but traction is increasing among financial services institutions and the public sector (See Exhibit 20).

When one of Japan’s largest banking institutions announced in 2017 that it was beginning an aggressive migration onto the public cloud, it created a powerful signaling effect to other businesses that that the public cloud is secure and reliable. A second potential game-changer for the public cloud was the Japanese government’s announcement in 2018 that it was embarking on a ‘cloud by default’ policy. The idea is that when government agencies are procuring new IT for their applications, they should consider the public cloud as the first option—then, in order of priority, the private cloud and on-premises storage. The government has set an ambitious goal of having 1,600 local government entities using the public cloud by 2023.

Industry adoption

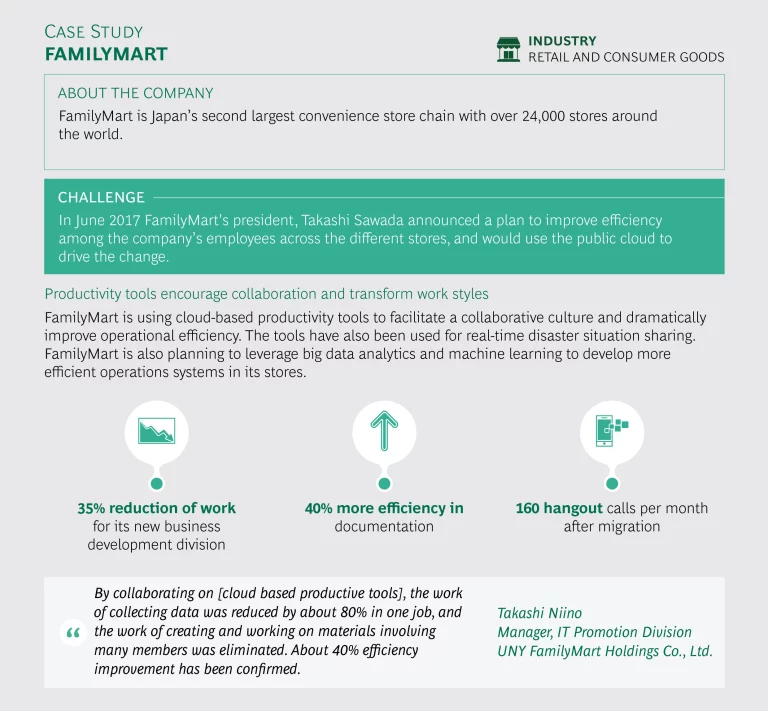

Among retailers and consumer product companies, the demand for public cloud services is strong, especially for the PaaS model and analytics offerings, which make it easy for users to create highly segmented and personalized products and services for their customers. In addition, they appreciate the quick time-to-market with changes to existing digital products and services and the efficiencies the cloud affords when it comes to internal functions.

“We are planning to move all of our IT infrastructure that we can onto a hyper-scale public cloud to standardize security standards, lighten the infrastructure management burden, and have more collaboration across the board.” —CTO, Global consumer goods company

Gaming companies, too, are migrating core applications onto the cloud to meet their needs for reaching and serving a global audience. These are industries in which reliable, always-on delivery of services and a positive, rich customer experience are critical, and the cloud has shown that it can deliver those benefits.

The 20-year old gaming company DeNA, which operates mobile and online services including games, e-commerce and entertainment content distribution, has announced that it will move all of its applications to the public cloud by 2021. DeNA has said that even if migrating to the public cloud increases some of its costs, the expense will be outweighed by the advantages of being able to improve the customer experience and having the infrastructure scale to accommodate new influxes of traffic (See DeNA case study).

Use of the public cloud is rising among financial institutions, which along with the public sector are expected to be the next major drivers of growth in Japan. It is becoming common for banks to use the public cloud for such functions as new application testing, big data analysis, fraud detection, risk modeling, and customer-facing services such as trading and mobile apps.

Few banks have gone to the trouble and expense of overhauling their legacy core banking systems of deposits, lending, and transaction processing, which operate on older technology infrastructure. However, that is beginning to change. A large financial institution has announced that there will be “no sanctuary” where cloud cannot be deployed, thereby not ruling out moving any applications to the public cloud. The announcement provides additional credence that even the largest financial institutions are beginning to see the advantages of migrating their core systems.

The manufacturing industry is not as active a user as these other three. Most manufacturing players have limited perceived need for public cloud, and business leaders tend to be reluctant to put proprietary manufacturing data online.

However, with the importance of the transportation industry in Japan, over the longer-term future we see growth opportunities with the evolution of Mobility as a Service (MaaS) and Industry 4.0 as the next wave in digital manufacturing. Automakers in Japan have already begun to partner with cloud service providers to build MaaS infrastructure and develop connected cars.

The government’s own adoption of the public cloud is expected to increase with the new ‘cloud by default’ policy, even as it acts as a trigger for further growth in the private sector. A sizeable number of local government offices are trying SaaS-based productivity tools, along with IaaS and PaaS, and have improved citizen services. This would further strengthen as the commitment develops.

Key benefits

The key benefits identified by users of public cloud include:

Higher team productivity. Businesses using the public cloud in Japan placed increased team productivity and the ability to digitize their front line staff at the top of the list of key benefits. In a country that is facing a labor shortage due to an aging population, the public cloud has enabled corporate teams to be more productive and focus on their core functions. Aided by standardized development environments and internal and external collaboration using doc sharing, communication apps and other basic features of the public cloud, most users agree that the productivity benefits are the most critical and visible directly.

“Developers and new engineers are getting well versed in the cloud native environment. They do not care as much about knowing legacy infrastructure.” — CTO, Fast-growing startup

The Tokyo-based convenience store chain FamilyMart started using the public cloud in 2017 to boost productivity in its stores around the world. The company has been able to transform its collaboration strategies, not just at the corporate level, but also between corporate offices and front-line staff members, so that everyone in the organization is able to communicate freely in a way that improves efficiency (See FamilyMart case study).

Faster time to market for products and services. For DNBs and companies relying heavily on digitalization—retailers and consumer products, media and gaming, and to a growing extent banking—agility is an important requirement. These companies increasingly value the ability to introduce new products and services with no lag time in order to make adaptations quickly.

Better security. Whereas security was once a top concern when it came to public cloud adoption in Japan, business leaders and IT professionals are now well aware of the security advantages that public cloud vendors can offer through their large-scale investments. Education about how the security measures work needs to continue to show decision makers on the business side that CSPs have robust technology, systems and processes that maintain security and offer improvements over on-premise systems.

Reduced cost. Users that consolidate their IT functions under the public cloud typically achieve significant cost benefits over time. Smaller companies report that they have been able to cut costs of ownership of their IT systems by half or more through their use of the public cloud. Even among large companies, cost savings led by IT as well as core business savings through productivity increases remain an important benefit for migrating applications to the public cloud.

Key challenges

The key challenges identified by users of public cloud include:

Legacy migration cost and risk. Users face difficulties in migrating and integrating their legacy systems. Migration takes time, requires upfront costs and carries a degree of risk in terms of a smooth continuity of system applications. Companies need to begin such a migration with a strategic plan that articulates how the process will be carried out and how long it will take, with time built in for troubleshooting, while driving home the message that the goal is to transform digitally, modernize product offerings and become more agile in order to remain competitive. Keeping all parties appraised of these long-term benefits can help overcome objections to the initial difficulties. For this reason, companies should work with systems integrators and IT consultants to help them through the hurdles of cloud migration.

Gaps in organizational capabilities. Having enough IT specialists trained in cloud capabilities is a key challenge for most organizations—users and CSPs alike are finding that there isn’t enough cloud-trained talent as usage grows. This is a challenge throughout the APAC region, but the organizational challenges are especially acute in Japan as a result of the country’s labor scarcity.

When companies look at vendor options, it is important to find a cloud provider with easy-to-use systems and reliable performance to help mitigate this challenge. Leading companies are also starting to leverage support from systems integrators and IT consultants while they take steps to build A-teams for public cloud deployment and overall digital transformation. By partnering with users to train and upskill their employees, the CSPs can take a step forward to alleviate the talent scarcity that organizations are facing.

Lack of cloud capabilities has been a serious barrier to smaller businesses adopting the public cloud—advanced SMEs are training their staff, but more educational programs throughout Japan would be very helpful in mitigating this challenge.

Lack of clear understanding of product performance. Many companies harbor a misconception that the public cloud doesn’t provide the resources to serve mission-critical applications, and that stops them from migrating important functions to the cloud. Some users are trying to address this concern by adopting multiple techniques to avoid a single point of failure, for example by using hybrid and multi-cloud models.

The economic impact

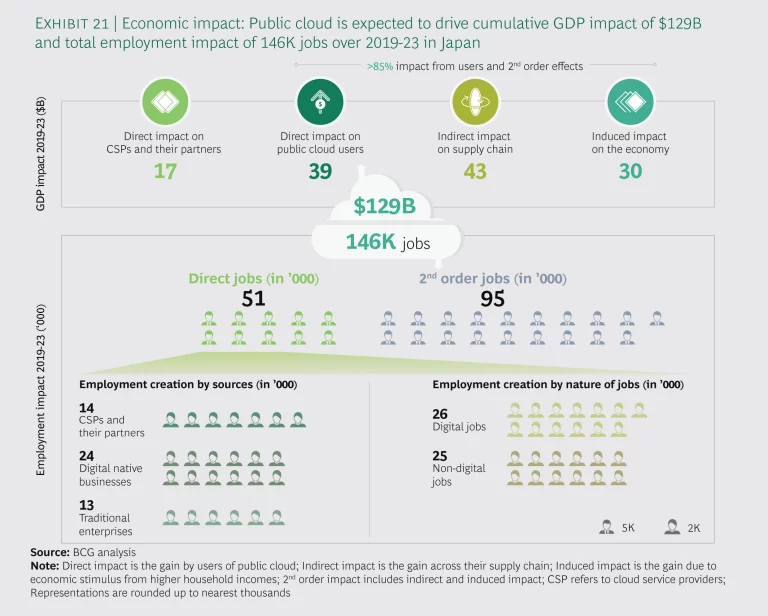

The overall cumulative impact from direct, indirect and induced sources between 2019 and 2023 is expected to be US$129 billion [JP¥14 trillion] if CSPs continue to introduce newer products and services and deployment keeps pace. In addition, this is also supported by policymakers maintaining their existing stance on public cloud deployment (See Exhibit 21). When annualized, this is a sum equivalent to about 25% of the annual impact of the electronics industry, about 20% of that of Japan’s automobile industry, and 0.5% of the country’s annual GDP. Approximately 85% of the added value will be generated through industry verticals.

Public cloud usage stands to create close to 51,000 direct jobs over the next five years. Roughly 25,000 of the direct jobs will be in non-digital roles such as sales, marketing, human resources, finance, logistics and operations. About 26,000 will be digital jobs, 14,000 of which will be with cloud service and IT system providers and the remaining 12,000 with industry verticals, representing approximately 1.3% of the current information and communications technology workforce. A large proportion of these jobs will require training incoming workforce as well as retraining and upskilling the existing workforce.

The second order effects are expected to influence another 95,000 indirect and induced jobs, bringing the total potential jobs that generated as offshoots of public cloud use to 146,000, which is 0.2% of the current workforce.

Two alternate scenarios

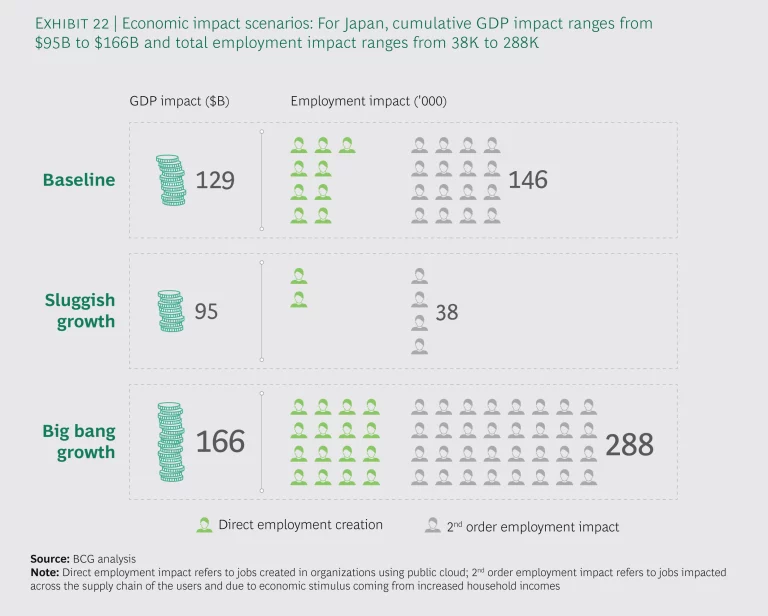

The economic impact we have assessed above is the Baseline Scenario, but we have drawn up two additional scenarios. The Big Bang Growth Scenario and the Sluggish Growth Scenario show the economic impact that would occur if the forces that shape the public cloud market cause growth to either speed up or slow down. If either of these scenarios were to unfold, the full cumulative economic impact of the public cloud could vary by a difference of about US$70 billion [JP¥8 trillion] between 2019 and 2023 (See Exhibit 22).

The Big Bang Growth Scenario. The government’s efforts to encourage public cloud adoption within its own agencies, if successful, would be a powerful factor in the optimal growth scenario. For Japan to realize the maximum impact from the public cloud, however, it will need a full range of supportive government policies, including a cloud procurement policy with clear accreditation steps and effective incentives to drive government deployment. Along with such policies, Japan’s growth could be faster if the government, the CSPs and user organizations all work together to resolve the problem of talent constraints and foster further cloud literacy.

In this scenario, a CAGR of 23% would lead to a total impact of about US$166 billion [JP¥18 trillion], or 0.7% of annual GDP. This growth would create 97,000 direct jobs and influence 191,000 additional indirect and induced jobs, thus yielding nearly 288,000 jobs.

The Sluggish Growth Scenario. Although the Japanese government has been supportive of the public cloud, and has enacted not just policies in support but also appropriate cooperation frameworks, lack of clarity in the regulatory regime can increase uncertainty and slow adoption, especially if the policy and regulatory stance were to become more restrictive. Inadequate supply of cloud-native talent in the country would also slow down adoption.

Here, CAGR would drop to only 13%, and total impact from all sources of US$95 billion [JP¥10 trillion], or 0.4% of annual GDP. Direct job creation would amount to about 13,000, and second order effects would influence another 25,000, for a total impact of about 38,000 jobs.

The public cloud market is strong in Japan, and the announcements over the last couple of years that a number of marquee private and public players intend to migrate significant applications will be an important boost to growth. The country does, however, have a critical need to make a concerted effort to develop and retrain a larger pool of IT and cloud-native talent to keep up with growing demand. If the country is able to address the talent shortage, and the government develops a more active procurement policy encouraging its own agencies to migrate applications to the public cloud, Japan will see particularly robust growth in public cloud use that will continue to foster innovation and digital transformation, and drive impact within the overall economy.