Companies in mature industries—including the travel-and-tourism sector—need new ways to increase revenues. They face plenty of barriers: feverish competition, excess capacity, and commoditized products, to name a few. Price is one lever that companies can still pull, even at a time when digital technologies give consumers near-total transparency. The irony is that in the industry that invented dynamic pricing and revenue management—travel and tourism—this high-impact tool often lies unused or is employed in ways that fall far short of realizing its full potential.

More than 30 years ago, American Airlines demonstrated the impact that dynamic pricing can have on increasing revenues—especially for a company with perishable inventory—with the first systematic yield-management system. In succeeding decades, revenue management took a backseat to network and capacity expansion and to managing products, such as first class and business class, which became the industry’s primary growth drivers. But price still matters. Low-cost airlines today repeatedly demonstrate that price is one of the major success factors in travel and that companies should be more active in managing price, not only to increase revenues but also to fend off the competition.

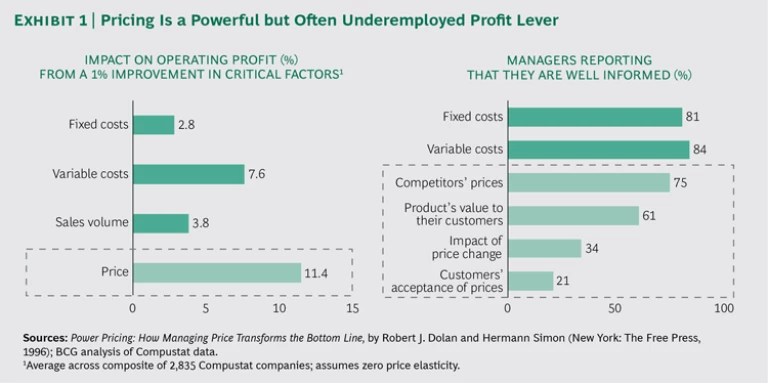

An analysis by The Boston Consulting Group of more than 2,800 companies across multiple industries indicates that a 1 percent improvement in price has a far greater impact on operating profit—more than 11 percent—than a similar level of improvement in other critical factors, such as sales volume or variable or fixed costs. Yet while four out of five managers think they have a good handle on costs, less than two-thirds believe they understand their product’s value to their customers, only one-third think they grasp the impact of a price change, and only one-fifth believe they are well informed about their customers’ acceptance of prices charged. (See Exhibit 1.) The time is right for the renaissance of one of the industry’s most significant revenue-enhancing tools.

From Source of Growth to Source of Frustration

The impact of revenue management extends beyond the lift it gives to revenues, cash flow, and earnings. Other benefits include the ability to keep abreast of competitors that are building or improving their own revenue-management systems and the quick-response capability that the systems provide in volatile market conditions. Moreover, it’s not only the large, sophisticated players that can make better use of revenue management. The tool has spread beyond traditional first movers (airlines, hotels, and rental cars) to companies with perishable inventory in other industry segments, such as cruise lines, tour operators, railways, and event managers. Companies employing revenue management have experienced revenue increases of up to 10 percent. But individual companies vary widely in their performance. Those that use suboptimal programs often leave substantial revenue on the table. They compromise their profitability in the process, since most of the incremental revenue generated by revenue management systems drops straight to the bottom line.

Many CEOs voice frustration with the systems. They complain that they are expensive to build (or buy) and that it’s hard to know if their companies are realizing the full value of their investment. The most common problems the CEOs cite are poor execution because of inadequate revenue-management-team capabilities, lack of support from systems that are either too basic or too sophisticated for their users, and unsupportive cultures within their organizations. If other company functions, such as finance, marketing, and sales, don’t believe in or collaborate with the revenue management team, it’s hard for revenue management to achieve the results the boss is looking for.

Ten problem areas emerge in our work with clients, not all directly or exclusively linked with pricing. The first four have to do with a flawed understanding of how consumers make their purchasing decisions.

- Limited sophistication in product design. Many companies do not design products or product combinations that take advantage of consumers’ willingness to pay. Well-designed pricing bundles (all-inclusive packages at resorts, for example) and ancillary services can generate enormous value.

- A generic view of consumer elasticity in making pricing decisions. Consumers’ willingness to pay can vary substantially over the booking period. A business traveler booking a ticket close to the departure date needs to buy the ticket almost regardless of price, while a leisure traveler making reservations well in advance can wait for the prospect of a better deal.

- Too much focus on matching the competition’s prices. In reality, prices do not often match—or need to. Companies with strong brands or those that offer special services or features can avoid direct comparison with competitors and maintain price premiums.

- An assumption that pricing decisions made for one market or customer segment will work just as well in another. Companies can benefit significantly from developing individual pricing playbooks for each market and customer segment that they operate in.

The next four problems involve execution.

- A shortage of revenue management capabilities in the organization. These may include both role-related technical skills and so-called soft skills, such as communication.

- An unclear or understaffed organization structure, with no formal role for the revenue management team and a limited number of dedicated resources.

- Business processes that are not formalized or efficient. These can include an unclear delineation of responsibilities and cumbersome interactions among business units.

- No clear reporting lines or performance objectives and metrics.

The last two problems involve support tools.

- Systems that tend to be biased toward volume over price. They seek to fill capacity instead of maximizing revenue or profit.

- Overinvestment in sophisticated revenue-management tools. These are either too complicated for the analysts running them or inadequately calibrated and thus provide misleading recommendations.

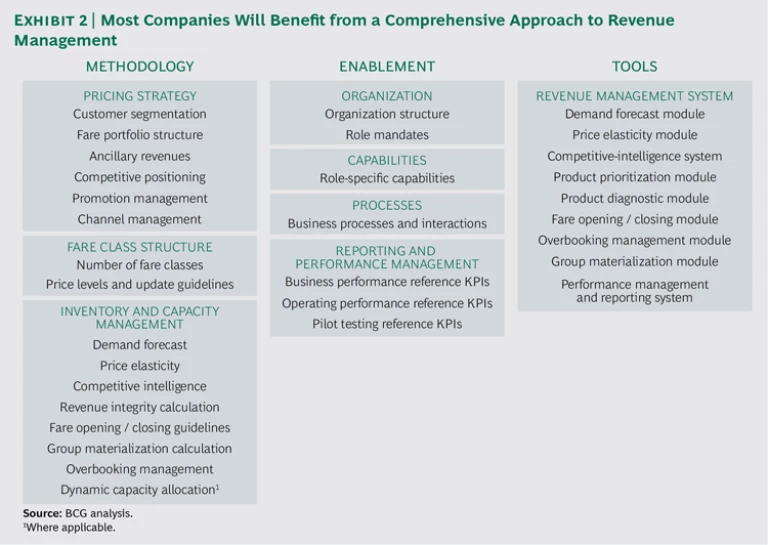

Too often, in our experience, companies address one, two, or even several of these issues, but other problems remain and undermine overall performance. Revenue management is a complex practice, and the various challenges cited above are interconnected. Companies looking to build a capability, or to improve what they have, should take a comprehensive approach. They need to address three critical system components in concert: methodology (pricing strategy, fare class structure, and inventory and capacity management); enablement (organization, capabilities, processes, and reporting and performance management); and tools (revenue-management-system components). (See Exhibit 2.) Companies that tackle problems in a piecemeal fashion achieve only partial improvement (and sometimes not even that), with the result that the revenue management team and system are often relegated to the lower levels of the organization and deprived of a strategic role.

How You Build Depends on Where You Start

The approach that travel companies take to methodology, enablement, and tools depends on their current use of revenue management and the degree of sophistication they have attained. Most companies fall into one of three categories:

- Leaders—companies that have developed sophisticated revenue-management systems but still have room to optimize their practices, often because they are overwhelmed by complexity

- Semipros—companies that employ revenue management techniques but could get much more bang for the buck by structuring and executing their programs more formally and effectively

- Sideliners—companies (or other organizations) that don’t yet use revenue management

Leaders. Most airlines, hotels, and car rental companies have long experience with revenue management, and many have built or bought highly sophisticated systems to manage their programs. For an increasing number, however, these “black boxes” have become overly complex, and some companies have become “slaves to the black box,” sustaining systems that require massive effort and investment—and not taking anywhere near full advantage of their output. These companies also usually lack the skills necessary to open the black box and adjust or recalibrate its mechanisms.

For other companies, even off-the-shelf systems can be sufficiently complex to overwhelm inadequately skilled or understaffed teams and to deliver subpar performance. In fact, in our experience, companies that install off-the-shelf systems often neglect the training that is necessary to maximize their performance.

Leaders can often improve their performance by reducing complexity and being open to new approaches and ways of working. We recently worked with one airline to simplify its revenue-management capabilities and approach by opening the black-box inventory-management system and applying a more customer-centric approach in order to capture customers’ true willingness to pay. The airline also streamlined its pricing methodology by creating a process to systematically update its fare ladders. It upgraded its tools with a customized software addition to its existing systems and provided in-depth training in the new capabilities to team members. This new approach helped the airline capture an improvement in revenue per average seat kilometer of more than 5 percent and a significant increase in its net profit.

Semipros. This category includes more recent converts to dynamic pricing, such as railways, cruise lines, tour operators, theme parks, and casinos. Many have experimented with various techniques, but revenue management typically remains a largely unstructured practice with limited skills and support tools. Not surprisingly, results suffer.

These companies have perhaps the biggest opportunity to increase revenues by formalizing their programs and integrating revenue management as a critical capability. In our experience, this generally involves addressing all three components—methodology, enablement, and tools—by defining a strategy and setting pricing guidelines, testing tools with ad hoc prototypes, and establishing a formal organization structure with defined skills, roles, training, processes, and rewards.

Too often, we have seen companies that try to leapfrog the more laborious design and installation of a purpose-built system by investing in a top-of-the-line off-the-shelf system, usually adapted from a more advanced subsector, such as airlines. This approach has three pitfalls: it relies on methodologies from other companies or subsectors that may not address the pricing issues the company actually faces; it limits the company’s ability to customize the new system; and it doesn’t provide training and other measures to help the company use the system to maximum effect.

We helped a tour operator transform its revenue-management system from a largely unstructured practice into a full business unit. We worked with the company to design the methodology and develop a prototype to test algorithms and tools before full implementation. At the same time, we designed the organization, assessed and trained existing employees, and helped fill staff vacancies. The company achieved an increase in EBITDA of more than 12 percent in the first six months of full operation.

Sideliners. While most travel-and-tourism companies have at least experimented with dynamic pricing, one large group of exceptions is travel infrastructure organizations—the companies and government authorities that run roadways, airports, and marine ports. Unlike other travel-related entities, these organizations don’t have to deal with perishable inventory, but many do manage periods of peak demand, which brings a number of similar factors into play. These organizations can employ dynamic pricing both to increase revenue and to support nonfinancial objectives. For example, the Interstate 15 express lanes in San Diego, California, employ a dynamic tolling system, with tolls ranging from $0.50 to $8.00 depending on the distance traveled and the congestion level.

Many infrastructure organizations don’t recognize the value of dynamic pricing, which is a mistake in our estimation, while others feel constrained by existing regulations from implementing pricing changes. The latter may have more leeway than they think.

The first step in both instances is to analyze the opportunities for dynamic pricing, including assessing the nonfinancial goals it can help achieve, and to build a business case to support a pilot program or the ability to experiment. This often entails balancing the priorities of various interested parties, including, for example, operators that need to operate profitably, local governments that want to ensure a fair pricing scheme for end users (consumers and voters), and higher levels of government, which are responsible for maintaining the infrastructure and facilitating its optimum utilization.

We believe that most infrastructure organizations can benefit from taking the first steps toward dynamic pricing—establishing a simple peak/off-peak pricing system, for example—and learning what outcomes users value (such as convenience or shorter routes) and at what cost. In the process, they will also begin to establish a pricing organization and gain experience in the skills and tools necessary to implement more complex revenue-management programs, should they choose to do so.

Outside of travel and tourism, many industries face similar issues of fixed capacity and perishable inventory (restaurants, for example). Companies in these sectors could generate tremendous value from applying the techniques of dynamic pricing.

The experiences of travel-and-tourism companies going back decades demonstrate that when built and executed properly, revenue management systems deliver substantial increases in revenue and profit. Almost any organization can benefit. Getting started is often the easy part; the challenges increase in complexity with the system’s sophistication. But with improvements in methodology, enablement, and tools come commensurate advances in performance.