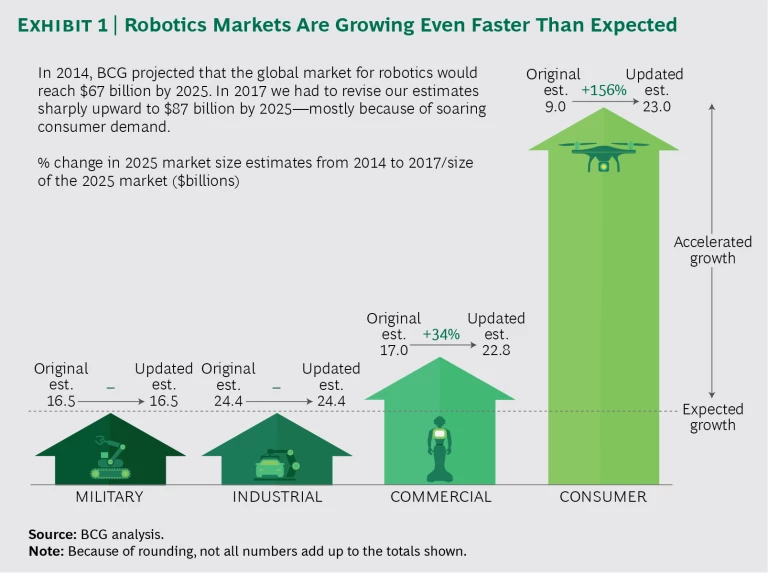

Robots are poised to change the global business landscape. These guidelines will help your company capitalize on the technology and gain a sustainable edge. The interactive shows growth projections for four key industry sectors and how surging consumer demand caused our projections to be revised sharply upward.

The global market for robotics—the use of computer-controlled robots to do manual tasks—is growing far faster than expected. In 2014, BCG projected that the market would reach $67 billion by 2025. In 2017, we increased that estimate to $87 billion. Much of the accelerated growth will come from the consumer market because of applications such as self-driving cars and devices for the home. Projected growth in the commercial sector accounts for the rest of the adjustment. (See Exhibit 1.)

The revamped estimates derive from many factors. First, in the space of just one year, from 2014 to 2015, private investment in the robotic space tripled.

The industrial and military sectors were the earliest adopters of robotics technologies. Robots were well suited to dirty, dull, repetitive, or hazardous tasks that required minimal precision. Now falling prices, faster CPUs, improved safety, and easier programming have put robots within reach of virtually every sector, and their ability to work side by side with humans opens up an array of new applications.

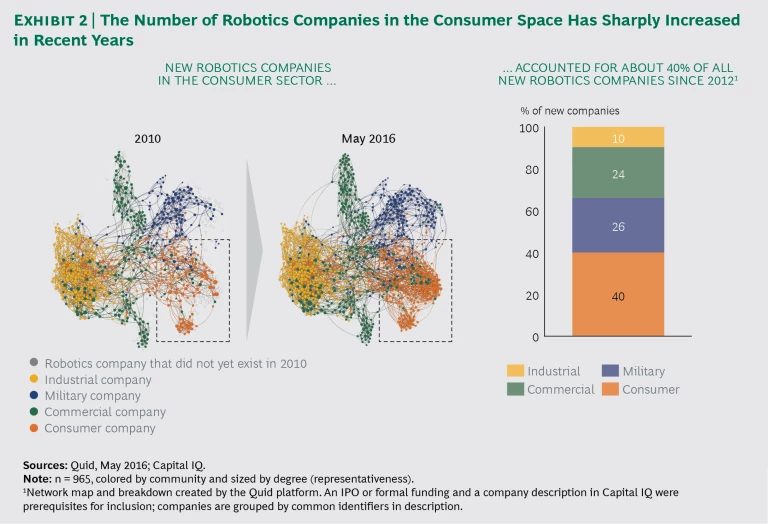

Industries as diverse as retail, health care, food processing, mining, transportation, and agriculture may see radical, robotics-fueled changes in coming years. In 2016, the robotics field experienced a dramatic shift toward consumer-focused applications and a sharp increase in robotics companies in the consumer space. (See Exhibit 2.) Today, robots can vacuum and mop your floor, clean your gutters, tutor your children, provide home surveillance and security, and act as companions and home-health aides for your loved ones.

Whether a company is considering robotics for the first time or made an earlier investment that didn’t pay off because of economics, limited capabilities, or untrained staff, ignoring developments in the field is risky. Robots are poised to change the global business landscape.

Advanced Capabilities, New Opportunities

New capabilities and applications are driving the shift to robotics. Today’s robots have voice and language recognition, access to large amounts of data, algorithms to process information independently, learning capability, greater mobility and dexterity, advanced sensors, and the ability to interact with their environment. They have gained flexibility, speed, and finesse, clearing the way for a generation of precision robots that can slice meats, sort and fill prescriptions, pick and pack warehouse orders, or harvest fruits and vegetables—far more quickly and accurately than human hands can.

The combination of advancing technology and retreating prices is making robots more widely accessible for a multitude of new uses—and entrepreneurs are taking note. Since 2012, 40% of new robotics companies have been in the consumer sector, outpacing the military, commercial, and industrial sectors.

Once consumers begin to buy, all sectors will feel the effects. As people become more accepting of robots in their everyday lives—embracing everything from robot vacuum cleaners to autonomous lawnmowers—they will begin to demand more such products. This will attract more investment capital and drive further advances in robotic capabilities. And as robots become increasingly humanlike, they’re even beginning to augment or replace labor in high-touch fields such as health care and elder care.

The impact of these changes will be profound. Differences in labor costs between developed countries and emerging economies will cease to be a critical factor for companies deciding where to set up operations, and new factors will come to the fore. These trends will change the dynamics in many industries.

How to Gain Robotics Advantage

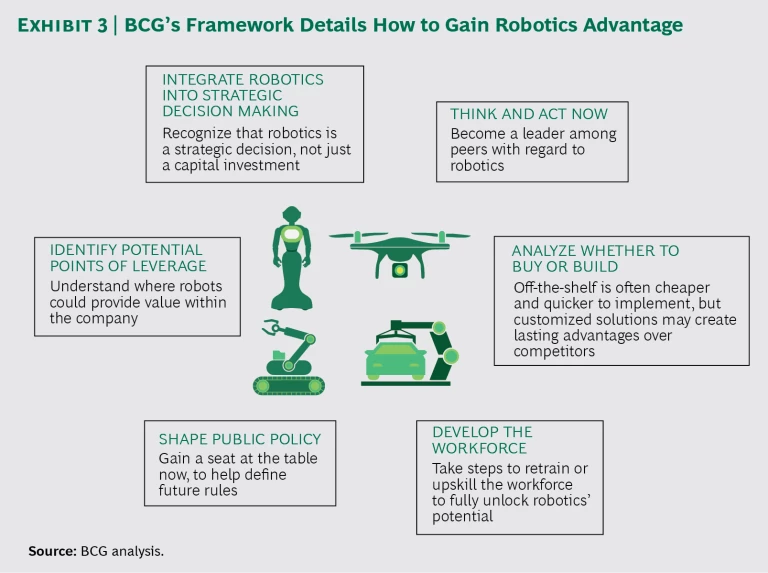

Gaining robotics advantage involves finding innovative, unexpected ways to leverage technology to differentiate a company from the competition and gain a sustainable edge. This may mean identifying the sweet spot where a hybrid mix of human worker and machine delivers the biggest payback, or it may involve creating an entirely new business model. But knowing where and how to start is often the biggest hurdle. On the basis of our experience in a variety of industries, we’ve developed a framework to help companies move forward. (See Exhibit 3.) The framework offers six guidelines.

Identify potential leverage points. Companies should look for areas of the business where robotics might be able to add value by cutting costs, enhancing productivity, improving performance, reducing risk, and addressing skill shortages or workforce variability. Cost savings are likely to be greatest in parts of the world where wages are high and robots could replace labor outright. Areas with highly repetitive or dangerous tasks, or jobs that require flexibility, speed, or precision are also natural fits for robotics. For instance, the da Vinci Surgical System allows doctors to perform surgery using robotics and 3D vision systems.

Robots can also be used to take on repetitive, low-skill tasks. In the US, for instance, Wendy’s and other fast-food chains are installing automated order kiosks to cut staffing levels. But besides replacing some human labor, robots can enhance the human staff’s productivity by working alongside them. Collaborative robots or “cobots” can do heavy lifting and perform precision activities more quickly than human workers can. By liberating workers from tedious, tiresome, or repetitive tasks, robots can improve not only the workers’ productivity but also their job satisfaction.

Integrate robotics into strategic decision making. Adding robotics to a business is a strategic decision, not just a capital investment. It requires rethinking and fundamentally altering staffing levels, product mix, manufacturing footprint, and other aspects of the business model. Management must also consider how robotics will affect the company’s brand, operations, and sales. For instance, building robot-enhanced plants closer to local markets may make sense as a way to accelerate response times and to fine-tune products to local tastes. Or splitting production into two shifts—a day shift for humans and a night shift for robots—may help to reduce overtime, supervision, and energy costs. Facilities in which robots do much of the work have different priorities. Proximity to workers can be less important than electricity rates, proximity to market, and access to programmers, for instance.

Nike has integrated robotics into its long-term strategy while bringing more production back to North America. Tired of the production delays and rising supply chain costs of overseas production, the company plans to use robots and automation to offset higher labor costs.

Think and act now. Where new technologies are concerned, timing is critical to market leadership. When robotics and automation cross certain price, performance, and adoption thresholds, a tipping point may be near. First movers capture a disproportionate share of the high margins that accrue to successful early adopters. That benefit decreases as adoption becomes more widespread. And because it can take a long time to integrate automation into operations, management needs to act now to develop a point of view, test and pilot robotic applications, and invest in infrastructure—including laying the foundation for a digital supply chain on the factory floor. All the while, the company must closely monitor the industry sector it competes in and move decisively when the time is right.

Amazon gained a first-mover advantage in 2012 when it bought Kiva Systems, which makes robots for warehouses. Once a Kiva customer, Amazon acquired the robot maker to improve the productivity and margins of its network of warehouses and fulfillment centers.

Analyze whether to buy or to build. Proven, off-the-shelf robotics applications can be put to work quickly, but they’re available to everyone, including the competition. For instance, Kuka sells Ready Packs—robotic kits that include a robot arm, a preconfigured controller, an operator control unit, and software that can be ready for operation in weeks. An alternative is to invest in a robotics solution tailored to a company’s particular operations. A customized solution could result in fundamental disruption of an industry’s dynamics and provide a long-term source of differentiation.

The decision about which direction to take may come down to sourcing options. Most companies will need to look beyond traditional equipment suppliers for their robotics needs. But even robotics suppliers may not have solutions on hand that meet the specific needs of individual companies or segments, necessitating a customized solution.

Develop the workforce. To fully unlock the potential of robotics, countries must retrain or increase the skills of their workforce. Today’s workers generally lack training in robotics installation, programming, operations, and maintenance. Few governments, universities, vocational schools, tech leaders, and manufacturers around the world are adequately addressing the problem. Despite some progress in early education through STEM initiatives—courses in science, technology, engineering, and mathematics—and in universities with specific degrees related to robotics, an ability gap remains.

The US lags behind other countries in worker development. In 2014 the US publicly spent only about 0.03% of its GDP on labor training. In comparison, among member nations of the Organisation for Economic Co-operation and Development, Denmark spent the most—0.52% of its GDP.

Without a pool of qualified applicants to choose from, companies will need to train their own people to install, program, operate, and maintain robotics applications. Retaining these people once they have acquired high-demand, high-value skills will be another challenge. As robots take over lower-value and repetitive tasks, the work that remains will be more complex and less structured—and workers will need new skills to perform these tasks successfully.

Foxconn, the maker of Apple’s iPhones, recognized an emerging skill gap among its workers in certain areas, including robotics expertise—a difficulty that threatened to become increasingly problematic as the firm continued to introduce more and more robots into its processes. To address the issue, the company has partnered with local universities to help workers gain the needed skills, especially in engineering.

Shape public policy. Companies that make or use robotics should work with communities, educators, local governments, and policymakers on issues related to safety, liability, social impact, and funding for education and training. By gaining a seat at the table, companies at the forefront of robotics can help define the rules, ensure progress, and become advocates for the needs of industry and society alike. For example, Google, Uber, Lyft, Volvo, and Ford created the Self-Driving Coalition for Safer Streets in hopes of formulating a federal standard for autonomous vehicles in the US.

Beyond helping to craft policy for robots that operate in public spaces, companies should participate in setting safety requirements at work, especially as cobots become more prevalent. As robots become safer, the certification process—particularly in Europe—should become quicker and less onerous, encouraging further development in the field of automation.

Collectively, the guidelines outlined above can help companies approach robotics in a strategic, disciplined, and pragmatic way—and improve their odds of achieving long-term, sustainable robotics advantage.

Acknowledgments

The authors would like to thank Yew Heng Lim, Markus Lorenz, Hyun Kim, Ailke Heidermann, Thomas Milon, and the Center for Sensing & Mining the Future team for their contributions to this article.