The ubiquity of the smartphone and its integrated camera has brought about a new era in consumer behavior. Users are increasingly engaging with the physical world through a digital lens, spending a large portion of their time with their smartphone and camera and sharing pictures and videos with their friends. An estimated 1.3 trillion photos were taken worldwide in 2017, nearly four times the number taken in 2010, most of them on smartphones. As Snap’s CEO, Evan Spiegel, puts it, “The camera is evolving from being a barrier, separating users from the world, to becoming an aperture, for users to explore the world.” (Snap commissioned this report; see “About This Report.”)

About This Report

About This Report

AR technology provides the ability to overlay or superimpose digital images and representations (such as furniture or apparel) onto real-world environments. AR is a fundamentally different technology from virtual reality (VR), which immerses users in a completely artificial and digital environment, typically through a head-mounted display. This report focuses exclusively on AR.

Given the fast-rising adoption of AR by users and the increasing interest by advertisers, Snap commissioned BCG to undertake a study of AR’s impact on the consumer-advertising market. As part of this BCG Marketing Executive Benchmarking Study, we surveyed more than 50 CMOs and senior marketing executives from the top 200 advertisers in the US, spanning multiple industries, on their current usage of AR and their outlook for future usage. We interviewed a sample of these executives directly to provide further details and insights.

All market projections and usage figures are specific to the US. We have discussed our work with Snap executives, but the analysis and conclusions are entirely the perspective of BCG.

This massive shift of eyeballs provides marketers with a powerful new canvas on which to create advertising experiences. “Camera marketing” could be the next wave of digital marketing, similar to the advent of web advertising in the mid-1990s or the development of mobile-first ads at the beginning of this decade. One specific form of camera marketing, the use of augmented reality (AR), is quickly gaining traction, as demonstrated by Pokémon Go’s meteoric rise to 50 million users in the US in a matter of weeks.

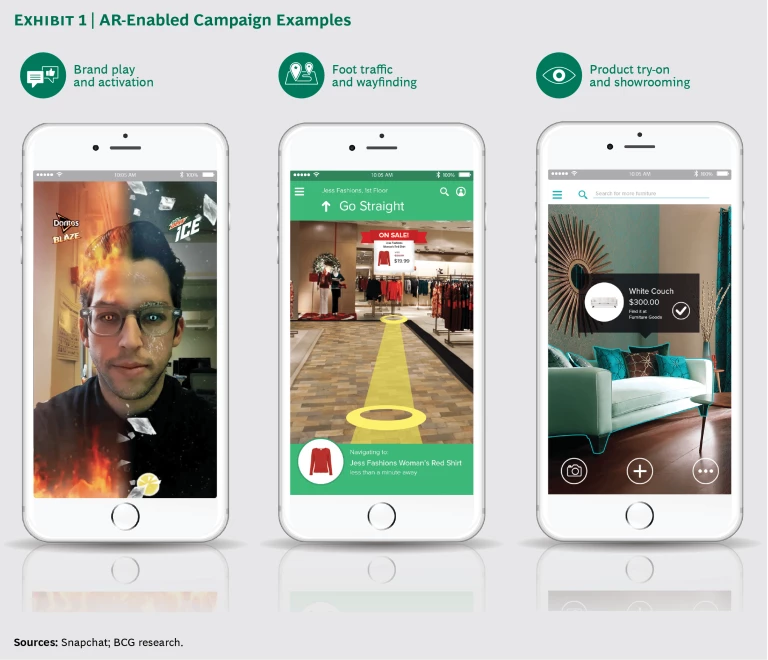

By blending the physical and digital worlds and enabling users to actively shape their experiences, AR offers unique ways for marketers to interact with consumers. These can range from brand overlays, to navigation and wayfinding, to virtual showrooming. (See Exhibit 1.) Our survey of over 50 of the top 200 advertisers in the US shows that marketers recognize the opportunities in AR. More than four out of five respondents said that AR marketing is a differentiated way to engage with customers. “There is high potential in AR to help transform the way we market,” a senior retail marketer told us. “The current traditional forms of digital marketing someday will be looked at as old school.”

Although they recognize the opportunity, few companies have yet moved beyond experimentation with AR, and only a small number of them consider the technology an integral part of their marketing strategy. Our research and client experience indicate that this is set to change. This report looks at what companies need to know—and do—to catch the fast-rising AR wave.

The AR Opportunity

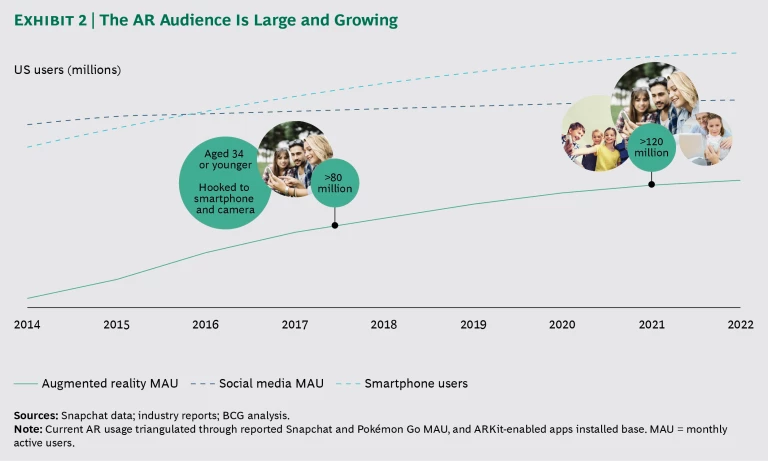

The AR opportunity is already bigger than many marketers realize. On the basis of 2017 data from Snapchat, Pokémon Go, and other AR applications, we estimate that more than 80 million people in the US, or roughly one-third of all smartphone users, engage with AR at least monthly. (See Exhibit 2.) The consumers using AR applications are a particularly attractive segment for advertisers: most are millennials (aged 19 to 34) or Generation Z consumers (aged 18 or younger). They use their smartphones and cameras continually throughout the day, communicating via images and video as much as they do through text and voice. This behavior opens up an entirely new method for engaging with consumers—an interactive approach where the advertiser is a participant in the “conversation” or activity rather than a company delivering a message.

As a result of rapid consumer adoption, a dynamic ecosystem is developing around AR and—in particular—around smartphone-based AR. Advertisers have two distinct pathways to reach consumers. First-party AR marketing uses applications or platforms owned and managed by brands, such as proprietary mobile apps or brickand- mortar store experiences. Third-party AR marketing involves advertising units bought on AR platforms owned or managed by social media, messaging, gaming, or digital-publishing companies, among others. First-party advertising so far is fragmented, with a growing number of bespoke mobile applications from major advertisers touting AR features but very few reaching significant scale. In comparison, third-party AR is concentrated across a few well-developed platforms, enabling advertisers to reach audiences at scale. Examples include Snapchat, which reports 70 million monthly active AR users in the US, and Pokémon Go.

Moving forward, we expect the AR ecosystem will continue to develop quickly as tech giants such as Facebook, Google, Apple, and Amazon make their own big bets on AR. In parallel, other players such as ad agencies, app and software developers, and ad networks are staking out their own roles in the value chain. Marketers can expect to have access to a wide array of AR-marketing options in the future as well as support and expertise from a host of external partners for the development and execution of campaigns.

Given the traction AR is gaining with consumers, and its fast-developing ecosystem, we expect it will reach more than 120 million regular users in the US by 2020. This growth will both drive and be fueled by an explosion of offerings across a broadening array of use cases, as well as by further penetration across all demographics. As Apple’s CEO Tim Cook told the BBC, “I’m incredibly excited by AR because I can see uses for it everywhere.”

How Advertisers See and Use AR Today

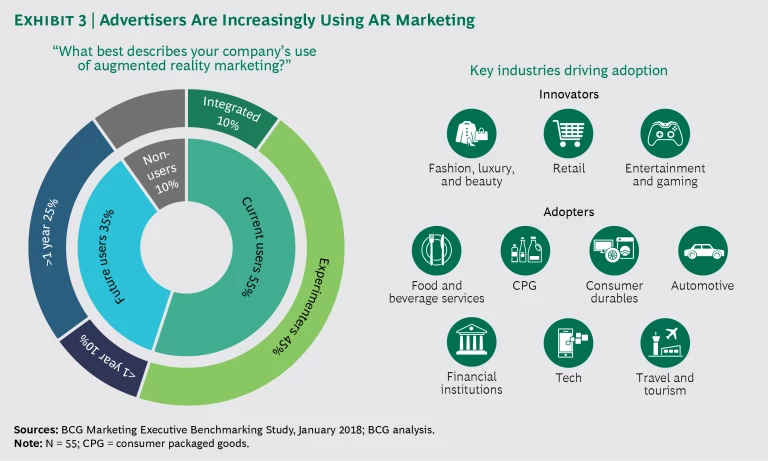

Marketers are moving quickly to capitalize on the opportunities in AR. Nine out of ten large consumer advertisers in our survey are already using, or are planning to use, AR in their marketing campaigns. Most of this usage, however, is still at the experimental stage; only one out of ten companies indicates that AR is well integrated into its marketing strategy. (See Exhibit 3.)

Companies in industries such as retail, fashion and beauty, and gaming and entertainment are leading adoption—and for good reason. In these verticals, AR offers a unique advantage over other channels in that it enables consumers to visualize products in use in a specific context, such as makeup on a potential purchaser’s face, furniture in an actual room, or video game or movie characters in a real-world setting. While these are the most intuitive use cases for AR, many other creative uses already exist and many more will emerge in a variety of sectors.

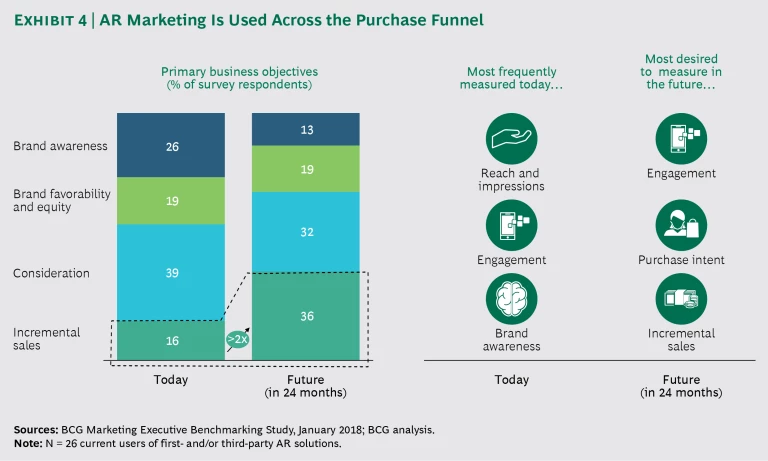

Advertisers regard AR as a marketing tool that can help engage consumers along all stages of the marketing funnel, from awareness to purchase. Currently, most are focused on the top and middle stages (awareness and consideration), but they expect more bottom-of-funnel activity to develop. In our research, fewer than one in five advertisers considers “incremental sales” a primary objective for AR marketing today, but more than a third expect it to be a primary objective 24 months from now. This prioritization of bottom-of-funnel objectives is also reflected in the metrics that advertisers use in AR campaigns. Today, advertisers look to AR to boost reach, engagement, and awareness, but the metrics they most want to use AR for two years from now are engagement, purchase intent, and sales. (See Exhibit 4.)

Against these objectives, AR advertising has already started to demonstrate measurable success, and it has done so across a wide variety of industries, including automotive, consumer goods, retail, food and beverage services, entertainment and gaming, and fashion, luxury, and beauty.

At the top of the funnel, marketers have seen double-digit increases in brand awareness and favorability. For example, Nissan drove a 15-percentage-point improvement in brand favorability with its See the Unseen campaign, which showcased advanced vehicle safety technologies through interaction with Star Wars movie characters. (See “Nissan Uses New Tech to Show Off New Tech.”) According to Jeremy Tucker, vice president, marketing at Nissan North America, “We got results that you don’t see in traditional media.” A number of third-party AR campaigns have shown an average 19-percentage-point increase in ad awareness, according to measurement company Nielsen.

Nissan Uses New Tech to Show Off New Tech

Nissan Uses New Tech to Show Off New Tech

Nissan came up with the See the Unseen campaign by first articulating the clear business objective of developing an interactive, educational means of communicating the benefits of the Intelligent Mobility technology. To execute the concept—given the complexity inherent in developing a first-of-its-kind campaign—Nissan mobilized significant internal and external capabilities. Internally, the automaker used learning from a previous third-party AR campaign and an experienced team. Externally, the automaker tapped into a network of creative and development agencies well versed in AR marketing applications. Underlying the entire effort was Nissan’s culture of innovation, which is fostered by its marketing leadership. The company empowered the team to develop and iterate the campaign in the face of some significant obstacles and bring the concept to life.

See the Unseen was embraced by consumers and outperformed similar campaigns using both traditional and digital media. In a survey of those who had been exposed to the campaign, Nissan found a 67-percentage-point rise in familiarity with the Intelligent Mobility technology and a 15-percentage- point lift in brand favorability— both sizable increases in important metrics for an automaker.

Owing in part to the success of See the Unseen, the automaker plans to step up its use of AR and further integrate the medium into its marketing strategy. Nissan believes that the technology will, in addition to making it possible to tell richer product stories, allow the company to improve its sales process. The marketing team is currently engaged in rolling out new AR applications, and it is focused on scaling these experiences to a wider audience.

At the bottom of the funnel, marketers have seen equally powerful results. Retailer Williams-Sonoma is using AR in many ways, including a mobile app that enables customers of Pottery Barn (a subsidiary) to visualize how furniture will look in their homes. Laura Alber, CEO of Williams-Sonoma, told Forbes, “Augmented reality and 3D rendering are fundamental for driving and changing the shopping experience.” Numerous third-party AR campaigns for consumer goods companies have delivered an average 10% increase in sales with a 3.1-fold return on ad spending, as measured by Nielsen Catalina Solutions. In the food and beverage services space, McDonald’s ran a particularly successful AR campaign on Snapchat that drove a significant lift in foot traffic and sales with a 10.5-fold return on ad spending, as measured by Placed. (See “McDonald’s Deploys a New Way to Feel Good.”)

McDonald’s Deploys a New Way to Feel Good

McDonald’s Deploys a New Way to Feel Good

In 2017, McDonald’s wanted to support a cold-beverages promotional campaign and create feel-good moments for customers (see the exhibit). It decided AR was a differentiated way to do so. The campaign had a clear business objective: to promote an offer of $1 cold beverages in order to drive foot traffic to McDonald’s restaurants, with the expectation that consumers would purchase a larger basket once in the restaurant.

McDonald’s used Snapchat because the app provided engaging AR features as well as the reach necessary for a campaign whose success depended on quickly driving mass scale. To ensure successful execution, McDonald’s tapped into its prior learning and worked alongside its media and creative partners as well as a Snapchat team to execute the cold-beverages AR campaign.

The campaign achieved exceptional results. A poll by Nielsen showed an 11-percentage-point increase in message awareness against the control group, twice McDonald’s normal campaign experience. In an attribution study that Placed conducted of the ad’s impact on in-store visits, McDonald’s observed a 6% behavioral lift—that is, an increase in the likelihood of visiting a McDonald’s among consumers exposed to the campaign. The campaign generated a 10.5-fold return on advertising spending, three to four times better than McDonald’s norms.

The Barriers to More AR Advertising

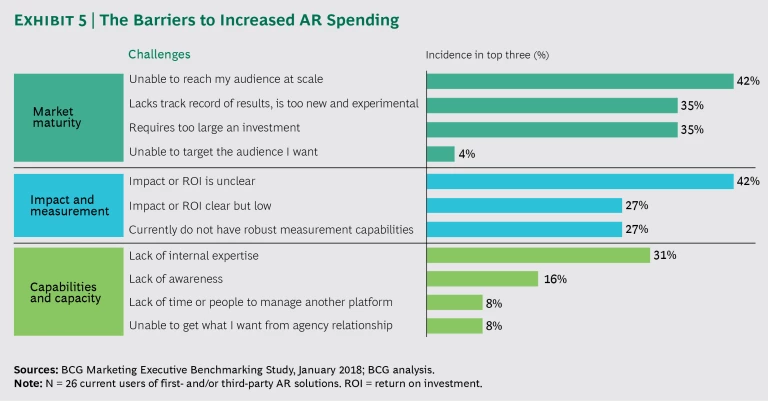

Despite the size of the opportunity and the encouraging results from early movers, big advertisers report several challenges that are preventing them from scaling up their AR efforts. Specifically, companies are wrestling with obstacles related to market maturity, impact and measurement, and internal capabilities and capacity. (See Exhibit 5.) In some cases, these barriers appear to be rooted in a lack of knowledge or understanding, so we expect they will recede over time. Advertisers may need to make a concerted effort to overcome others, however.

Market maturity is the biggest challenge reported by marketers today. Advertisers in our survey pointed to such factors as “unable to reach my audience at scale,” “lacks a track record of results, is too new and experimental,” and “requires too large an investment” as barriers. In our judgment, some of these are more perceived than actual challenges; for example, scale is not an issue because there is already a substantial audience of AR users. And as the market matures and standard tools and platforms—such as Snap’s Lens Studio, Facebook’s AR Studio, and Amazon’s Sumerian—become more widespread, deployment costs will drop and a track record of results will build.

Impact and measurement is the second-most-cited challenge, particularly the uncertainty around return on investment (ROI). While this is understandable given how new AR is, a body of evidence already exists to demonstrate that AR marketing can be effective at driving business outcomes, which will only continue to improve with greater adoption. In this context, it will be critical for advertisers to determine how to clearly measure the efficacy of their AR marketing activities—and encourage their partners to do so—in order to demonstrate the impact of AR compared with that of other marketing channels.

Internal capabilities are another barrier to increased AR adoption, which is hardly surprising given the newness of the technology. Advertisers need to gain experience, and as is the case with most advanced technologies, the supply of expert talent needs to catch up with fast-rising demand. In the meantime, advertisers can accelerate their capability development by deploying limited-cost test-and-learn approaches and by tapping the experience of external partners, such as agencies and advertising platforms.

Stepping Up Your AR Game

We expect the AR-advertising ecosystem to continue to mature quickly, overcoming barriers and pushing AR into the mainstream. For marketers, the user numbers are too large, the engagement and results too promising, and the potential brand halo too compelling to ignore. As one retail CMO stated, “AR is a powerful new technology that can elevate customer experiences, and it’s incumbent upon marketing leadership to push involvement.”

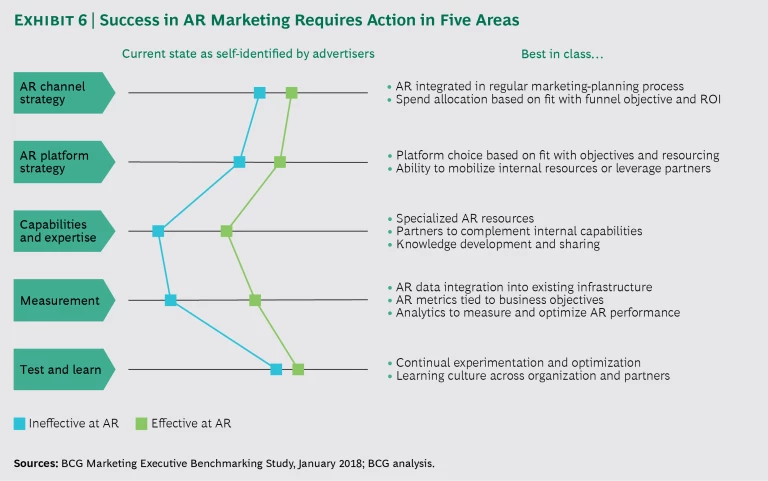

To lay the foundation for their AR strategies and to prepare their organizations to execute successfully, marketers need to take action in five areas. (See Exhibit 6.)

Elevate AR in your marketing strategy. Given AR’s current usage and expected growth, advertisers should start considering this new channel a core component of their marketing portfolio. When setting up campaigns, advertisers should clearly articulate their business objectives and determine which marketing tool will serve those objectives most effectively and efficiently. In this decision, companies should consider AR advertising alongside other channels such as TV, social media, search, and email.

The actual campaigns in which AR will be the best tool in the toolkit will vary by advertiser and industry because of AR’s many uses and its efficacy at different stages of the marketing funnel. In some cases, AR will be a clear fit (such as a cosmetic brand showcasing new makeup and hair-coloring products), while in others the execution of AR campaigns will require a more thorough assessment.

As companies ramp up their AR efforts, the guiding principle remains axiomatic: allocate spending to AR to the extent that it benefits your business and marketing objectives. AR will follow a journey similar to that of digital, mobile, and social advertising to become a core element of the marketing portfolio.

Pick the right platform for your AR strategy. Advertisers need to decide whether to develop their own first-party AR apps (as Ikea, Nike, and others have done) or to place AR advertising on third-party platforms such as Snapchat or Facebook—or use a combination of both approaches. This choice has substantial implications for the required resourcing and outcomes, and, as with AR strategy, it should be made in the context of overall marketing objectives.

Advertisers seeking a more bespoke experience for a highly targeted audience will be best served by a first-party execution. This high-touch approach can be very effective, especially when users are given a compelling reason to download and engage with an application. But this tactic is also more costly and resource intensive; it requires marketers to collaborate closely with the product team and manage customer acquisition as well as retention.

Conversely, advertisers aiming for lighter-touch executions that can achieve reach and scale might opt for standardized AR ads on third-party platforms. These campaigns generally require more limited internal capabilities because they can lean more heavily on the expertise of digital-media agencies, creative studios, and the third-party platforms themselves.

Of course, advertisers might also adopt hybrid strategies that involve both their own first-party apps and campaigns on third-party platforms. This approach will likely become more common over time as the leading third-party platforms facilitate the sharing of creative assets between first- and third-party participants.

Augment your AR capabilities. Advertisers recognize that their lack of capabilities and expertise prevents them from scaling up their AR advertising. At the same time, our survey revealed a strong link between the strength of internal capabilities and the effectiveness of AR campaigns (as seen in Exhibit 6). As has been the case with other innovations, advertisers may feel trapped in a difficult conundrum: they execute unsuccessful AR campaigns because they don’t have the requisite capabilities, and at the same time, they don’t invest in building or acquiring capabilities because they don’t see positive returns from their AR campaigns.

Developing AR capabilities requires a conscious and active effort on the part of the CMO, and it is better to start now while the game is still in its early innings. Advertisers will be well served by small targeted investments such as hiring or training one or two people to become internal AR specialists (not necessarily dedicated exclusively to AR). These employees can champion when and how to use AR, centralize learning, interact with industry leaders and external partners, and train others as AR becomes more mainstream.

Internal resources are only half the equation. Developing relationships with partners across the fast-growing ecosystem also will help advertisers increase their capabilities, expertise, and bandwidth, without necessarily making large investments. Specialized AR media agencies, or AR teams within larger agencies, can help educate internal resources; AR development studios can do the heavy lifting to create AR campaigns, and third-party platforms are keen to sponsor test campaigns and impact studies.

Be disciplined about measurement. As with any digital-marketing channel, advertisers’ success in AR will ultimately hinge on their ability to measure results and adjust campaigns for optimal impact against set objectives. Our research shows that the measurement-related processes we included in our survey (such as “capture performance data,” “incorporate AR data into existing marketing reporting,” and “conduct rigorous analytics on AR to compare against objectives”) are key differentiators for advertisers that consider their AR campaigns effective.

Advertisers must start by setting metrics for AR that are aligned with the business objectives of a specific marketing campaign, such as building brand awareness, improving brand equity, or increasing sales. Although AR is still a new marketing tool for most, the approach to measuring its efficacy need not be. Advertisers can use existing measurement tools and metrics for AR, ensuring that AR is assessed on its own merits and compared with other channels transparently and on a level playing field. CMOs should demand a high level of clarity and hold their teams and themselves accountable for results and ROI. They should also establish recurring reporting (including both internal and partner studies) to optimize AR campaigns and make informed budget allocation decisions between AR and other marketing channels.

Embrace a test-and-learn culture. Marketers have been hearing for years that digital advertising allows for experimentation like no medium before. Although many companies have made progress toward developing a test-and-learn culture, BCG research has shown that measurement, and in particular testing, remains a capability that plenty of marketers (and their agencies) struggle to build. (See A Disconnect and a Divide in Digital-Marketing Talent, BCG Focus, March 2017.)

CMOs should instill a mindset of test and learn throughout their organizations by setting up the right processes, rewarding new ideas (and not punishing failed ones), and incorporating test and learn into the operating model with partners (and even into contracts when possible). Only by taking risks and continually improving will advertisers get the most out of a new marketing tool like AR.

No one can predict how new technologies such as camera marketing and AR will evolve or how they will shape consumer behavior and the marketing landscape. But the tailwinds for AR advertising are too strong for CMOs to ignore. Now that the pioneers have paved the way, other marketers should move quickly if they don’t want to miss the boat.