It’s encouraging that the overall M&A market in 2018 was largely stable and that the year ended with reasonably robust activity. But over the year, both deal volume and value slipped from their heights of the first quarter. And even though the first quarter of 2019 held steady, the global outlook for 2019 and beyond also looks mixed—volatility is on the rise, and economic and political uncertainties may be here to stay, potentially dampening M&A activity. The big bright spot is that the capital available for dealmaking is still at record levels.

One other factor deserves attention: the rise of shareholder activism. Although deals driven directly by activist investors represent a small share of the overall M&A landscape, activist impact is growing rapidly and has spread from the US to Europe and Asia-Pacific. In addition, some companies have taken measures based on the prospect of potential activism. Given these trends, leaders of larger public companies must plan for the likelihood of activists knocking on their doors.

We’ll dive deeper into activist impact, but let’s first look at the numbers for overall M&A activity.

A Fast Start to 2018 but a Slower Finish

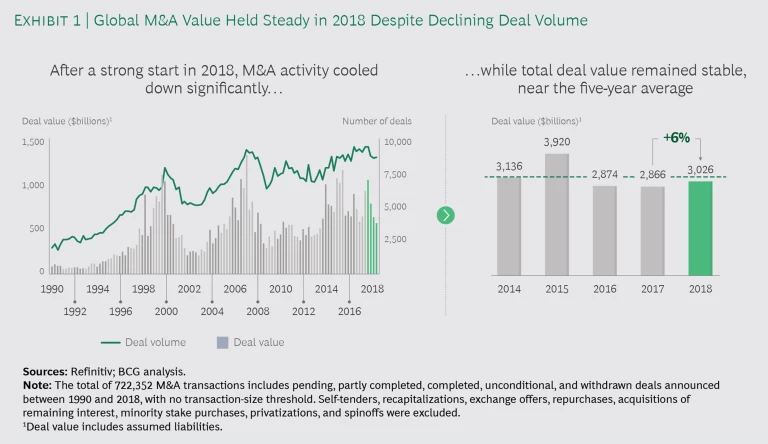

In 2018, M&A activity was stable compared with that in previous years. Global M&A value increased by about 6% in 2018, and deal volume declined by 4%, with about 35,500 deals announced during the year. (See Exhibit 1.)

Still, there was a major change between the first and second halves of 2018. The year started with a flood of megadeals (transactions valued at $10 billion or more). There were 17 such deals announced in the first quarter alone, compared with a quarterly average of six in each of the previous ten years. In contrast, overall M&A activity slowed in the second half of 2018, largely due to increased volatility in equity capital markets, declining valuations, and lingering macroeconomic uncertainty. So far, 2019 is holding steady; while deal volume is down globally in the first quarter, average deal value is slightly up compared with the past five years, mainly due to nine announced megadeals.

Just about every industry saw a decline in overall M&A volume for the full year. Counterintuitively, some industries posted increases in aggregate deal value, due to outlier effects from a few large deals. The leader in deal value was the media and entertainment sector, with a 42% increase in 2018 (although volume was actually down by 4%) resulting from large-scale industry consolidation. Two noteworthy deals were US cable company Comcast’s $40 billion bid for Sky and Vodafone’s $22 billion acquisition of German cable operator Unitymedia.

The health care industry posted the second-biggest increase in M&A value, growing 31% over the prior year (volume was up by only 3%), supported by large-scale deals such as the $60 billion takeover of UK-based biopharmaceutical specialist Shire by Takeda, Asia’s largest pharmaceutical company.

In terms of valuation, deal multiples—enterprise value divided by EBITDA—declined slightly in 2018, to a median of about 14x. That is lower than the all-time high of 15x in 2017 but still well above the long-term average of 12x.

Looking forward, BCG’s latest analyses indicate that tech-oriented dealmaking, consolidation, and divestment will be central themes in many M&A deals through 2019. Several factors are likely to contribute further to M&A activity. Private equity firms’ “dry powder” (funds ready to invest) is at record levels, along with corporate cash holdings. In addition, interest rates remain low by historical standards, especially in Europe. And the drop in valuation levels may have narrowed the gap between the expectations of buyers and sellers.

Private equity firms’ “dry powder” is at record levels, along with corporate cash holdings.

Five Prominent Themes

So how should business leaders and investors interpret the numbers to guide their next moves? We expect five themes to shape the M&A market in the near future.

1. A Changing Macroeconomic Environment and Growing Uncertainty. Current sentiment in capital markets is mixed; the macroeconomic environment is characterized by increased political uncertainty and market volatility. Underlying factors include issues such as Brexit, trade disputes, and inconsistent regulatory scrutiny, as well as tightening monetary policy and rising interest rates. In addition, the prevailing view is that the global economy is in the later stages of the cycle. Bloomberg consensus estimates indicate that global GDP will grow only 3.3% for this year, roughly in line with historical averages but down from the estimate of 3.7% made a year ago. This may cause some dealmakers to sit on the sidelines, at least until the environment becomes more favorable.

2. Technology Deals. Deals spurred by advances in technology are another important theme. We still see an uninterrupted flow of transactions in which companies buy technology businesses in order to upgrade their digital capabilities; these deals tend to be relatively small in value. (See Cracking the Code of Digital M&A, BCG Focus, February 2019.) This is particularly true for acquirers in traditional industries that want to transform their businesses and develop digital business models. Examples include deals between retail players (such as Walmart’s acquisition of Flipkart); automotive OEMs investing in e-mobility technology, ridesharing, and similar digital offerings; and banks and insurers investing in fintech startups.

3. Divestitures. Another category where M&A activity is likely to remain strong is corporate and private equity divestments. Though not quite reaching the heights of 2017 in terms of the number of deals, 2018 has been another strong year for larger corporate divestments and private equity exits—the latter now represent 8% of global M&A activity. Some management teams—often spurred by investors—are keen to shed underperforming assets so they can focus on their core businesses. Large deals, which have been numerous over the past couple of years, can also lead to a second wave of transactions as recent buyers sell off pieces—either to address antitrust concerns or because the components do not fit with their portfolios. And some companies and PE firms are looking to sell while valuation levels are still relatively high—and before a potential further slowdown of the global economy.

Large deals can lead to a second wave of transactions as recent buyers sell off pieces.

4. Consolidation. Some industries are fueling M&A as they undergo consolidation. Examples include chemicals; telecom, media, and entertainment; and health care. In the chemicals sector, consolidation is an ongoing theme. (See “Consolidation Remakes Chemicals,” BCG article, August 2018.) The same should hold true for media business, a sector that has already seen several large consolidation deals driven by US players, with Walt Disney acquiring Twenty-First Century Fox and, more recently, Comcast buying Sky.

This activity will likely lead to further consolidation pressure in other markets, as local players work to gain scale and stay competitive against large-scale global competitors and tech giants such as Netflix and Amazon. Industries that have not yet experienced much consolidation are expected to do so soon. For example, in the banking sector, deal talks have already commenced, with large European players such as Deutsche Bank, UniCredit, ING, and Commerzbank subject to plenty of merger rumors.

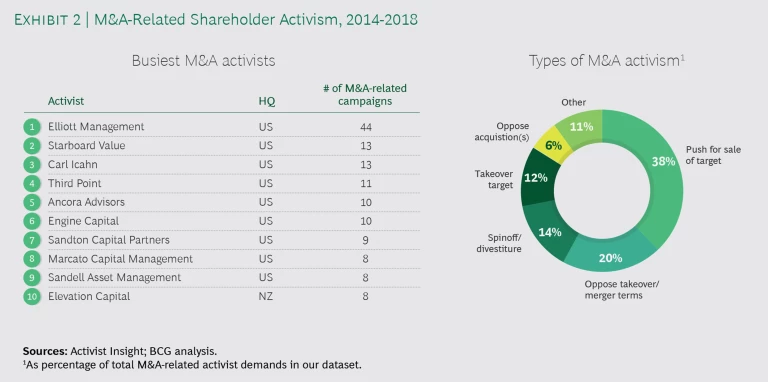

5. Rising Shareholder Activism in M&A. Activism continues to make plenty of headlines. We analyzed M&A deals related to shareholder activism to determine how big the issue really is. Specifically, we collected a dataset of more than 2,500 activist demands globally over five years, 2014 through 2018, of which slightly more than 900 were M&A-related. (We excluded board-related demands from the underlying sample. See the sidebar, “Study Methodology.”)

Study Methodology

Study Methodology

BCG’s study sampled 2,527 activist demands globally during the years 2014 through 2018. Of those demands, 927 were M&A-related. All board-related demands were excluded from the sample.

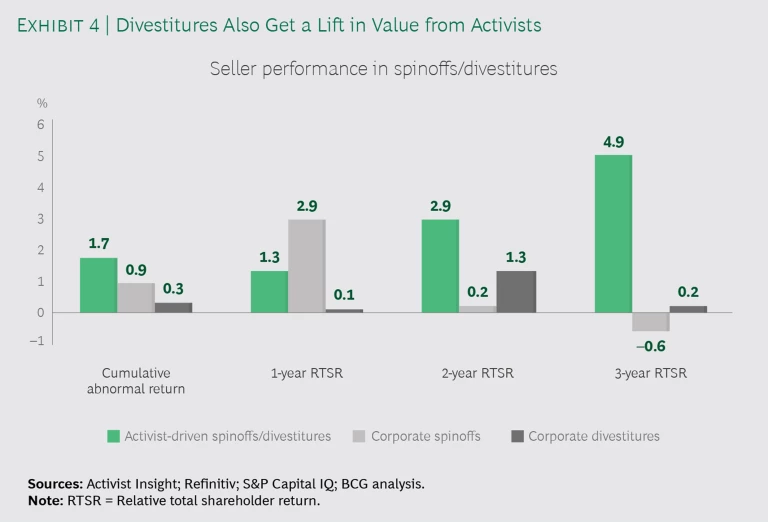

To derive the cumulative abnormal return (CAR) around the announcement date, we adjusted the target’s total return over the six-day period surrounding the deal announcement (three days before and three days after) for the respective return of the industry index. Industry indices were derived using the fourth-level sector assignment by Refinitiv (formerly Thomson Reuters). Relative total shareholder return (RTSR) is calculated by subtracting the return of the industry index from total shareholder return (TSR).

To calculate CAR and RTSR for spinoffs based on the announcement date, we collected a sample of 281 spinoffs/split-offs announced between 2014 and 2018. And to calculate CAR and RTSR for divestitures based on the announcement date, we sampled 660 corporate divestitures, each with a transaction value greater than $300 million and announced between 2014 and 2018.

Without a doubt, investor activism is on the rise globally. Our analysis shows that the phenomenon of activist-driven M&A demands has spread more and more from the US into Europe (which represented 23% of these campaigns in 2018) and Asia-Pacific (12%). Nevertheless, it’s worth noting that there were only 51 M&A-related demands in the first four months of 2019, compared with 66 in the same period in 2018, which might be a sign of reduced momentum.

In particular, activists often target large, cash-rich companies. One-third of the targeted companies in our sample had market caps of more than $3 billion, including international mega-caps such as Nestlé and Bayer in Europe and Hyundai and Toshiba in Asia. As Exhibit 2 shows, the typical objectives of M&A-related shareholder activists include lobbying for the sale of a company or selling or spinning off business units. The latter is particularly true for conglomerates, which can be attractive breakup targets with significant potential for value creation, given that the individual businesses are often worth more individually than as parts of larger entities. In other situations, activist shareholders are more defensive in nature, arguing against a merger or acquisition.

Several other aspects of our research are worth highlighting. First, while activist-related M&A is on the rise, it still makes up only a small share of the overall dealmaking landscape. Of the more than 170,000 M&A deals announced during the five years of our study period (2014 through 2018), just 900 were based on activist demands. In addition, not all demands are met by the target company; in the group we studied, only 34% of demands were successful and 34% are still ongoing, meaning that 32% were unsuccessful. A related phenomenon is that the mere presence of activists may push some executives to proactively pursue an M&A agenda to avoid becoming a campaign target. Those situations are not reflected in our research, suggesting that the actual impact of activists could be higher than our data shows.

The mere presence of activists may push some executives to pursue an M&A agenda to avoid becoming a campaign target.

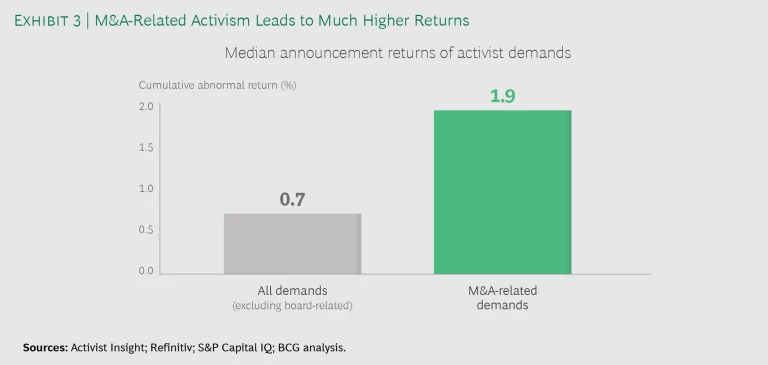

At the same time, deals in which activists are involved—to demand a transaction or oppose it—tend to be larger and more prominent than the average. And, critically, the market perceives that activism increases shareholder returns. Activist campaigns tend to be very well targeted and based on significant preparatory research and analysis, applying clear logic for unlocking value.

Our research supports this perception. We looked at the cumulative abnormal return (CAR)—a measure of the target’s total return for the six-day period surrounding the deal announcement (three days before and three days after), compared with the overall return for the target’s industry. For M&A-related demands based on shareholder activists, the median CAR around the announcement date is +1.9%. That is nearly three times the CAR for activist demands that were not related to M&A (+0.7%). (See Exhibit 3.)

Drilling down, we also looked at the market reaction to activist demands for spinoffs and divestitures. These seem to create additional value not only in the short term (supported by a CAR of +1.7%) but also in the longer term, with a positive total shareholder return relative to the industry benchmark (RTSR). When comparing these gains with the seller returns of spinoffs and corporate divestitures in general, the spinoffs and divestitures demanded by activists outperform significantly. (See Exhibit 4.)

The upshot is this: it’s too late to defend against an activist campaign once a letter with demands has been issued; then you can only react, not act. BCG urges management teams at public companies to focus on the following four priorities in order to be ready when an activist tries to make a move.

- Be prepared. Proper preparation goes far beyond what is found in the typical activist defense playbooks. Leadership teams should start by determining whether they are a likely target or not and, if so, considering the moves a potential activist would likely engage in. Some companies even act as activists themselves; they anticipate the moves that an activist would demand, and then make those moves preemptively. (See “Do-It-Yourself Activism,” BCG article, February 2014.)

- Know your counterpart. Some activist investors are collaborative and willing to sit down and discuss various strategies with company leaders; they might therefore help with any necessary changes. Others are confrontational, launching hostile, often public, initiatives to force change. By knowing which type of investor poses the most immediate challenge, management can craft a strategic response. (See Winning Moves in the Age of Shareholder Activism, BCG Focus, August 2015.)

- Do your homework. Understand the demands of an activist campaign and the implications, including the rationale behind the demand and the bargaining power of the activist. Be prepared to respond with even more detail and deeper analysis. In addition, the homework often calls for ongoing reviews of corporate strategy and an active portfolio strategy, with strategic acquisitions and regular divestments of non-core businesses that, in turn, can help close off some activism opportunities. Companies with well-honed portfolio strategies can not only deter activists more easily but also put their dealmaking prowess to good use during periods of economic uncertainty.

- Develop a clear communication strategy. Management can often buy time and support by clearly stating that it is listening to the activist’s ideas and seeking to act in the best interests of all shareholders. It should make its case on the basis of solid, defensible analysis. Company leaders should also be candid and forthright in discussing performance—including legitimate issues—rather than trying to downplay concerns.

Shareholder activism is one of the most controversially debated topics in boardrooms and the financial press these days, but it’s only one of many factors that impact dealmaking. For all companies, the challenge is to understand how activist investors are affecting M&A deals, and to know where their vulnerabilities lie. With this knowledge, management teams can position their companies to succeed, whether or not activist investors come knocking.