Pharmaceutical companies have a long-established process for clinical development, but the COVID-19 pandemic has massively disrupted the face-to-face patient interactions central to how these companies have traditionally tested new drugs and devices. At the same time, development efforts for COVID-19 diagnostics, therapies, and vaccines have been thrown into overdrive as governments across the world push for solutions at unprecedented speed. In response to these twin forces, pharmaceutical companies have devised new ways of working, accelerated digital adoption, and scaled pilot programs and innovation across their organizations within weeks—far faster than almost anyone could have imagined in early 2020.

It’s unlikely the industry will return to many pre-COVID-19 ways of working. Pharmaceutical companies will need to expand the art of the possible.

Based on our work with clients as well as BCG analysis, we believe that many of the changes occurring around clinical development are here to stay and that it’s highly unlikely the industry will return to many of the pre-COVID-19 ways of working. In light of this, pharmaceutical companies will need to continue to expand the art of the possible. They need to understand the three elements that are redefining clinical development and the four steps they can take immediately to inform drug development and drive value in the short term, even by the end of 2020.

Three Elements Redefining Clinical Development

The COVID-19 pandemic has made change unavoidable. As pharmaceutical companies prepare themselves for the future, they need to embrace and integrate three elements that will redefine clinical development: virtual first approaches, using real world evidence, and adopting new ways for working.

Virtual First Approaches. COVID-19 has profoundly disrupted the way classical clinical trials are conducted. As of April 2020, only 14% of European and 20% of US oncology trials were enrolling as

Mature technologies already exist to virtualize many typical clinical trial activities.

In response, many organizations are now considering or accelerating virtual trials, especially where interventions are well understood and seen as low-risk (e.g., new indications of existing therapies for chronic diseases). Clinical research organization and healthcare data provider QVIA is moving a substantial portion of its trials to virtual platforms, and regulators including the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have issued guidance in support of virtual trials. Indeed, mature technologies already exist to virtualize many typical clinical trial activities, including remote physician consultations, secure drop-shipping and medication tracking, and wearable/near-patient medical devices and apps to track clinical changes.

Even in higher-risk trials where patient site visits are essential (e.g., in oncology), many routine aspects of the trial can be safely virtualized. Onsite visits could be limited to specific activities, such as high-risk interventions and invasive monitoring.

Many development organizations have already made significant investments in the technology infrastructure to manage virtual trials. For example, Janssen Pharmaceuticals launched two entirely virtual clinical trials in the first three months of 2020. Its Invokana (canagliflozin) heart failure study uses virtual enrollment, app-guided self-assessment of symptoms, wearable devices for monitoring physical activity, and drop-shipping of trial medications. No physical infrastructure is required, and the trial can recruit patients at scale across the US.

A key benefit of virtual trials is the ability to recruit specific patient segments quickly wherever they live, rather than being limited to those located near a physical trial site. Industry estimates suggest that virtual trials are approximately 20% more likely to launch, and the time to recruit the first 100 patients accelerates from seven months to four

Real World Evidence. Over the past few years, there has been significant progress in the use of real world evidence (RWE) in clinical development. Historically, regulators have been reluctant to allow the use of RWE. But in 2016, the US passed the 21st Century American Cures Act, which set out a new regulatory framework for RWE. Subsequently, in 2017, the FDA relied on RWE to expand the use of Edwards Lifesciences’ transcatheter aortic valve replacement device for valve-in-valve procedures, the first FDA approval based on RWE without requiring new clinical trial data. The FDA has also approved or extended indications for a number of drugs based in part on RWE—including Pfizer’s IBRANCE for HR+, HER2-metastatic breast cancer in men.

Clinical evidence generation is becoming more integrated, with RWE as a key element alongside classical randomized controlled trials (RCTs) used across the asset lifecycle. COVID-19 has accelerated this trend toward increasing RWE as a way to test new treatments in weeks or months rather than the multiyear timeline typical for RCTs and traditional observational studies. For example, the UK set up its flagship RECOVERY trial for COVID-19 so that data is reported through the NHS DigiTrials platform. This allows investigators to link trial data and RWE in the form of NHS primary- and secondary-care datasets, giving researchers insights quickly once first-order questions on COVID-19 treatments are answered in the trial itself.

Another example of RWE usage is to better characterize COVID-19 risk cohorts and evaluate potential interventions. Regulators have recently started collaborating with RWE companies to leverage a wider array of data sets outside of traditional RCTs to deepen understanding of the disease and inform research priorities and clinical interventions. These collaborations demonstrate the growing interest in “regulatory grade” RWE and how the industry is becoming increasingly focused on high-quality data to support regulatory discussions. Biopharma companies should review current partnerships or efforts where data is not regulatory grade and either upgrade data collection or redeploy resources to higher-quality efforts. In our experience across the industry, the “sweet spot” for RWE is describing the response of specific cohorts (in this case, to COVID-19 infection) and generating evidence for therapies already in use on- or off-label.

New Ways of Working. For many years, the biopharma industry has been under pressure to accelerate clinical development timelines. To accelerate time to market and stay ahead of the emerging new reality of aggressive competitive timelines, developers need to leverage all the tools at hand (e.g., agile principles, regulatory flexibility, new trial designs, integrated evidence generation strategies) in a test, learn, and scale mode.

Regulators have often supported these efforts; in 2017, for example, 92% of novel oncology drugs approved by the FDA used an expedited pathway (priority review, fast track, breakthrough therapy, or accelerated approval). Even so, clinical development timelines have remained relatively flat over time (Phases I to III: about seven years for

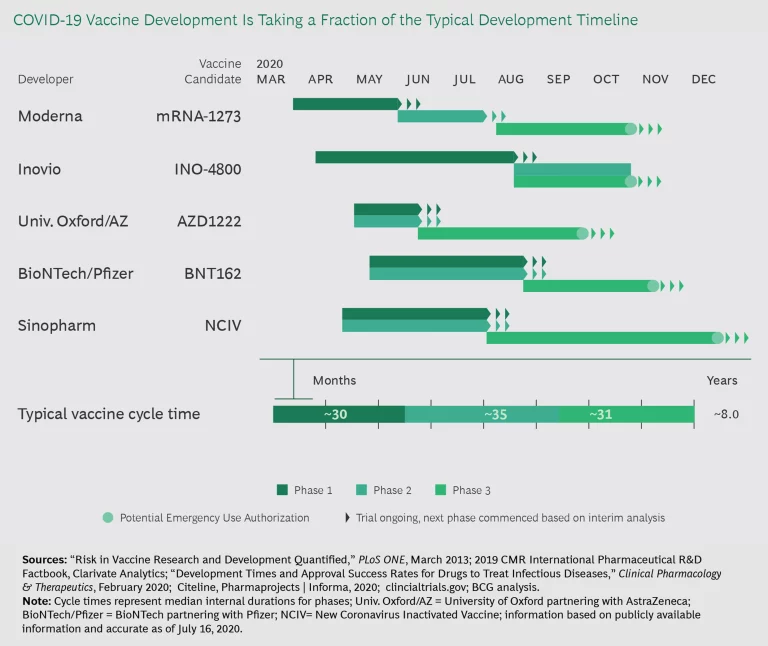

But COVID-19 is changing the game and showing what is possible when there is urgent patient need and a highly motivated regulator. In the US, Operation Warp Speed is spending $10 billion in public funds to accelerate the development of COVID-19 vaccines, diagnostics, and therapies. Given that the goal is to speed through clinical testing in 12 to 18 months—about five times faster than the “standard” vaccine development times—COVID-19 phases must run in parallel (see Exhibit 1). The same is true for COVID-19 therapeutics. This parallel approach would cut 4 to 4.5 years off average clinical development times if sustained.

Under its Coronavirus Treatment Acceleration Program (CTAP), the FDA is responding to requests to start trials within a day and providing “ultra-rapid” and collaborative input on most development plans. CTAP has reviewed some protocols within 24 hours and responded to most single-patient, extended-access requests within three hours (working around the clock to do so).

Investigators and regulators are gaining experience deploying novel trial constructs to accelerate cycle times.

Meanwhile, investigators and regulators are gaining experience deploying novel trial constructs to accelerate cycle times and provide more agility to investigate therapeutic combinations. For example, the UK RECOVERY trial mentioned above has a highly ambitious design with six trial arms covering several modalities: traditional small molecules (e.g., dexamethasone or hydroxychloroquine), biologics (e.g., tocilizumab), and blood products (e.g., convalescent plasma).

With this trial design, investigators ramped up sites rapidly, enrolling more than 11,500 patients in 175 sites between March and mid-June. The design also allows investigators to add and remove trial arms as information becomes

This exceptional level of regulator engagement and responsiveness has shown the art of the possible for regulators and the industry if they work together to achieve common goals. Of course, at the present time, this level of engagement is specific to COVID-19 and may not apply to other therapy areas to the same degree. Nonetheless, the pandemic has reset the expectations that will frame the environment post-COVID-19.

What Pharmaceutical Companies Need to Do Right Now

Some of what must change in clinical development, such as technology upgrades and a cultural shift to embrace new ways of working, will play out over the next two to three years. But there are four steps pharmaceutical companies can take immediately to inform drug development and drive value in the short-term, even by the end of 2020.

Drive end-to-end transformation of development. Pharmaceutical companies have been experimenting with digital, data, and analytics for many years. However, these experiments have typically occurred as pilots and in isolated areas (e.g., a decentralized trial for one specific asset) and are rarely designed to scale across a company’s full pipeline or portfolio. As a result, the impact is often limited, delivering value in a narrow domain. It’s urgent that development organizations consider how to scale up and drive an end-to-end transformation—to fully leverage digital, data, and analytics as well as evolve the operating model.

When selecting and designing projects, companies should identify categories of use cases that are broadly applicable and can be replicated across divisions, business units, or therapy areas. For example, in clinical operations, one well-established use case is optimizing site selection and patient recruitment via statistical learning and artificial intelligence (AI). At the individual trial level, the benefits of this use case may vary. But when scaling across the full clinical pipeline, it’s possible to achieve speed and quality improvements of 10% to 15% or more. We have observed similar scale effects in other areas, including protocol design and optimization, biostatistical analysis, regulatory, and medical.

Build relevant talent and capabilities. Most development organizations need to augment their skill base. From our experience, three skills are particularly important going forward: data scientists with biomedical experience who can conduct analyses and identify suitable sources of data (e.g., for RWE-driven approvals); clinicians who can translate development questions into testable hypotheses and then translate the results of data science back into the language of development (e.g., from more complex multi-arm trial designs); and strategic decision makers who can apply new ways of working and new sources of data to maximize business impact. Companies need to start recruiting these individuals now to act as trailblazers for the organization. At the same time, they will need to upskill a significant portion of their workforce.

Evolve the development operating model. The new demands on clinical development will disrupt the operating model of most organizations. Processes and ways of working will need to be re-engineered across the asset lifecycle and successful changes rapidly scaled across the pipeline and organization. Deploying a “learning by doing” approach also requires a development model that can handle a portfolio of assets with different characteristics and requirements; some older assets may have a largely traditional clinical development paradigm, while newer assets or programs might more fully embrace the new reality. Many aspects of the new model will remain in-house, but winning will also require building an ecosystem of strategic partners in new areas such as decentralized trials and RWE. In our experience, most development organizations need to restructure several key areas to support the new reality, including cross-functional interfaces, decision making around data and analytics, and governance procedures on critical investments and asset progression. More agile ways of working will be critical.

Deploying a “learning by doing” approach requires a development model that can handle a portfolio of assets with different characteristics and requirements.

Engage with regulators to shape the environment. The regulatory framework for using advanced analytics and RWE in development is evolving rapidly, evidenced by regulators’ growing acceptance of new trial designs and RWE. With this in mind, development organizations should proactively engage with regulators to understand what new degrees of freedom may be emerging and how these apply to different therapeutic areas. This might include working together directly to accelerate specific assets targeting unmet patient needs or working through industry groups to help set new standards based on the COVID-19 response.

Redefining Clinical Development

The old rules for running clinical trials are changing fast. Virtual first approaches, RWE, and new ways of working promise to accelerate and focus trials in unprecedented ways. While realistically, it will take most pharmaceutical companies two or three years to fully adapt to this new reality, they can immediately take the four steps laid out in this article to jump-start the process, drive short-term value, and ensure that they don’t fall behind competitors.