Container repositioning is the bane of every carrier. The expenses associated with transporting empty boxes to locations where they can be loaded with cargo represent 5% to 8% of a typical carrier’s total operating costs and amount to $15 billion to $20 billion each year for the industry. What’s the solution? Insights from the sharing economy—think Uber and eBay—may point the way forward.

In “Think Outside Your Boxes” (BCG article, November 2015), we discussed how carriers can reduce repositioning costs by sharing their empty boxes—through lending, swapping, or subleasing containers for specific bookings. Many carriers use brokers or arrange do-it-yourself deals to interchange boxes among a trusted circle of partners. But those processes rely on small logistics teams that make ad hoc phone and e-mail requests within their limited network using incomplete market knowledge. Carriers manage just a small fraction of container imbalances in this way. We believe that digital technologies can help carriers and other container operators manage a considerably larger share of imbalances and thus achieve significant cost savings.

Today, there is limited transparency into who has how many boxes and where those boxes are. That makes finding interchange opportunities difficult. Independent digital enablers, such as BCG xChange, an online interchange marketplace, can help surmount this challenge. For example, xChange uses global container-fleet data and big data analytics to offer full market visibility, an efficient online interface to organize transactions, and decision aids to optimize repositioning. Together, these tools can deliver far greater savings than current interchange processes offer.

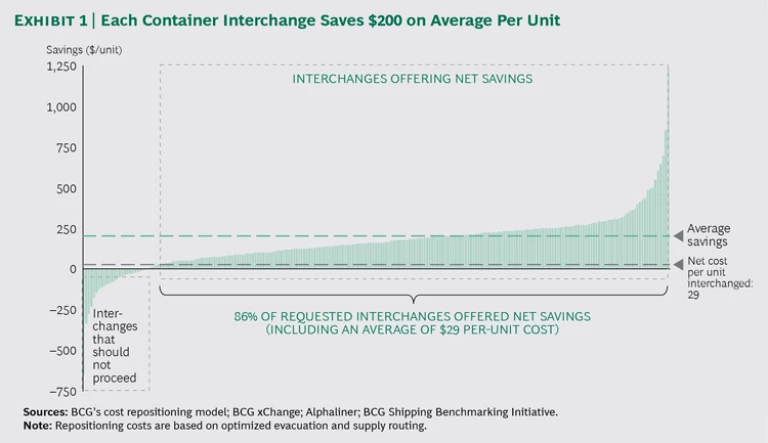

Our analysis shows that 33% of repositioning costs arise from company-specific imbalances—that is, container imbalances that do not result from structural trade imbalances but from factors such as client circumstances and commercial strengths. Here, digital container marketplaces can offer substantial cost reduction. They can also help other container owners, such as traders and leasing companies, capture savings. Analysis of half a million data points from xChange shows that each interchange saved roughly $200 on average per unit for both parties.

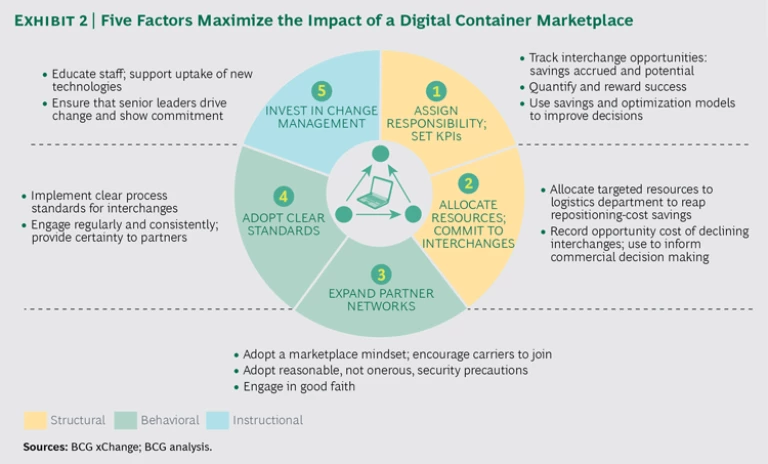

We draw on a year of experience with xChange to offer five success factors that can help carriers maximize savings from digital marketplaces, and we consider how those marketplaces can enable carriers to achieve those savings. Some of the success factors are structural, while others are behavioral and instructional. (See Exhibit 2.) We use xChange and container carriers as examples, but these success factors apply to other market players (such as trading and leasing companies) and to asset-sharing services and tools that have already transformed similar industries—and are now rapidly reshaping shipping. Examples of such services and tools include slot marketplaces, where carriers offer slots to other carriers’ empty containers (a feature currently being developed by xChange), street-turn matching platforms, which match inland import containers with export bookings (such as MatchBack Systems), and big data supply- and demand-forecasting tools (for instance, ClearMetal).

Success Factor 1: Assign Responsibility and Set KPIs

To facilitate a smooth container interchange process, carriers must articulate the relevant roles and responsibilities and hold their logistics staff accountable for performing them. The most fundamental responsibilities are tracking and capturing interchange opportunities.

Our observations suggest that logistics departments are seldom rewarded for successful interchanges and rarely face negative consequences for missed interchange opportunities. Logistics departments understand the benefits of interchanges in a broad sense, but few carriers have quantified success in terms of measurable savings. Indeed, many repositioning decisions are driven by gut feel rather than objective data, and cost savings are rough estimates. Consequently, logistics departments have difficulty determining the value that interchanges add to the bottom line.

To foster accountability for maximizing interchange savings and to motivate logistics departments to pursue interchanges with the highest savings potential, carriers must measure their performance in optimizing repositioning costs. It’s crucial to define and communicate the right performance metrics and targets, such as “number of interchanges needed to save X in repositioning costs” and “X% of potential repositioning savings captured.”

How a Digital Exchange Can Help. As independent third parties, digital exchange services can use industry-wide data and full market visibility to conduct more comprehensive internal and external benchmarking than carriers can on their own. This benchmarking can be reported through market data and performance dashboards. For instance, xChange regularly reports interchange potential and cost savings to logistics departments and senior management, helping them decide which requests to accept. A basic performance report calculates savings by multiplying the average interchange saving of $200 by the number of units transacted. An advanced report aids decision making by applying a repositioning cost model based on the BCG Shipping Benchmarking Initiative database—along with global imbalance, sailing schedule, and cargo flow data—to predict empty repositioning movements and savings from particular transactions. While xChange applies fleet imbalance, booking, and route data to propose optimal interchanges, it is up to logistics departments to act on this information by integrating it into their decision processes.

We expect new digital technologies—live tracking, smart containers, demand forecasting, and automated booking and fleet management—to provide real-time performance modeling and decision-making assistance. These developments will contribute to the creation of a smart, automated container fleet that will offer opportunities for carriers to capture cost-saving efficiencies and significantly rationalize fleet size.

Success Factor 2: Allocate Resources and Commit to Pursuing Interchanges

A digital container marketplace cannot offer benefits unless carriers pursue interchanges. But many logistics departments lack the manpower for this, so they reposition their own boxes despite the cost involved. Further, sales departments often veto particular interchanges for qualitative reasons. For instance, they do not want to cooperate with a competitor, assuming that their customers will want to use their branded boxes; or they worry that another operator will not take good care of their equipment.

Those commercial concerns are understandable, but most sales departments (as well as logistics staff) overlook an important quantitative consideration: the financial impact of declining an interchange request. Absent this consideration, carriers cannot conduct rigorous cost-benefit analyses to guide interchange decisions.

For example, a new carrier was looking for empty containers in a particular location that it could use to ship cargo to China. Other carriers had many empty containers to offer in this location. The carrier sent requests on xChange to 11 carriers, all of which declined to work with the new partner for commercial reasons. Total repositioning savings available was $1.24 million; each declined request represented lost savings of about $60,000 ($250 per box). Such a direct bottom-line impact is difficult (if not impossible) to achieve in an industry characterized by overcapacity and narrow margins. For the 11 carriers, the refusal to cooperate was a missed opportunity. The only consequence for the new carrier was having to obtain empty units from other providers, such as leasing companies.

To improve decisions about interchange opportunities, carriers should require their sales departments to justify the forgone cost savings when vetoing an interchange, as well as allocate resources to help sales and logistics departments evaluate interchange requests from a more informed position.

How a Digital Exchange Can Help. Given the resource constraints facing many logistics departments, BCG xChange uses big data and machine learning tools to identify interchanges with the highest expected value on the basis of savings potential and chance of success. The latter increases when the user operates a service or has regular bookings along the route, the supplier has a particular redelivery schedule for these types of containers from this location, the interchange partner has a high level of platform activity, and there is an existing interchange agreement or a previous transaction between the parties. Of the roughly 100,000 weekly matches that xChange identifies, the top 5% are provided to users through a daily report. This saves time and energy spent searching or responding to matches with little chance of success. To support behavioral change, xChange also publishes interchange cost-benefit analyses, so senior managers and logistics staff can advocate for interchanges from an informed position.

Success Factor 3: Expand Partner Networks

To realize the full benefits of digital interchange networks, carriers must be willing to deal with a wide range of partners outside their traditional comfort zone—including competitors and leasing companies. As with other online marketplaces, such as Uber and Airbnb, effectiveness increases as the number of users increases.

Our experience with xChange confirms that some carriers indeed limit themselves to a relatively small circle of trusted, familiar partners. As a result, they miss out on the full, global range of interchange opportunities—and corresponding savings.

To overcome their reluctance to deal with new partners, carriers should reflect on insights from online marketplaces in other industries. For instance, Uber wouldn’t work if customers wanted to ride only with drivers they already knew. With that in mind, carriers should consider the bigger cost picture—comparing costs associated with forging a new interchange partnership with the long-term opportunities that the relationship offers. In our experience, much of the current untapped interchange potential is between large global carriers and small regional operators, which have different trade flows and imbalances. Most interchange opportunities arise between carriers that have opposite flows.

Of course, questions of trust and data security arise whenever an organization considers working with a new partner. For carriers, such questions might include the following: How do we know that this carrier will return our boxes in good condition, on time, and to the right location? What if this leasing company learns too much about our equipment needs—and takes advantage of us the next time we negotiate an equipment lease?

The repositioning-cost problem isn’t going away, and carriers that engage with new partners in good faith will reap the greatest rewards. Sharing reputation information among network members can help, as can investing time in developing relationships that will deliver the greatest benefits in the long run.

How a Digital Exchange Can Help. Like all digital enablers, BCG xChange must manage the mathematical problem of optimizing equipment positioning while addressing carriers’ trust and data security concerns. To address those concerns, xChange proposes minimum behavior standards and issues reputation records (such as carrier ratings) to which all participants have access. Online markets in other industries (auctions, ride hailing, and vacation rentals, for instance) have dealt with trust and data security concerns in a similar way. As uptake of and familiarity with digital optimization tools increase in the shipping industry, we expect that users will devote more effort to optimizing fleet performance than to scrutinizing potential partners.

With this in mind, xChange is developing a multiparty interchange agreement in collaboration with BIMCO, the largest international shipping association. This opt-in agreement will allow platform users to sign a single contract that covers all transactions with other xChange members that have signed the agreement. This emphasizes the notion of all trading relationships as equal while maintaining an effective system of direct, bilateral dispute resolution between partners. In addition, xChange intends to facilitate the provision of bank guarantees from smaller participating companies to build long-term trust and secure transactions in case of disputes.

Success Factor 4: Adopt Clear Standards for Engaging with Interchange Partners

Adopting—and sticking to—standards for engaging with interchange partners enables the expansion of partnership networks. Basic standards for interchanges (such as common fees, release orders, and quality standards) are relatively well developed, since most carriers have some experience with interchanges. But to foster behavior that builds trust among partners, carriers must implement clear standards governing how they treat their interchange commitments.

As discussed, many carriers engage with interchange partners in an ad hoc manner. For example, a carrier might accept an interchange request but then not follow through on it or respond to some requests quickly but drag its feet on others. Such behavior spawns uncertainty among all carriers. Uncertainty decreases confidence, erodes trust, and discourages carriers from engaging with interchange requests or seeking new interchange opportunities. Ultimately, all of this harms the party at fault.

Adopting minimum marketplace process and behavioral standards is a good way to address these challenges. For instance, carriers might agree to check the status of interchange opportunities daily, to respond to new interchange requests within a specific time frame, and to deliver a “decline” response at first contact, if possible.

How a Digital Exchange Can Help. BCG xChange has supported the effort to establish clear standards by providing a single online platform with request templates and consolidated communications. We estimate that this one-stop shop for interchanges can reduce initial organizing time by up to 80% per transaction. Secondary benefits include making teams more responsive and reducing confusion and disagreements between partners. However, as an independent marketplace operator, xChange should go further in this role by, for example, developing and enforcing codes of conduct and reporting participants’ performance against such standards.

In the long term, we expect that the importance of enforcing standards will ease, as track-and-trace tools and real-time carrier data integration drive automation of the approval process. Ultimately, operator input will occur only in exceptional circumstances.

Success Factor 5: Invest Time and Resources to Manage Change

A digital container exchange operates like online marketplaces such as eBay and Uber. However, many carriers have little experience with marketplace technologies. They may fully understand the container interchange concept but not the principles and benefits of online marketplaces. This is especially true of “matching marketplaces,” such as those supporting online interchanges. On these platforms, the rules of exchange are driven by mutually beneficial needs and opportunities rather than a willingness to pay, and complex optimization techniques such as multiparty matches are possible. Because of their gap in understanding, carriers may be reluctant to look beyond traditional interchange processes, or even basic digital automation of these processes, to explore sophisticated digital solutions.

To move past these obstacles, carriers can critique their current equipment management processes and performance. They can also investigate the benefits that the analytics revolution and matching marketplaces have delivered in other fields. And they can remind themselves that, as in any emerging industry, first movers in the digital-backed container industry will reap the greatest rewards. All this will motivate them to encourage their partners to engage with new digital solutions and to share data with independent third parties in order to optimize the industry’s performance.

Still, involvement and commitment from senior managers are essential. Leaders must push their staff to adopt the new technologies and to treat the transition as a priority.

How a Digital Exchange Can Help. BCG xChange helps users navigate the transition by sharing strategies for integrating new technologies into daily operations. This assistance involves developing a knowledge base of tools to expand carriers’ view of interchanges, including new types of interchange opportunities that digital solutions enable. The platform also offers a change management program, the Resident xChanger, which includes a shipping expert who provides on-site support and training to help carriers integrate xChange into equipment operations. Top management also receives regular reports on the program’s progress, which sets an example for how a carrier’s logistics department can report repositioning savings to management.

Thanks to advances in digital technologies, shipping-industry players have a vital opportunity to reduce operating costs across their value chain. But getting the most from these technologies requires some changes—in carriers’ daily operating procedures, operating models, performance management systems, and culture. Carriers that master the five success factors will be the first to reap the benefits of digital technologies. Equally important, those that use technology to optimize container repositioning will help build a more energy- and cost-efficient global container market—one that ultimately benefits all participants.