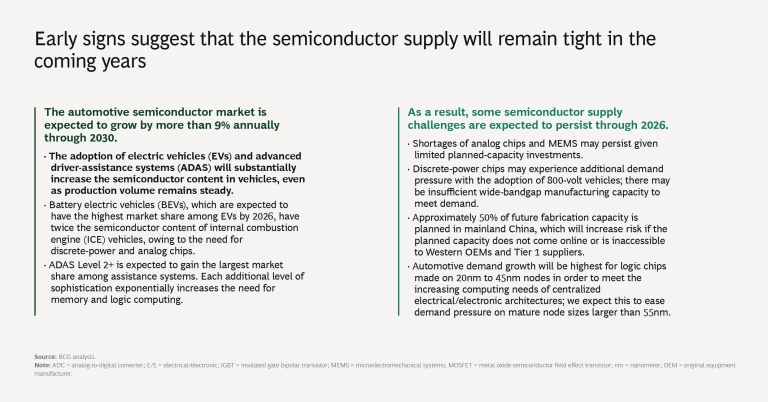

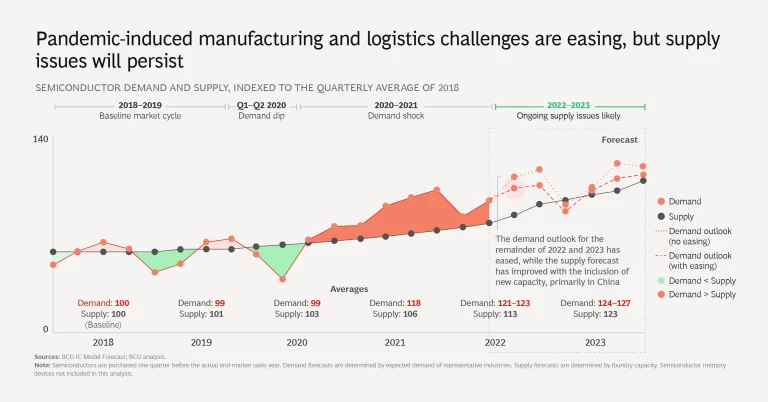

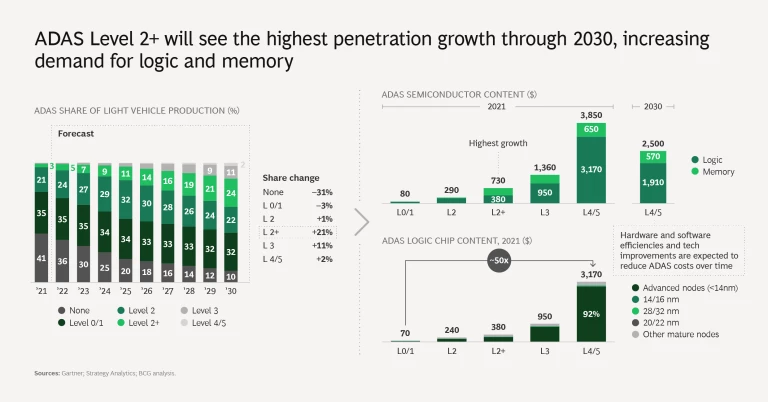

The semiconductor shortages that have plagued the automotive industry may persist in some form through as late as 2026. Pandemic-induced manufacturing and logistics challenges are easing; consumer chip demand has reached a saturation point and is in a cyclical decline. But continuing growth in automotive semiconductor demand is inevitable, as penetration of semiconductor-intense automotive applications, such as higher levels of advanced driver assistance systems (ADAS) and electrification, increases.

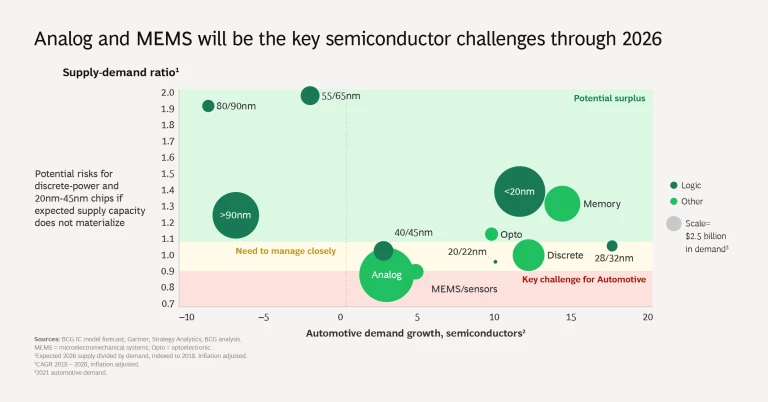

The growing sophistication of vehicles means that, despite recent capacity investments, the imbalance between chip supply and demand will persist—at least for some types of semiconductors—over the next four years. However, the nature of the chip shortages and the device types affected will change over time, requiring automakers to actively manage risks as the situation evolves.

This slide show presents the findings of a BCG study that looked at trends in the automotive semiconductor market; crucially, our study disaggregated the market by chip type and manufacturing technology.

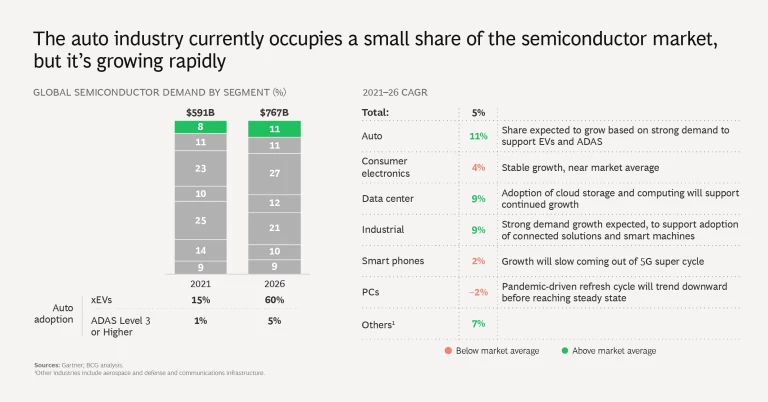

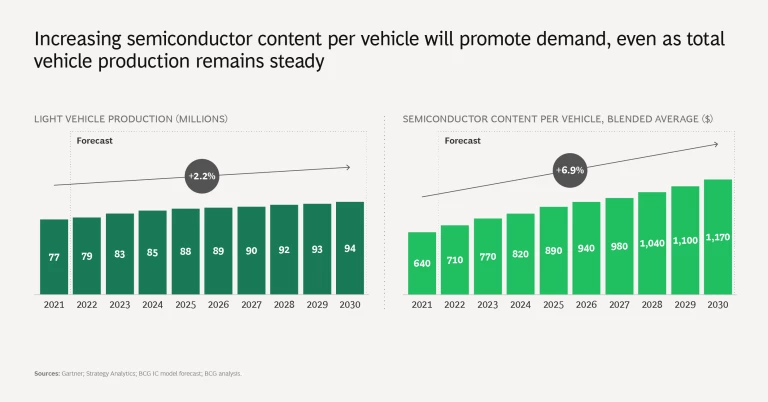

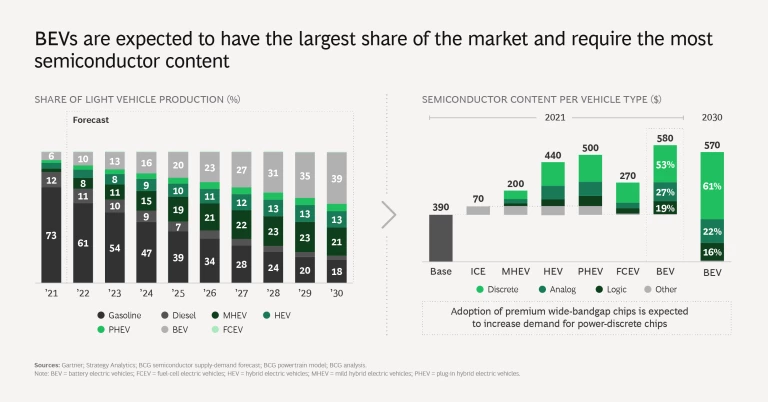

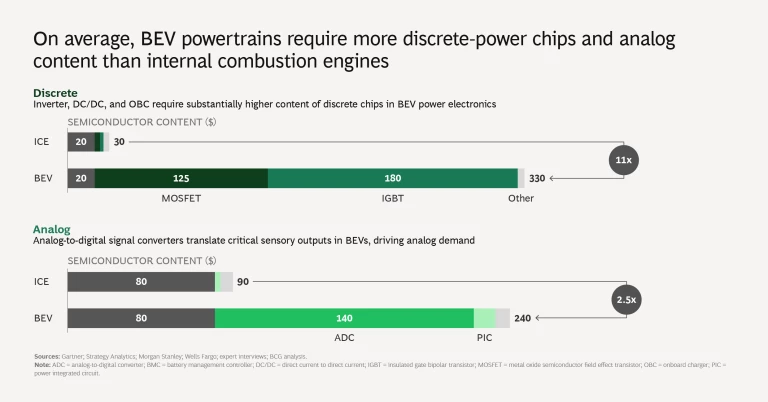

We expect the automotive semiconductor market to grow by more than 9% annually through 2030. The adoption of electric vehicles and ADAS will substantially increase the semiconductor content in automobiles, even as production volume remains steady.

Disaggregating the market revealed three major challenges:

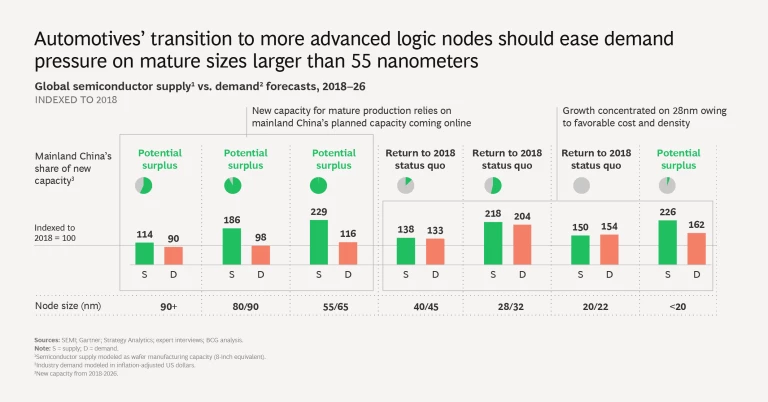

- First, to meet the needs of centralized electrical and electronic architecture as well as ADAS, auto semiconductor demand will need to shift from mature nodes above 45 nanometers to more advanced nodes as well as to wide-bandgap discrete components. Managing this transition effectively will be the difference between offering compelling new features and products and being an industry laggard.

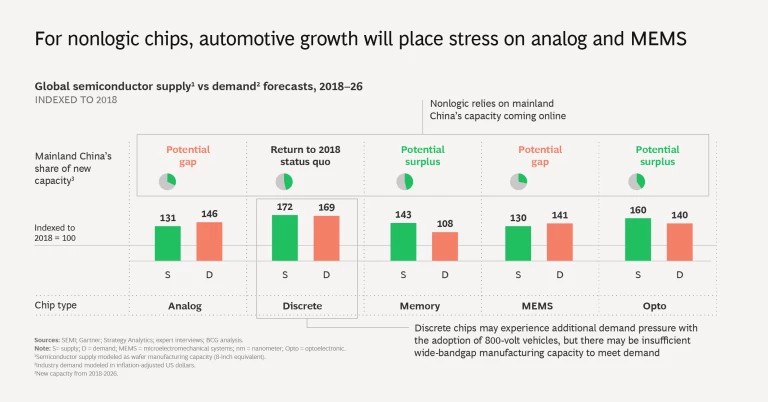

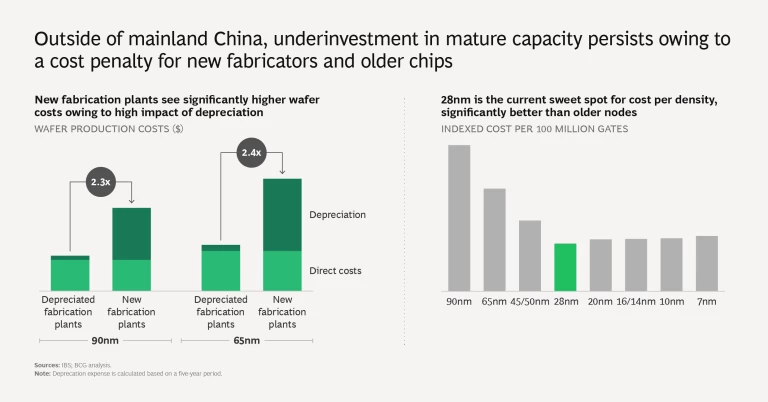

- Second, the tight supply for analog and microelectromechanical systems chips will likely persist, in part due to the comparative cost penalty of new versus fully depreciated fabrication plants acting as a headwind to new investment.

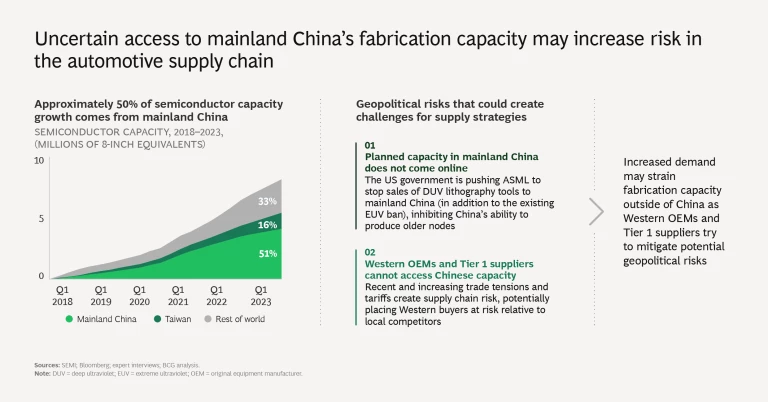

- Third, 50% of future fabrication capacity is planned in mainland China, creating significant geopolitical risk.

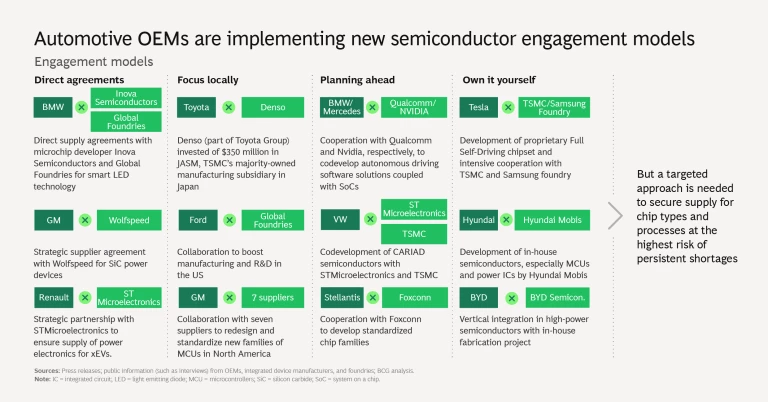

To manage risks and secure supplies, the automotive industry must take several steps:

- Stay focused on building resilient supply chains by, for example, considering geopolitical risks when making long-term supply decisions.

- Align semiconductor strategy with product strategy—for example, by cooperating within the industry to standardize commodity-integrated circuits.

- Shape the future by establishing your place in semiconductor value chains to support your critical supply needs—including building the right win-win partnerships with chip makers and developing clear, robust fact bases and analyses to help inform policymakers of the full impact of their decisions.

Automotive executives must recognize that semiconductor supply challenges, while evolving, are here to stay. The winners will understand their areas of greatest need, assess supply constraints, capitalize on new technologies, and manage geopolitical uncertainty to solve their most crucial supply issues.

This article and slideshow have been published in conjunction with a piece that examines the challenges facing the global automotive industry. That piece explores current macroeconomic trends alongside other critical factors such as geopolitical uncertainty and emerging demand-side pressures, and it offers four clear actions that companies can take to stay resilient today and reinvent themselves for tomorrow. To learn more, click here.