The challenge is enormous. To keep global warming to less than 2°C—a critical limit for avoiding the most catastrophic consequences of climate change—accomplishing two goals is a must: reducing greenhouse gas emissions to 45% below 2010 levels by 2030 and reaching net-zero emissions by 2050. To achieve these goals will require a fundamental reinvention of the world’s energy and industrial systems in virtually every major industry.

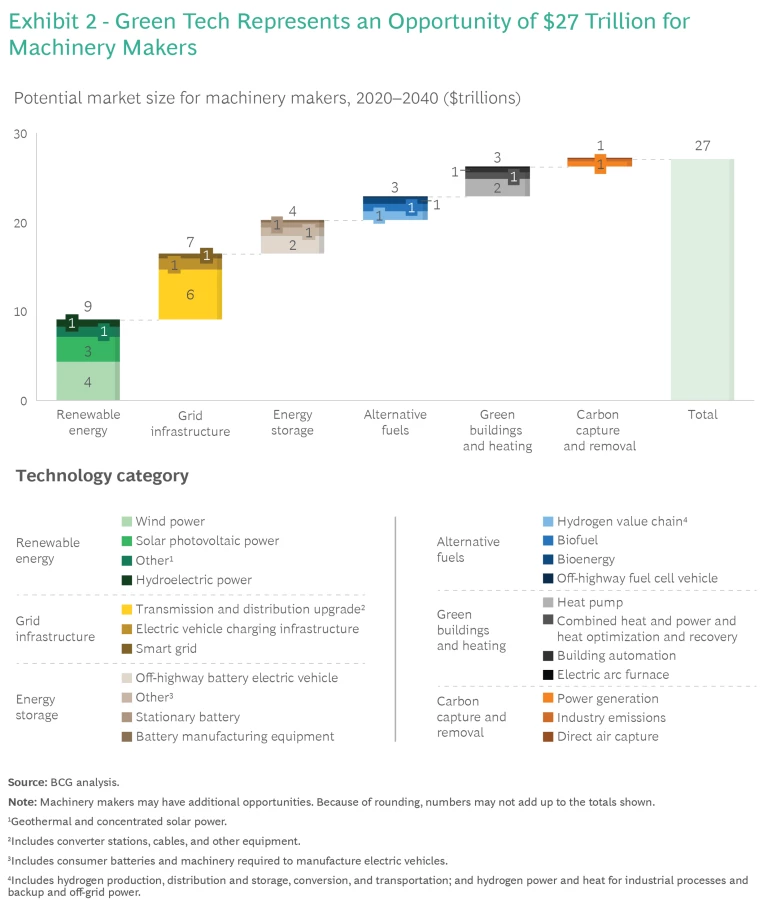

The task at hand will fall in large part to the world’s machinery makers—the companies that provide the equipment, components, and industrial automation systems to industries across the globe. Our earlier analysis of the economic opportunity available to machinery makers uncovered a meaningful prize of $12 trillion. However, considering the full range of technologies required and the growing implementation gap, our recent analysis estimates the opportunity will be $27 trillion from 2020 through 2040.

Companies looking to capture their share of the opportunity must act boldly, committing to a thorough yet expeditious reexamination of their businesses and swiftly bringing the next generation of green technologies to market.

Early movers have historically reaped real economic and strategic advantages during periods of rapid technological change, suggesting just how critical it is for machinery makers to begin now to prepare their businesses for the climate transition. In what follows, we examine the role that key technologies will play in helping industries meet their abatement goals, the opportunity for machinery makers, and how they can take action to capture it.

Assessing the Challenges of Decarbonization

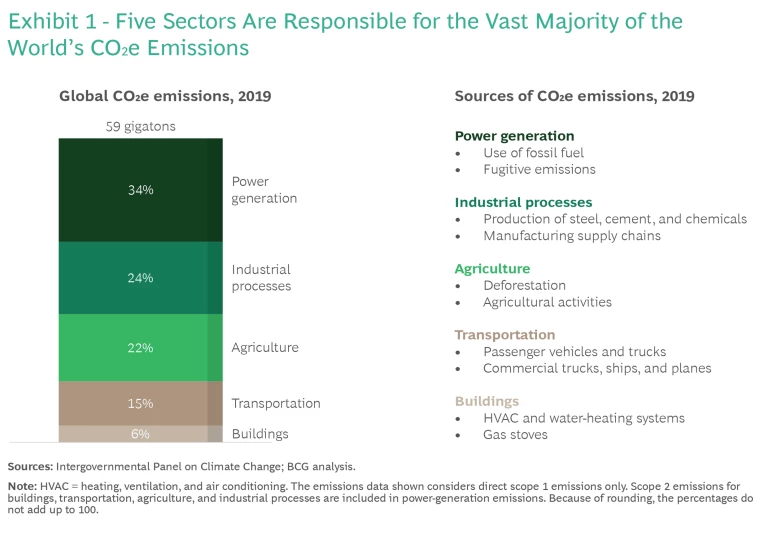

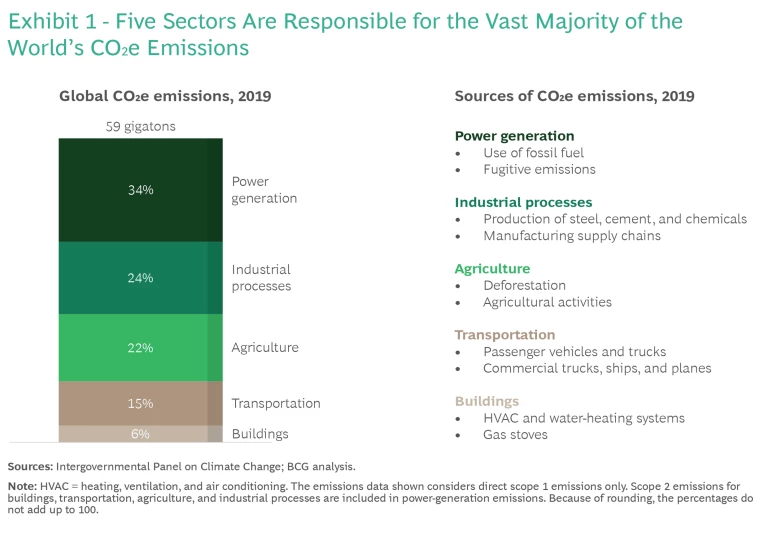

Global emissions are just under 60 gigatons of CO2e each year and largely generated by five broad sectors: power generation, industrial processes, agriculture, transportation, and buildings. (See Exhibit 1.) Effectively zeroing out the emissions from these sectors will require companies to fundamentally rethink—at a far faster pace than any previous energy transition has required—how they source and use energy. To meet the challenges, companies in these sectors will look to machinery makers as they seek ways to reinvent their operations.

Power Generation. This industry is key to the fight against global warming, given that it emits 34% of total emissions. Decarbonizing power generation will require outsized investments in renewables not only to replace existing fossil fuel-based power generation but also to meet increased power demand due to higher rates of home, auto, and industrial electrification. Meanwhile, major investments in the grid will be needed to connect new renewable resources, manage distributed and intermittent generation, and harden transmission and distribution networks against more extreme weather. These investments will drive the bulk of the value opportunity for machinery makers.

Industrial Processes. This sector includes mining; the production of chemicals, metals, and cement; and the downstream manufacturing of a wide variety of machinery and end products. Here, the need to decarbonize both production processes and supply chains will require advancing a wide variety of new technologies, some of them still in their infancy. Switching to sustainable fuels or high-load electrification will be needed for processes with high heat requirements, and technologies for optimizing heat and power will be needed to manage costs and emissions. Still, the release of some emissions will be unavoidable, likely requiring carbon capture, utilization, and storage technologies.

Agriculture. Agriculture and related changes in land use account for more than 20% of global GHG emissions. These potent emissions are driven by methane and nitrous oxide in addition to CO2. Methane emissions come primarily from livestock, while the application of fertilizer produces nitrous oxide. Conventional farming practices, such as tilling and overgrazing, have resulted in the loss of up to a quarter of the original carbon stock in the world’s soil. Changes in land use is another significant contributor, as growing demand for agricultural output continues to fuel deforestation and the loss of biodiversity, resulting in the further destruction of natural carbon stores.

Transportation. The automotive industry is currently undergoing a fundamental change, as vehicles shift from using the internal combustion engine to using battery electric powertrains. Navigating this change will require massive investments not only in machinery to manufacture electric vehicles but also in the charging infrastructure required to support them. Over the long term, heavy-duty trucks may shift to hydrogen as a fuel source for hauling freight over longer distances.

Machinery to manufacture electric vehicles and the charging infrastructure to support them will require massive investment.

Decarbonizing the aviation and maritime industries presents a unique set of challenges given that batteries lack the power density required for long-distance travel. Instead, these industries will turn to sustainable biofuels or synthetic power-to-X fuels that can replace existing fossil fuels with a fraction of the emissions. Biofuels will lead to new supply chains and production facilities that use specialized membranes and compressors. Power-to-X fuels will rely heavily on green hydrogen that is produced using electrolyzers and sustainably sourced CO2.

Buildings. The most significant source of direct emissions from buildings is heating and cooling systems. Converting legacy heating, ventilation, and air conditioning (HVAC) equipment to heat pumps can dramatically reduce fossil fuel use and the resulting emissions. While this switch will increase the use of electricity, more-efficient HVAC units and heat pumps can help reduce the incremental power needed from utilities. New digital technologies that manage power consumption, directing it to only where it is truly needed, will also play a key role.

To construct net-zero buildings, improved insulation and decarbonized materials will be needed. Machinery makers will likely find opportunities to help industrial materials makers reduce emissions during the manufacturing process.

The Challenges of Rising Demand for New Machinery

As demand for new machinery, equipment, and automation systems ramps up, machinery makers will need to juggle three challenges simultaneously. They must decide which new product and technology areas to compete in, balancing their existing competencies with the needs of their customers. They must continue making their legacy offerings more efficient to remain competitive throughout the transition. And they must develop new data and analytics tools that can help support their customers’ efforts to decarbonize.

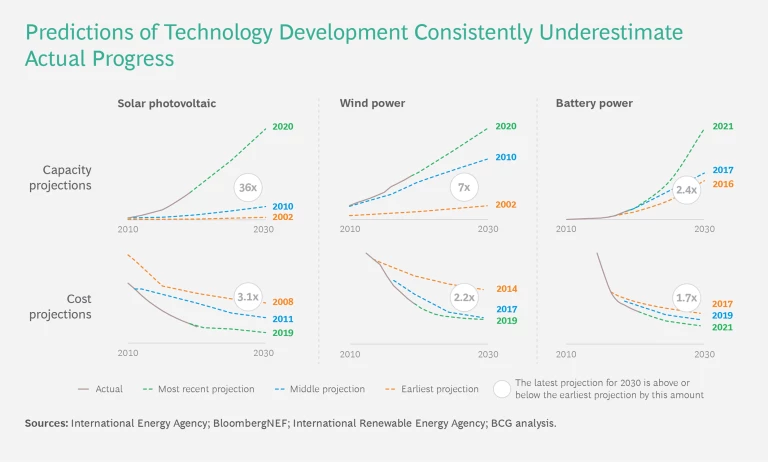

Meeting these challenges will be no easy task. And predictions consistently underestimate the speed at which the transition to new technologies and systems take place. (See “Rising Expectations.”) As the pressure on industries to decarbonize increases, and as governments take a more active role in the transition, the demand for new products will likely accelerate, reach an inflection point sooner than expected, and become an avalanche. There are early signs that the US Inflation Reduction Act, for example, may be triggering a sudden increase in demand.

Rising Expectations

In short, technology deployment continues to outpace expectations, driven in part by the achievement of greater cost efficiencies than expected. And rapid deployment drives greater cost efficiencies, promoting yet more deployment, creating a virtuous circle. There is no reason to believe that the next generation of green tech will be any different.

Opportunity Strikes

As substantial as the challenges may seem, the green tech opportunity for machinery makers is equally vast—about $27 trillion through 2040 across six critical technology categories. (See Exhibit 2.) And while the opportunity is significant in each category, it is important to note that the growth trajectories for each type of technology will vary considerably given their current maturity and future innovations.

- Renewable Energy. Driven by an average cost that is increasingly favorable to customers and the pressing need to decrease reliance on fossil fuel-based power generation, renewable power will be central to decarbonization. Solar and wind power, both onshore and offshore, will drive the bulk of this $9 trillion opportunity through 2040.

- Grid Infrastructure. Because of the increased load from electrification, the added complexity of intermittent and distributed power generation, and the deployment of new renewable capacity, power grids worldwide will require $7 trillion in investments through 2040. Existing suppliers of equipment with established relationships with utilities will be especially well positioned to benefit.

- Energy Storage. Batteries will become pervasive in a variety of industrial applications. For example, stationary batteries will be used by utilities and buildings to manage intermittent power generation and the resulting cost fluctuations, and off-highway vehicles will increasingly feature electric powertrains. Battery manufacturing equipment will be needed to keep up with the demand. The result will be a $4 trillion opportunity through 2040, even before considering investments to produce batteries for on-highway vehicles.

- Alternative Fuels. While batteries and electrification can help address many challenges, liquid fuels will remain critical for heavy transportation and industrial processes with high heat requirements. These alternative fuels include biofuels, hydrogen, and power-to-X fuels, which are synthetic hydrocarbons assembled from green hydrogen and CO2 captured from the atmosphere. Producing these fuels will require new membranes, pumps and compressors, electrolyzers, and equipment to support carbon capture, resulting in investments of up to $3 trillion through 2040.

- Green Buildings and Heating. Decarbonizing buildings will require converting fossil fuel-based heating systems to electric ones, as well as adopting more-efficient appliances and power-management solutions. Demand will be driven by the steady conversion of a large installed base, thanks to a favorable total cost of ownership for these solutions relative to legacy systems, as well as rebates and financial incentives. This demand will drive investments of $3 trillion through 2040.

- Carbon Capture and Removal. While all sectors should strive to reduce their carbon intensity, some hard-to-abate industries (such as concrete) will be unable to fully decarbonize without capturing the carbon they emit. And given the current trajectory of global emissions, CO2 will also need to be removed from the atmosphere to avoid the worst impacts of climate change. Technologies to capture CO2 from industrial and power applications, as well as a budding direct-air-capture industry, will drive approximately $1 trillion in machinery investments through 2040.

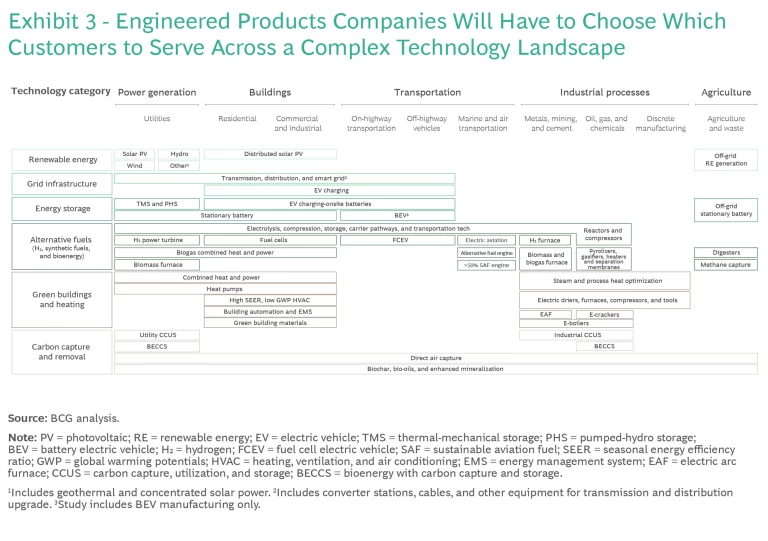

A wide variety of technologies—those already available at scale and those that have not yet been brought to market—will be needed to meet global decarbonization goals. (See Exhibit 3.) The variety highlights the sheer complexity of the strategic challenge for machinery makers: many of the technologies that customers will invest in will differ significantly across industries.

In choosing where to play, machinery makers must consider two factors: where their current core competencies lie and where their end customers are most likely to have needs—including customers of ancillary and aftermarket services. (See “The Aftermarket.”) These considerations will help machinery makers decide where to focus as they evolve their businesses.

The Aftermarket

Green tech aftermarkets will likely look very different from the aftermarkets for legacy technologies, requiring business models to evolve. Decisions made in the near term on how to compete in these markets will have long-term implications for machinery makers’ revenue streams.

Some machinery makers, for example, have historically chosen to sell machinery at a lower margin to capture aftermarket revenues for parts and services throughout the equipment’s life cycle. Products such as gas-powered turbines and jet engines are already sold at very low margins with just that strategy in mind.

However, many green tech products have fewer moving parts and will require less ongoing maintenance and fewer replacement parts. This change may limit aftermarket opportunities and shift value pools forward to the initial sale, which would include ancillary services, such as engineering, commissioning, and life cycle support.

Machinery makers that can think strategically about how to engage across a variety of services have the opportunity to write the rules on how aftermarkets evolve. They must make critical strategic decisions now if they are to capture a share of this value.

Priming the Pump

The vast majority of the estimated $27 trillion in green tech investments will come from the private sector as it seeks to decarbonize operations and supply chains with high emissions. But early and sustained support from governments around the world will also be essential to support research into new technologies, stimulate demand for green tech, and create the regulatory frameworks required to promote change.

Public and private investments will help transform industries, offering enormous prizes to machinery makers bold enough to enter green tech markets quickly.

In the US alone, for example, the Infrastructure Investment and Jobs Act, enacted in 2021, and the Inflation Reduction Act of 2022 will provide close to $500 billion in direct funding and tax credits for renewable and nuclear energy, battery electric vehicles and charging infrastructure, green buildings, hydrogen production, carbon removal, and low-carbon manufacturing. That funding is to be matched by an estimated $600 billion in private investment. We are beginning to see evidence that similar efforts around the world, such as the European Union’s Green Deal Industrial Plan, may lead to competition among countries to catalyze their own green-tech economies. This, in turn, will help drive the rapid transformation of legacy industries and offer enormous prizes to machinery makers bold enough to enter green tech markets quickly.

Regulators can also play a significant role by directly affecting the adoption of certain technologies and products. For example, to increase the public’s adoption of energy-efficient light-emitting diode, or LED, light bulbs, the US enacted rules to phase out and then ban incandescent light bulbs. Similarly, the European Union’s regulations are accelerating a shift away from gas boilers to heat pumps for home heating. Heat pump installations are expected to reach 40 million by 2030, reducing the total number of gas boilers in use today by a third.

Stay ahead with BCG insights on industrial goods

Strategic Implications

Green tech markets are already starting to pick up steam, making it critical for machinery makers to develop the right strategies to enter them now. This effort will require gaining an understanding of the business models, technologies, and projected demand across each industrial sector under consideration, as the following companies have done.

- Green tech market opportunity scan. An engine and products manufacturer wanted to identify and prioritize green tech growth opportunities. After surveying the full landscape of technologies, the company identified priority areas on the basis of favorable market dynamics and customer preferences. It then evaluated these priority technologies against its existing competencies and established roadmaps for pursuing the most promising new businesses.

- Go-to-market strategy. A multinational energy company wanted to develop a plan to make and sell US residents energy systems, including residential solar and storage systems, smart appliances, and home electric-vehicle charging systems. To this end, the company undertook an assessment of the competitive landscape, including a detailed analysis of consumer preferences, market outlook, and the regulatory environment. The result enabled the company to develop a comprehensive, state-by-state go-to-market strategy.

- Ecosystem and value chain mapping. A compressor manufacturer wanted to identify strategic partnerships that would allow it to serve the growing market for hydrogen transportation and storage infrastructure. It mapped the hydrogen ecosystem in relevant regions, built partnership profiles across the value chain, and identified specific partners to approach with targeted value propositions.

These examples suggest that companies are already beginning to incorporate green tech into their business. Those looking to do the same must ask themselves five key questions:

- How can the company evolve its core business to capture green tech growth opportunities with its existing customers and installed base?

- Which new green tech markets does the company have a right to win in and which are most attractive for its businesses?

- What partnerships and ecosystems can the company leverage to strengthen its position in the green tech markets of the future?

- What does the company need to support its green tech growth strategy in terms of investment, talent, capabilities, and an operating model?

- How can the company decarbonize its operations without disrupting business continuity, and what public commitments should it make?

All the evidence points to dire consequences unless the world succeeds in limiting global warming to 2°C or less. As the pressure mounts to decarbonize the global economy, companies in every industry will be making massive investments in the new machinery and equipment that is needed for the effort. The result: a $27 trillion opportunity through 2040 for the machinery makers that can meet the demand. The opportunity is enormous, and companies that move quickly to build green tech businesses will have a considerable advantage over those that wait.