Brand marketing is an easy target when CMOs face pressure to shrink budgets in times of uncertainty. CMOs often struggle to resist such cuts because most companies lack an unequivocal answer to this long-lingering question: Can brand-marketing spending be dialed down as needed to shore up financials, or is it an essential, always-on investment that must be safeguarded to avoid devastating long-term impacts on the business?

Our recent research resolves that question: it reveals that reducing investments in brand marketing during downturns backfires in many ways. Such budget cuts are sound bites that may play well on earnings calls, but their effectiveness is dubious at best—and destructive at worst. CMOs and CFOs should instead see times of economic uncertainty as a marketing and sales opportunity to double down on the right customers, gain share, enhance the value of their customer relationships and their company, and build resilience.

A Time to Invest in Brand Marketing, Not Cut It

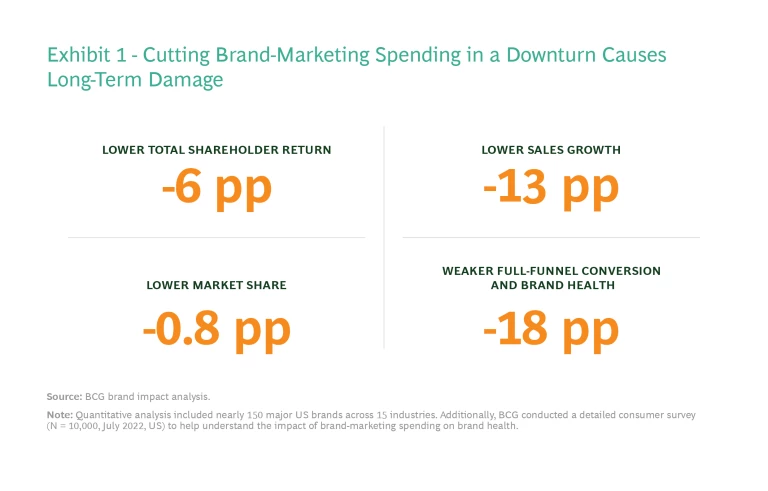

Across all the industries and periods of uncertainty we examined (see “About Our Research”), key performance metrics suffer when companies decrease their investments in brand marketing (see Exhibit 1):

- Costs rise. Regaining lost market share requires a future investment of $1.85 for every $1.00 saved from near-term reductions in brand spending. This is the consequence of one fundamental tenet of marketing: at an individual level, it costs more to gain than to maintain mindshare.

- Total shareholder return declines. The TSR of companies that decreased brand spending from 2017 to 2019 was 6 percentage points lower over the 2018 to 2021 period than the TSR of those that increased brand spending.

- Growth rates underperform. Sales CAGRs for brand spenders in the bottom quartile of our research were 13 percentage points lower than the CAGRs of the top quartile.

- Market share drops. Companies that cut brand spending lost 0.8 percentage points of market share relative to those that boosted brand spending.

- Conversion and brand health weaken. Bottom-quartile brand spenders had an awareness-to-purchase conversion that was 6 percentage points lower than that of brand spenders in the top quartile. Their association with top consumer needs was two to three times weaker, and consequently, their likelihood of being recommended was 18 percentage points lower.

About Our Research

About Our Research

In short, companies that reduce brand-marketing investments suffer from market share loss, reduced sales, and decreased shareholder returns, as well as higher long-term costs associated with building back their brand. In a downturn accompanied by high inflation, reducing brand investments also leaves companies no more profitable in the short run.

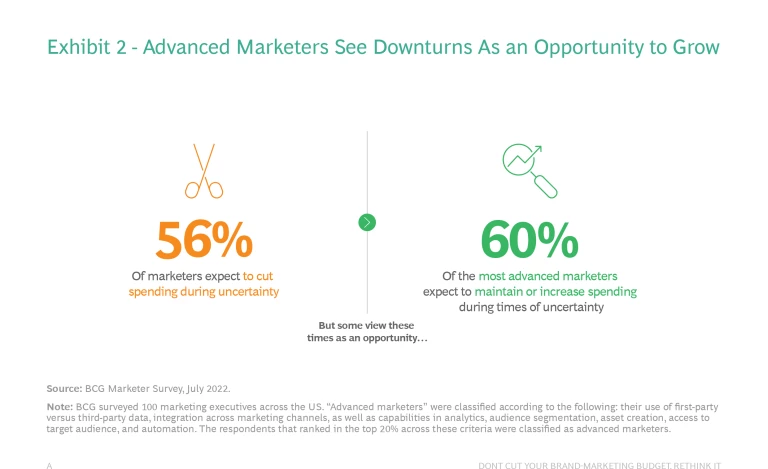

Preserving healthy levels of brand spending is essential in the midst of economic uncertainty. As Exhibit 2 shows, the most sophisticated marketers plan to maintain or boost spending during a downturn, seizing on the opportunity to capture market share, even while a majority of marketers plan to reduce spending.

A Radically Better Approach to Brand Marketing

While continuing healthy levels of spending is important during challenging economic times, the takeaway isn’t to preserve the status quo. Downturns provide the opportunity—and often the impetus—for marketers to radically enhance how they spend brand-marketing dollars.

Precision branding offers CMOs and CFOs a holistic way to drive success during periods of uncertainty, using modern-day advances in consumer insights (demand spaces, meaning the intersection of consumer context and the consumer’s emotional and functional needs), marketing technology, lower-cost creative, and analytics. The most commonly used brand-marketing strategies and tactics have limitations, as Exhibit 3 shows. Precision branding overcomes these constraints. It is the radically more efficient, effective way to invest in brand marketing at scale.

Precision Targeting

Determine which consumers to win with, where to capitulate, and how best to position the brand competitively

Companies should take a demand-space approach to consumer segmentation by identifying the needs and occasions their brands could play in and prioritizing these according to market size, share, and brand and competitor perceptions. To guide investment decisions, companies should leverage the fundamental tenet that it costs more to gain than to maintain. All things being equal, as investment levels change, so too will brand position. Thus, companies should think carefully about where to focus their investments: Which customers do they want to maintain (those with high lifetime values, for example)? Which may be newly available because competitors capitulated?

Precision Activation

Connect with consumers where they are with messages they need to hear

Think back to the young professional and the meal delivery service in Exhibit 3. Precision activation at scale means reaching consumers where messages will resonate the strongest—for example, intercepting a “temporary dieter” with a message about self-care during an online cooking tutorial.

For each demand space or individual, the most advanced marketers home in on behavioral signals, such as purchase history, frequency of site visits, or specific pages visited. They then serve individuals the most relevant needs-based messaging, taking into account their preexisting brand and competitor associations, including whether the brand is in a challenger or champion position versus competitors with those consumers. For each demand space being activated, the ultimate goal is to maximize targeted, relevant reach to challenge, build, or reinforce mental brand associations.

Stay ahead with BCG insights on marketing and sales

Digital channels are especially well suited to precision targeting and activation at scale because they enable a level of reach and precision that is virtually impossible with traditional mass media. While the power of online video has yet to be fully unlocked, top online video platforms have already been shown to have greater influence on purchase than TV by 13 percentage points. Additionally, brands whose customers engaged with both online video platforms and search engines increased their full-funnel conversion by 12 percentage points. In the past, digital marketing versus TV meant compromising on reach, but top online video platforms today reach 95% of the total US internet audience—enabling unprecedented efficiency and effectiveness at scale. Increasingly, marketers are recognizing the reach afforded by digital channels. Within the media and entertainment verticals, for example, marketing executives rated top online video platforms as having better reach than TV.

Digital channels are especially well suited to precision targeting and activation at scale.

Precision Measurement

Assess brand impact across demand spaces to effectively drive growth and optimize accordingly

Companies should never lose sight of long-term brand-health metrics such as unaided awareness, consideration, performance against top needs, and the likelihood of being recommended. But they should complement long-term KPIs with short-term metrics that correlate with long-term results, such as sales and market share, and monitor them regularly. One such metric is First-Fast Response (FFR), BCG’s new near-term KPI that measures a consumer’s unconscious “System 1” associations at the demand space level, which can typically show improvement in weeks versus months.

Other metrics include share of search, social interactions, and engagement. These quantify the brand buzz, sentiment, interest, and potential future demand in the digital realm relative to the competition.

These KPIs can power a test-and-learn, agile strategy that helps marketers identify the best-performing campaigns and reduce waste on underperforming ones.

Our research provides several key takeaways for CFOs and CMOs, as they scrutinize marketing budgets during a downturn—and strive to build resilience and come out stronger on the other side. These leaders need to work together to:

- Examine spending through a multiyear lens because brand-marketing investments and cuts have multiyear consequences.

- Take a cross-functional view, as brand-marketing investments pay out across a diverse set of stakeholders, not just marketing.

- Incorporate the risk of future costs into decision making because it costs twice as much to gain market share as to maintain share.

- Think carefully about priority segments that are worth maintaining and new segments made available by competitors capitulating.

- Embrace precision branding at scale for a radically better return on brand spending.