Our Purpose

At BCG, we have one simple statement that encapsulates our broader purpose as a global business consulting firm: unlocking the potential of those who advance the world. We try to live our purpose through our work every day by focusing on five purpose principles:

We bring insight to light by challenging traditional thinking and ways of operating and bringing new perspectives to the toughest problems.

We drive inspired impact by looking beyond the next deadline to the next decade and by collaborating closely with our clients to enable and energize their organizations.

We conquer complexity by discovering unique sources of competitive advantage and hidden truths in dynamic, complex systems.

We lead with integrity by confronting the hard issues, staying true to our values, and stating our views candidly and directly.

We grow by growing others, enabling our clients, colleagues, and the broader community to build success and achieve their full potential.

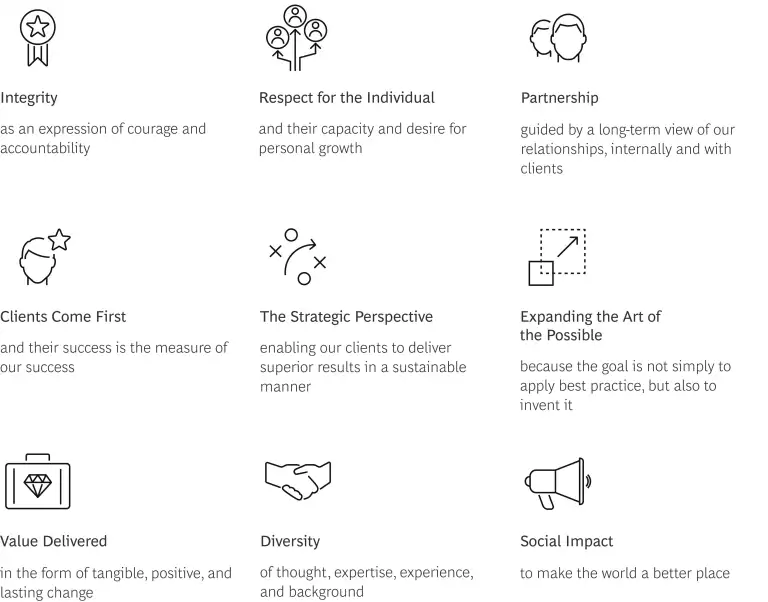

Our Values

Maintaining a strong culture anchored in clear, frequently communicated values is at the heart of what makes BCG a market leader. We are committed to the highest standards of ethics, business conduct, and company principles, and every employee is expected to uphold these standards.

Our Code of Conduct

Our Code of Conduct encapsulates BCG’s commitment to acting responsibly, backed by individual integrity and professional conduct. It outlines our expectations for behavior to all employees and others working on our behalf, and serves as a bridge between our purpose, our values, and our global processes and policies. It is intended to foster integrity and inform decision making while aligning our actions with expected standards of professional conduct.

We periodically review and if needed update the Code of Conduct to reflect developments in corporate ethics and compliance: Code of Conduct | Supplier Code of Conduct | AI Code of Conduct

Our Expertise

Our experts bring industry and functional expertise and a range of perspectives that spark change. We work in a collaborative model, fueled by the goal of helping our clients thrive and enabling them to make the world a better place.

Artificial Intelligence

Business and Organizational Purpose

Business Resilience

Business Transformation

Climate Change and Sustainability

Corporate Finance and Strategy

Cost Management

Customer Insights

Digital, Technology, and Data

Inclusive Advantage

Innovation Strategy and Delivery

International Business

M&A, Transactions, and PMI

Manufacturing

Marketing and Sales

Operations

Organization Strategy

People Strategy

Pricing and Revenue Management

Risk Management and Compliance

Social Impact

Aerospace and Defense

Automotive Industry

Consumer Products Industry

Financial Institutions

Health Care Industry

Industrial Goods

Insurance Industry

Principal Investors and Private Equity

Public Sector

Retail Industry

Technology, Media, and Telecommunications

Transportation and Logistics

Travel and Tourism

Urban Planning

Our Specialty Businesses

Our Partners

Partnership is one of BCG’s core values. We collaborate across a diverse ecosystem of partner organizations to drive shared value and innovation.