Sustainability is no longer just a matter of complying with regulators and dealing with NGOs. As customers and investors join the chorus of concern about the need to protect resources over the long term, it’s become a hot topic in chemical industry boardrooms. Sustainability also involves many more issues than it did in the past, from water and food supplies to climate change. But there’s a major upside to all this attention. For many companies, the demand for sustainable products offers opportunities for revenue and margins that outweigh the associated costs.

Most chemical companies are aware of the potential and already have a sustainability strategy. But they’ve struggled to develop effective business cases for investment. Their proposals tend to be small compared with most other investments, and these often fail to pass muster because the benefits are too “soft.” Some companies, however, have made sustainability investments that more than paid for themselves through higher margins. The key to success is supporting the company’s new products and services with a clear strategic ambition, a focus on the main value to be generated, and a commitment to driving change throughout the organization.

Diverse Stakeholder Interest

Before 2000, the chemical industry faced little demand for sustainability beyond the need to protect worker health and safety and prevent environmental pollution. Since then, ambitions have broadened. The United Nations’ Sustainable Development Goals, released in 2015, include ensuring that populations have sufficient food, water, and other key resources over the long term. Backing up these goals, several national governments have set strong sustainability targets with stepped-up enforcement.

Consumers and the general public, with help from NGOs, have made their voices heard as well. Whether you operate paraxylene plants in China or methanol plants in the US, your neighbors are aware of your operations and are increasingly willing to engage in protests and boycotts. Retailers, as agents of consumers, have also stepped in, with Walmart and other giants banning certain chemicals, such as triclosan, from their shelves.

Finally, institutional investors are increasingly making sustainability an investment criterion. A 2014 report from the Forum for Sustainable and Responsible Investment found that sustainability-minded investment now represents almost a fifth of assets under management. Attention has mainly centered on energy stocks but is beginning to spread to chemicals.

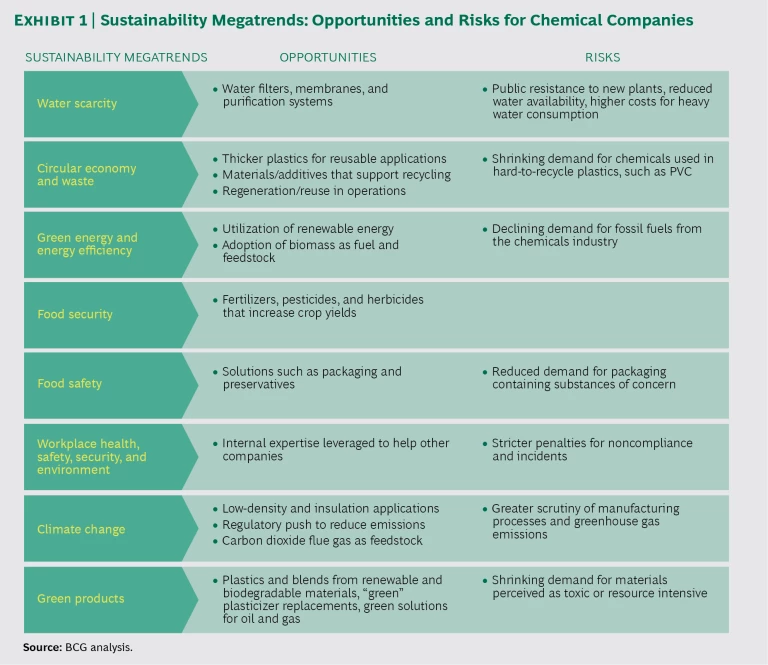

These trends have a silver lining: they create demand for new products and services that address sustainability challenges. For at least a significant segment of the chemical industry, sustainability has the potential to move from a compliance issue to a revenue generator. (See Exhibit 1.)

Laying Out a Sustainability Strategy

Chemical companies are increasingly aware of this demand. In 2015, as part of an annual BCG survey conducted with MIT Sloan Management Review on sustainability issues in a variety of industries, 85% of chemical companies reported having a sustainability strategy. That was more than any other industry covered, and a 70% increase from 2009. Also in 2015, 95% of chemical company executives reported that investors were paying closer attention to sustainability performance—yet only 36% said their company had developed a clear business case or a proven value proposition for sustainability. That’s up from 19% in 2009, but it shows that many companies are still struggling to make the case for investing in sustainability initiatives. (See “Investors Care More About Sustainability Than Many Executives Believe,” BCG article, May 2016.)

To gain a richer understanding of chemical companies’ experience with sustainability strategies, we studied 15 chemical and petrochemical businesses in developed and emerging economies. The sample included diversified companies as well as focused firms. Through interviews and other research, combined with insights from BCG’s project work, we have developed a framework that can help chemical companies get more value from their sustainability initiatives and investments. The framework comprises three steps: setting the strategic ambition, articulating the business case, and driving results.

Setting the Strategic Ambition

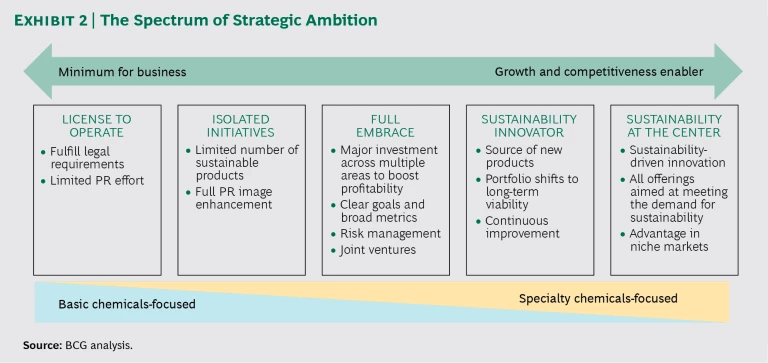

Ambition runs along a continuum, and while we urge companies to raise their sights as they gain more expertise (and thus see more possibilities), not all companies have the same options. For example, those focused on basic chemicals, with few possibilities for differentiation, will tend to have fewer opportunities. Specialty chemical companies, by contrast, have more options because they are closer to end consumers who reward sustainability-driven innovation. Companies with a high public profile place greater weight on benefits to their reputation, so they will have an easier time making the case for sustainability than less well-known companies, which will focus on direct financial impacts. A single company can set different ambitions for its individual businesses.

Across the chemicals sector, we see five distinct levels of strategic ambition for sustainability. (See Exhibit 2.) Here are the assumptions and guidelines for each one, from basic to most ambitious:

- License to Operate. Companies that follow this approach—as most have, until recently—see no reason to do more than the minimum to satisfy regulators and perhaps preempt future rules. Legal requirements determine disclosures, not the company’s public image.

- Isolated Initiatives. Companies with this level of ambition see some payoff in sustainability that goes beyond mere compliance and are comfortable trying out a few small initiatives. They add some sustainability-oriented performance indicators to address areas of greatest concern and make sure to publicize their efforts in order to boost the company’s image.

- Full Embrace. Here companies are fully onboard, and sustainability is a key—but not the dominating—part of corporate strategy. Companies pursue major investments across multiple areas of sustainability, both to develop new products and services and to improve internal operations. They adopt clear goals and a broad set of metrics. But sustainability efforts still have to compete with other goals.

- Sustainability Innovator. For companies at this level of strategic ambition, the opportunity is so great that sustainability is the driving force behind new products and services. Often these efforts center on a flagship offering that represents a major advance over current practice. Most of the business portfolio is still oriented toward conventional activities, but all of these must meet rigorous standards, from sourcing to reuse or disposal, as applicable. Companies innovate toward sustainability while gradually divesting the less sustainable parts of the business, and they communicate transparently with the public.

- Sustainability at the Center. This is a niche strategy for startup and established companies with new technologies, such as performance-oriented biopolymers made from renewables. The resulting products or services are core to the company, whose entire business model is to serve the demand for sustainability. These companies don’t have to be fully independent; some are joint ventures with established chemical firms. But all require stringent management, a sustainability mindset throughout the organization, and strong marketing.

Over time, we expect most companies to move along this continuum as they respond to increasing regulation and uncover new, profitable opportunities.

Articulating the Business Case

The next step is to clarify where—within the scope of the company’s ambition—the principal value will be created and to develop a business case that justifies the needed investment. Exactly how this plays out will vary from company to company, but our research suggests four approaches around which the business case can be built, listed here in order of least to most ambitious:

- Adopting Eco-efficient Processes. The products and services are the same, but production methods change to address sustainability concerns. New machinery, for example, might reduce water consumption or allow for recycling. In some cases, the changes don’t even need to involve the physical side of production; it may be enough to invest in better monitoring and assessment. Lanxess, for example, has found that some customers are willing to pay a premium simply because they value the company’s transparency about its existing sustainable production standards.

- Embracing Eco-efficient Raw Materials. Here the emphasis is on redesigning existing products to use new, more sustainable inputs—ones that generate less waste in production, for instance, or yield products that are easier to recycle at the end of their useful lives. Since such materials usually cost more, companies need to identify the payoff, either in lower production costs or a higher price premium. The petroleum giant Total, for example, recently launched a joint venture with Corbion to build a PLA polymerization plant with an annual capacity of 75,000 tons. The plant will generate biodegradable plastics that will reduce end users’ solid waste—and support a higher price point than conventional plastics. Likewise, Borealis took note of the rising demand for blended plastics when it acquired MTM Plastics, which mixes recycled and virgin materials to generate commercial-grade plastics.

- Fielding New Offerings. Companies taking this approach focus on developing new products and services in response to the growing demand for sustainability. These can be true innovations or simply new services enabled by the company’s existing approach to sustainability. With water supplies threatened in many parts of the world, for example, Dow Chemical has built a $1 billion water and process solutions business. Newlight, a startup, developed AirCarbon thermoplastics from captured carbon emissions. On the service side, BASF created a consulting business out of its internal eco-efficiency methodology.

- Improving Downstream Performance. Here the company’s own sustainability footprint is unchanged, but products are altered to provide such benefits as reduced waste or lower carbon emissions. For example, a product can be redesigned to increase its reusability or recyclability, thus diminishing the environmental footprint of its users. Demonstrating such benefits usually requires a comprehensive product life cycle assessment covering the activities of the chemical company, its customers, and end users. High-growth areas, such as plastics for automobiles, offer the greatest potential for a price premium here. Solvay, for example, has been developing lightweight plastics that reduce products’ energy usage and emissions for end users.

To build the business case for any of these four approaches, the company first needs to understand the impact of the new or altered product over its life cycle. It then designs the product to improve its life cycle value and reduce its environmental footprint. After validating the design, the company quantifies the benefits across the value chain and defines the new cost structure. Then it can factor the product’s benefits into pricing and marketing to ensure sufficient payoff. Are there likely to be enough buyers, willing to pay a high enough price, to generate a return on the investment? How will the company communicate with or educate consumers about the benefits?

Driving Results

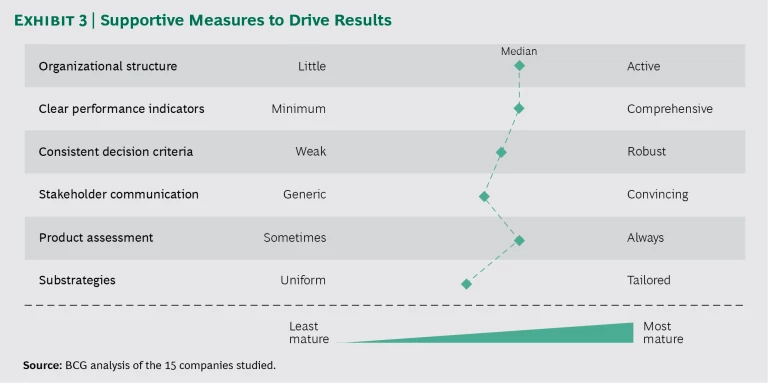

To realize the value from sustainability investments, companies often need to adjust their ways of working. The greater their strategic ambition, the more they need to drive change throughout the organization. Leading companies have adopted a number of supportive measures. (See Exhibit 3.)

- Organizational Structure. A chief sustainability officer, reporting to the CEO and engaging with external stakeholders, typically leads the effort and is supported by dedicated staff at headquarters and throughout the organization. Dow Chemical went even further, combining an executive sustainability team with an external advisory council comprising sustainability experts, scientists, and community organizations. Both the team and the council communicated with people with subject matter expertise throughout the business units.

- Clear Performance Indicators. These are typically based on ambitious and clearly communicated targets across the value chain. Companies monitor them regularly, communicate the results, and include them with other KPIs when determining executive and middle-manager promotions and bonuses.

- Consistent Decision Criteria. The organization as a whole gives weight to sustainability concerns in capital investments, mergers, and acquisitions. One company, for example, canceled a planned polyethylene plant because it would have required toxic additives. Another company was close to acquiring a plant but declined the deal after assessing its carbon footprint over the long term.

- Stakeholder Communication. The most mature companies tell stories, backed up by data, that appeal to stakeholders’ emotions. They also provide regular updates on their sustainability activities. They’re present in social media as well as conventional channels, they participate in public rankings, and they segment and tailor their communications to the interests of their audience. They take the time to listen and adapt their practices accordingly. To help forge consensus and shape industry standards, they collaborate with a variety of industry associations, nonprofits, and even NGOs.

- Product Assessment. Leading companies incorporate sustainability analysis into decisions about their product portfolios. They rank each offering according to the sustainability of the manufacturing process and how the product will be used over its life cycle. Products at the bottom of the ranking are often divested or phased out, while highly ranked products receive R&D funding.

- Substrategies. Global companies increasingly understand that certain aspects of sustainability are of greater concern in some regions than in others. Much of Asia, for example, struggles with water scarcity, while in Africa people are also concerned about food security. Thus, to adapt its global strategy to regional demand, a company might tailor its production footprint so that water-intensive plants do not need to be located in semiarid regions.

The Way Forward

As the demand for sustainability rises and executives gain greater experience with how it contributes to competitive advantage, investments in sustainable products and processes will become more central to companies’ overall business strategy. This shift will make it easier to develop and justify business cases for new investment. Over time, these initiatives could lead to major new sources of earnings, while boosting the industry’s overall standing in the marketplace.

In following the three-step framework set out here, companies should start with only one or two initiatives and see how these play out in the organization. Sustainability will mean different things for different companies—and even for different divisions. Over time, in response to the opportunities that arise and its own ambition, the organization can expand its capabilities and move strategically along the sustainability spectrum.