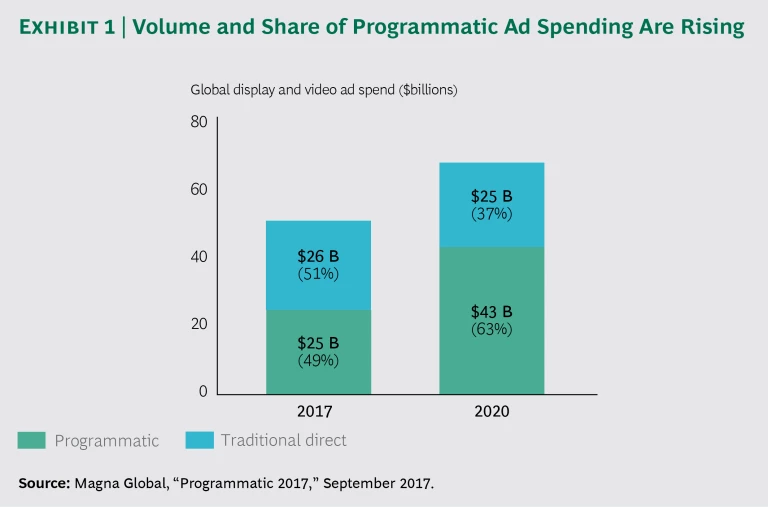

Automation and digital technologies are bringing big leaps in effectiveness and efficiency to many industries by extending reach, speeding up interactions, streamlining processes, and replacing manual and paper-based activities. As more and more advertising spending has moved online in recent years, automated, or programmatic, processing of ad sales and campaign execution has built significant share of the digital market. Around the world, this trend shows no signs of slowing. Programmatic spending hit $25 billion in 2017 and is projected to exceed $43 billion by 2020, when programmatic penetration of the digital ad market will be 63%. (See Exhibit 1.)

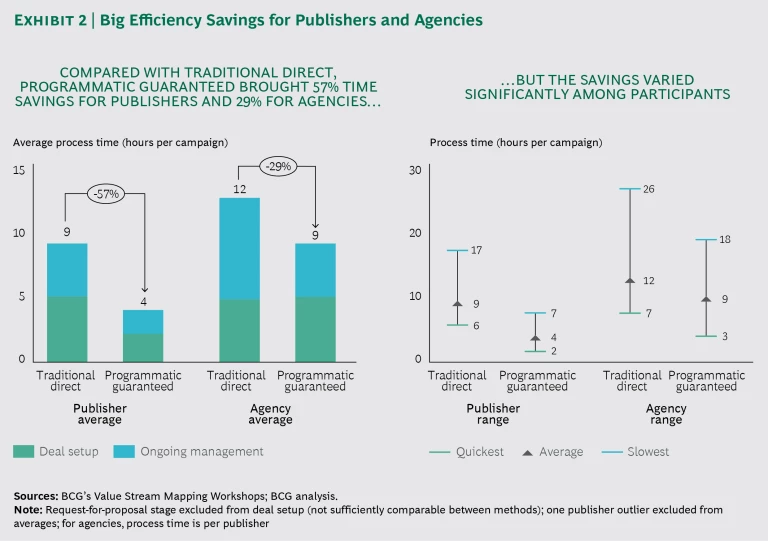

One fast-rising driver of this growth is commonly known as “programmatic guaranteed.” It effectively replaces the manual execution processes involved in the premium inventory segment that is regularly used by brand campaigns. As with other programmatic processes, programmatic guaranteed is both more efficient and more effective than manual approaches. In fact, our recent research found that the programmatic guaranteed process, compared with traditional tag-based reservations, was more than 50% more efficient in terms of time saved for the publishers and almost 30% more efficient for the agencies. (See Exhibit 2 and the sidebar.) Advertisers, agencies, and publishers that are ahead of the curve are realizing big benefits, but full implementation of programmatic guaranteed requires a rethinking of the organization and its operations and systems.

About this Report

This report focuses on the differences in the digital advertising market between traditional direct reservations and the automated buying and selling process commonly known as “programmatic guaranteed.” By traditional direct reservations we mean the traditional process in which inventory is bought at fixed prices directly from media owners using offline insertion orders and manual methods to book and run the campaign. By programmatic guaranteed we refer to guaranteed inventory that is bought at fixed prices directly from media owners, but in a process that uses programmatic software to execute the transaction and deliver the campaign.

The capabilities, features, and costs of the various programmatic guaranteed platforms in operation today differ. But because the underlying methodologies of the various platforms are similar, these differences are not material to our study. We did not explicitly consider how programmatic guaranteed compares with other programmatic trading models; we focused on the comparison between automated and manual approaches.

We examined the direct reservation and programmatic guaranteed processes in detail to assess the efficiency and effectiveness that advertisers, agencies, and publishers can achieve with each. By efficiency, we mean achieving the same performance with less time and effort (think about a baker who makes the same pastry in half the time). Efficiency savings refer to the proportion of time saved to produce the same outcome. By effectiveness, we mean improved campaign performance using the same resources, such as the amount of media spending (how that baker makes a more delicious pastry using the same ingredients and the same amount of time).

The study included more than 40 participants from 12 countries (Australia, Brazil, China, France, Germany, India, Italy, Japan, Singapore, the UAE, the UK, and the US). The participants had various levels of experience with programmatic guaranteed.

To estimate efficiency savings, we used the lean-management method of value stream mapping to visualize and measure processes with 22 of our study participants (12 agencies and 10 publishers). We considered the entire workflow, including deal setup (request for proposal, finalizing contracts and insertion orders, and campaign setup) and ongoing campaign management (optimizing, reporting, and billing). We excluded the request-for-proposal stage from the efficiency calculation because of the difficulty in comparing programmatic guaranteed and direct reservations on a like-for-like basis. Efficiency savings are based on a standard campaign without custom formats.

Our source for the current and projected direct and programmatic market sizes is Magna Global.

This report was commissioned by Google, and the findings were discussed with Google executives, but BCG is solely responsible for the analysis and conclusions.

Programmatic guaranteed brings the power of automation to direct sales. Advertisers and agencies benefit from access to premium guaranteed inventory (as they do with traditional reservations)—and they can optimize for multiple campaigns, as well as manage frequency across programmatic and guaranteed reservation inventory. Publishers can lock in revenue through advance reservations, automatically update their forecasts, and take advantage of automated reporting, billing, and collections (saving time by not having to issue invoices and chase payments, for example).

In light of these benefits, we believe that the industry will adopt programmatic guaranteed more broadly, prompting a second wave of programmatic-driven transformation in digital ad selling. Traditional direct reservations’ share of the total digital display market is projected to shrink from 51% ($26 billion) in 2017 to 37% ($25 billion) in 2020.

BCG has conducted several examinations of the benefits and challenges of the programmatic market for both buyers and sellers of digital advertising and of the effectiveness with which this marketplace functions. (See The Programmatic Path to Profit for Publishers, BCG Focus, July 2015; Efficiency and Effectiveness in Digital Advertising, BCG Focus, May 2013; and Improving Engagement and Performance in Digital Advertising, BCG Focus, September 2014.) This report examines the rising worldwide market for programmatic guaranteed. Although the market is still ramping up, we found a significant opportunity for programmatic guaranteed to enhance efficiency and effectiveness for advertisers, agencies, and publishers.

The Sources of Inefficiency

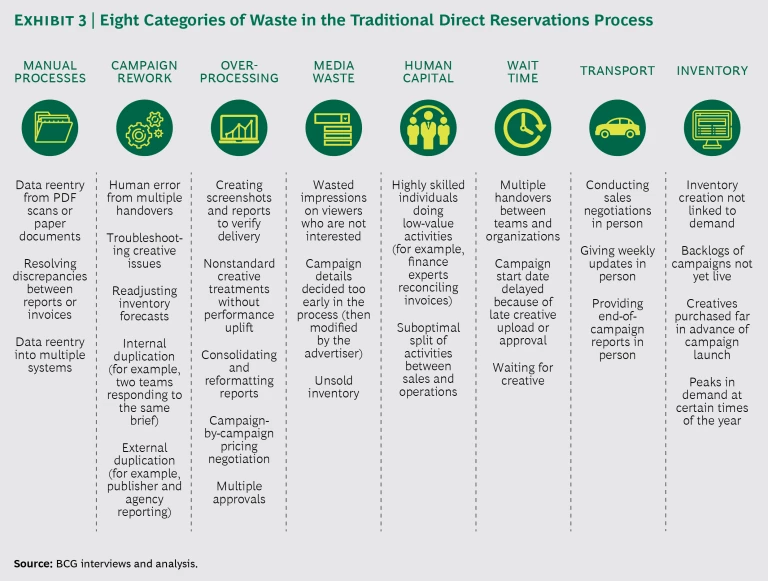

Our study unearthed a number of pain points in the traditional reservation process, many of which are common in the negotiation, setup, and delivery of digital advertising campaigns (as well as in other business processes). (See Exhibit 3.) These inefficiencies result in significant levels of operational waste—and therefore in value left on the table—for advertisers, agencies, and publishers. Three primary sources of operational waste are manual processes, campaign reworking, and overprocessing. We also found significant levels of media waste—various combinations of the wrong ads, unintended viewers, and poor timing.

Manual Processes

Heavy reliance on manual processes leads to duplication of effort across systems and the potential for error during insertion order setup. Manual reentry of data from PDF scans or paper documents into multiple systems (often using different agency and publisher templates) is error-prone and chews up time. Once campaigns go live, publishers spend significant time manually generating confirmation report decks and screenshots. In one instance we found an agency mocking up screenshots for client reporting; the aim was not to deceive, it was simply faster to do mockups than to take real screenshots.

Campaign Reworking

Within both agencies and publishers, organizational silos with little cross-functional interaction lead to excessive work and rework, including costly handovers, long wait times, and fragmented decision making. Across the traditional reservations process, multiple handovers among organizations (advertiser, agency, and publisher) and among subteams (such as advertising operations and sales) cause significant wait times and potential for error. Long wait times increase the risk that advertiser plans or publisher inventory availability will change between the initiation of a deal and its completion, which leads to further rework. One publisher told us, “Sometimes our direct and programmatic sales teams will both create a response to the same brief, without talking to each other.”

Overprocessing

Out-of-date systems that were designed to support manual processes almost inevitably lead to overprocessing (activities that are supposed to create value but do not) and time-wasting workarounds, such as consolidating and reformatting reports, campaign-by-campaign pricing negotiation, and multiple approvals. Reconciling data across agency and publisher reports can take significant time, even with high materiality thresholds (no action on discrepancies of less than 10%, for example). Additional time is consumed chasing invoices; one publisher had three full-time employees devoted to pursuing payment.

Media Waste

In the late 19th century, the US retailer and marketing pioneer John Wanamaker knew that half of his advertising dollars were wasted, and there is still waste in advertising today. Poor frequency management means some individuals see the same ad too many times (and possibly become annoyed), and others don’t see the ad at all. Advertisers can't take advantage of available data to improve the quality of targeting. And human error in campaign setup can lead to mistargeting or to impressions not being served.

The Promise of Programmatic Guaranteed

Programmatic guaranteed enables users on both sides of the advertising transaction to reap the benefits of both traditional direct reservations and programmatic deals. Traditional reservations do a number of things well. They guarantee inventory and revenue, accommodate a wide range of formats, provide for better forecasting and spending allocation, reduce concerns over brand safety, and allow for a high level of creative review. Programmatic guaranteed offers all of the same benefits. It can also deliver greater campaign effectiveness with advanced targeting via audience lists, the ability to target and optimize across campaigns, better frequency management across spending types, and better tracking across a wide range of metrics. Programmatic guaranteed improves workflow efficiency, reduces human error, and saves time and money through centralized trading.

But how many of these potential benefits are actually realized by agencies and publishers, and what is the value achieved? We examined the direct reservation and programmatic guaranteed processes to assess the efficiencies and value achieved by advertisers, agencies, and publishers.

Overall, we found that all parties realize significant benefits from programmatic guaranteed in the planning, setup, and execution of campaigns. After the upfront work necessary to streamline and simplify workflows, programmatic guaranteed, on average, made deal transactions 57% more efficient (in terms of time saved) for the publishers and 29% more efficient for the agencies involved in our study. Publishers realized major efficiency improvements in campaign setup and management. As one publisher put it, “Programmatic guaranteed takes away a lot of operational execution load, including campaign administration and creative upload.” Another said, “With direct reservations, we spend a lot of time pulling reports and reformatting them into client templates. With programmatic guaranteed, the agency typically doesn’t even ask us for reports, they just pull their own.”

For agencies, campaign setup times were an average of 27% faster with programmatic guaranteed than with traditional direct. Most of the time saved came from the areas of insertion order setup and troubleshooting creative issues between agency and publisher. Agencies saved an average of more than 30% in campaign management, with the greatest savings coming from reporting and optimization activities. “The fact that I see everything live means it’s much easier to figure out what’s going wrong,” said one agency executive. Wavemaker, a global media buying agency, realizes efficiencies and savings by buying programmatic guaranteed inventory in bulk each quarter and dividing it among brands’ portfolios and campaigns.

For many agencies, the transition to programmatic guaranteed is relatively easy because they already use demand-side platforms, and the programmatic guaranteed process is similar to nonguaranteed deal types in areas such as order management, targeting, and reporting. One test of time, however, will be whether the programmatic guaranteed teams, as they grow in size, maintain their close coordination and agility or succumb to the tendency to separate into silos, as was the case with the much larger traditional reservation teams in our study.

All in all, sophisticated users of programmatic guaranteed achieve significant results, but the average publisher or agency cannot immediately achieve the efficiencies shown by our study participants. Users of programmatic guaranteed do achieve early savings, but gains of the size seen in our study come only with running a significant number of campaigns and making a relatively full transition from legacy systems and processes.

Our study highlighted a number of areas in which programmatic guaranteed can reduce media waste and enhance the effectiveness of a campaign. These areas include important benefits to advertisers. The best-in-class advertisers and agencies in our study showed improvement in the following categories, among others:

- Audience Matching. With programmatic guaranteed, buyers can securely match inventory against first-party advertiser data and execute precise and operationally effective targeting strategies, while maintaining control of their data. One agency saw a 67% increase in click-through rates and a 20% rise in view-through rates—compared with traditional direct—when using programmatic guaranteed and layering in first-party advertiser data.

- Optimization and Reporting Across Campaigns. Agencies can improve frequency management—and thereby reduce wasted impressions and improve campaign reach—by linking open auction activity to guaranteed campaigns. “With programmatic guaranteed, we can control frequency across all of programmatic, reducing wasted impressions on noninterested viewers,” said one agency executive. “Having all of our spend on one platform means we’re able to report and optimize across campaigns. This enables us to improve overall performance,” said another.

- The Ability to Guarantee Inventory Programmatically. This benefit will increase in importance as programmatic budgets grow, particularly for scarce segments such as video. “We’re using programmatic guaranteed to guarantee access to publishers with a small pool of premium inventory that is nearly always sold out,” said one agency executive. A publisher said, “Our video inventory sells out a year in advance; we don’t underestimate the benefit of guaranteed revenue on the books, particularly via programmatic, which allows us to track everything with more transparency.”

- Greater Transparency Across Campaigns. Agencies and advertisers can see the details of the campaign setup and track a greater range of live metrics, although this benefit comes with some loss of flexibility for publishers, especially when optimizing campaigns.

To achieve such improvements, however, participants must address the underlying issues that inhibit broader programmatic usage. Challenges include the significant variation in setup and campaign management times among advertisers, agencies, and publishers that adhere to legacy systems and manual processes. “We have to enter the programmatic guaranteed deal data into three different tools to get it into our order management system,” said one publisher. Lack of programmatic expertise is another limiting factor, as is decision making that takes place in organizational silos, which make it difficult to plan across direct and programmatic channels. Programmatic and traditional sales teams often find themselves in competition, and the siloed operating model used by many agencies hides the benefits of programmatic guaranteed from senior management and clients.

Format limitations are another current barrier to adoption of programmatic guaranteed. Rich media, for example, are not widely supported on today’s standard programmatic guaranteed platforms. As usage grows, we expect the range of formats that can be fully integrated to increase. Some platforms are developing features that accommodate partial integration of nonstandard or custom creative formats. The benefits to agencies from such platforms include consolidated reporting and real-time tracking. “Our strategy is to run more and more custom formats, and programmatic guaranteed allows us to make this process more efficient,” one publisher said.

Big differences in market dynamics from region to region also affect programmatic guaranteed’s global penetration. Countries with high programmatic penetration (such as the US, the UK, and Australia, where rates are all above 50%) typically have high programmatic guaranteed penetration as well. At the same time, programmatic guaranteed is growing more rapidly in emerging markets (such as India) that rely less on legacy systems and thus have the potential to leapfrog traditional direct reservations. (See “The Rise of Programmatic Guaranteed Advertising in Asia-Pacific,” BCG Article, February 2018.)

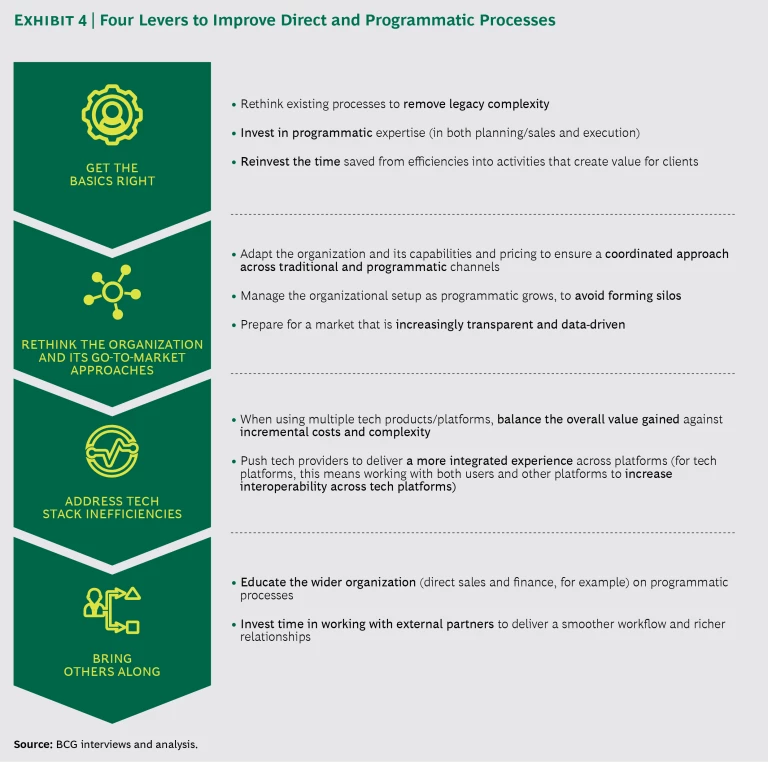

Four Levers That Agencies and Publishers Can Pull

The benefits of programmatic guaranteed to both publishers and agencies (and to agencies’ advertiser clients) are large enough that we expect this technique’s replacement of traditional reservations and other forms of programmatic to accelerate. We see four things that agencies and publishers can do to position themselves to take advantage. (See Exhibit 4.)

Get the Basics Right

Both agencies and publishers need to remove the legacy complexity from their processes and invest in programmatic expertise (in both sales and execution positions). For example, these companies can eliminate legacy IT systems where possible and create positions and teams that work across traditional reservations, programmatic guaranteed, and other programmatic channels. They can also reinvest the time saved from the new process efficiencies into activities that create value for clients, such as improving targeting strategy, analyzing campaign performance, and optimizing across campaigns. As one publisher said, “When we first adopted programmatic guaranteed, it was a nightmare that made it hard to justify the tech costs, but then we invested time into redesigning the workflow, and now it runs pretty smoothly.”

There are plenty of immediate benefits. For example, MightyHive, a global digital advertising partner, found that programmatic guaranteed’s reporting processes eliminated the need to reconcile publisher and technology platform reports. MightyHive has been reinvesting the time saved into such value-added activities as cross-campaign and audience optimization analyses.

Rethink the Organization and Go-to-Market Approaches

Agencies and publishers should reexamine their approaches to organization, capabilities, and pricing.

Organization and Capabilities. In a market that is increasingly transparent and data-driven, it is important for agencies and publishers alike to ensure a coordinated approach to strategy and planning across programmatic and traditional teams. Flexibility in the allocation of resources to the various channels helps.

To enhance decision making, agencies and publishers should bring programmatic expertise into the campaign process early on. This means involving programmatic expertise in the planning for all channels and making the necessary structural changes to campaign setup processes. Agency and advertiser planning teams should be aware of which formats are possible in the various programmatic models. Similarly, publishers should make clear which formats are available through the programmatic models on their sites.

Both agencies and publishers need to rethink their organizational structure to ensure that they get the most value from each channel. At the moment, for example, publisher prioritization of traditional deals over programmatic deals can generate friction with agencies and lead to underuse of programmatic guaranteed. At a minimum, both sides should ensure that incentives are aligned so that publisher sales teams and agency planning teams are rewarded consistently across direct and programmatic guaranteed.

Times Internet, part of The Times of India Group, has coordinated programmatic and direct sales team incentives to ensure that both teams get credit for successful deals. NetBooster, a global digital agency, merged its traditional and programmatic teams to ensure that decisions are made based on which channel is the most appropriate. All team members are trained in sales, strategy, operations, and reporting, so one person is able to support the entire workflow for display and video campaigns.

Once programmatic capabilities are in place, organizations can rethink how they sell, create, and deliver digital advertising; the streamlined teams will be able to focus much more of their time and resources on high-value-added activities. For many organizations today, these are big shifts from the way they currently operate, and, like any such changes, they won’t happen overnight, but implementation should be a priority.

Pricing. Many organizations still spend too much time on repetitive, low-value price negotiations, not unlike a travel agency that negotiates with each airline for every individual customer. As the pricing of programmatic campaigns becomes more transparent, both sides need to take a comprehensive view of what constitutes a smart, unified cross-channel pricing strategy. Publishers, in particular, need to devise a strategy that considers the inventory tradeoffs across channels and the opportunities for monetizing the added-value features of programmatic guaranteed, such as audience matching.

Agency and publisher teams also need to build a common understanding of, and language for, pricing and related issues, such as performance metrics and technology fees. The programmatic guaranteed fees charged by tech platforms vary, as do the capabilities and features of the platforms. All players—advertisers, agencies, and publishers—should invest the time upfront to ensure that they share an understanding of the issues and terminology related to price and compensation.

Address Inefficiencies in Technology

Lack of integration across tech platforms, or with third-party tools, was a common pain point in our study. Companies on both sides of the advertising transaction need to balance technical complexity with access to demand and supply. When deciding which technology to use, publishers should take a comprehensive view of the costs of, and value derived from, an integrated approach versus a nonintegrated approach. Put another way, they should decide which technology to employ based on the value of the transactions it enables. Agencies also need to consider the scale benefits of technology consolidation (such as optimization across campaigns) when determining which platforms to use.

Toward a longer-term solution, both publishers and agencies should push tech suppliers to provide a more integrated tech experience. Programmatic guaranteed currently works well when the buyer and the seller are using the same tech platform. We see some movement in this direction as exchanges adopt programmatic guaranteed and connect with demand-side platforms, but the trend is nascent.

Bring Others Along

Agencies and publishers can help deliver smoother workflows and richer relationships by investing time in educating the staff of key functions in their organizations (such as finance and direct sales), as well as their external partners, in programmatic processes. Vox Media, for example, put its direct-sales team through “PG 101” training to facilitate conversations with clients and ensure that all sales team members understand the benefits of programmatic guaranteed. The company invested in training its finance department on the details of programmatic guaranteed workflow and how to treat programmatic guaranteed in the billing function. One result: the time spent on programmatic guaranteed billing is now only one-tenth as much as the time spent on direct billing. Advertisers, agencies, and publishers can work with one another (agencies training advertisers, for example, or publishers training agencies), as well as within their own organizations, to expand knowledge and use of programmatic guaranteed.

One clear lesson from the short history of digital advertising is that innovations that improve campaign effectiveness for advertisers, increase the efficiency of agencies, or boost revenue opportunities for publishers catch on quickly. Programmatic guaranteed takes waste out of the advertiser-agency-publisher relationship, reduces friction among the parties, and improves results, which should lead to a shift in spending from traditional deals to programmatic guaranteed, and perhaps to increased spending overall. This shift has the potential to be transformative: advertisers get the inventory and reach the audiences they want, and publishers and agencies are able to deliver them with greater efficiency. Companies that cling to legacy direct reservation processes and technologies may soon find themselves struggling to climb another fast-rising digital curve.