The COVID-19 crisis has amped up the complexities and stress of M&A more than ever. Many buyers and sellers have postponed, frozen, or aborted deals: in fact, 73% of respondents in a recent BCG M&A Pulse Check survey said that they had seen deal valuations being renegotiated. What’s more, dealmakers expect the economic crisis to keep M&A deal volume low and prices depressed for a prolonged period.

Nevertheless, as previous BCG research shows, downturns can offer attractive M&A opportunities, particularly for experienced dealmakers. In fact, by late summer 2020, M&A activity was bouncing back even faster than expected.

The differentiating factor for M&A success is thus deal execution, not the economic climate. With this in mind, we have identified some key dealmaking lessons that can help both buyers and sellers reassess the logic of a particular deal, get a stalled transaction moving again, or make a reasoned decision to abandon a deal. In all situations, creative thinking and agile ways of working are critical.

Steps for Buyers in the Early Stages

An acquirer considering a deal and trying to get out of the starting block early can take several common-sense steps. The prospective buyer should begin with a ruthless assessment of the pandemic’s impact on both its own operations and those of its target. Have circumstances fundamentally changed for either side in ways that clearly undermine the rationale for the deal, such as the ability to realize assumed synergies?

A prospective buyer should begin with a ruthless assessment of the pandemic’s impact on both its own operations and those of its target.

If the strategy and rationale still seem to hold, then the acquirer needs to dig in for some painstaking due diligence. This might even mean scrapping any due diligence done so far and rebooting the process, extending the timeline to consider the impact of the crisis across all due-diligence dimensions. Such an effort could include:

- Short-term market developments, such as the depth of the recession and changes in price versus volume

- A midterm outlook, such as the same rate of growth but from a new, lower basis

- Potential changes to long-term trends as a result of the pandemic, such as a faster shift to e-mobility and an increase in employees working from home

- Changes in the value chain (for example, supplier consolidation and changes in customer behavior) and the competitive landscape

It’s also important to assess how the pandemic could alter the regulatory and political environment.

If the logic of the deal continues to hold up, the next step is to engage in agile scenario planning. This will help the acquirer to better understand the range of possible effects on the business and thus begin to zero in on the right valuation—a truly daunting proposition given today’s heightened uncertainty. The buyer should pick several key variables that drive value and then run scenarios for, say, a V-shaped recovery, a U-shaped recovery, and an L-shaped recovery. How sensitive is the target to each of these three scenarios? If the deal makes sense for only one of them, how likely is that scenario to occur?

Once the valuation has been determined, the acquirer can begin to negotiate contract terms. Given today’s uncertainty and the range of possible outcomes over the next two years, the buyer and seller might need to agree to share risk in order to keep the deal on track. For example, the two sides might settle on a valuation based on the best-case scenario but with payments occurring in installments, depending on whether certain EBITDA milestones have been reached.

Finally, a prospective buyer also needs to align even more closely than usual with other key stakeholders in the transaction. Such stakeholders could include financing partners, to secure acquisition financing and define feasible covenants, and board or investment committee members, to shepherd the deal along and address uncertainties.

Steps for Buyers with a Signed Deal

If a deal has been signed but has not yet closed, the buyer should still conduct a quick assessment of the pandemic’s impact on both its own operations and those of its target. This is critical, because if circumstances have fundamentally altered the playing field and undermined assumptions, then the buyer should assess options to abandon the deal—such as by triggering a material-adverse-change clause (if not ruled out) or similar language in the contract.

If the buyer moves forward—whether by choice or by necessity—or if the integration has already begun, the key is to make adjustments fast and act swiftly. Most firms focus their merger integration on three areas: day one, post-close business continuity, and overall value capture. In the current environment, companies are working on what’s important now and over the next three or four months. For example, what will day one look like and how, exactly, will they get there?

This focus on day one readiness might mean postponing some long-term planning to capture value. Alternatively, it could mean just the opposite. If, for example, the long-term plans for integration include shuttering some facilities and reducing headcount, then accelerating those plans, such as by permanently closing some facilities already idled due to the pandemic, might make sense.

It’s also important to remember that good talent, especially if working remotely, might be vulnerable. Communication, therefore, is key. This is the time to double down on proactive communication and planning:

- Devote extra energy to planning a virtual day one experience.

- Make sure that leaders know how to welcome and integrate new team members virtually.

- Schedule extra touch points for integration leaders to promote collaboration across teams and help fill gaps.

- Ensure that practical tools, such as videoconferencing, work flawlessly.

Teams should also continue their integration-planning cadence to promote clear communication and governance. Sharing knowledge will be important.

Steps for Sellers in the Early Stages

Like buyers, sellers considering a divestiture can take several common-sense steps. A seller should begin with a rapid reassessment of why—and how fast—it wants to sell. In the current environment, which is mostly a buyer’s market, valuations will be under pressure. The best course of action might be to wait, if possible. The seller could then use that time to do additional prep work to make the asset more attractive for sale at a later date. For example, the seller could shut down marginal operations that are already idle or reduce headcount by converting staff furloughs into permanent cuts.

For a seller considering divestiture in today’s buyer's market, the best course of action might be to wait.

If the seller decides to move forward, it should assess how the crisis is affecting prospective buyers. Are those companies still in a position to make acquisitions? Might it be necessary, for example, to expand the universe of buyers to include not only strategic acquirers interested in synergies and access to new markets (but who might now be financially weakened) but also financial buyers, whose focus is on cash flow and optimizing operations (but who might be in a stronger position to do a deal)?

At the same time, a seller should restart the vendor due diligence that it plans to share with potential buyers. Given pandemic-related changes, virtually all previous numbers and assumptions will have to be updated. Although vendor reports are neutral assessments, a seller may also want to adjust how it positions the sale given buyers’ different priorities, especially if the buyer universe has been expanded.

Steps for Sellers in an Ongoing or Halted Process

If the divestiture process is underway and potential bidders have already been contacted—or if restarting an abandoned, halted, or postponed process is desirable—then the seller will need to develop both external and internal views of the divestiture in light of the crisis.

The external view should have two components: a market overview and a demand impact analysis.

The market overview should assess COVID-19’s impact on market fundamentals, including top-line economics and the potential shape of the crisis; recovery times by industry and region; and the competitive environment (including a comparison with peers).

The demand impact analysis should include a detailed customer sentiment analysis in key dimensions, such as regions and expenditure categories. It’s also important to analyze the development of short- and midterm demand, including sales and profitability across end markets, recovery time frames, and changes in customer needs.

Together, the market overview and demand impact analysis will help sellers understand demand variables and identify concrete ways to respond to specific concerns, thus putting potential bidders more at ease. For example, sellers could give potential buyers more time for due diligence and propose a risk-sharing deal structure, such as taking less money up front and agreeing to EBITDA or other milestones as the basis for future payments.

To develop an internal view of the deal in light of the crisis, sellers must revisit the logic of the divestiture. In addition, executives leading the effort need to confirm that senior stakeholders are still on board with the sale. This internal view should also have two components: operational preparedness and a review of the business plan.

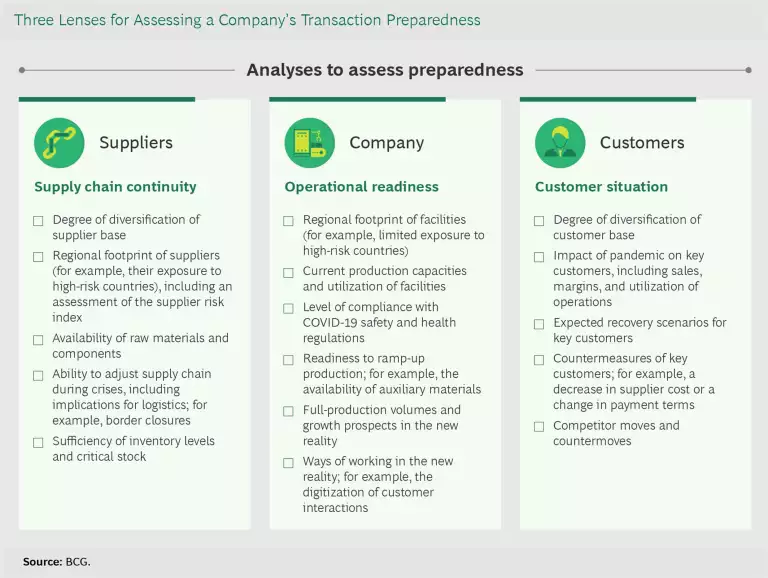

For operational preparedness, the seller should analyze short- and midterm operational resilience and readiness, such as supply chain continuity. (See the exhibit.) It should also assess the divestiture’s positioning to participate in a market recovery—and potentially gain market share.

Meanwhile, the business plan review should include implications for the top line and the bottom line, in both the short term and the midterm, in areas such as order backlog, regional growth, and margin impact. The seller should also create hypothetical scenarios developed on the basis of sensitivity analyses and update budget and midterm management plans.

Despite the gravity of today’s economic crisis, executives should not reflexively end their M&A plans. After carefully reassessing the deal logic in light of current events, some buyers and sellers will undoubtedly decide not to move forward. But strong arguments will be made to keep many deals—probably most—on track during the COVID-19 downturn. Vital to this effort will be patience (such as during the extended due diligence) and creativity (in, for example, risk-sharing and deal structures). For acquirers, in particular, today’s environment may offer a rare opportunity to buy assets at very attractive valuations—if they are both bold and careful.