Consumers are experiencing a heightened sense of responsibility with respect to the implications of their choices on people and the planet. BCG’s recent global consumer survey showed that Australians are some of the most motivated in the world to act on climate change. We subsequently surveyed more than 2,500 Australians to explore what sustainability issues they care most about, and how this translates into action.

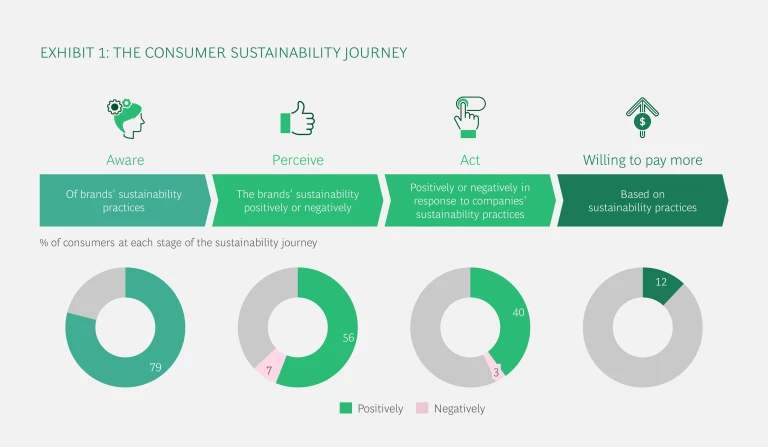

In a typical sustainability journey, a consumer first becomes aware of a company or brand’s sustainability practices, consequently perceives the brand’s sustainability positively or negatively, and finally may take action. The actions that consumers take in response to a company’s sustainability practices can be either positive (such as being willing to pay more for a sustainable product, recommending the brand to a friend), or negative (such avoiding a product or brand, criticising the brand on social media). There is significant drop-off throughout this journey; overall, only 43% of consumers take sustainability-motivated action and only 12% end up willing to pay more. By understanding the sustainability journey, companies can find better ways to retain consumers at each stage and ultimately unlock business value while also driving better social and environmental outcomes.

More than half of Australians are interested in sustainability issues

In general, interest in sustainability issues is higher for those on higher incomes (77% interest from households with income >$131k p.a. vs 59% interest from households with income <$35k) and education (75% interest among individuals with an advanced degree vs 61% interest among those who did not pursue tertiary education).

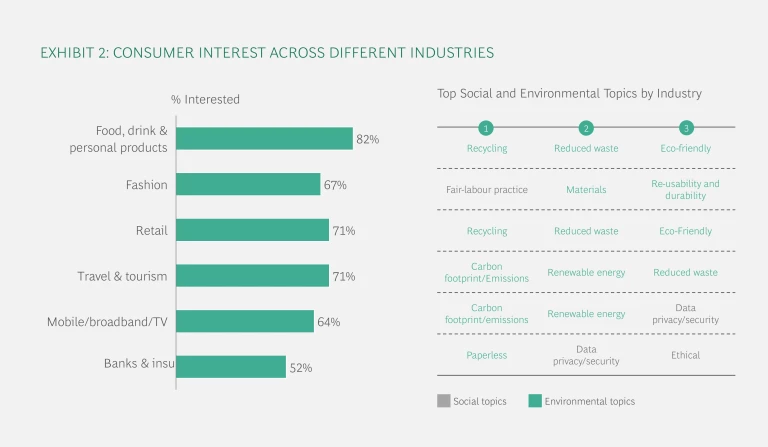

Interest also varies by industry. Consumers are most engaged on sustainability topics for things they buy often, such as food, drinks and personal items. They are least engaged with sustainability in the banking and insurance industry, and the topics they are interested in vary by industry.

Australian consumers have high sustainability awareness

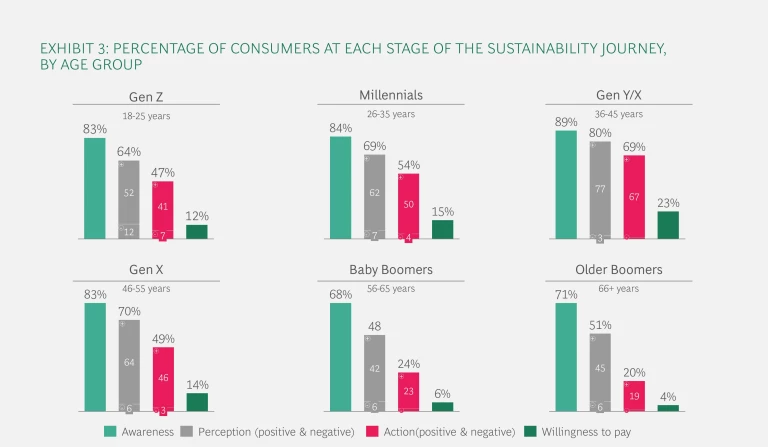

The first step in the sustainability journey is awareness. 79% of survey respondents said they are aware of brands’ “sustainability” practices, with people under 51 years of age typically having higher awareness than those over 51 years.

Sustainability means different things to different people. The majority (55%) of people associate sustainability with environmental issues – e.g., climate change, energy use or waste – with around a third (31%) associating sustainability with social issues, e.g., human rights and ethical practices.

In the past 12 months, three in every four consumers adopted, maintained, or increased their use of sustainable practices. The most common practices are recycling (90%), buying locally produced goods (85%), and reducing energy consumption (83%). The two sustainability practices consumers have adopted at the highest rate over the past 12 months are purchasing locally produced or more environmentally friendly products, and using less single-use packaging.

There is a significant drop-off between awareness and action

For most age groups, between 20p.p. and 50p.p. of consumers are lost in the step between awareness and action; for whatever reason, they do not promote or criticise the brands, switch to or from them or change their willingness to pay.

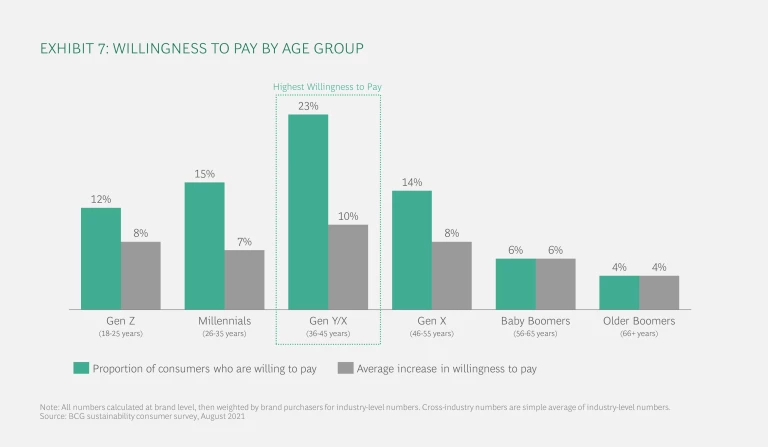

Gen Y/X consumers (36-45 years old) are the most likely to take action once they are aware of a brand’s sustainability practices and develop a positive or negative perception of their sustainability, with less than a 20p.p. decrease between the awareness and action stage of the consumer journey. This age group is the most aware, has the highest level of change in perception based on knowledge of sustainability practices of a brand, and is most likely to take action. This is also the age group most willing to pay more for brands perceived as sustainable.

We expected to see Millennial and Gen Z respondents with similar levels of response to Gen Y/X, although the Australian survey results reflect findings from a similar UK survey. This might be because their sense of what is important is broader than traditional concepts of “sustainability”. Their levels of interest might also be influenced by the COVID-19 pandemic and subsequent economic impacts, which have disproportionately impacted younger people.

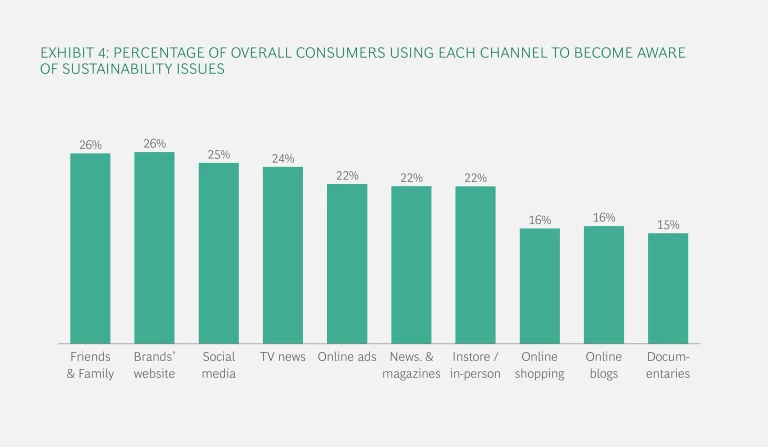

Word of mouth matters

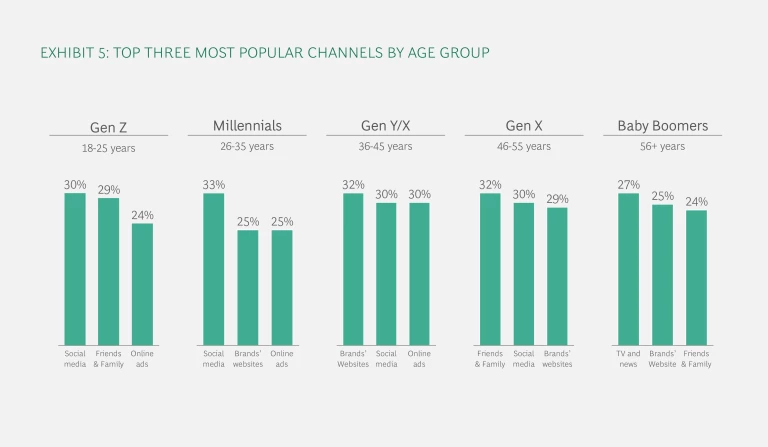

Consumers use a variety of sources to understand the sustainability of different brands, and younger consumers are predominantly turning to their peers as a source. Friends and family, and social media are among the most trusted sources of information.

Different age groups have different preferred sources:

- Under 35s predominantly use social media

- 36-45 year olds most commonly use company websites. However, this age group uses the largest number of sources (2.7) of any age group.

- People aged over 50 tend to rely more on TV and news

Interest and awareness do not always translate into positive responses toward companies

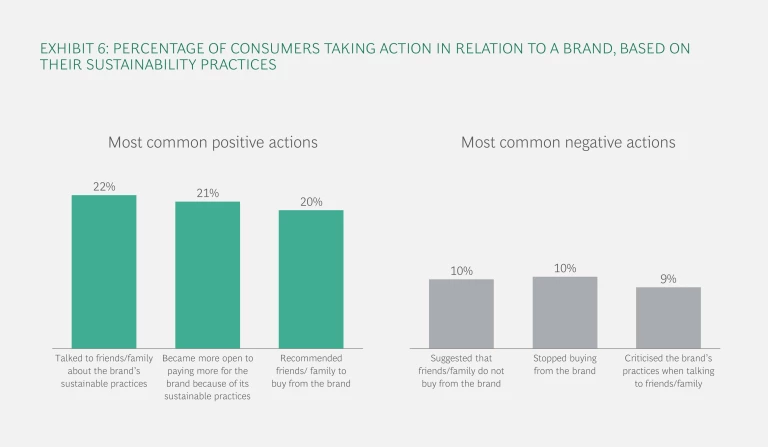

Consumers can take positive or negative action in response to information about the sustainability practices of an industry or brand. Overall, fewer than half of respondents indicated that they had taken some type of action in the past 12 months. These actions can be wide-ranging, with the most common actions involving influencing family and friends.

Younger consumers are more likely to take negative action against a brand they perceive to be unsustainable. The most common negative actions by Gen Z and Millennial consumers include liking/sharing critical information on social media, avoiding a brand or product, and sharing their negative perceptions with friends and family.

When examining consumer actions by industry, BCG’s survey found several trends:

- Many people care about sustainability issues when it comes to supermarket brands and have a positive perception of Australian supermarkets’ sustainability commitments. But this does not necessarily translate to action, be it positive, negative or a higher willingness to pay. Price and convenience may be overriding sustainability considerations

- Brands positioned as ‘premium’ across all industries experience the highest rate of positive action from consumers, as well as a higher willingness to pay

- Consumers are most willing to take negative action against unsustainable brands in the media/telco industry

- Companies in the banking and insurance sector have the lowest rates of action overall, following low levels of awareness and interest

Cost is a factor with switching to more sustainable brands

Only a fraction of those interested and acting on sustainability practices change their spending behaviour, with only 12% of overall consumers willing to pay more based on a brand’s sustainability practice. Willingness to pay also varies with age: 23% of 36-45 year olds are willing to pay more, and to pay 10% more on average, compared to 5% of Baby Boomers, who are only willing to pay 5% more.

How Australian brands can ensure their sustainability practices are driving impact

Based on the results of this consumer survey, we believe there are four key principles for Australian companies to keep in mind when engaging with consumers on sustainability:

- By supporting consumers on their sustainability journey, companies can drive top line impact as well as social and environmental outcomes. Most Australians are interested in sustainability and are expanding their sustainable habits. For a smaller but growing group of consumers, sustainability is playing an increasing role in their purchasing decisions and how they influence others’ decisions. To drive impact, raising awareness about sustainability is not enough; they need to find ways to encourage consumers to take action.

- Engage even those audiences that appear less interested because they can be very active once engaged. Gen Z are the consumers of the future. Although they have a relatively lower interest in sustainability now, many of those who are interested take action. This includes negative actions against what they perceive to be unsustainable brands, as well as positive actions including a willingness to pay more for sustainable brands.

- Tailor communications to align with target demographics’ position along the sustainability journey, as well as their most utilised engagement channels. The top sources of information vary by demographic; younger consumers rely on social media, while older consumers turn to TV and brands’ websites. Choose the channels to raise awareness or interest in sustainability practices carefully, based on your target audience.

- Sustainability is a long-term play – don’t disregard actions that don’t directly impact top line. Consumers respond in a variety of ways including sharing on social media or recommending or dissuading friends and family. While these actions may not directly impact the top line, they raise awareness (positively or negatively) for other consumers, ultimately creating a cycle of awareness and response.