Outcomes are the new opportunity. In a connected world, companies across a broad swath of industries are developing strategies to deliver business outcomes to customers. By using digital technologies to create new offerings and complement existing ones, they’re shifting from the transactional process of selling products and services to developing deeper relationships and providing outcomes, which is turning into a fast-growing and profitable market segment. As the focus of creating and capturing value shifts from one-time sales to long-term partnerships, it is driving higher customer retention as well as rapid account expansion. No wonder many CEOs are convinced that deploying outcome-based business models (OBMs, for short) is the best way to win the future.

Helping to deliver and measure outcomes allows vendors to break free from today’s buying centers, such as CTOs and CIOs, and become partners with a company’s businesses and functions.

Companies deliver outcomes mainly by combining servitization with digitalization. In B2C markets, the early entrants are using digital technologies to deliver customized and personalized outcomes in real time. Their counterparts in B2B manufacturing markets are capturing data from the physical assets they manufacture and wrapping software around them to learn how customers actually use products and to prevent machines from breaking down by conducting predictive maintenance. This ensures that machines and processes work optimally and deliver measurable results. Thus, instead of selling locomotives, the pioneers sell momentum. Instead of power turbines, they offer electricity. And instead of selling jet engines, they provide thrust by the hour.

Analog and digital technologies must work together to produce outcomes. Data, data-driven insights, and software are critical for the delivery of outcomes, pushing many companies to develop or, often, buy different kinds of software. That has created a huge market for software firms as well. Helping to deliver and measure outcomes allows vendors to break free from today’s buying centers, such as CTOs and CIOs, and become partners with a company’s businesses and functions. As customers grow accustomed to purchasing outcomes, manufacturing companies and software firms must learn to cash in on the lucrative opportunities that OBMs create if they wish to thrive in the future.

Pervasive Evidence of This New Approach

Outcomes are gaining ground in consumer markets globally. Fast-growing born-digital companies such as Uber, Lyft, and Didi allow consumers to buy rides and travel from one spot to another faster and cheaper than they could by buying and driving their own cars.

Industrial manufacturers too are offering outcomes. Britain’s Rolls-Royce delivers power by the hour to commercial airlines, providing, rather than selling, the engines it manufactures, monitors, and maintains. France’s Alstom ensures that the trains it makes meet customers’ needs 24/7, with its Train Life Services minimizing the delays caused by problems in train engines and coaches. Alstom incurs financial penalties if there are breakdowns, particularly during peak hours. Similarly, Germany’s Kaeser Kompressoren no longer sells air compressors. It sells air compression as a service, using digital technologies to remotely monitor the use of its machines. And Holland’s Philips sells lighting – rather than LED bulbs – to institutional customers such as Amsterdam’s Schiphol Airport. The bulb manufacturer manages the airport’s lighting through an Internet of Things-based system, reducing Schiphol’s annual electricity consumption by 50 percent.

Most adopters of the new approach share three characteristics:

OBMs Are Customer-Driven. Customers have always wanted solutions to problems, not products or services, although they may not have believed it was possible. The preference is for end results. As Harvard Business School Professor Theodore Levitt once wrote: “People don’t want a quarter-inch drill. They want a quarter-inch hole.”

Customers have always wanted solutions to problems, not products or services, although they may not have believed it was possible. The preference is for end results.

OBMs Focus on Delivering Measurable Results. To provide outcomes, companies must concentrate on customers’ goals, objectives, and success. It may be easier, habitual, and less risky to sell products, services, and processes, but outcome-providers must go the extra mile and deliver quantifiable customer outcomes that create and capture more value. Measurability is particularly important for software firms. For instance, if a customer desires more inventory turns, the vendor must be able to show that its application is the key driver of that outcome.

OBMs Are Enabled by Digital Technologies and Data. Companies can use sensors to capture data, the Internet of Things and 5G to transmit them wirelessly, and the cloud to store and process Big Data. That helps create applications and platforms that can process data, generate data-driven insights and digital twins, and develop ML and AI algorithms that drive hardware to deliver customer outcomes.

The need to create OBMs is partly why almost every company has launched a digital transformation in recent times. Analog and digital companies face different challenges, though. While born-analog companies find developing digital capabilities time-consuming and investment-intensive, digital start-ups don’t possess much knowledge of physical machinery, processes and patents, or have an installed equipment base that they can tap for data. Consequently, the best way to deliver outcomes is for analog and digital companies to work together, which will create new markets for both kinds of enterprises.

The best way to deliver outcomes is for analog and digital companies to work together, which will create new markets for both kinds of enterprises.

Manufacturers Must Change How They Think About Customers

When well-established, asset-heavy manufacturing companies switch to outcome-based business models, usually at the behest of customers, they must move past the transactional approach that ends with the purchase of a good or a service. The deeper, long-term relationships they will need to build with customers will produce several advantages, each of which can propel faster growth.

As they learn more about how customers are using their products and services, manufacturers will be able to offer new product features, additional services, and new offerings that meet customers’ current and prospective needs. Entering into long-term contracts will increase customers’ lifetime values and reduce attrition.

Long-term relationships also lead to more upselling opportunities. The entry barriers are lower because companies can quickly demonstrate proof of value for new ideas. And relationships boost long-term profits. According to a 2019 BCG study, Software as a Service (SaaS) companies generate 25 times more value over the lifetime of a customer than in the first year they acquired it.

Starting Points. Executing an OBM must start with executives coming to grips with the nature of each customer’s needs. Then they must figure out how to use physical assets, digital technologies, and data from customers as well as other sources, such as third parties, suppliers, and other customers, to deliver the outcome that a customer wants. It’s critical to regard the desired outcome as a product in itself.

Companies that deliver outcomes take over some of their customers’ responsibilities, so the latter are often willing to pay a premium for outcomes.

Outcomes are best delivered through full-service models. One key selling point of an OBM is the 24/7 reliability of the assets it will deliver consistently. That’s often possible only if the supplier deploys a team of service engineers as well as AI-based support. The predictability of costs – which are guaranteed by outcome-providers even if there are daily or weekly fluctuations in demand – adds to OBMs’ perceived value. Moreover, companies that deliver outcomes take over some of their customers’ responsibilities, so the latter are often willing to pay a premium for outcomes.

Every element that contributes to the delivery of an outcome must be integrated to provide a connected experience. Data is the starting point. From the initial sale to after-sales services, it fuels every OBM. It must therefore flow seamlessly from end to end, integrating legacy systems and new technologies to create an interconnected view of the outcome-delivery process. Companies must automate data collection and analysis as far as possible to reduce the risks associated with manual operations.

Over time, manufacturers can strike partnerships with their customers to jointly develop solutions that meet customers’ specific and specialized requirements. These relationships form not only between a company and its customers, but with other suppliers as well. Smart companies create business ecosystems – customers willing – to deliver outcomes. Every player in the ecosystem must adopt a customer-centered approach to the product development, manufacturing, and supply process to jointly deliver outcomes the customer desires. And all the companies in the ecosystem will optimize their growth potential as long as they stay committed to the customer’s success.

Software Firms Lay the Foundations for Outcome Delivery

The basic building blocks of OBMs are digital technologies such as sensors, the IoT, digital twins, and cloud computing – along with the data that flows through those systems. And software is the key enabler, led by recent advances in AI, ML, and predictive modeling. That’s why, rather than selling subscriptions or licenses, software firms would do well to develop applications that will deliver customer outcomes. This applies in the asset-heavy parts of a business, as well as the asset-lite ones. In HR, for instance, a software package could develop a new capability set among employees as an outcome, while in the customer function, an application could ensure increases in cross-selling and upselling opportunities.

Software is critical to outcome-providers at all stages of their business life cycle. Start-ups and new entrants will likely be digital natives, whose edge stems from their technical capabilities, but established businesses will have to buy third-party software and services. Developing an outcome-based offering requires deep dives into every function, and third-party software offers quicker, less expensive, more effective solutions than developing software from scratch.

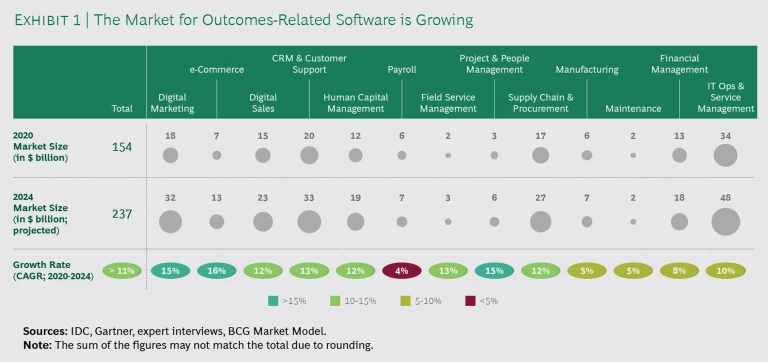

Needs Vary by Sector. Each business or sector has distinct needs, and will place more importance on certain areas than others. More than any other metric, IT spending is a reliable indicator of the importance of software in an industry. According to a recent study that we conducted, the size of the market for outcome-based software was over $150 billion in 2020, and it is expected to grow at a compounded annual rate of 11%. (See Exhibit 1.)

Manufacturing-oriented businesses, such as aerospace, defense, heavy industry, and construction, emphasize asset-management software solutions, as do sectors such as telecom, utilities, healthcare, and pharmaceuticals. A study we conducted estimates the size of the outcomes-software market in those sectors last year at around $88 billion – and growing at the rate of 11 percent a year. In contrast, companies in industries such as retailing, e-commerce, financial services, insurance, professional services, and the sharing economy are more likely to invest in customer management-led software. In 2020, that market was around $66 billion, according to our estimates, with the same growth rate of 11 percent.

Starting Points. To adopt outcome-based business models, software vendors must revisit their business strategies. They must analyze customer workflows, understand how processes affect outcomes, and develop software solutions to help achieve results. Their R&D expenditure must be prioritized to adapt current offerings or innovate where opportunities exist. Any new or updated software must be designed to work with other software solutions and legacy infrastructure.

To adopt outcome-based business models, software vendors must analyze customer workflows, understand how processes affect outcomes, and develop software solutions to help achieve results.

Cross-functional collaboration is central to delivering solutions across software modules; the different teams of a vendor must collaborate to build OBM-enabling software. Otherwise, silos will persist, preventing the data flows and analysis needed to provide automated services.

OBM software also needs to integrate with other firms’ software. Working with other software vendors is therefore critical. It will create additional customer value, accelerate the time to market, and also lead to opportunities in adjacent markets. (See the sidebar, How Companies Choose Outcome Software Providers.)

How Companies Choose Outcome Software Providers

One, companies must study each vendor’s enterprise software architecture as well as its software roadmap for the future, and assess their fit with customers’ current and future needs. It’s important to figure out how up to date the firm’s technology stack is, and if the software will interface easily with existing applications.

Two, outcome-providers must pick either a best-in-suite or a best-of-breed approach to software. For example, established customers will be keen that software modules fit their existing infrastructure, so a best-of-breed software will work if it interfaces with existing applications. A best-in-suite approach will be more appropriate for newer enterprises that don’t have much infrastructure, or for corporations that are planning to replace their legacy systems. Similarly, corporations tend to use best-in-suite offerings for complex applications, such as enterprise resource planning, and best-of-breed applications for simpler ones, such as human capital management. Another reason for picking best-in-suite software is the ability to extend platform functionality, which will allow data to flow easily between modules and help the development of use cases.

Three, companies must evaluate each vendor’s software in relation to the customer’s strategy. Unless the software has the ability to deliver outcomes, work with existing software, and meet the customer’s future plans, it will not be of much help.

When software has been optimized for OBMs, its pricing will be transparent and integrate into outcome-focused packages. Reviewing case studies, speaking to customers, and evaluating credentials should help outcome-providers judge vendors’ fit. Companies should also use the selection process as an opportunity to scrutinize their workflows, to check if they can be simplified, and figure out how software vendors can help them deliver outcomes faster, better, and less expensively.

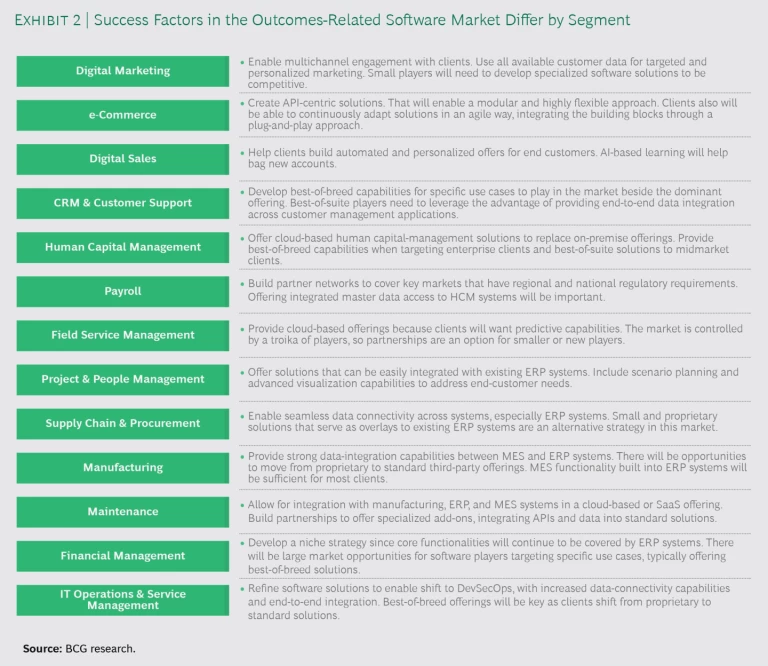

Success for software firms can take many forms, driven by the sector and the need. (The key success factors in different sectors are shown in Exhibit 2.)

Software that integrates with other applications and follows the customer life cycle is key to increasing the value of client relationships. From the emerging enterprise with an urgent need to establish fundamental infrastructure, to the established incumbent looking to connect legacy solutions and replace proprietary processes, software can generate outcomes in different ways. Doing so supports a land-and-expand strategy, where the outcome-provider builds on the trust and comfort level it has developed with its clients. Many companies see benefits in selecting a software vendor whose platform offers capabilities across many different software modules, as the tight integration allows customers to create even better data-driven value opportunities.

Monetizing outcomes. How software firms monetize their outcome-based offerings could change over time. They will be responsible for creating more value than before, so they can charge a premium. To do that, though, the vendor and its customers must align on what each outcome is worth. That’s often the biggest challenge. It’s difficult to a priori estimate an outcome’s value and create a value-capture model – the price per outcome – so that it delivers value to both the software vendor and its client.

In the last ten years, software firms have continuously built on traditional approaches to discover value. Numerous software vendors have earned their spurs not only by discovering new sources of value, but also by tailoring their activities to drive client outcomes. The importance of these activities will only increase over time as customers get accustomed to the idea that software firms must be partners in their journeys.

A word of caution. As more customers start demanding outcomes, challenging suppliers and software vendors to deploy OBMs, it may be dangerous to ignore them. Companies that can’t deliver outcomes and don’t have a role to play in their customers’ ecosystems may find they are expendable. They will give up market share, miss growth opportunities, and lose long-term buyers. By sticking to the delivery of products or services, they may also end up investing in capabilities that their customers no longer need, and become irrelevant over time. Focusing on products in a business world that is increasingly interested in the ends, rather than the means, is hardly a risk-proof strategy for the future.