There are plenty of reasons for companies to be intrigued by the consumer economies of Africa, and they can be summed up in one word: growth. The middle class and affluent segments of Africa’s population are expanding fast. In sub-Saharan Africa, what was a 7% annual growth rate from 2005 through 2015 is now accelerating to an anticipated 12% a year through 2035. In Africa’s eight largest markets, private consumption is expected to grow at 5% a year (in real terms) to $1.25 trillion in 2025. As other markets mature, growth slows, and volatility rises, Africa’s consumers are widely—and highly—optimistic, as is evidenced by BCG’s most recent African Consumer Sentiment report. (See African Consumer Sentiment 2016: The Promise of New Markets, BCG Focus, June 2016.) From the Mediterranean Sea to the Cape of Good Hope, from the Atlantic to the Indian Ocean, large majorities of urban consumers—in many areas, 90% or more—express a positive view of the future.

There are also many reasons for companies to be cautious, and these too can be captured in a single word: complexity. Africa is anything but another emerging-market opportunity. It comprises more than 50 markets—each socially, culturally, politically, and economically unique—that span a continent the size of the US, Europe, China, India, and Japan combined. The logistics alone are daunting, never mind the intricacies of multiple operating models, supply chains, distribution networks, marketing strategies, and regulatory regimes—all in an evolving ecosystem in which the word developing takes on new breadth and depth.

For some multinational companies (MNCs), the complexity is overwhelming. For others, getting it right means big rewards for years to come. This report examines the particular challenges that MNCs face in Africa and presents a five-step route-to-market (RTM) approach.

Continental Complexity

More than a billion consumers (60% living in rural areas), 2,100 languages, and 54 countries: these facts only begin to capture Africa’s size and diversity. Every emerging market is defined by its particular types of challenge: a complex mix of trade channels, unique consumption patterns, limited infrastructure, lack of data, and, often, a difficult regulatory and business environment. Africa takes each of these to a different level.

Trade Channels. Africa is an amalgam of traditional and modern trade channels. Traditional trade consists largely of informal channels, such as open-air markets with scores—even hundreds—of individual vendors (including street vendors), kiosks, cantinas, and tabletop merchants. Modern channels include the supermarkets, shopping malls, and specialty retailers that MNCs are more used to, as well as nascent e-commerce. The mix of channels varies by market. (See Exhibit 1.) In South Africa, for example, modern trade is well developed throughout the country, even beyond major cities. Modern trade channels in Kenya are found mainly in major cities, such as Nairobi and Mombasa, while people living outside of urban centers shop in traditional channels. Modern trade channels are barely a factor in Cameroon.

The meaning of traditional trade can vary from market to market as well. In Angola, male-run cantinas—small rooms stocked with popular food brands and a variety of basic goods—are commonplace. Nigeria, on the other hand, is dominated by open-air markets. Most offer a variety of general merchandise, while some specialize in a particular type of product, such as building materials. The mix of trade channels in each country is dictated as much by local culture and consumer preference as by economics and the state of development. Many people see traditional trade as part of their culture: markets are meeting places, and shoppers enjoy haggling with merchants over prices. Multiple local trade formats increase convenience and accessibility, and goods are generally priced lower than they are at modern stores. The availability of small and broken-up package sizes also allows for smaller basket size.

While in most African countries, the growth of modern trade is correlated with growth in per capita GDP, there are also many constraints, including lack of infrastructure, security concerns, limited government support for new commercial developments, and business and regulatory uncertainty. For all of these reasons, MNCs cannot afford to focus on modern trade alone. A sound RTM strategy must embrace both modern and traditional channels.

Consumption Patterns. Many consumption patterns in Africa differ from those typical of Western and other emerging markets. In Ghana, for example, people typically eat a small breakfast and one large meal late in the afternoon. Nigerians tend to prefer blue or green tinted windows to clear glass. The postal system in South Africa is unreliable, and email and online portals are much-used alternatives. In addition, many consumers are unable to afford even low-priced products that sell well in other markets. Furthermore, African incomes fluctuate over time, and consumers have to adapt their purchase decisions to current economic circumstances.

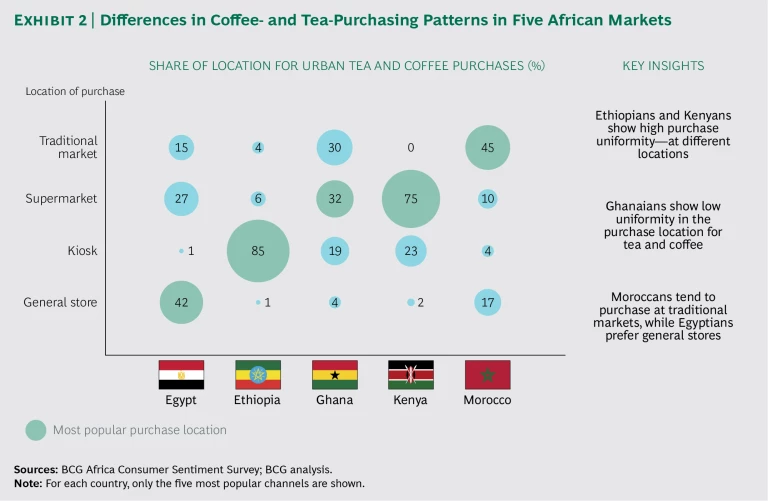

Consumption patterns can vary substantially across African markets. Take tea and coffee, for example. Moroccans prefer to purchase these products in traditional markets, Kenyans buy most of their tea and coffee at supermarkets, and Ethiopians purchase almost all of theirs at kiosks. (See Exhibit 2.)

Consumption patterns also vary within individual markets. For example urban Ghanaian consumers prefer imported frozen chicken, which they view as both higher quality and a better value for the money. In smaller towns, however, consuming fresh locally raised chicken is the norm because the local birds are perceived to provide higher nutritional value, among other benefits. Understanding how one’s product is consumed is critical to setting up the right RTM.

Limited Infrastructure. Infrastructure is an issue everywhere. Building quality, transportation, and electric power are problematic in many urban and most rural areas. At the very least, limited and basic infrastructure requires substantial expenditures that cannot easily be passed along to less affluent consumers, and in many places underdevelopment, combined with long distances, makes it difficult or impossible to serve large rural populations cost-effectively. Take Nigeria, for example. The Nigerian national road network of more than 190,000 kilometers carries more than 90% of all freight and passengers, but fewer than 20% of the roads are paved. This adds significantly to transit times and contributes notable wear and tear to vehicles. Poor road networks also exacerbate heavy traffic, causing big delays, especially on routes to and from ports, where trucks are frequently forced to queue up overnight.

Lack of Market Data. Gaining access to, compiling, and analyzing market data in many countries can be like trying to solve a mystery. In Nigeria, for example, reported rice consumption totaled 6.5 million metric tons in 2015. Local production accounted for about 2.5 million metric tons and imports for another 2.3 million, leaving a gap of some 1.7 million metric tons between the reported consumption and production figures. There are many possible explanations, including inaccurate statistics, many instances of smuggling across local borders, and irregular customs processes. It’s all but impossible to know exactly which apply and to what extent.

Regulatory and Business Environment. While import-export conditions are improving—the proposed Continental Free Trade Area, currently under negotiation, would establish a single market of a billion people—African markets today are characterized by multiple trade barriers, including import quotas and duties, banned imports, foreign-exchange controls, and unreliable customs procedures. It is, perhaps, not surprising that business conditions are rife with legal uncertainty and illicit practices, including counterfeiting, parallel imports, and smuggling.

In addition to growth and complexity, two things are certain: the challenges are big, but the companies that invest in overcoming them have achieved significant success.

A Successful RTM Strategy in Africa

In addition to working with clients across the continent, BCG has studied how companies, including local players and MNCs, overcome the considerable challenges that define Africa’s business environment. Although there are outliers and exceptions, we have found that most successful companies take the following five steps in setting their routes to market:

- Achieving a clear understanding of the market

- Setting the level of their ambition and deciding where to play

- Establishing the right structure and distribution setup

- Choosing the right partners

- Designing a route to retailers and supporting in-store execution

Achieving a Clear Understanding of the Market. There are generally three aspects to assessing a market, each of which, in Africa, has its complexities: understanding the consumer, mapping the supply chain, and gauging the competitive landscape.

Coming to grips with basic factors about a market—such as its size, the drivers of consumer behavior, and who buys which company’s products—can require enormous effort. In developed markets, multiple research organizations provide all kinds of data, but in many African markets such organizations don’t exist or, if they do, they have very different definitions of categories and products. As a result, assessments of market size and composition are highly inconsistent.

Africa’s diversity also comes into play, and the differences span both country and category. Spending on insurance, for example, increases significantly at higher income levels in Angola and South Africa, but, in the Democratic Republic of Congo (DRC), at all income levels, spending on insurance is low. In Nigeria, household spending on insurance increases only up to the $2,000-a-month income level and remains about the same for wealthier households. Mobile phone spending in the same four countries presents a similar pattern of difference. Mobile phone penetration is lower in Angola than in Nigeria, South Africa, and the DRC. While penetration in Nigeria and South Africa reaches nearly 100% at the $1,000-a-month household income level, it is still rising among those with higher incomes in the DRC and Angola.

The composition of supply chains can also vary substantially. In the DRC, large local retailers make up almost all the links in the chain, importing goods, distributing to smaller retailers, and serving customers directly. It should be no surprise that they use their strong position and influence to discourage new competition. In Angola’s meat market, by contrast, warehouses are the critical players. They supply all retail channels including cantinas (small informal stores), kitandeiras (tabletop sellers), and zungueiras (mobile vendors who carry goods for sale in plastic baskets). They also sell direct to retail consumers and are the vendors of choice for consumers making monthly meat purchases in bulk.

It is not uncommon for different channels to serve different customer segments, and this affects RTM decisions. In Nigeria, major building contractors procure imported glass primarily from Europe, while smaller contractors in West Africa buy at the glass open market in Lagos.

For all these reasons, MNCs looking at particular markets in one or more countries will likely need to invest in proprietary market research. Although the upfront costs may be unwelcome and significant, the investment offers multiple payoffs. A global consumer products company was able to achieve strong competitive advantage in an attractive West African market by conducting its own in-depth retail census, which encompassed sales figures, GPS coordinates, and more than 75,000 retail outlets in the surrounding terrain. The company was able to identify and rank the leading outlets and distributors, allowing it to reallocate resources, redirect distribu-tion, and outsource low-priority and high-cost outlets to subdistributors and whole-salers. It was also able to rethink the transportation needs of its sales force. The results included reduced cost of distribution and a notable increase in market share.

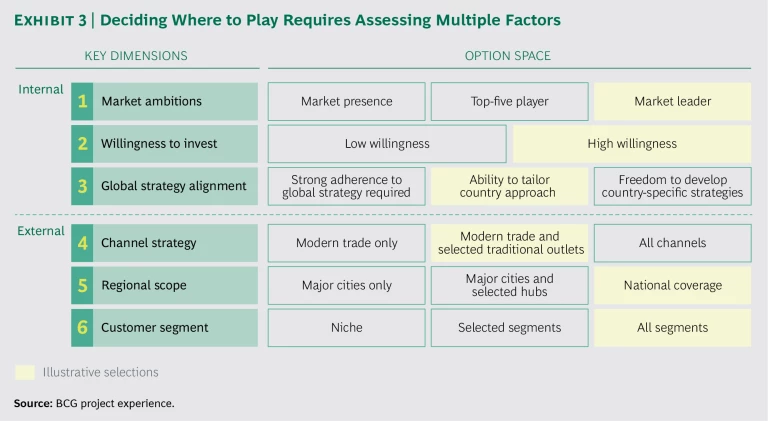

Deciding Where to Play. This requires a multipart assessment of six internal and external factors. (See Exhibit 3.) The internal dimensions include the company’s ambitions (to, for example, establish a presence or be a leader), its willingness to invest, and how local operations fit into its global strategy. In emerging markets, particularly those characterized by complex challenges at all stages, there’s a big difference between having the freedom to develop a country-specific approach and being required to adhere to a global strategy. Each of these factors, of course, has an impact on the others: adhering to a global strategy, for example, could well negate any opportunity to become a market leader.

Companies need to assess at least three external factors as well: channel strategy (modern trade, traditional trade, or a combination of those), regional scope (major cities, national, or something in between), and targeted customer segments (niche, mass market, or something in between). Again, decisions made in one area affect the others, and there is also strong interplay among the internal- and external-factor decisions.

Establish the Right Structure and Distribution. From this point on, companies are making decisions that directly affect how they will operate on the ground. They need to determine their operating model. How will they structure their value chain? Which parts will they outsource, and which will they keep in house? To what extent will they localize production, sourcing, and decision making? Distribution is another big issue. How many distributors will they use, and how will they organize? Will suppliers use a single distribution model for all channels or tailor by channel? What type of support will they provide to distributors, and how will that support be structured?

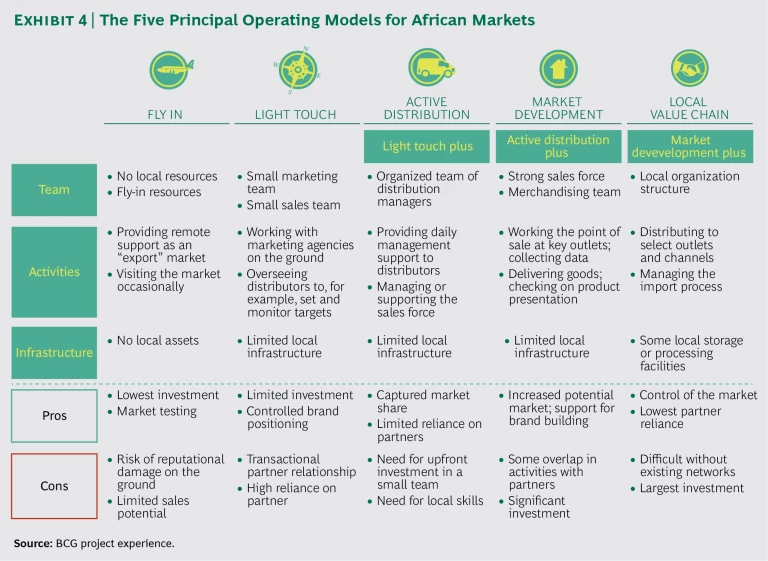

In our experience, the where-to-play assessment described above leads to five principal operating models in African markets. In order of increasing direct company involvement, we call these five models fly in, light touch, active distribution, market development, and local value chain. Each has its pros and cons. (See Exhibit 4.)

The main considerations for determining which model to employ are the market, product or category, willingness to invest, and timeline, but the market and product or category can loom large. In markets where illicit practices are common, the fly-in model may be the only viable approach for a major MNC. At the other end of the spectrum, in which ensuring product integrity is essential (as it is for categories that require refrigeration throughout the distribution chain, for instance), the local value chain model could be the only way to go.

Generally speaking, as markets develop, the fly-in and light-touch models become less effective, and companies need to move to models that involve greater direct engagement. It is also fairly common for a company to use a combination of operating models in a single market. For example, an international agrochemical company developed a multimodel approach in Kenya. Originally the company had used the fly-in model and outsourced its full distribution chain. Its distributors were taking a significant cut (20% to 25%), which, inevitably, affected profitability. As its business grew in Kenya, the company decided to move toward the active-distribution model for larger accounts, increasing its local presence by expanding its marketing and sales teams. As it gained experience, the company rolled out a direct-distribution model targeting large-scale farmers, both increasing profitability and gaining a better understanding of customer needs. At the same time, the company maintained its existing distributor-based model for serving the more fragmented base of small-scale farmers.

Companies pursuing multichannel distribution arrangements face challenges in deciding whether to organize by channel, territory, product line, or customer segment. Given a customer base that is in many areas widely dispersed, organizing by territory is commonly used to ensure adequate coverage and avoid overlap. Many companies choose a channel-based system that makes the most of individual distributors’ networks and skills in different channels (such as traditional trade outlets) while serving priority channels (such as modern trade) directly. As companies expand their presence, they often add further dimensions to the distributor structure, as was the case with the agrochemical company.

New entrants to African markets may value a strong distributor network, but they can underestimate the level of managerial, operational, and financial support such a network requires. For example, distributors know from experience the transportation or delivery assets required for different sales territories (such as tricycles instead of vans for heavily congested areas with many retailers in close proximity). But as thinly capitalized businesses, distributors may need support for the acquisition of these assets. There are several commonly used mechanisms, including direct purchase with a payback structure for the distributor, a guarantee of accessing credit to purchase, and awarding assets as part of an incentive program. Similarly, distributors can play a valuable market development role with market intelligence, lead generation, and new-customer development, while they benefit from MNC support in such areas as business improvement, best practices, and ongoing financial assistance. Typically, the level of support that companies provide depends on the length of the relationship and the distributors’ sales volumes.

Choosing the Right Partners. Few decisions combine difficulty with uncertainty and impact to the extent of decisions related to partners. Nothing can have a bigger impact than the selection of partners, especially for distribution, and few decisions are tougher to make in a foreign and unfamiliar environment. Companies need to be clear on what they expect, and they need to determine the type of partner and type of arrangement they want to pursue.

Clarity on expectations is essential for both sides if a partnership is to succeed. Options that suppliers should consider include the following:

- End-to-end distribution or last-mile delivery only? Most MNCs and other companies require partners for at least last-mile distribution, which is very costly. Some, however, want partners to handle the full distribution chain.

- Product and brand development efforts or pure trading? Some partners have the capability only to push products into retail distribution; they lack the relationships or resources to support retailers or engage in brand building or promotional efforts.

- Use the company’s own infrastructure or rely on the distributor’s existing assets? If a company wants its own infrastructure—such as warehousing and transportation—it will require significant investment and distributor support.

- Large distribution network with existing relationships? Typically, only large companies with their own capabilities on the ground can grow and develop smaller distributors.

- Direct employment of a sales force? The size and exclusivity of the sales force, route planning, and level of sales force training are all subjects for negotiation.

- Market-related trade terms or special agreements? It is important to determine targets, incentives, and expected margins in advance.

In each market, suppliers need to decide whether they want to pursue an exclusive or a shared distributor partnership, both of which offer a distinct value proposition. An exclusive arrangement, which typically involves the distributor’s agreeing not to stock direct competitors’ products and the company’s committing to not using other distributors, can provide a high level of control for the company and greater certainty for the distributor. As a practical matter, however, both sides need to have established significant scale to make the exclusive model feasible. Furthermore, exclusivity can be a relative term. The number of major distributors in many markets is limited, and even in “exclusive” situations, they generally stock other, noncompeting products from other companies. Shared relationships have more manageable economics and operating models, but they also have their downsides, such as the lack of the distributor’s guaranteed focus on a supplier’s products and the potential to inadvertently assist other companies: any sales force training or retail market development assistance that the company provides the distributor is likely to benefit other suppliers as well.

In our work in Africa, we have encountered four main types of distributors. Each has its own set of advantages and disadvantages for MNC suppliers.

Pure traders offer the basics: stock points and logistics capabilities. They have good access to capital and often trade significant volumes, but they don’t help develop the market. Suppliers can find themselves in a power battle with these companies, many of which have strong market positions.

Large established distributors are typically the go-to organizations for MNCs entering a new market. They represent a large basket of brands and have significant capabilities and capital backing, but they do not devote particular attention to each individual brand in their portfolio. They are most likely to focus on what sells.

Small but focused distributors handle a limited number of brands. These distributors can be a good alternative if the supplier has capacity to grow and develop a brand with them, because they are often highly motivated. On the downside, they have limited access to capital and infrastructure and frequently require significant support.

Niche distributors focus on certain types of products or channels, such as hotels and cafeterias. They are not likely to move significant volumes, but they do have strong networks in their dedicated channels. Many suppliers use niche distributors along with other types of distribution to build coverage and visibility across channels.

More often than not, a perfect-partner option does not exist, and mixing and matching is the most effective way to achieve target coverage—even at the expense of some additional complexity and a greater commitment of management resources. Companies should apply a rigorous approach to identifying and assessing potential distribution partners. We have found that a three-step methodology works well in most situations.

- Adopt a structured approach for identifying potential candidates. These can include distributors currently active in the company’s product lines, distributors active in adjacent product lines with potential synergies, and distributors active in priority channels. Companies should not exclude the possibility of dealing directly with large retailers or wholesalers offering alternative distribution solutions.

- Perform a rigorous assessment, applying key criteria. In many markets, the most basic criteria may also be the most important—a reputation for loyalty and trustworthiness and experience working with global brands. Suppliers should also take into account experience with complementary or competing products, relationships with key retail decision makers and market participants, and the size and reach of the distributor’s business, including its warehousing capacity, import experience, and retail network.

- Scrutinize a shortlist to make the final selections. Suppliers will want to apply additional criteria at the selection stage, including distribution partners’ alignment with company strategy, their rapport with the company and the strategic fit, and the market rates for margins, incentives, and compensation.

As the supplier moves forward with its new partner or partners, it will want to bear in mind the golden rules for successful partner management. (See “Six Golden Rules for Successful Distribution Partnerships.”)

SIX GOLDEN RULES FOR SUCCESSFUL DISTRIBUTION PARTNERSHIPS

In emerging markets—especially African emerging markets—business conditions, customs, and trade practices can vary widely. Few relationships are more important to an MNC supplier than its distributor associations, and companies often need to combine flexibility, firmness, and vigilance in their management of these arrangements. Adhering to six golden rules can help companies manage their distribution partnerships effectively.

Make sure that the company constitutes a significant portion of the distributor’s P&L. Ideally, a supplier should represent more than 50% of its distributor’s business base to ensure that it receives sufficient focus from the distributor on developing its business.

Don’t let the company become too dependent on a single distributor. No supplier wants more than 15% to 20% of its overall portfolio with one distributor. If, out of necessity, the business is overly concentrated, it’s all the more important to maintain a strong and active presence that provides the company with direct access to marketplace information and activity.

Ensure a good balance of give-and-take. Suppliers can advance strong partnerships by making an effort to understand their distributors’ business and their most important priorities. In Ghana, one consumer products company uses a system of noncash incentives that vary by region according to the needs and preferences of its distributors. In the rural north, for instance, distributors that exceed performance targets are rewarded with motorbikes, which not only are useful for servicing small retail outlets that are far apart but are also the locals’ primary form of personal transportation.

Have at least one dedicated manager working closely with the distributor. Suppliers should seek to understand how their distributors operate and who their main customers are. They can also benefit from actively supporting distributors in skills development.

Be in the market to understand and check activities on the ground. There’s no substitute for firsthand intelligence. Suppliers should aim to understand their competitors’ and their own distributors’ actions. Such knowledge also helps companies react quickly to market activities.

To manage risk, companies should set clear guidelines on standard operating procedures. Suppliers should always make sure that their staff and distributors’ personnel clearly understand what are acceptable and unacceptable practices.

Designing a Route Plan and Supporting In-Store Execution. In African markets, even more than in other emerging markets, suppliers should take an active role in route planning and in-store execution if they are planning to achieve or maintain significant scale. Routes can be a big factor in distribution costs, and suppliers should invest the time upfront in working with their distributors to determine the amount of time needed to service each selected outlet, segment the territory, and assign the number of FTEs needed to service each one. One generally successful approach involves setting up miniterritories for sales reps and a daily sales route plan that ensures that each sales rep is fully occupied.

The most successful suppliers are those that offer strong levels of sales force support—even if the sales force is employed by the distributor. Support can include training the sales force, mapping routes, setting KPIs and incentives, and even providing additional sales force capability. A Nigerian beverage company uses digital technology to support its distributors. By accessing a dedicated platform, distributors can request and monitor credit levels, automate orders, and track sales performance data by account. At the same time, the manufacturer can monitor the order and stock levels of its 3,000 distributors and track KPIs linked to sales force effectiveness, gaining superior visibility into—and control over—distributors’ activities in a highly fragmented market.

In Africa, opportunity and complexity go hand in hand. Companies need to master the latter to take advantage of the former. Taking the time to understand the continent’s individual markets, determine where to play, choose the right partners, and establish an effective structure and distribution setup can make the difference between a failed experiment and a successful long-term business in some of the world’s fastest-growing markets.