The dominant producer in every business should increase his market share steadily. Failure to do so is prima facie evidence of failure to compete.

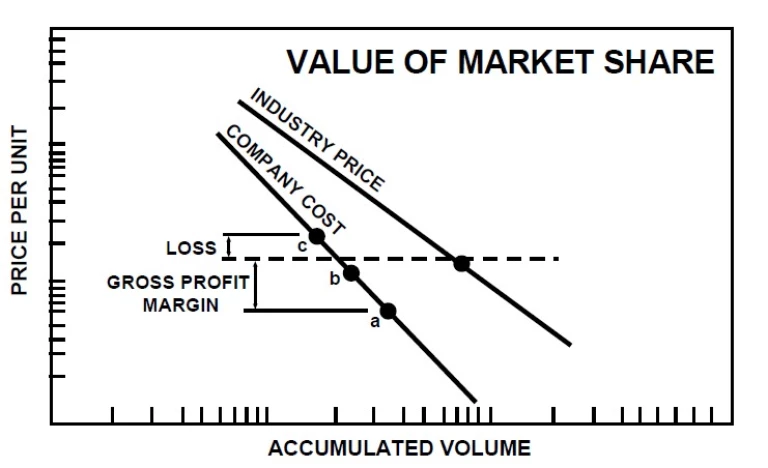

Cost and market share are inversely related. The highest market share should produce the lowest cost as a result of the experience curve effect. At least part of that superior cost should be passed on to the customer in lower prices or better quality. That in turn should lead to faster growth of the leading competitor.

Failure to gain market share even with superior costs is failure to compete. This failure is also a failure to achieve even lower costs.

Competitors' market shares should be unstable. Low cost competitors should displace higher cost competitors. Customers should share the benefits of lower cost with those suppliers who make it possible. Any failure to gain market share even with lower cost is self-evident restraint of trade.

Displacement of high cost competitors by lower prices benefits the customer. It leads to benign monopoly. No monopoly can be justly accused of exercising monopoly powers if it does not raise prices more than the extent of inflation.

Failure of an industry to concentrate is failure to compete and a failure of the national economy to optimize productivity and reduce inflation.