In some American cities, Craigslist, a largely free Internet listing service, has displaced more than 50 percent of the classified advertising revenues of the local newspaper. Since the average metropolitan daily would lose money without classifieds, Craig Newmark and his two dozen employees are well on their way to upending an industry.

Elsewhere on the Internet’s new frontier, dubbed Web 2.0, Wikipedia gets 1,000 page views per second while traditional encyclopedia companies struggle. And then there’s Napster. For companies in the cross hairs, Web 2.0 competitors can be lethal. But why would anybody else care? It is not as if Craig Newmark, Jimmy Wales (the founder of Wikipedia), or Shawn Fanning (Napster’s creator) got rich in the process.

These glitzy exemplars of the new “new economy” are interesting less for what they are driving than for what is driving them. They are bright paper boats floating on much deeper currents. It is the deeper currents that have wider application.

Web 2.0 is often described as an exciting set of new technologies: RSS, AJAX, SOAP, and so forth. These are cool: they change the Net from a noun (static Web pages) into a verb (services delivered over the network, through the browser). But the deeper technological current is simply the uninterrupted progression of Moore’s Law and its correlates for storage and bandwidth. As computing and storage and transmission become arbitrarily cheap, it does not matter where the data are kept or where the code is executed. Client and server become interchangeable peers. The network becomes the platform—an infinitely large platform that nobody really owns.

Implicit in these abstract statements are the two basic (and quite distinct) phenomena that characterize Web 2.0: the empowerment of the periphery and loose modularity.

The Empowerment of the Periphery: Threadless

Threadless (www.threadless.com) serves a community of some 370,000 T-shirt enthusiasts. Visitors can browse a gallery of 94,000 T-shirt concepts—all designed by the community members themselves. They post about 800 new designs each week, critique one another’s work, upload photos of T-shirt sightings, and maintain personal Web pages to advertise their taste—and themselves. Submissions are presented for evaluation on a scale from 0 to 5; the site receives about 750,000 evaluations a week. On the basis of that feedback, Threadless puts about four designs into production each week, paying the winning designers $1,000 and putting their names on the labels. When scoring a design, members indicate whether they would buy the T-shirt if it were manufactured. (See Exhibit 1.) Threadless uses those responses to set production volumes. No Threadless T-shirt has ever flopped.

It is an elegant business model: Threadless has its customers creating the designs, selecting the product line, fixing production volumes, and doing the marketing, promotion, and selling. Manufacturing, of course, is outsourced. All Threadless has to do is maintain the Web site. Zero market risk and negative working capital.

According to estimates by Frank Piller of MIT, Threadless sells about 60,000 items a month at $20 each. With a 35 percent gross margin, the company earns about $5 million a year before sales, general, and administrative expenses. Threadless has 20 employees. With $250,000 in gross margin per employee, what’s not to love?

User-generated content is the essence of Web 2.0. Blogs, eBay, Wikipedia, MySpace, Facebook, YouTube for videos, Flickr for photographs, delicious for bookmarks, The Cambrian House for soft ware: they all exploit a simple peer-to-peer technology platform to nurture peer-to-peer human networks. “Communities” are born, often of staggering size. Thirty-five million people writing blogs. More than a million Wikipedia articles. Sixty-seven million members on MySpace.

Size matters. It makes possible a diversity unlikely in geographically defined communities: critical masses of people with even the most obscure enthusiasms can find one another. The community—by adding descriptive metadata (“tagging”), by voting, and by sharing mutual feedback—builds social capital in the form of personal reputations and collective trust. Metadata describing the community’s own behavior become the means of its own organization, and the sheer volume of potential applause serves as a motivation to contribute.

Size permits semiprofessional and professional participation: small shops on eBay, rock bands on MySpace, and art students and graphic designers honing their skills or promoting their portfolios on Threadless. Instead of big, corporate, economically motivated producers selling to individual passive consumers, we see the growth and empowerment of active user-producers spanning a continuum of skills, scales, and motivations. The distinction between producer and consumer—the starting point of almost all marketing—is blurred beyond recognition.

Loose Modularity: Trulia

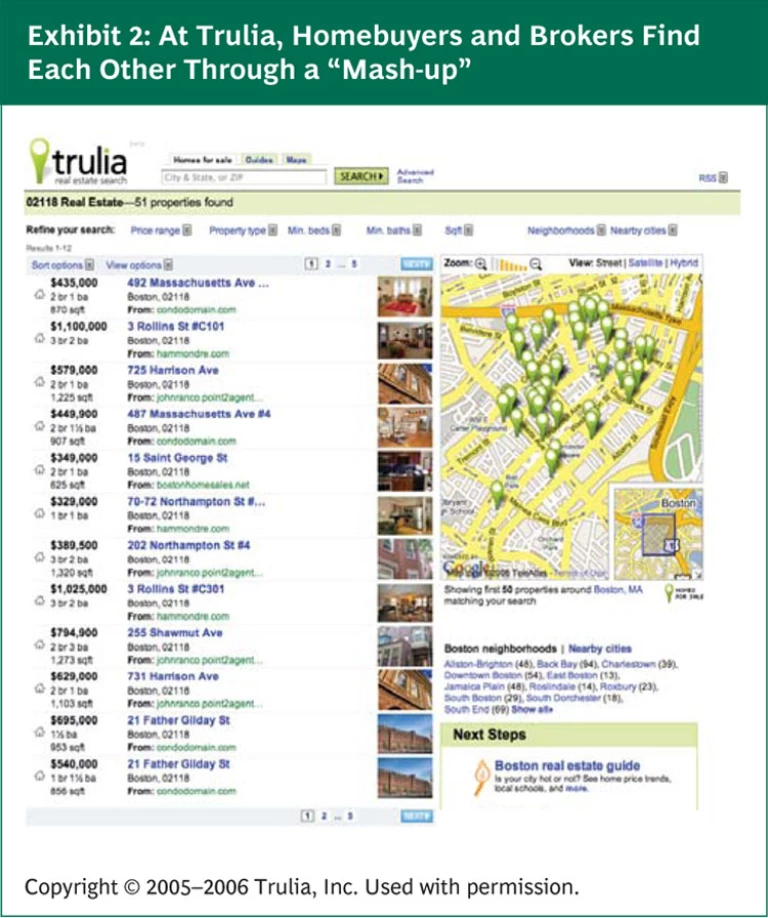

Trulia (www.trulia.com) is a real estate search engine. It is paid by real estate brokers for the leads it generates. On the home page, you choose a geographic location and specify the type of home you are seeking. Trulia then displays a wonderfully interactive and easy to navigate list of homes that satisfy those criteria. (See Exhibit 2.) Click on a property on the adjacent map and get more information; click on an item on the list and see full details and a map of comparable listings. Thanks to AJAX (asynchronous JavaScript and XML), Trulia feels like an application rather than a Web page—a “verb” rather than a “noun.”

The listings are sourced from participating local realestate offices, and the map comes from Google Maps—all at no cost to Trulia. An API (application programming interface) published by Trulia allows brokers to submit their listings as data feeds; Trulia in turn relies on a Google API to generate the custom map. Joining these feeds is easy: people with moderate programming skills could build a simple version of Trulia in a few days.

Trulia is a “mash-up”: a new service created from the easy combination of other people’s data. There are currently about 280 APIs published by more than 100 Web companies (including Amazon, eBay, and Google). That universe defi nes, in principle, 60,000 services that could be “mashed up” through their pairwise combination. Already more than 1,000 actually exist. API publishers don’t know what applications will emerge; they don’t need to. Most do not even know or care how their API is currently being used. But at very low cost, APIs place in the hands of entrepreneurs the means to create value through the near-infinite power of recombination—and thereby reduce the cost of innovation by orders of magnitude.

Most publishers of APIs make them available for free, in the belief that they will gain more from a vibrant application ecosystem than they will forgo in cash flow; in the belief that indirectly monetizing something that has become really big has a far higher expected value than charging ex ante for something that nobody knows how to use; and in the belief that “some rights reserved” can be more profitable than “all rights reserved,” because a tax on experimentation costs more than it yields.

Mash-ups tap into the well-known power of modularity to accommodate complexity, adaptability, and variety. But this is not the modularity of enterprise software or of an automobile. In the wonderful phrase of Harvard’s David Weinberger, it is “small pieces loosely joined”—building blocks that you can mix, match, and combine with almost childlike ease.

One has to ask: Are these principles widely applicable? How much of the tight coupling that corporations typically prefer is the legacy of obsolete technologies and a reflex for control? How much net value is lost by taxing innovation to satisfy some financial calculus? Craigslist is 99 percent free, yet the company thrives. And if that still seems a little too crunchy-granola, what percentage of Google searches are uncompensated? Probably about the same. Maybe, just maybe, Google—the paradigmatic Web 2.0 company—understands something that the textbooks of finance and control have missed. And maybe the power of these remarkably thin business models can in fact depend, like Blanche DuBois, on “the kindness of strangers.”

Web 2.0 isn’t just for geeks and goths. Companies—whether in the cross hairs or on the sidelines—must address some hard questions. How can we catalyze, build, and influence communities? How can we create the open standards that allow those communities to innovate as we cannot? How must we redefine the boundaries of our business? How can we earn a return, directly or indirectly? Can we stomach the leakage of brand control, of intellectual property, of predictable cash flow? And if we cannot or will not, how will we deal with a competitor that has no such inhibitions? Or with customers, suppliers, and employees who simply demand a Web 2.0 experience? And even if we can cope with all that now, how will we cope in five years’ time, when the principles are the same but the challenge, thanks to Moore’s Law, is ten times stronger?