Every postmerger integration (PMI) is as different as the two companies involved in the process. But as we discussed in the first two reports in our series on PMI, the differences are primarily a question of degree, rather than of substance, and can be addressed by employing a common strategic

Nevertheless, there are several special issues in PMI that demand particular attention. This Focus report, the third in our series on PMI, addresses four of these issues: carving out value from spinoffs, working productively with unions, rising to the challenges of rapidly developing economies, and putting customers—and growth—at the heart of a PMI.

Carving Out Value from Spinoffs

Companies are increasingly spinning off parts of their business, known as carve-outs, either to sharpen their strategic focus or to gain regulatory approval for a separate deal. In some sectors, carve-outs account for up to 25 percent of the value of all mergers and acquisitions (M&A). But one of the main difficulties with these types of transactions—from an integration perspective for the acquirer and from a marketing point of view for the seller—is that carve-outs are often neglected assets, underfunded and underresourced. In some cases, important elements of the spun-off business—such as research and development, information technology (IT), and key personnel might not even be included in the sale.

How can an acquirer assess and integrate a potentially weak and incomplete business whose value might be dependent on its parent company’s internal synergies? And how can a seller optimize its value from the sale of such an asset?

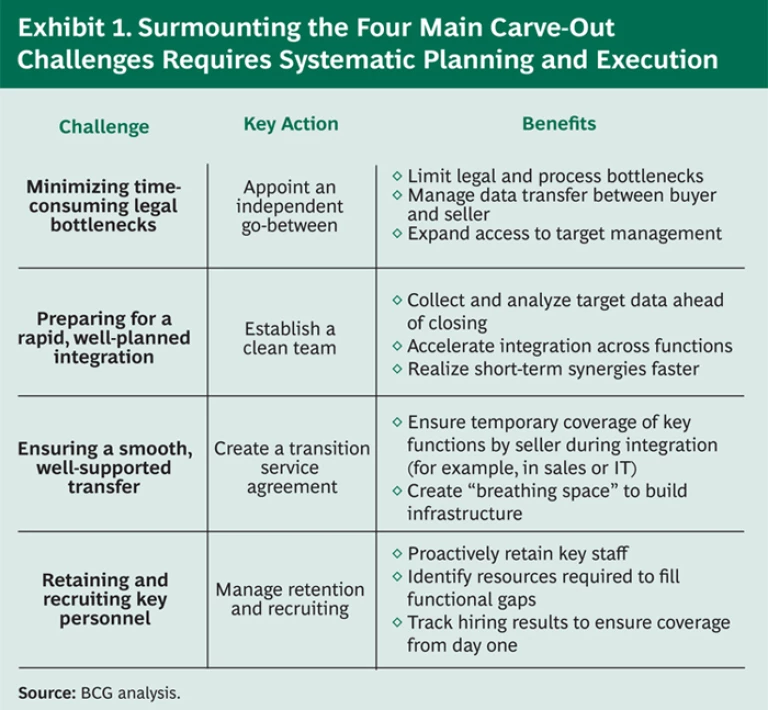

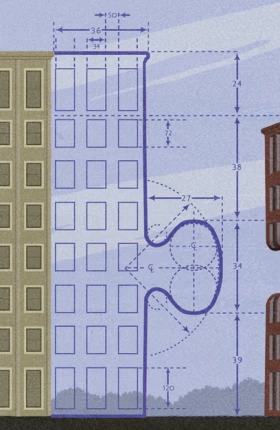

For the buyer, there are four main challenges, all surmountable yet all requiring systematic planning and execution: minimizing time consuming legal bottlenecks; preparing for a rapid, well-planned integration; ensuring a smooth, well-supported transfer; and retaining and recruiting key personnel. (See Exhibit 1.)

Minimizing Time-Consuming Legal Bottlenecks. The legal complexities of carve-outs are much greater than those of traditional mergers in which an entire company is purchased. Which exact parts of a business will or will not be transferred? How should the interaction between the two parties be managed to enable the buyer to prepare for the transfer without violating regulatory laws? For example, which data should be open to all and which data should be available only in a so-called clean room environment that is physically and electronically isolated from both buyer and seller? And what access will the buyer have to executives with critical relevant expertise who will not be transferring with the asset?

These and other issues that require detailed legal clarification can overwhelm acquirers, delaying integration for months. To avoid this pitfall, an acquirer should appoint an independent go-between to work with the two parties’ legal teams in developing and managing processes for dealing with day-to-day and strategic issues, including fielding and coordinating data requests.

Preparing for a Rapid, Well-Planned Integration. Preintegration analysis and planning are prerequisites for the success of any PMI. But they are even more critical when dealing with a carve-out. First, the asset is likely to be distressed and will probably deteriorate further without rapid integration and proper funding and resourcing. Second, the seller will have little incentive to help the acquirer build up a fact base about the spun-off business after the deal is closed.

Long before a transaction is finalized, the acquirer needs to set up a clean team to analyze the target’s data in a secure, confidential environment and to prepare an initial integration

Ensuring a Smooth, Well-Supported Transfer. After a carve-out deal is finalized, but before the asset is transferred, the acquirer needs both "breathing space" and the active support of the seller in order to build necessary infrastructure for the asset. This support is especially important for nontraditional carve-outs, or “amputations,” which may lack major core functions such as procurement and marketing.

The two parties should draw up a comprehensive transition service agreement (TSA) to ensure sufficient support for a smooth transfer.

The TSA should detail the type and level of support that the seller will provide, by function and location, during different stages of the transition period. The TSA should include reporting requirements for services provided by the seller, such as sales support, as well as arrangements for sharing and transferring revenues and services over time. Initially, the seller should operate the business as usual and then gradually hand over parts of the business at agreed points. Regular, systematic communication between both parties is vital throughout the transition and should be a condition of the TSA.

Retaining and Recruiting Key Personnel. The human resources challenges of a carve-out should never be underestimated. Buyers need to painstakingly plan and budget for these challenges well in advance, including designing an organizational structure for the acquired business. Critical questions that buyers need to ask include the following: Which personnel will be central to the success of the acquisition? And where will there be functional gaps that need to be filled by recruiting new employees?

Retaining key employees can be particularly problematic in carve-outs. This is partly because most carve-outs have a history of being underfunded, and many staff will already have been scouting for alternative jobs: the seeds of doubt about the business’s future will already have been sown. It is essential that buyers address these concerns by stressing forthcoming investments and healthy prospects in face-to face meetings with key personnel. Buyers should also utilize retention bonuses and other devices to secure essential personnel.

Hiring staff to create or fill missing or incomplete functions can also be a significant task. One major consumer-goods company, which acquired a leading brand as a carve-out, had to recruit more than 200 people across a variety of functions, from brand management to sales. It is critical to start the recruiting process early, supported by a detailed plan, a budget, job specifications, and systems to monitor progress weekly. Buyers should also anticipate and address potential obstacles to recruiting staff, including out-of-cycle business-school recruiting and unattractive geographic locations.

But what about the seller? How can a seller optimize the value from a business unit that it intends to spin off? Recent BCG research indicates that most sellers produce substantially lower shareholder returns from carve-outs than they do from selling an entire company. To extract the maximum value from a carve-out, companies need to do more than prepare a business plan and valuation, supported by data from all functions; sellers also have to put together a compelling equity story.

The equity story should clearly spell out the attractiveness of the business and its market, as well as opportunities for buyers to create additional value—for example, through restructuring and entering adjacent markets. All claims should be supported by data and transparent forecasting assumptions. A prioritized list of prospective buyers should also be drawn up. BCG research suggests that sellers can maximize their shareholder value from spinoffs if they target firms whose core business would be complemented by the asset and if the asset is worth at least half the value of the acquirer.

Working Productively with Unions

Trade union membership might be in decline, but it is estimated that between one-fifth and one-quarter of the world’s labor force, excluding agriculture, still belong to unions—equivalent to more than 300 million people. Although the intensity of unionization is higher in the public sector and varies substantially by country and industry, the fact remains that unions can still play a significant role in PMI in many deals. Handled incorrectly, buyers’ negotiations with unions can delay an integration for months, create labor unrest, and (in some countries) even result in criminal prosecutions. Successful negotiations depend on three factors: communicating openly and honestly, employing creative approaches to reducing labor costs, and filling key positions sensitively.

Communicating Openly and Honestly. The optimum game plan for dealing with unions will depend on the regulatory environment. In heavily regulated labor markets—such as France, Germany, and Italy—there are well-defined legal processes for consulting with unions that must be adhered to strictly. For megamergers, involving hundreds of legal entities, these processes can make integration unavoidably complex and time consuming. In less regulated markets, such as the United States, the legal maze might be less daunting, but unions in certain sectors can still exert a considerable influence.

Regardless of the regulatory conditions, the golden rule is to communicate openly and honestly with the unions at the earliest possible moment. Such communication is essential not only to remove uncertainty—and the risk of industrial or job action—but also to create a favorable climate for negotiating. Involving the unions as “partners” from the outset, with the support of confidentiality agreements, also minimizes the risk of competitively valuable information leaking out to the press.

Inevitably, the unions’ principal concern will be any intended layoffs. As soon as the number of potential redundancies is known, the acquirer must inform the unions—not just about the scale of expected layoffs but also about its “social strategy” for dealing with any head count reduction. One major retailer successfully announced that it would not lay off any employees but would offer generous compensation to those who voluntarily chose to leave. Another company, a bank, ensured swift integration by agreeing to create individualized plans including retraining and opportunities to relocate to other parts of the business—for employees who would otherwise lose their positions in the merger.

Employing Creative Approaches to Reducing Labor Costs. Three main issues need to be taken into account when devising a social strategy for layoffs. First, the acquirer has to accept that speed comes at a cost: the deeper and quicker the reduction in head count, the higher the price unions will demand—both in terms of compensation for their members who lose their jobs and for those who retain their positions (for example, through more generous holiday entitlements). Second, the package of incentives offered to promote voluntary departure from the company must be easy for the unions to sell to their members. The package should include immediate gains—financial and nonfinancial—as well as long-term incentives. Finally, the principles of the social strategy, which should be formulated long before the merger is announced, should be clearly communicated to the unions, employees, and the market as a whole. One of the advantages of broadcasting the social strategy as widely as possible is that it will put pressure on the unions, especially from employees, to arrive at a solution as rapidly as possible.

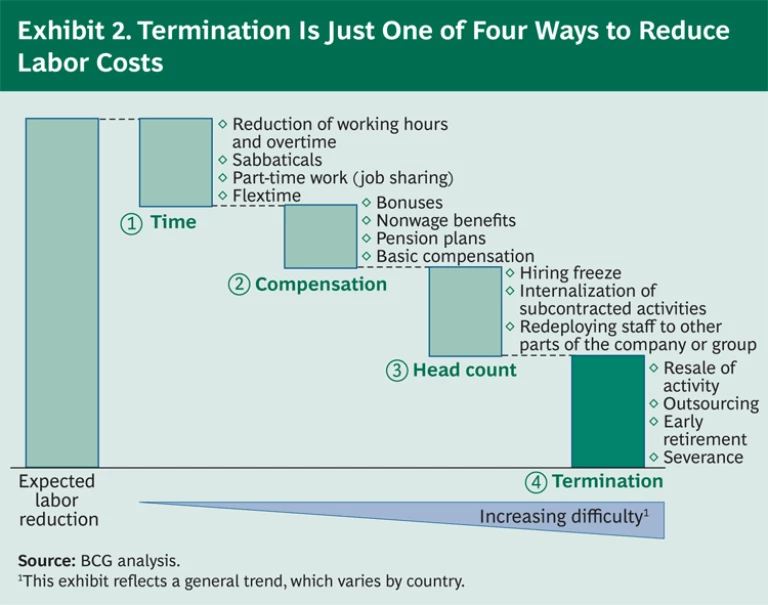

Acquirers should also recognize that layoffs are not the only way to cut labor costs. In fact, there are three additional ways to cut such costs, each of which should be used: rethinking the time employees spend working, assessing the components of compensation, and considering “soft” measures to control head count. (See Exhibit 2.)

For example, on the time front, labor costs can be reduced by introducing shorter working hours, part-time work (job sharing), and flextime. Different elements of compensation, including bonuses, can also be adjusted. Soft head-count measures might include hiring freezes and redeploying staff to other parts of the company or group.

Filling Key Positions Sensitively. Dealing with nominations of individuals for key posts in strongly regulated markets is a more challenging issue. In Germany, for example, acquirers must consult with work councils before making any appointments below board level. Failure to do so can lead to criminal prosecution against the CEO, which has happened. The danger is that any delay in announcing pivotal appointments can lead to defections of star players, destabilizing the organization.

Depending on the country, there are various ways to overcome this difficulty. One solution might be to announce important personnel as leaders of specific PMI-related projects—everyone will understand what is being communicated. Other approaches include holding private one-on-one discussions with key personnel or simply announcing that everyone will have a role but that it will take time to finalize the positions. As with so many other issues when managing PMI in a unionized country, progress ultimately depends on communication—and, thus, on building trust.

Rising to the Challenges of Rapidly Developing Economies

Many companies have struggled with cross-border acquisitions in rapidly developing economies (RDEs) such as China, India, and Russia. However, a recent BCG study found that the biggest challenge in RDEs is not extracting synergies during the integration but understanding, managing, and accepting the full spectrum of risks before the transaction is

Based on a survey of executives with extensive M&A experience in 30 RDEs, our study revealed that 69 percent of executives considered the challenges of realizing synergies similar to those in developed markets, with just 31 percent claiming PMI was somewhat more difficult in RDEs. Instead, executives said that the principal difficulties in these markets are gaining appropriate information to assess the target’s risks and potential (cited by 68 percent of our sample) and regulatory hurdles (cited by 63 percent of executives). Other predeal stumbling blocks include limited deal structure options and the target’s lack of familiarity with the M&A process.

Successfully meeting the challenges of PMI in RDEs requires understanding and dealing with cultural complexities, realizing that the West doesn’t always know best, and focusing on growth over cost reduction.

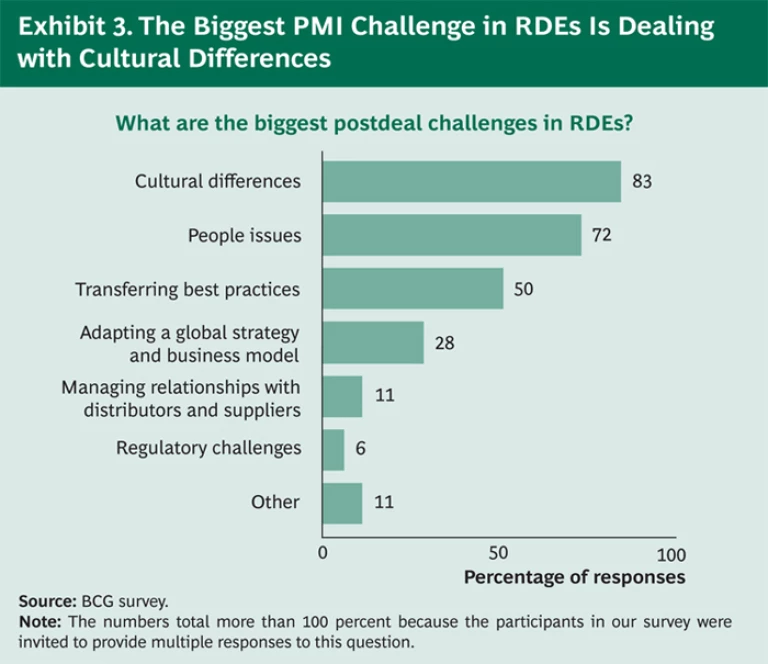

Understanding and Dealing with Cultural Complexities. Although PMI is generally considered no more difficult in RDEs than in developed markets, the challenges are not the same. Not surprisingly, the top obstacle to successful integration in an RDE, cited by 83 percent of executives in our survey, is managing the cultural differences between the acquirer and the target. (See Exhibit 3.) Cultural differences play an important role in all PMIs, regardless of the geographic location of the deal, but these differences assume much greater significance—and require much greater sensitivity—in RDEs, where mindsets can be radically different from those in developed economies. This is especially true in RDEs that have only recently opened their doors to foreign investment or in which there are distinctly different value systems. One executive singled out the problems in “changing the mindset [of the target’s management] from ‘production’ to ‘sales and marketing.’” Others said that it was difficult to get the target to accept Western best practices: “Some people perceived the processes and procedures as inefficient and time consuming.”

The primary factor for success in these situations is not to impose one culture on another. Instead, the acquirer should map out the potential points of cultural conflict before the transaction is completed and then deal swiftly yet sensitively with them once the transaction is legally closed, clearly spelling out the new rules of play. This might include making quick symbolic gestures to demonstrate that the target’s core values—which often reflect local values—will be respected and upheld. More often than not, local values and culture are a significant reason for making the acquisition. “We decided to design the new office as it was under the previous owner to show we were committed to Indonesian values,” said an executive with a multinational consumer-goods company. “Staff also still wear the acquired company’s uniform, reinforcing the company’s unique identity.”

Realizing That the West Doesn’t Always Know Best. It is equally critical not to assume always that the “West knows best.” “The key to successful acquisitions is having an open mind and being able to learn from the acquired companies,” said one M&A veteran participating in the survey. “In our case, we learned business practices that we could export to other developing markets and, in some instances, even to our developed markets.” Another executive commented: “You have to approach it as a merger of equals. Both organizations should systematically evaluate each other’s processes and learn from each other.”

People issues also need to be managed carefully. In mergers in RDEs, the target, not the acquirer, usually has the greater local expertise, and this expertise is often concentrated in the hands of a limited number of people—typically the owner and a few senior managers. It is essential to approach these individuals early on in order to convince them of the opportunities ahead and assure them of their continued role in the business. Retaining top talent is particularly important in RDEs because the demand for high-quality employees often outstrips supply.

“Having a local CEO who knows the market well is also important,” said one executive. Another claimed that it is equally vital that the senior team speak the local language. “When the business language of the acquired company is different and top managers do not converse in the local language, it can make gaining credibility and trust a big challenge.”

Focusing on Growth Over Cost Reduction. Above all, the acquirer needs to keep its sights firmly fixed on growth and ensure the right team and priorities are in place to support growth. One of the biggest pitfalls in RDEs, where many companies are enjoying double-digit growth, is approaching PMI from a traditional, Western cost-reduction mentality. To avoid this risk and optimize returns, it is essential to select senior members of the integration team who have a solid track record of promoting growth—even if this means bringing people on board who have relatively little PMI experience. If high-growth talent is not readily available within the acquirer’s management team, local managers need to be motivated to deliver growth—for example, by introducing performance-related salaries and stock options, which are still relatively rare incentives in many RDEs.

Focusing on growth also gives the acquirer greater flexibility during the integration because there will be less urgency to deliver cost savings. In fact, care should be taken not to destabilize growth. New IT systems and procurement processes, for example, should be approached gradually, and overzealous cost-reduction initiatives—especially in customer-facing and sales functions—should be avoided. One major consumer-goods company, for example, chose not to lay off any staff for up to 12 months and instead concentrated on increasing market share. It was a smart tactic—growth from increased market share more than compensated for any cost savings that could have been made.

Putting Customers—and Growth—at the Heart of a PMI

One of Ford Motor Company’s most celebrated advertising slogans was “Everything we do is driven by you.” Unfortunately, this sentiment notably that the customer is king—is rarely evident during an integration. Although most acquirers claim that their deals are in the best interests of their customers, the practical reality is that PMI is usually dominated by a relentless quest to release cost synergies. Customers tend to be treated as an afterthought.

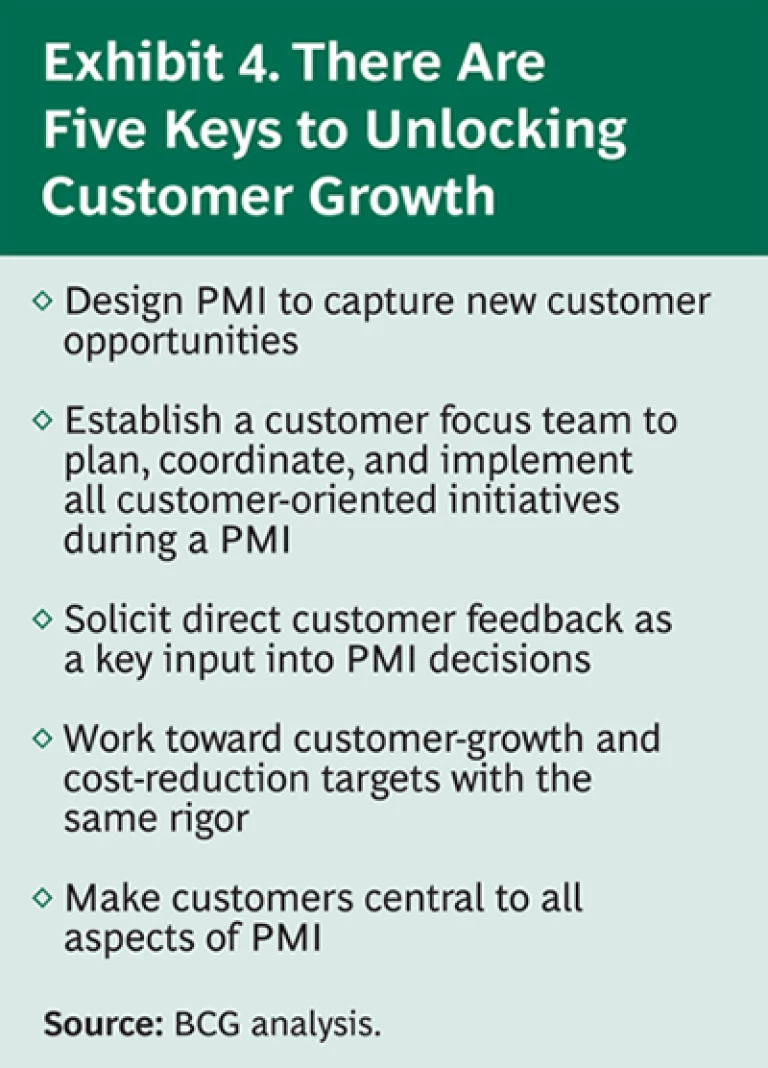

Yes, cost synergies are important, not least to help cover the cost of the transaction. They also provide quick wins, signaling to investors that progress is being made. But cost savings have a logical limit—they cannot drive long-term sustainable shareholder value. Only customers can. Everything is driven by customers—or, more specifically, by profitable growth. And to unlock the growth potential of customers, acquirers need to place their customers center stage and pursue them as systematically as they do cost synergies, especially in noncommoditized sectors where customer relationships are critical for long-term growth. (See Exhibit 4.)

Putting customers—and growth—at the heart of a PMI requires taking five main steps: planning for growth before a deal is finalized; creating a dedicated customer-focus team; understanding customers’ expectations, concerns, and aspirations; preparing a coordinated customer plan for day one; and taking regular customer pulse checks.

Planning for Growth Before a Deal Is Finalized. Growth rarely comes naturally—it has to be planned. Before a deal is closed, the clean team should work closely with both companies’ sales and product teams to identify white spaces and cross-selling opportunities, as well as product overlaps and price differentials that could undermine the combined entity’s sales and revenue. Based on these insights, the acquirer should develop a provisional business continuity and growth plan. The plan should include a realistic yet ambitious growth target and proposals for addressing at-risk customers where there are product overlaps. A dashboard for monitoring customers throughout the PMI categorized by their relative risks and opportunities—should also be developed.

Creating a Dedicated Customer-Focus Team. A dedicated customer-focus team should be established alongside the main project management office, which serves at the core of any PMI. The team’s primary role should be to ensure that all decisions made during the integration are in the customers’ interests or, at the very least, have a neutral impact on customers. All decisions should be vetted by the customer focus team.

One of the advantages of this approach is that it instills a “customer first” mentality in the newly merged entity. It also provides staff with a positive counterbalance to the often relentless and dispiriting drumbeat of cost reductions. In addition to acting as the “customers’ conscience,” the team should be responsible for planning, coordinating, and implementing all customer-oriented initiatives during the PMI which includes analyzing opportunities and threats, conducting customer surveys, developing day-one action plans for the sales and marketing teams, and monitoring progress in executing these initiatives.

Understanding Customers’ Expectations, Concerns, and Aspirations. Gaining detailed, firsthand insights into the issues that are uppermost in customers’ minds is essential not only to crafting an appropriate action plan but also to developing a communications package that presses the right buttons. To provide these insights, the acquirer should interview a representative cross section of major customers from different regions in order to identify their concerns about, expectations of, and aspirations for the newly merged entity. Questions should include the following: Which capabilities, and which specific members of the team, do customers want the combined entity to retain? How can the quality of the service and products be improved? What do customers fear most from the merger? What hopes do they hold about the transaction? How can the combined entity support customers’ growth and innovation plans?

Preparing a Coordinated Customer Plan for Day One. Sales and customer service teams must be prepared to market the benefits of a merger to customers and to calm any concerns. Before a deal is closed, regional workshops should be held with these teams to agree on the main messages for customers, to prepare the top ten FAQs and answers, and to devise plans for managing and growing customer accounts. Particular attention should be paid to high-risk and priority customers, using customer maps to document relationships with customers; their buying criteria, bid histories, and outlooks; their business and competitive environment; and perceived risks from the merger accompanied by an action plan.

Taking Regular Customer Pulse Checks. Soliciting regular feedback from customers not only enables an acquirer to enhance its strategy but also ensures that customers feel that they are where they should be—at the center of the combined entity’s growth plans. Regular surveys should be conducted to ascertain customers’ perceptions of the combined entity’s service level, speed of response, and product quality, among other issues.

Thinking Ahead to Stay Ahead

Integrations are complex, and special issues such as carve-outs, working productively with unions, and other challenges discussed in this report only add to the complexity. There are proven PMI tools to manage these challenges. But once an integration is under way, the success or failure of any PMI ultimately hinges on the strategic and tactical choices made before an M&A is legally finalized, as we have stressed in this series of reports on PMI.

These choices have to be rooted in a detailed analysis of the challenges and opportunities. Above all, the chosen path forward needs to be rigorously and systematically mapped out well in advance in order for the combined entity to hit the ground running and to release cost and growth synergies as rapidly as possible. Thinking ahead is the only way to stay ahead.

With the possibility of a recession looming on the horizon—making every synergy cent count—the importance of pre-PMI preparation will become more crucial than ever.