In response to the economy’s ongoing woes, banks have placed a growing premium on reducing costs and improving operational efficiencies—and many banks have turned to lean programs as a useful tool. Most of these banks will find themselves disappointed, however, because few lean initiatives, in our experience, deliver the expected results. The near- and longer-term impact on costs proves to be far less than expected, and any gains in efficiency prove to be either temporary or too limited in scope to make a real difference. There is no fundamental, lasting change in the way the bank conducts its operations—and hence little impact on long-term performance.

The problem is not with lean itself, however. Indeed, we believe that lean has much to offer banks. The problem lies in the approach and implementation. Typically, banks go wrong in one of two ways. One, they apply lean too narrowly and from too limited a perspective. There is no cohesive, end-to-end view of the process itself or the alignment of all of its elements. Alternatively, the effort is driven solely from the top down and fails to engage and involve the key people who actually perform the critical tasks within the process. This leads to a lack of process ownership and accountability. The end result, in either case, is that the lean effort delivers only a fraction of its potential benefits.

In this article, we discuss what we consider to be the optimal means of deploying lean in the banking sector. Specifically, we advocate a holistic lean program that addresses underlying processes and employee behaviors and attitudes. We also recommend an incremental, pilot-based approach to adoption, one that allows banks to generate quick wins and establish a culture of continuous self-improvement. These elements, we believe, can mean the difference between an unsuccessful lean initiative and a truly transformational one.

Why Lean?

Lean offers banks many advantages.

But lean’s benefits go even further. Lean-based thinking can help management understand what customers value most—and where it makes the most sense to focus improvements in operations and service levels. Improved organizational engagement via lean—particularly among the frontline staff—can lead to increased morale and reduced attrition. And a successful lean-transformation effort can instill a firmwide mindset of self-reliance and continuous improvement, one that keeps performance on an upward trajectory.

The challenge lies in the application. Lean needs to be applied holistically—that is, from an organization-wide, cross-functional perspective. Targeting only individual “silos” will doom the effort to failure. Lean also needs to be supported by true cultural change, from the top of the organization to the bottom. The senior leadership team must believe in and demonstrate commitment to the effort, and middle managers and frontline workers must feel engaged and be empowered to contribute. Lean thinking—and a culture of continuously raising the bar on performance—must permeate the organization’s psyche and become part of its DNA and its performance-management system.

To facilitate this process, lean must be phased in incrementally rather than through a “big bang” approach. A series of well-targeted and well-sequenced pilot programs, whereby success breeds success, will lay the groundwork for the necessary organizational and cultural changes to “stick” and for lean’s benefits to last.

A Holistic Approach

A holistic, multifaceted approach to a lean initiative will incorporate top-down, bottom-up, and “middle-out” components. The top-down component consists of identifying clear goals; focusing on processes that tie directly to competitive advantage and value creation; taking a cross-functional, end-to-end view that starts with the customer and works backward; and securing executive commitment. The bottom-up component consists of engaging frontline workers and managers and empowering them to own and drive process improvement, not just once but on an ongoing basis. The middle-out component is the empowerment of middle managers to apply checks and balances to frontline-driven change recommendations and implement change across the organization. Collectively, these measures lay the groundwork for fundamental and self-sustaining process improvement.

How might this work in practice? Let’s look at the mortgage-application process. This is a process that, in most banks, is plagued by a multitude of inefficiencies, including long cycle times from application to approval, numerous handoffs throughout the process, and the involvement of too many functional silos, often leading to a poor customer experience. To optimize this process via lean, a bank would start with the things that are most important to the customer, such as access to the mortgage application form through multiple channels, clear presentation of and directions for completing all necessary documentation, ease of data entry and immediate identification of entry errors, and a rapid approval process. Working backward through the process chain, the bank would examine the specifics of the process—for example, the roles of those involved, the performance metrics, and the mechanics of the handoffs—from start to finish. It would apply lean principles to optimize performance—for example, to minimize or eliminate paper flow throughout the process, optimize data entry and error-proofing, and ensure that automation is used where logistically and economically feasible. Managers and, in particular, frontline staff would be actively engaged throughout this effort and would continue to try to identify areas where the process might be improved and streamlined.

The underlying philosophy—a continuous focus on customers, value drivers, and cost optimization—accompanied by supportive changes to organizational behaviors and attitudes are what allow the lean program to deliver its transformational effects. Improvement spans multiple functions, is sustainable, and lays a foundation for additional, broader improvement across the organization.

Development of Organizational Alignment

The organizational alignment achieved via this three-pronged approach is a key enabler of lean. Senior management, middle management, and frontline personnel become of one mind regarding the vision and objectives of the transformation and play their respective roles in making it a success. Senior management provides visible leadership and commitment to the effort and communicates that commitment consistently and strategically. Frontline staff members work actively to identify solutions and improve results. Middle management vets the frontline staff’s solutions and assures stakeholders that any recommendations being implemented are sound. And both middle and senior management confirm that changes are being made across business and functional units.

A Focus on Change Management

A closely related element, and one to which most banks give short shrift when trying to implement lean, is change management. Effective change-management practices can identify and address behavioral and organizational issues that hamper process efficiency. This capability is particularly vital for lean initiatives, which require banks to engage workers in unfamiliar ways—for example, empowering and encouraging frontline workers to actively challenge the status quo and work on problem solving. Change management can also establish momentum for supportive cultural change by instilling mindsets and behaviors that encourage continuous learning and self-improvement.

In fact, we consider change management to be as important as the “hard” work behind process optimization—and we believe it should be actively managed from day one. Some managers might view this as a hindrance, but ultimately it can simplify their task and improve the eventual outcome. Experience shows that employees are more likely to resist new approaches when they don’t understand their role and how they can contribute. It is vital to remove such stumbling blocks so that the staff is fully engaged and committed. (See "The Importance of Engaging Frontline Employees," below.)

The Importance of Engaging Frontline Employees

Frontline employees—those closest to the process—typically have many ideas that can improve process efficiency and add value. But those ideas are often not aired, either because there is no forum for sharing them or because the employees feel undervalued and hence are reluctant to speak out. The end result is that the bank fails to leverage what could be a key competitive weapon.

A properly implemented lean program places a heavy emphasis on engaging these employees and actively tapping into their insights and expertise. This delivers a range of benefits. The most immediate is that process efficiency does, indeed, improve. Employees are also considerably more willing to buy into a new approach or program, because they now feel that they are a valued and vital part of the process.

But the advantages go further. They include greater job satisfaction, increased opportunities for training and career development, and lower attrition owing to the reduction of busywork. The benefits of lower attrition, in particular, cannot be overstated. Most banks lose from 15 to 25 percent of their frontline employees and first-line managers in operational areas annually. Hence, there is always a large percentage of the staff that is learning how to do its job. Shaving this percentage by even a few points via lowered attrition can have a significant impact on productivity.

Incremental Implementation

How a bank introduces and follows through on lean is equally critical to the effort’s success. Many banks take what amounts to a one-time, big-bang approach, often led by experts (“black belts” and “master black belts”), and assume that the problem will be solved. This typically generates gains, but the gains are short-lived. Once the black belts leave, the organization reverts to its old patterns and behaviors.

Far better results can be achieved, in our experience, through an incremental approach based on a series of pilots. Such a “do-learn-do” approach allows a bank to produce quick wins and “minitransformations,” one process at a time, to set the stage and build momentum for a broader transformation.

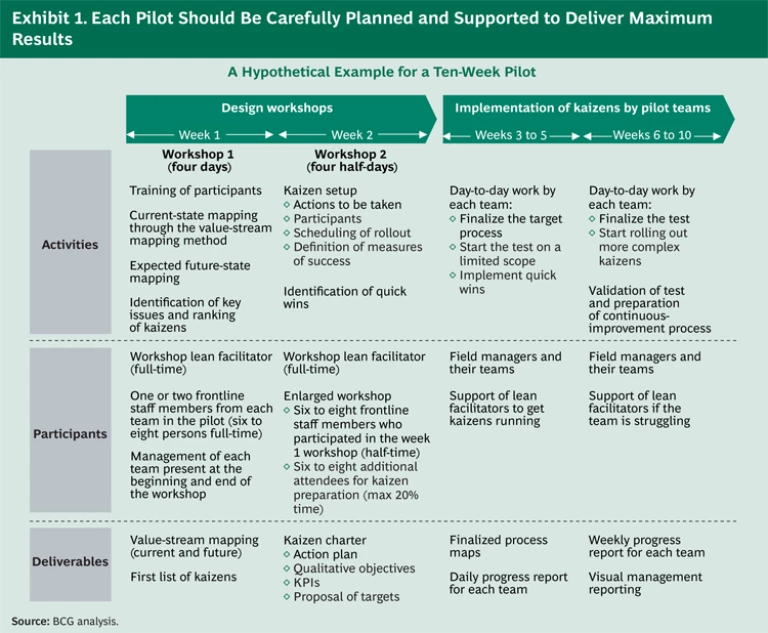

The series of minitransformations should be rapid and should target processes where results can be achieved quickly—that is, in under six months—and where transformation will have the largest and broadest impact. (See Exhibit 1.) The approach should also be designed to be minimally invasive, allowing implementation of the program without a disruption of the target processes’ day-to-day operations.

Within each minitransformation, the focus should be on optimizing value levers to eliminate waste, reduce variability, and ultimately maximize systemwide performance. Enablers such as information technology, which can allow the automation of many tasks—resulting in fewer processing errors, shorter cycle times, and a freeing up of manpower to focus on higher-value-added activities—should be incorporated into the effort, and lean tools such as kaizen and value-stream mapping should be utilized heavily to identify improvement opportunities and solutions.

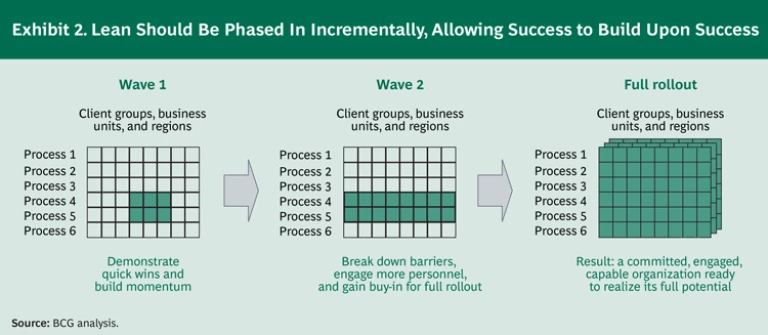

The transformations can be structured to deliver benefits in three waves. (See Exhibit 2.) The first wave is the delivery of quick wins (for example, process improvements and quick system fixes) and the establishment of momentum. The second wave involves breaking down broader organizational barriers (for example, risk policies and procedures), engaging more personnel, and gaining buy-in for the full rollout. The third wave encompasses more difficult actions (such as decisions about outsourcing or offshoring and more comprehensive IT changes) and the full rollout.

Success Stories

A number of financial institutions have employed lean in the manner we describe and achieved impressive results. One major U.S.-based global asset manager used it to redesign its core back-office processes, targeting both a significant increase in productivity and a revitalized, improvement-focused culture. The institution initiated the effort with a 12-week pilot focused on the securities-pricing process—and it conducted workshops utilizing value-stream mapping and other lean tools to engage frontline workers and managers and solicit their ideas on how the process could be improved.

These workshops generated a range of actionable ideas that were subsequently developed further and validated. For example, the institution identified and eliminated multiple redundant verifications of individual equity prices throughout the value chain. Employees did not realize that they had all been performing those checks against the same reference data—nor were they aware of the rigorous validation process performed by the centralized pricing group before the prices were sent out in the first place. The institution conducted similar workshops for frontline managers, which led to additional ideas that could be implemented broadly across the organization.

Throughout the pilot, and as the transformation was extended to other processes, the institution focused not just on the mechanics of process improvement but also on related organizational issues such as training, coaching, mentorship, and work allocation. It also instituted rigorous governance and change-management programs to sustain momentum.

As a result of these efforts, the institution was able to achieve reductions of approximately 20 percent in the number of full-time employees needed to fulfill the targeted processes. It also significantly reduced the probability of errors and achieved greater client satisfaction. Employee engagement and satisfaction also rose significantly, which, in turn, enhanced the institution’s ability to broaden the overall lean transformation program.

A leading North American bank seeking overall process improvement launched a similar initiative and had comparable success. The bank initiated the effort with simultaneous eight-week pilots focused on its retail-mortgage and commercial-lending processes. It examined the processes end to end, working backward from the customer. It employed lean tools to engage management and frontline staff and to solicit, vet, and validate ideas for improvement. It placed a heavy emphasis on change management to ensure that the necessary cultural changes were initiated and reinforced.

The result: the bank significantly reduced cycle times and cost—and improved quality. It also identified opportunities to realize significant longer-term gains in efficiency, including reductions of roughly 40 percent in processing time and 60 percent in total lead time in its retail-mortgage process—and even larger gains in those areas in its commercial-lending process. The bank also gained confidence in its ability to execute additional lean transformations.

A global corporate and investment bank achieved similar gains through its deployment of lean. Through a series of minitransformations over a period of 16 months, the bank made significant improvements in its credit-approval processes, whose operations spanned nearly 30 countries. The improvements occurred across three categories: process efficiency, the operating model, and employee behaviors. The bank’s credit file, for example, was significantly simplified and standardized, and the application process was redesigned to take into account different clients and credit types. Measurable improvements included a 30 to 50 percent reduction in response time, a 15 to 30 percent boost in the productivity of credit analysts, and a freeing up of roughly 20 percent of relationship managers’ time.

Lean can be a truly transformational tool for banks, one that delivers a step change in process efficiencies and builds a foundation for ongoing, organization-wide improvement. The key is to approach and implement it correctly. A holistic, end-to-end approach that is phased in incrementally and that effectively engages the frontline staff will realize all of lean’s potential and ensure that the gains last.