To mark The Boston Consulting Group’s fiftieth anniversary, BCG’s Strategy Institute is taking a fresh look at some of BCG’s classic thinking on strategy to gauge its relevance to today’s business environment. This first in a planned series of articles examines “The Rule of Three and Four,” a Perspective written by BCG founder, Bruce Henderson, in 1976.

BCG CLASSICS REVISITED

- The Rule of Three and Four

- The Experience Curve

- Time-Based Competition

- The Growth Share Matrix

In “The Rule of Three and Four,” Bruce Henderson put forth an intriguing hypothesis about the evolution of industry structure and leadership. He posited that a “stable, competitive” industry will never have more than three significant competitors. Moreover, that industry structure will find equilibrium when the market shares of the three companies reach a ratio of approximately 4:2:1.

Henderson noted that his observation had yet to be validated by rigorous analysis. But it did seem to map closely with the then-current structures of a wide range of industries, from automobiles to soft drinks. He believed that even if the hypothesis were only approximately true, it would have significant implications for businesses.

Fast-forward to 2012. Has the rule of three and four held? If so, to what degree? Does it merit the attention of today’s decision makers? Our analysis yielded compelling findings.

Testing the Rule of Three and Four

To test Henderson’s theory, the BCG Strategy Institute, working in collaboration with academics from Chapman, Claremont, and Rutgers Universities, studied industry data from more than 10,000 companies dating back to 1975.

To facilitate our analysis, we divided companies into two categories: those with market shares of more than 10 percent (“generalists”) and those with shares of 10 percent or less. The prevalence of industries with no more than three generalists (the “three” part of Henderson’s rule) was striking. From 1976 through 2009, industries with one, two, or three generalists ranged from 72 percent to 85 percent and averaged 78 percent. The most common industry structure throughout the period was the three-generalist configuration, which prevailed in 13 of those 34 years and was the second-most common in 20 out of 34 years.

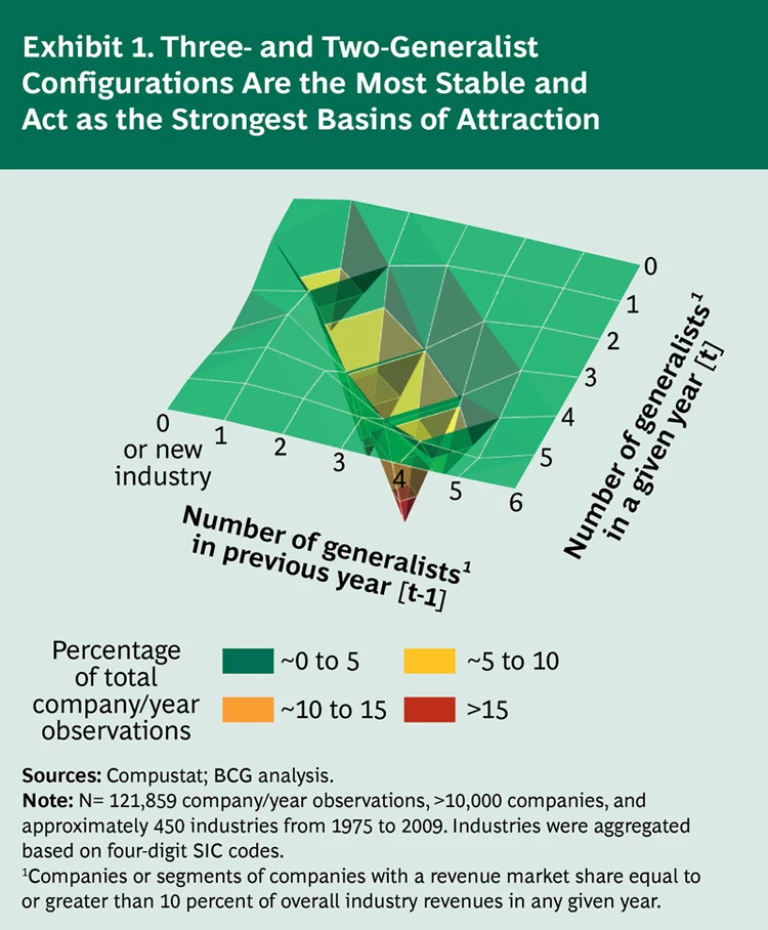

Industries with three-generalist structures have also proven the most profitable for industry participants, with an average return on assets a full 2.5 percentage points higher than in industries with four, five, or six generalists. Additionally, three- and two-generalist configurations appear to have the greatest stability and to act as the strongest “basins of attraction”—that is, more companies gravitate toward these structures every year than toward any other. (See Exhibit 1.)

Our study also confirmed the “four” part of Henderson’s rule—the 4:2:1 market-share ratio that tends to characterize equilibrium in these industries. Over the period studied, the top players in nearly 60 percent of industries with three-generalist structures had relative market shares of 1.5x to 2.5x, quite close to Henderson’s prediction of 2.0x. And we confirmed that today, the 4:2:1 relationship is the most prevalent among industries led by three generalists.

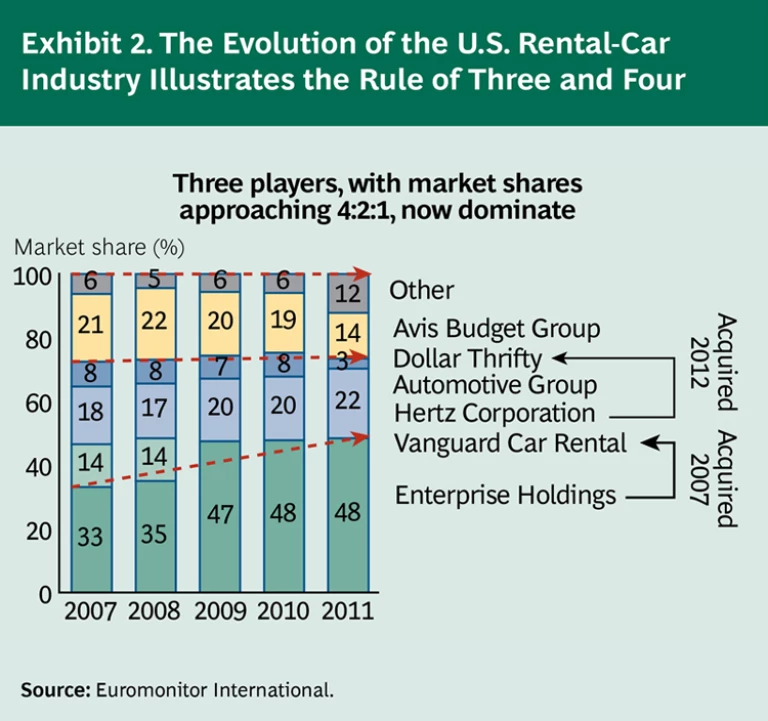

Current examples of the rule of three and four are easy to find. The U.S. rental-car industry is one. (See Exhibit 2.) In 2006, four competitors—Avis, Enterprise Holdings, Hertz, and Vanguard Car Rental—had market shares exceeding 10 percent. The March 2007 acquisition of Vanguard by Enterprise, however, gave the latter nearly half the market—and set in motion competitive dynamics implicit in the rule of three and four. In fact, the market has closely followed Henderson’s script. In 2011, the three market leaders—Enterprise, Hertz, and Avis—had market shares of 48 percent, 22 percent, and 14 percent, respectively, close to the 4:2:1 ratio Henderson predicted. Hertz’s 2012 acquisition of Dollar Thrifty, which held a 3 percent market share at the time, made the numbers align even more closely with the rule.

All told, the rule of three and four appears to be very much alive and well in 2012. But its applicability, as Henderson proposed, remains confined to “stable, competitive” industries characterized by low turbulence and limited regulator intervention. Other examples of industries where the rule applies today include machinery manufacturing (companies such as John Deere, Agco, and CNH), household appliances (Whirlpool, Electrolux, and GE), and credit-rating agencies (Experian, Transunion, and Equifax).

The rule of three and four does not seem to apply to the growing number of more dynamic, unstable industries, such as consumer electronics, investment banking, life insurance, and IT software and services. Nor does it apply to industries where regulation hinders genuine competition or industry consolidation, such as telecommunications in the U.S. (witness, for example, the government’s antitrust action against the merger of AT&T and T-Mobile). The difference in applicability is stark. For companies in low-volatility industries led by three generalists, we measured a return on assets 6.1 percentage points higher than that of companies in low-volatility industries led by a larger number of generalists. Yet we found no such trend in high-volatility industries—the three-generalist configuration had no advantage over others. A possible explanation for this is that experience curve effects, which Henderson supposed underpinned the rule, are less applicable in industries where technological innovation and other factors shift the basis of advantage before the benefits of a lower cost position can be realized.

Rising turbulence in many industries has also reduced the rule’s impact over time. The higher return on assets associated with three-generalist structures, for example, has decreased, falling from an average of approximately 3 percentage points in the 1970s to roughly 1 percentage point today. The same holds for the prevalence of the 4:2:1 market-share ratio among industries led by three generalists—that ratio is still the most common in such industries, but it is less common than it was at its peak.

Implications for Decision Makers

For corporate decision-makers, the rule of three and four has important implications. First, an understanding of the industry environment is critical. Is the industry one in which classical “rules” of strategy, such as the rule of three and four, apply, or does it demand an alternative—for example, an adaptive—approach? (See “Your Strategy Needs a Strategy,” Harvard Business Review, September 2012.) Next, decision makers must determine whether their company has a long-term viable position in its industry. Where the rule applies, this is largely determined by market share. Being the industry’s largest player is the most desirable position; the number two and three spots are also sustainable. Any other position is likely to be unsustainable.

Once they understand their company’s position, decision makers must shape their strategies accordingly. If the company is a top-three player, it should aggressively defend its share. If it is outside the top three, it should attempt to improve its position through consolidation or by shifting the basis of competition—or it should exit the industry. (As Henderson wrote, “…cash out as soon as practical. Take your writeoff. Take your tax loss. Take your cash value. Reinvest in products and markets where you can be a successful leader.”) If the company operates in an environment where the rule does not apply, it should employ adaptive or shaping strategies, which we have described elsewhere. (See “Adaptability: The New Competitive Advantage,” Harvard Business Review, July 2011.)

The rule has implications for other stakeholders as well. Investors, for example, should factor an industry’s dynamics and likely trajectory into their investment strategies. And policy makers should consider the rule and its ramifications as they weigh antitrust issues.

As we have seen, the rule of three and four remains relevant more than three decades after its conception—in a business environment that is, in many respects, profoundly different—and its implications continue to provide guidance for decision makers working in environments where classical business strategies hold. For companies in increasingly unstable environments, a new set of rules applies, calling for more adaptive approaches to strategy. In future articles, we will critically reexamine additional pivotal ideas from BCG’s classic strategic thinking to see what lessons they hold for today’s businesses.