Is the glass half empty or half full? This is the question that the results of the 2012 BCG e-Intensity Index pose to governments across Africa.

On the one hand, e-Intensity Index scores are rising quickly for many of the 14 nations on the African continent that are included in the 2012 list—more so than those of developed nations and many other developing economies.

The e-Intensity Index measures countries according to three gauges of Internet activity: enablement (50 percent weighting; how well built is the infrastructure and how available is access?), expenditure (25 percent; how much money is spent on online retail and online advertising?), and engagement (25 percent; how actively are businesses, governments, and consumers embracing the Internet?). The Index shows not only how one country compares with others but also where a country’s strengths and weaknesses lie within the three dimensions.

The Expanding Digital Divide

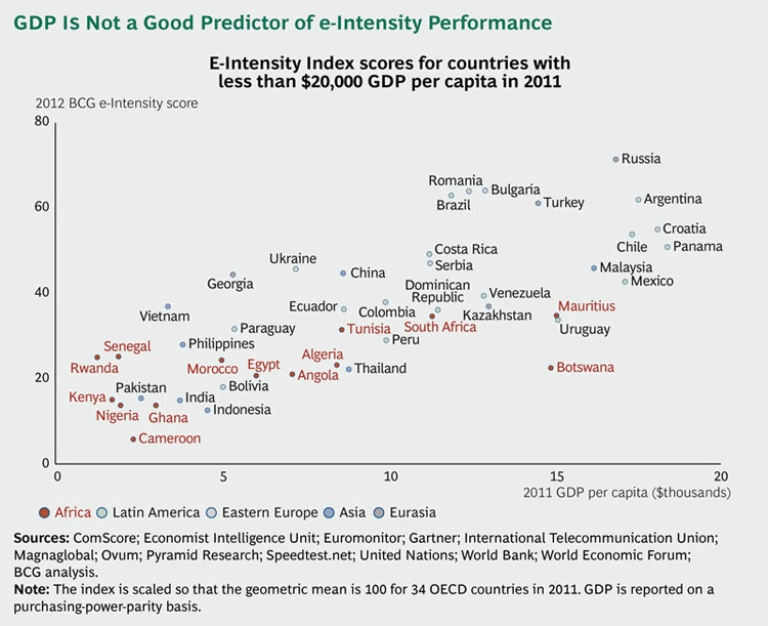

Around the world, e-Intensity Index scores continued to increase—but far from evenly, with clear overperformers and underperformers emerging. The average score in 2012 was 52, up from 44 in 2011 and 27 in 2009. The average score of the countries in the Index’s lowest ten percent, which includes five African nations, rose from 5.7 to 14.4 between 2009 and 2012, whereas the average score of the leaders in the top-10 percent improved from 115 to 184.3. Mauritius and South Africa, the highest-ranking African countries, each had a score of 35 in 2012. (See the exhibit below.)

The e-Intensity Index rankings are important indicators of more than just Internet depth and breadth. Around the world, the Internet is having a large and growing impact on national economic activity. Across the G-20, it accounted for 4.1 percent of GDP in 2010, or $2.3 trillion, and will rise to 5.3 percent of GDP, or $4.2 trillion, in 2016. The Internet economy in South Africa contributed 1.9 percent to overall GDP in 2010, a figure that is expected to rise to 2.5 percent in 2016. In Egypt, this figure was 1.1 percent in 2011 and should increase to 1.6 percent in the next five years. In most other African countries, the direct contribution of the Internet to GDP is barely measurable. In the coming years, developing-country growth rates will be more than twice those of developed economies—18 percent on average, far outpacing just about every traditional economic sector. Since national levels of Internet economic activity generally track the e-Intensity Index, countries that are slipping on the Index are also losing out on economic growth and job creation.

Opportunities to Leapfrog

It may seem counterintuitive, but the relatively low state of Internet intensity in African nations gives these countries, and other developing economies, a big opportunity. Unshackled by legacy infrastructure or embedded commercial interests, they can leapfrog their developed counterparts by taking advantage of the next waves of innovation, including mobile access and social networking. Around the world, forward-thinking governments are moving to seize these opportunities, and their rising e-Intensity Index scores reflect these efforts. African governments can do the same.

Mobile phones are increasingly helping Africans run businesses, find jobs, pay their bills, transfer money, learn, share, bank, and connect. Four out of five Internet users in sub-Saharan Africa go online using mobile phones, compared with one in three globally, according to TNS, a market research firm. Three-quarters of sub-Saharan Africans say that they are content to do all their Internet surfing on a mobile phone, compared with about one-quarter in developed countries. Between 2012 and 2016, mobile connections in Africa are projected to grow at an annual rate of 21 percent.

Smartphone penetration is increasing, too. Samsung, the largest smartphone maker, recently announced plans to double its sales and marketing efforts in Africa, which it sees as the world’s second-biggest and fastest-growing market after China. Kenya, Nigeria, and Ghana lead in smartphone sales. As feature phones are replaced by smartphones in the coming years, the Internet will be redefined across the continent. Governments and companies alike need to think “mobile first” when planning their Internet strategies.

Social networks play a key role in the Internet experience in emerging markets and are fast becoming important sources of information and commerce. Facebook has about 50 million users in Africa, according to analytics firm socialbakers. Facebook’s penetration is 13 percent in South Africa and around 30 percent in Tunisia and Mauritius. Egypt is Facebook’s most important country, with close to 12 million users, or 14 percent of the population. Mxit, a South Africa-based mobile-messaging platform, has rapidly developed itself into a content distribution platform and claims to be Africa’s biggest social network with 50 million users. Almost 60 percent of sub-Saharan African Internet users think social networking is the most important reason to use the Internet, compared with 26 percent worldwide, according to TNS.

Growing Internet use brings increasing benefits to both businesses and consumers. Our research shows that across 11 G-20 countries over the past three years, small and medium-sized enterprises (SMEs) with high Internet use experienced revenue growth that was up to 22 percent higher than that achieved by SMEs with low or no use of the Web. And they created more jobs. A 2012 survey of South African SMEs by World Wide Worx, a South African technology-research firm, found that almost 80 percent of those SMEs with websites were profitable, while only 60 percent of those without a website reported profitable operations.

There is an increasing number of examples of local applications, including mobile technology that helps farmers share best practices in order to increase crop yields and a Ghana based not-for-profit organization using an SMS-platform to fight the spread of counterfeit medication. Google is working in Africa to make the Internet local by providing language translation for many of the continent’s more than 2,000 languages.

As in developed economies, consumers place a considerable value on the Internet. In South Africa, for example, consumers believe that they receive value amounting to $1,215 over and above what they pay for devices, applications, services, and access—not far below the $1,430 average “consumer surplus” of the G-20. By comparison, Brazil’s consumer surplus is $1,287, Russia’s $1,002, Indonesia’s $364, and India’s $414.

Inconsistency Remains an Issue

In Africa, unfortunately, the picture painted by the e-Intensity Index is one of inconsistency for now. Several countries—including Egypt, Angola, Morocco, and Rwanda—are experiencing rapid growth in online expenditure—but, again, the bases are very small. At the same time, two-thirds of Kenyans use mobile-money technology, far more than in Kansas, Kazakhstan, or Copenhagen. According to mobile operator Safaricom, the M-Pesa service has 15 million users and handles some KSH 1.8 billion (US$21 million) a day. Mobile money has met with less success elsewhere, however, and the lack of effective online-payment systems in most countries still hampers Internet-based economic activity.

Some countries are boosting their e-Intensity rankings by pursuing Internet enablement and engagement programs. The government of Rwanda hopes to establish that country as a regional information- and communications-technology hub by 2020 and has embarked on building a fiber optic network and an advanced data center. Senegal has built a digital-telecommunications infrastructure and a widespread network of “telecentres” and Internet cafés. The Egyptian government’s eMisr National Broadband Plan targets 3G coverage of 98 percent of the population by 2015.

Even given rapid advances in mobile technology, enablement remains a big issue for most African countries. In Angola, for example, while business broadband penetration is 60 percent—high by African terms—only 15 percent of individuals use the Internet (through any connection), ranking the country ninth of the 14 included in the Index on this metric. There are only 1.5 active mobile-broadband subscriptions per 100 inhabitants in Angola, compared with 21 in Egypt and 23 in Ghana.

Things are improving, though. EASSy, the East African Submarine Cable System, went live in 2010 and delivers nearly 5 terabit-per-second access to 21 countries, making it increasingly affordable for Africans to have access to the global Internet. New services are starting up. In October 2012, Net One launched YahClick in Angola with the goal “to deliver an Internet service through satellite at a low price, providing an easy access to all Angolans.” In June 2012, Angola’s Education Ministry mobile-network operator Unitel partnered with Huawei to launch “E-net,” a project designed to provide free Internet access for selected groups of public and private secondary-school students across all of the country’s 18 provinces.

Governments Can Make a Difference…

It is increasingly clear that in Africa, as elsewhere, some countries “get” the Internet—and its impact on economic activity—while others are failing to fulfill its potential. Governments of the countries at the top of, or rapidly moving up, the e-Intensity Index rankings look to encourage Internet use among consumers, businesses, and within government itself because they recognize that it can be a powerful edge in the competitive global economy. Countries further down the list risk falling increasingly behind if they do not act.

What’s a country to do? One suggestion is to look at what has worked elsewhere. Many countries that are leading the e-Intensity Index, or are moving fast up the rankings, have long pursued explicit strategies to boost Internet growth. Sweden was the first country in Europe to develop a broadband policy. South Korea has used ICT technologies to turn that country into an economic powerhouse. Estonia’s EstWin program aims to provide every household and business with fast fiber-optic access by 2015 and has helped that country move up ten places in the 2012 enablement rankings and four spots in the overall e-Intensity Index rankings since 2011. African policymakers should look to successful policies that they can adopt, adapt, and amplify.

A key area of focus should be infrastructure. After water, energy, and transport, broadband is now the fourth essential infrastructure element in developed countries. For the last decade or so, many governments have been encouraging private investment to build this infrastructure, but the private sector delivers only patchy broadband coverage in many countries. Governments have stepped in with public money and sponsored partnerships to increase speeds in densely populated areas and to ensure sufficient access in remote ones.

Fiber optic connections in Kenya have brought down prices and expanded broadband access. Nearly 12 million of the country’s 40 million people now use the Internet—three times the number in 2009. Nairobi, developing into a center of technology incubation, has earned the nickname “Silicon Savannah.” Its technology-related exports grew to $360 million in 2010 from less than $20 million eight years earlier. One Nairobi-based start-up, Planet Rackus, released a game last year in which players try to avoid running over pedestrians with their matatu minibuses. Within a month, The Economist reports, some 250,000 people in more than 150 countries had downloaded a copy.

Education and training is another high-impact area. Today’s challenge is not whether to use the Internet in education; it is how to do so effectively. Developing countries such as Thailand, Chile, and Peru have established programs to connect schools and build digital literacy. As BCG has argued before, schools and school districts need to reorganize their instructional models, using digital technology to raise the productivity of teaching staff and to improve educational outcomes through high-quality, individualized instruction at a more affordable cost. Use of the Internet can also help reduce unemployment by better matching available jobs with job seekers.

In emerging and developed markets alike, putting government services online can encourage Internet use. As the UN recently argued, “E-government has strongly shifted expectations of what governments can and should do, using modern information and communication technologies, to strengthen public service and advance equitable, people-centred development.” The government of Botswana has launched a National Broadband Plan with the aim that all appropriate government information and services (more than 300 services in all) will be available through a single government portal by 2016.

…But They Must Get Engaged

In sectors such as agriculture, finance, health care, and education, the Internet can boost development in Africa. The fact that so many connections will be mobile—taking place anytime, anywhere—magnifies the degree to which consumers and businesses can benefit. Smart government policies can help make sure that this opportunity is realized. For example, governments can do the following:

- Play an aggressive role in spectrum planning and spectrum usage, the fastest way to drive mass mobile-Internet adoption.

- Take a long-term view on investments in broadband infrastructure based on a clear understanding of how good infrastructure helps increase education levels and drives economic growth.

- Think strategically about how and where to build scale. The natural inclination is to focus on political and financial capitals, but faster growth may come from investing in existing wired hot spots and expanding from this base.

- Regulate deftly. Government can help kick-start use, but it should be careful not to keep the private sector from taking the ball and running with it. Smart policies can assist the private sector, as well as governments, to increase Internet penetration, use, and activity, bringing benefits to consumers and businesses.

Economic development has long challenged much of the African continent. The Internet can help generate growth. The rest of the world, developing world included, is not standing still, however. Winners will determine the policies that can move them forward now.