Anyone who has followed our research over the past two years knows that The Boston Consulting Group is bullish about the future of American manufacturing. As wages and other costs rise in China, we expect more U.S. companies to repatriate production— from China and elsewhere—of everything from machinery to furniture. Meanwhile, we see more companies in Europe and Japan taking advantage of lower costs in the U.S. by announcing plans to use the country as a manufacturing base for export to the rest of the world. We have estimated that these trends could help create 2.5 million to 5 million U.S. jobs by the end of the decade.

But even if economic factors are swinging in favor of the U.S., will the manufacturing sector be able to absorb so much work? One concern cited by skeptics is a deficit of skilled workers. Years of relentless outsourcing and offshoring have so decimated U.S. manufacturing, the argument goes, that the once abundant pool of U.S. welders, engineers, machine operators, engineers, and factory managers has moved on to other occupations. And the U.S. education system is failing to train enough new skilled workers to replace them.

So is the U.S. really facing a manufacturing skills crunch? That likely depends on your perspective and on whether you take a short-term or a long-term view.

Currently, our analysis indicates that the U.S. skills gap doesn't appear to be as significant as many believe—and is unlikely to prevent a resurgence in U.S. manufacturing. New BCG research estimates that the U.S. is short around 80,000 to 100,000 highly skilled manufacturing workers. But that represents less than 1 percent of the nation’s 11.5 million manufacturing workers and less than 8 percent of its 1.4 million highly skilled workers. What’s more, those shortages are very local rather than national. Only five of the nation's 50 largest manufacturing centers—Baton Rouge, Charlotte, Miami, San Antonio, and Wichita—appear to have significant or severe gaps in workers such as welders, machinists, and industrial-machinery mechanics.

This conclusion is based on an analysis of wage data and job vacancy rates in locations across the U.S. Wage growth is a widely accepted indicator of skills shortages. If demand exceeds supply, employers are likely to have to raise wages significantly to attract hard to find workers. We believe that a significant skills gap exists where wage growth has exceeded inflation by at least 3 percentage points annually for five years. Such wage growth is an accepted indicator of skills shortages in other sectors, such as energy.

A survey BCG conducted in February of more than 100 U.S.-based manufacturing executives at companies with sales of $1 billion or more also suggests that talk of a skills gap crisis is overstated. Thirty-seven percent of respondents whose companies had shifted manufacturing to the U.S. from another country cited "better access to skilled workforce/talent" as a strong factor in their decision. Only 8 percent, one-fifth as many, cited this as a reason for moving production out of the U.S.

The more serious concern for the U.S. involves the long term. Unless aggressive steps are taken now, serious shortages could develop as aging workers in key trades retire and as labor demand increases because of ramped-up manufacturing. The average U.S. manufacturing worker is 56 years old. U.S. Bureau of Labor Statistics and BCG estimates indicate that the shortage of highly skilled manufacturing workers could worsen to around 875,000 machinists, welders, industrial-machinery mechanics, and industrial engineers by 2020. A shortage of that magnitude could indeed constrain a U.S. manufacturing revival.

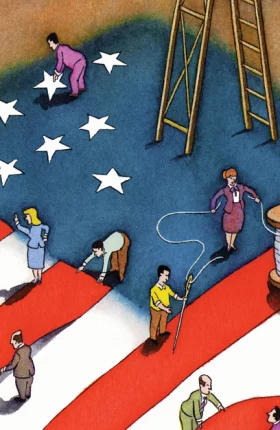

This potential crisis can be averted, however, with stepped-up investment in training, skills development, and recruitment. Companies, schools, governments, and nonprofits must work together to ensure that enough new talent is entering the right trades.

The good news is that a wide array of public-private collaborations already exist across the U.S. that seek to address these needs. Quick Start is one such example. In partnership with technical colleges across Georgia, the program provides customized workforce training and retraining free of charge for such companies as NCR and Caterpillar. To qualify, a company must create 15 jobs of a similar type in a 12-month period. Another example is the Austin Polytechnical Academy, founded in Chicago in 2007, which teaches students about all aspects of industry at its own manufacturing-training center. The academy's 65 industry partners include WaterSaver Faucet, Johnson Controls, S&C Electric, and Atlas Tool & Die Works. Another program, Custom Machine, offered by the Center for Manufacturing Technology in Woburn, Massachusetts, helps manufacturers assess new hires and train certified machine operators and computer-control programmers, graduating up to a dozen students every six weeks.

Ways need to be found to extend such programs to reach a broader population. And companies can and should be doing much more. In another BCG survey, conducted in June, only 14 percent of U.S. managers said their companies currently recruit in high schools. Less than half said that they partner with training programs at community colleges. Manufacturers should be much more aggressive about cultivating the next generation of manufacturing talent. They should work with government agencies and community colleges to build awareness among today’s students of the attractive careers in manufacturing. Companies should also anticipate future gaps by using demographic risk management and workforce planning tools.

If these types of investments in training and skills development are stepped up, there is little reason to doubt that the U.S. will be able to fully capture the opportunities presented by shifting economic forces and to enjoy a manufacturing renaissance by 2020.