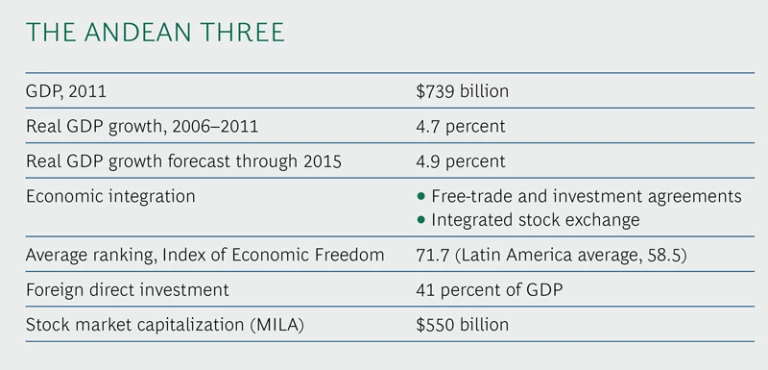

The rugged Andes mountains, stretching from the Caribbean to Patagonia, are a place of breathtaking vistas and the famed site of Machu Picchu, but they are also home to three dynamic—and often overlooked—economic powerhouses: Chile, Colombia, and Peru. The combined GDP of these economies is 65 percent that of Mexico and is forecast to grow faster than both Mexico’s and Brazil’s over the next five years, in part because of rising foreign direct investment (FDI). (See the table below.) Certainly an impressive outlook by any measure.

There are other reasons why Chile, Colombia, and Peru should rank high in the strategic planning of global companies. Increasingly, they are being viewed as an economic bloc that is serving as a new driver of regional dynamism. The Andean Three have already forged an alliance that is binding together these countries’ financial and commercial markets. They have free-trade and investment agreements, and last year their stock exchanges merged to form the Integrated Latin American Market, or MILA. This bourse boasts Latin America’s second-largest market capitalization, after Brazil’s Bovespa, and has the largest number of listed companies. The three countries are also planning to connect their electricity grids.

In addition, Chile, Colombia, and Peru all have market-friendly, fiscally prudent democracies that favor free trade and investment. Chile is ranked 11 among all nations in terms of openness to trade on the Heritage Foundation’s Index of Economic Freedom, while Colombia and Peru have moved up in rank to 45 and 41, respectively. By contrast, Brazil ranks only 113 and Argentina 138.

The sound macroeconomic management of the Andean Three makes them particularly appealing to investors. The Colombian economy has expanded by an average of 4.6 percent annually over the past five years. Chile has averaged 5.1 percent annual growth and Peru 5.6 percent. Yet inflation has been kept in check. The three nations posted balanced budgets or healthy surpluses from 2005 through 2008. After running deficits in 2009 in response to the global recession, Chile returned to a balanced budget in 2010, and Peru ran only a 1 percent deficit. Brazil and Venezuela, by contrast, have run significant budget deficits since 2006.

The Andean Three are considered to present much lower macroeconomic, political, labor, and foreign-trade risks than most other Latin American nations, according to rankings by the Economist Intelligence Unit. Tax rates and competition policies are also more business friendly. These are important considerations for companies making large long-term bets in major regional sectors such as mining and energy resources.

Although the new Peruvian government headed by President Ollanta Humala is putting greater emphasis on social inclusion, its economic policies have mainly stayed on course. The policies of the Andean Three stand in sharp contrast to the leftist populism of Venezuela, the protectionism of Argentina, and the domestic focus of Brazil.

Investors have rewarded these policies. FDI as a percentage of GDP has risen since 2005 in all three nations and averages 41 percent for the bloc. In Brazil and Argentina, by contrast, FDI as a share of GDP has dropped to 17 percent and 21 percent, respectively. In Venezuela, it plunged from 31 percent in 2005 to just 12 percent in 2010.

The private sector, too, is an important integrating force. Chile’s LAN Airlines has its main South American hub in Lima and plans another in Bogotá, for example, and Chilean companies such as Abastible, Gasco, and Lipigas control half of Colombia’s $1 billion liquefied-natural-gas market. Cross-border mergers and acquisitions within the bloc rose from 16 per year on average from 2003 through 2006 to 40 per year from 2007 through 2010. Peru’s Brescia family, whose interests include banking and mining, now owns Chile’s largest cement producer, Cementos Melón, as well as a Colombian maker of welding electrodes. CorpBanca, one of Chile’s largest commercial banks, is expected to win regulatory approval in 2012 to buy the Colombian operations of Banco Santander. Meanwhile, the state-run Colombian energy group Empresa de Energía de Bogotá acquired 60 percent of Peruvian gas distributor Calidda in 2011. M&A is also becoming a trend in industries such as retail, telecommunications, and transportation.

Together, the Andean Three are only 35 percent the size of Brazil with less than half that nation’s population. But the bloc is rising on the radar screen of both multinationals and local companies as a driver of Latin American growth. Its consumer markets are at least as thriving as those in the rest of Latin America. More than 30 percent of Chile’s population and 25 percent of Peru’s rose from poverty to the lower middle class between 1990 and 2010, making the Andean Three a growing market for mobile communications, consumer finance, and retail. The bloc’s strong trade links with the rapidly growing economies of Asia are another attraction. Total trade with Asia grew by 5 percent annually from 2005 through 2009 and accounts for around 10 percent of the three countries’ combined GDP. That is around double the level of South America’s other big economies, where trade with Asia has grown more slowly.

By seizing opportunities in the Andean Three, companies can position themselves strongly in Latin America. They should keep the following guidelines in mind as they craft their Latin America strategies:

- Take advantage of the Andean Three’s economic integration. At the same time, companies should keep in mind that there are still differences among Chile, Colombia, and Peru. Chile’s economy is the most advanced, for example, and is in a good position to attract well-trained business talent, making it a better option for a regional headquarters. Columbia and Peru are less developed, but that could create better opportunities for short-term gains. Therefore, whether a company is analyzing the case for investing in Colombia, Chile, or Peru, it should take into account the potential to expand into one or both of the other two nations.

- Approach the Andean Three differently from other Latin American markets. The ease of doing business in Colombia, Chile, and Peru, compared with much of the rest of the region, means there is less pressure on foreign companies to find local partners, cultivate government connections, and worry about capital expenditure risks. Indeed, the open business environment of the three Andean nations increasingly resembles that of developed nations.

- Take advantage of the growing linkages between the Andean Three and Asia. Because of these countries’ geographic position and openness to trade, their economies are positioned to grow as conduits for Asian–Latin American commerce. As their performance continues to diverge from that of other Latin American economies, Chile, Colombia, and Peru should occupy a privileged spot on the agenda of any truly global company with a clear action plan for the region.