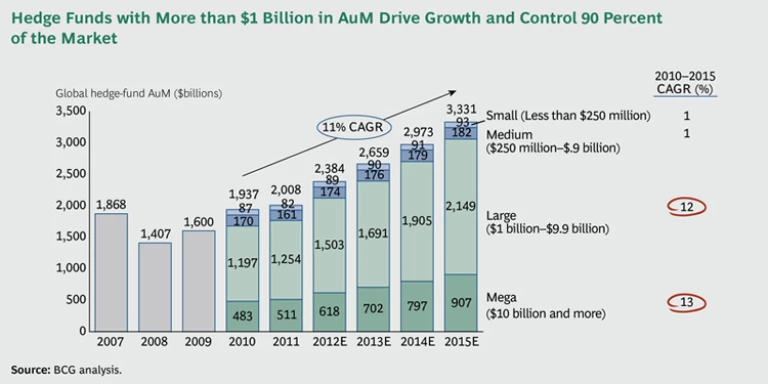

In early 2012, hedge fund assets under management (AuM) surpassed $2 trillion globally, exceeding for the first time the precrisis peak of $1.9 trillion observed in late 2007. Institutional investors seeking absolute returns have been the primary drivers of this growth. Compound annual growth rates of around 15 percent are expected though 2015, lifting hedge fund AuM to about $3.3 trillion. Moreover, convergence is expected to take hold, putting hedge fund managers and traditional asset managers in competition for the same pool of assets.

The shift of the hedge fund investor base toward institutions, combined with recent regulatory changes, has had some notable consequences: investors are expecting their hedge funds to bring to the table higher levels of transparency, lower levels of operational risk, less complexity, and strong reputations. Operational due diligences are increasingly becoming the norm among institutional investors.

It is against this backdrop that the hedge fund industry has reached an inflection point. Indeed, as the alternative-investments industry matures and becomes more competitive, consistent returns will no longer suffice. Investors are demanding that solid returns be accompanied by a robust operating model and a lower overall risk profile. A world class operating model will become a source of competitive advantage.

Of course, hedge fund managers can pursue this goal in many ways, including investing in world class core infrastructure, adopting solutions based on application service providers, making use of prime-brokerage relationships, and outsourcing aggressively. There is no one-size-fits-all solution for better operational performance and a brighter future. Yet the key challenge that most hedge funds face today is creating an operating model that is aligned with the fund’s strategic vision and flexible enough to enable the front office to evolve along critical dimensions. These dimensions include AuM growth, asset class mix, trading strategy, trading volume, investment vehicles (such as separately managed accounts, or SMAs), products (such as 40-Act and UCITS), and geographic expansion.

Fortunately, there are steps that hedge funds can take to build such an operating model and put themselves on a strong, positive trajectory. But first, it is important to understand how the industry has evolved in recent years.

Facing Up to Tougher Investor Demands

Beginning around 2000, institutional investors—insurers, pension funds, corporations, governments, and other entities—began to aggressively increase their allocation to hedge funds. They saw hedge funds as good vehicles for delivering risk-adjusted returns and enhancing investors’ ability to control portfolio volatility. These institutional mandates differed from those of high-net-worth (HNW) individuals, who sought outsize returns on what they had already set aside as risk capital. Over time, institutional assets overtook HNW assets as the primary source of hedge fund assets and growth.

Hedge funds initially responded to this “institutionalization” by adapting their investment and service strategies to meet client demands. For example, some hedge funds expanded the availability of SMAs and accepted the process of working with investment consultants as intermediaries. By 2010, however, the financial crisis had ushered in a new level of scrutiny both from institutional investors and regulators. Thus began the current era in which institutional investors must focus not just on risk-adjusted returns and volatility but also on effectively managing operational risk.

A recent survey conducted by SEI Knowledge Partnership and Greenwich Associates found that 70 percent of institutional investors reported lack of transparency as their greatest worry (up from 56 percent in 2009). The Alternative Investment Management Association confirmed this trend, revealing that 90 percent of hedge fund respondents to a different survey reported greater investor demands for transparency as a top concern. Moreover, as scrutiny increased, hedge funds expanded in size and complexity, with many outgrowing legacy operating models. Currently, hedge funds with more than $1 billion in AuM represent less than 20 percent of all hedge funds—but they hold 90 percent of hedge fund assets. (See the exhibit below.) Since such funds are driving a disproportionate share of industry growth, this concentration of assets is expected to increase.

As the height of the crisis faded further into the past, funds that had survived by remaining relatively small found themselves hitting size and complexity thresholds that required more sophisticated infrastructure and more rigorous management. Institutional investors began demanding not only greater transparency but also robust operations and strong risk management. Ultimately, the institutionalization of the hedge fund investor base signaled a far-reaching need to significantly upgrade the industry’s infrastructure.

Responding to the Pressure on Operating Models

Obviously, the need for more-robust operations, higher levels of transparency, and stronger infrastructure is not new to most hedge-fund managers. Nonetheless, we have seen many managers surprised by the present inadequacy and inefficiency of their own operational setups. Many hedge-fund chief operating officers face serious difficulties in ensuring that their back and middle offices are capable of the following:

- Supporting current trading strategies and being able to introduce new asset classes without adding operational risk

- Absorbing a 50 percent (at minimum) spike in volume

- Delivering the transparency and reporting required by clients and regulators (either directly or through administrators)

- Operating efficiently in terms of people, processes, and technology costs

- Providing seamless connection to the front office in order to minimize operational risks (such as erroneous trades)

Challenges such as these are increasingly giving hedge fund managers reason to pause and take hard looks at their operating models. They realize that these weaknesses are increasing the likelihood of failures that could put their entire organizations at risk. Managers are asking themselves what the financial and reputational cost would be of an error on a multimillion-dollar trade or on a net asset value or fee calculation. They are even wondering what the consequences would be if they were unable to trade for a full day—a less likely scenario but one that we have nonetheless observed in the past.

As management teams discuss the impact of these types of potential operational failures—and the growing probability that they could occur—they will see a clear need for action.

Building the Right Operating Model for Your Organization

The first step in the journey toward a better operating model is to clearly define the strategic vision for your fund—“What does the fund want to be when it grows up?”—and to place your answer within the context of implications for the back and middle offices. You will have to take a detailed look at what is working and what is not working in your operations. This strategic lens, along with input from your clients, will help you make the leap from planning incremental changes that don’t really accomplish much to planning a broad transformation program that will create true competitive advantage.

Once aligned on the strategic vision (the “what”), you will then need to define the “how” by analyzing key target operating-model decisions. These choices will vary by fund but they typically include the following:

- Scope/Configuration. How deeply do you need to transform standard operations functions such as back office, valuation, and cash and collateral management? What needs to happen to more complex middle-office functions such as risk analytics and client reporting? And what about front-office operations and infrastructure (for trade execution, for example)?

- Sourcing/Technology. What is the more appropriate approach—building a brand new solution from scratch or choosing avenues such as vendor solutions and outsourcing?

- People/Organization. Do you have the right people in place to preside over the transformation and run the new operating solution once it has been rolled out? If not, how can you acquire and retain the talent you need in your organization?

What does a world class hedge-fund back office look like? Again, there is no one-size-fits-all answer. There are, however, a set of capabilities that virtually all winning models share:

- Agility. The ability to add new asset classes and make strategic moves in a very short time frame

- Flexibility. The capacity to customize operations within existing systems without having to reengineer processes

- Fast Access to Data. The ability to access, manipulate, and analyze data at any point across the organization—front office, client services, sales, back office, and middle office—and to do this in real time (or close to it)

- Automation. The ability to use straight-through processing for simpler operations and end-to-end workflow for more complex ones

- Integration. The ability to ensure seamless system and data integration throughout the front office, middle office, and back office

- Standardization. Internally, the ability to run basic processes in a consistent way; externally, the ability to communicate with the investment community in a fashion that is consistent with industry standards

Once the “how” has been established for achieving the envisioned target operating model, hedge fund managers need to define a migration path for getting from point A to point B. For some, this journey will be short and relatively straightforward. But for most, the transformation will be a longer, more winding road. For large, complicated funds with legacy technology and processes to cope with, a true transformation is typically a 12- to 36-month endeavor involving stakeholders from across the organization.

Seizing the Moment

What differentiates hedge funds that have successfully reworked their operating models to adapt to the increasing demands of institutional investors from those that have lagged behind? These are some of the main attributes:

- Commitment from the Top. True transformation requires substantial resources (both financial and human) and involves major issues that mandate the support and hands-on participation of senior management.

- Cooperation Among Departments. The change program also requires substantial support from internal clients—such as those in the front office and the sales force—who will need to feel that they are a part of shaping the new solution and that the solution will create value for them.

- Client Communication. The upgrading of operations and infrastructure will be a major attribute in the eyes of institutional clients. Still, there will likely be bumps in the road. It will be critical to clearly communicate with clients about the elements and timing of the transformation program and manage their expectations along the way.

- Keeping a Business-Driven Focus. The quest for a new operating model is a business endeavor enabled by technology, not the reverse. Key roles and decisions, especially in defining and implementing the new model, should therefore be driven by the business.

- Using Your A-Team. For a project of this scope, each hedge fund will need its very best resources. If you feel you lack seasoned executive capability for a large-scale transformation, you will need to look outside the organization to find the help that you require.

- Forging Beneficial Partnerships with Third Parties. Whatever solution you choose to pursue, you will likely need to lean heavily on third-party vendors. They will be critical to your success. Finding the right partners should be a top priority.

Yet hedge funds that are willing to invest—to define their vision and cascade that vision into a scalable and flexible operating model—will be well equipped to handle changing market and investor dynamics. These players will be positioned to turn a very tall challenge into an opportunity to become market leaders.