Ever since the “fast fashion” model emerged two decades ago, supply chains have become a key driver of success for apparel companies. Today, they are more strategically important than ever before, due to the added pressures brought about by several trends.

First, globalization demands that companies balance global consistency with local needs—exerting many associated tensions on the supply chain. Second, the digital movement is bringing about greater price transparency, increasing the potential for product refreshment, and adding pressure on margins—all of which have key implications on supply chain flexibility.

Third, and related to the digital trend, consumers increasingly demand “omni-channel” offerings, requiring many retailers to add new supply-chain modes such as delivery from the store, in-store pickup, and exclusive collections. Fourth, factors such as the financial crisis are boosting economic volatility, which demands that operations be more flexible.

In the face of these trends, leading fashion retailers are building competitive advantage by redesigning and adapting their supply chains to best meet their individual strategies. This approach delivers—among other benefits—significantly reduced production costs by cutting development, manufacturing, and logistics costs. It also reduces the amount of time it takes a company to move from concept development to in-store placement.

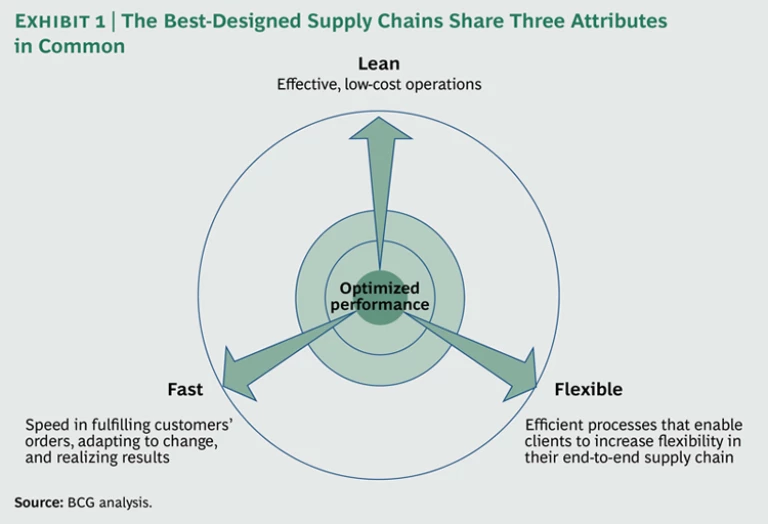

BCG’s analysis has found that the best-designed supply chains share three common characteristics, as illustrated in Exhibit 1:

- Fast. They demonstrate particular speed in fulfilling customer orders, adapting to change, and realizing results.

- Flexible. They create efficient processes that enable their clients to boost flexibility in the end-to-end supply chain.

- Lean. They emphasize effective, low-cost operations.

Each company will handle these three attributes differently, depending on its own unique priorities. Consider for example, how the following three companies excel along one or two of the dimensions:

- Fast. Esprit, a global manufacturer of apparel, footwear, accessories, jewelry, and housewares, optimized its supply chain for speed by setting up a dedicated quick-response division. The company shortened the timeline for quick-response capsules to eight weeks. (A quick-response capsule consists of internal teams of designers and production staff working with retail stores to deliver new fashions quickly.) Similarly, it cut the turnaround time for quick-response flash products to six weeks.

- Fast and Flexible. Zara, the Spanish clothing and accessories retailer, is well known for being both fast and flexible. It achieves these dual goals by de-averaging its supply chains, near-sourcing (that is, keeping about 50 percent of its production in nearby countries), and designing approximately 80 percent of its products in season.

- Lean. Sports clothing manufacturer adidas exemplifies the lean operation. By combining late ordering, efficient selection of materials and colors, and central pooling, the company has reduced production lead times for footwear and apparel to 60 days.

Strategic Line Planning

Through our work with numerous clients, we have found that successful supply chains that effectively meet the needs of consumers share a common denominator: strategic line planning (SLP). Leading fashion companies utilize SLP each season to build a shared vision and strategy for the brand, product line, targeted consumers, planned volumes, and relative economic performance (including factors such as price and margin).

The crucial components of SLP include the following, all of which must link with overall company strategy:

- Consumer research

- Competitive benchmarks (comparisons to the competition’s assortments)

- Projections from their fashion-trend radar

- Historical sales analysis

Once a company has embraced SLP as a healthy and holistic part of the collection-development process, it has a solid foundation on which to optimize its supply chain.

Seven Best Practices for an Optimized Supply Chain

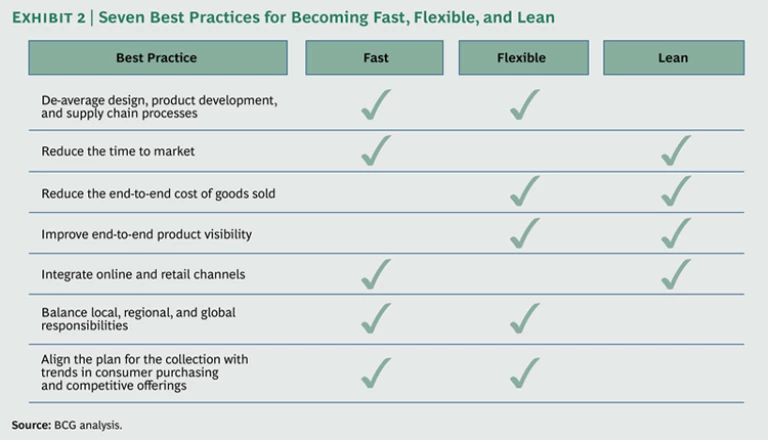

In work our throughout the industry, BCG has identified seven best practices that can enable apparel companies to make their supply chains faster, leaner, and more flexible. We explore each of the best practices in turn.

De-average design, product development, and supply chain processes. We have found in our work with clients that the best-in-class companies segment the speed and processes of their go-to-market (GTM) approaches. Companies must first decide whether to segment these by:

- Product—such as permanent, essential, fashion, or image-building

- Geography—global, regional, or local

- Category—men’s, women’s, or children’s

- Customer type—wholesale or retail

Next, companies should determine each product’s type and strategic objectives, then define the appropriate cycle time, process, and interfaces for developing the product collection. From there, companies should identify their supply-chain priorities: defending margins, limiting out-of-stocks, ensuring fast replenishment, or reducing after-sales inventories or discounts. Finally, they should establish the applicable supply-chain characteristics.

Reduce the time to market. The fashion cycle is collapsing, forcing retailers to radically accelerate development and delivery times. To reduce their own time to market, companies need to fully understand the flow of their processes and information—and then build an optimized and comprehensive procedure from the ground up.

BCG has helped clients achieve this by optimizing SKU rationalization, streamlining their handoff processes, improving validation processes, optimizing reserved capacity, prepositioning fabric and trim, minimizing lead times, and optimizing the use of various freight options. The resulting improvements have been huge. After undertaking such efforts, companies have seen their margins improve by 400 to 700 basis points. Inventory turns have improved dramatically, and commitments have been reduced by as much as 30 percent.

Reduce the end-to-end cost of goods sold. Companies can reduce costs by undertaking a broad and systematic review of the end-to-end process. In our experience, the best practices for removing costs span the entire spectrum from SKU rationalization to sourcing and logistics.

BCG has helped clients identify and implement opportunities for trimming costs by reducing SKU complexity, reducing the number of sample rounds, optimizing sourcing, reallocating product across stores based on demand, and using pull-based store replenishment. Companies have achieved significant and sustainable cost advantages—typically 3 to 5 percent of the cost of goods sold—as part of a structural cost-reduction program.

One client, a major European apparel company, asked BCG for help in reducing unnecessary supply-chain costs and in making its stores more uniform. Using our methodology, the client trimmed its collection by 20 percent, introduced a fabric-rationalization process, defined guidelines for new store concepts, and developed plans that enabled the company to realize both growth and an annual cost savings of €36 million.

Improve end-to-end product visibility. Coordinating across individual process steps and making those steps fully transparent are key success factors for operational excellence. Many companies are using new technologies such as RFID to improve end-to-end product visibility. For example, after a successful test in its men’s division, Macy’s is working with suppliers to integrate RFID technology into the UPC tickets. And Li & Fung is pushing “source-to-store” RFID technology with its network of factories through initiatives such as requiring RFID tagging at each product’s origin.

For many of our clients, making product location and history transparent has resulted in increased demand, a greater understanding of inventory levels, improved business abilities, and leaner operations.

Integrate online and retail channels. Successful companies are driving down costs and boosting margins by more fully integrating their online and retail inventory models. Many have achieved multichannel integration by bringing together merchandising and inventory-management capabilities, utilizing common performance metrics, and locating their warehouses and distribution facilities in centralized sites or regions.

More and more players are also thinking about creating an integrated view of retail inventory—across all stores as well as e-commerce—to allow for delivery from stores. This delivery mode incurs extra costs, but it can also boost profit margins. When a product is moved from a store where it is not selling to another store where a customer wants to purchase it, the company gains both higher sales as well as reduced markdowns and out-of-stocks at the end of the season. BCG has examined the economics of this delivery mode, and it is clear that the key drivers of profits are linked to:

- The Product’s Price Points. Higher price points help justify delivery from the store.

- Fashion Positioning. High fashion can also help justify delivery from the store. Less suitable for this delivery mode are permanent and less fashion-reliant collections that have “more time to sell.”

- Depth of Inventory. Discount players have trouble even thinking about e-commerce when they are working with very tight inventory and targeting a product turn between just two to three weeks.

Balance local, regional, and global responsibilities. Many companies are moving toward a structure wherein a global team helps gain scale and protect the brand. Most of these structures also maintain some local design teams to infuse product lines with elements of local fashions or trends, and coordinate with the global team. BCG has helped some clients align their local, regional, and global tiers by adjusting their local and regional processes to be more in sync with those of the global team. Often, the solution calls for having either local functions at the center (such as Zara’s product team) or global functions decentralized in each country (such as global development centers in the regions).

We’ve also helped improve integration by reorganizing the team structure to increase coordination and communication, evaluating and recommending key technology improvements, and coordinating all production calendars into one master global calendar.

By optimizing local, regional, and global responsibilities along all areas of the end-to-end supply chain, companies are able to achieve scale benefits and greater vertical integration. Thus they enjoy increased purchasing power with suppliers, as well as enhanced control and brand consistency.

Align the plan for the collection with trends in consumer purchasing and competitive offerings. Fashion collections, too, should be planned in alignment with the overall supply-chain strategy. By leveraging the SLP tool, a company can establish its shared vision regarding brand positioning, targeted consumers, and which key initiatives to pursue. It can also develop a strategic vision of the product range, while setting price and margin expectations. And, it can estimate volumes for each segment, identify potential bestsellers, and provide direction to designers.

One multinational apparel and footwear company we worked with achieved this goal by implementing an in-season reordering process. This made the company more flexible in responding to new requirements from customers. As a result, it reduced customer inventory levels by 30 percent and increased sellthrough by 10 percent. It also reduced its lead times by 30 percent.

The Path Ahead

The seven best practices, built upon a foundation of strategic line planning, are the keys to a well-designed supply chain. A company should evaluate which combination of speed, flexibility, and lean is best for its strategy—and apply these practices accordingly. (See Exhibit 2.) We recommend that companies begin this process with a “health check” assessment that helps them identify key opportunities across the supply chain.

The rewards of building these capabilities include a shorter time to market, reduced costs, and streamlined operations, ultimately enabling companies to perform more competitively in the marketplace and to realize their strategies.