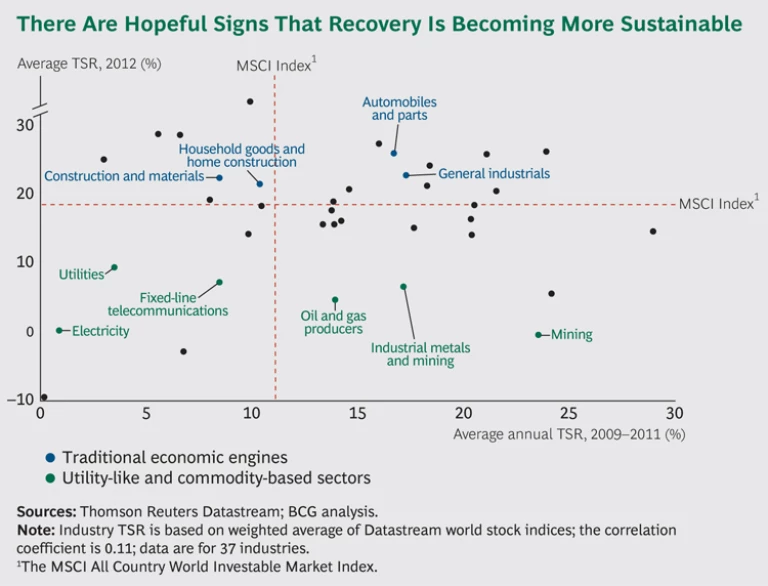

The comparative performance of 37 industrial sectors points to positive signs about the global economic recovery. The relatively strong performance of traditional economic engines such as automobiles and parts, household goods and home construction, construction and materials, and general industrials suggests that a broader recovery may be under way.

Many of the underperforming companies in 2012 hailed from sectors that experienced value-creation challenges in recent years, such as utilities, electricity, and fixed-line telecommunications, or from commodity-based sectors, including mining, oil and gas producers, and industrial metals and mining, that were unable to sustain their outsize returns.

It is important to be careful about drawing unequivocal conclusions from single-year TSR performance, which by itself is a poor indicator of sustainable long-term value creation. Among the questions that we will be tracking throughout the coming year are the following:

- What does it take for a company to chart its own course to superior value creation, despite the specific circumstances of its industry or home market?

- Are companies with a global footprint finding a sustainable model for growth?

- What can we learn from those companies that have been the top value creators in the five-year period from 2008 through 2012—a period that started with the global downturn and ended with still-considerable economic uncertainty?