In today’s highly connected world, rural communities are increasingly seeking greater access to fast broadband. This demand is being driven by more advanced uses—such as media solutions, high-definition video, and sophisticated IT—that require fast, reliable bandwidth to support a wide array of services, such as precision agriculture, remote patient care, online education, and games. Optimized for urban environments, many existing broadband solutions lack the capabilities to meet the demand.

To gain insight into the broadband solutions that offer the greatest benefits for rural areas, NetComm Wireless commissioned The Boston Consulting Group to prepare this independent report. NetComm Wireless is not a current or previous client of BCG. The findings of our research have been discussed with company executives, but BCG is responsible for the analysis and conclusions.

Broadly speaking, rural areas are those that are less populated than urban areas and more populated than remote locations. More specifically, we’ve adopted the OECD’s definition of rural areas, which includes those areas with fewer than

To define fast broadband, we considered several existing definitions. For example, the U.S. Federal Communications Commission (FCC) defines broadband as providing downlink speeds of more than 4 megabits per second (Mbps) and uplink speeds of 1 Mbps. Superfast broadband, according to Ofcom in the UK, achieves downlink speeds higher than 24 Mbps. For this report, we’ve adopted Akamai Technologies’ definition of high broadband: a committed downlink speed of 10 Mbps or higher and a committed uplink speed of 1 Mbps.

Finding the Sweet Spot for Rural Broadband

Providing fast broadband to rural areas falls into a telecommunication gray zone that presents particular technology and economic challenges. Solutions that work well in urban settings—copper, fiber, cable, and mobile—can be unreliable in rural areas or prohibitively expensive. For example, premises near small towns and villages are often too dispersed to make the rollout of fast fixed-line solutions economically viable. In these areas, most premises are more than a few kilometers from the nearest telephone exchange, placing a limit on asymmetric digital subscriber line (ADSL) speeds and increasing the cost per premises for fiber to the node (FTTN) solutions to several thousand

The economic challenge for carriers, then, is how to deliver access to fast broadband without incurring the high costs that many customers are unwilling to pay and most governments are unwilling to subsidize. In most rural markets, providing fast broadband will require some level of subsidy, given the capital expenditure involved: the willingness to subsidize drops off when the capital expenditure exceeds approximately $1,500 per premises.

Successfully navigating this gray zone presents a significant opportunity for carriers. As broadband penetration accelerates around the world, new applications are fundamentally altering the way we work, learn, and communicate. Worldwide, rural areas account for approximately half of the population. In developed countries, nearly one-quarter—22 percent—of the population resides in rural areas. In developing countries, that figure more than doubles, to 54 percent. Some of the 4 billion rural consumers are not yet online, while others are online but now require faster, higher-quality networks to access new services.

Delivering fast broadband to rural areas is not simply a matter of providing convenience or faster downloads. Access to fast broadband has profound economic implications. The rise of industries, such as precision farming, remote patient care, e-commerce, smart energy, and emergency services, as well as the increase in opportunities for online education, are only some of the ways fast broadband can transform the quality of life for rural populations. We estimate the addressable fast-broadband market for rural areas to be approximately $80 billion, of which $50 billion reflects the market size of the top 20 countries, ranked by the number of fixed-line broadband subscribers

Although many have studied the social and economic impact of populations gaining access to broadband, the economic impact of populations moving from broadband to fast broadband is not yet fully understood. A 2009 study, for example, found that a 10 percent increase in broadband penetration boosted GDP growth by 1.2 percent for developing countries, a gain that could not be matched by any

In this report, we survey the current state of rural broadband in terms of available solutions and important players. Then we apply BCG’s Four Cs framework, which lays out the critical selection criteria for choosing the right fast-broadband solution for various locations. Our research has shown that an emerging solution—fixed wireless, which uses the same underlying technology as mobile wireless but is designed to do a different job—may represent the wave of the future. When the economics are right, fixed wireless can give customers reliable access to advanced applications (such as streaming video and enterprise solutions) and offer carriers a range of benefits (such as remote management, traffic policing, and other network-grade features).

The Current State of Rural Broadband

Six broadband technologies have varying degrees of suitability for different locations.

- ADSL or VDSL. ADSL is the dominant fixed-line broadband solution in 26 of the 34 OECD member countries. ADSL uses the local copper-wire loop between a telephone exchange and a customer’s premises to deliver broadband. In urban areas, few premises are more than 4 kilometers from an exchange, while in rural areas this is common. Beyond 4 kilometers, ADSL typically delivers less than 4 Mbps, making it unsuitable for fast broadband. The physical constraints inherent in twisted-pair copper wiring mean many carriers are investing in technologies, such as vectored very-high-bit-rate digital subscriber line (VDSL), FTTN, and fiber to the distribution point, and are shortening the distance between the equipment they use to drive the line and a customer’s premises, allowing carriers to increase transmission speed—in some cases, above 80 Mbps.

- HFC. Hybrid fiber-coaxial (HFC) cable networks mix fiber with coaxial cable and are now capable of speeds up to 200 Mbps, following the 3.1 release of the data over cable service interface specification (DOCSIS). The cost and architecture of these networks make them suitable for both urban and urban-fringe areas. In areas where customers are willing to pay media companies for access to subscription television services—delivered over a cable network—it makes economic sense to use the same network for fast broadband. Although using HFC for fast broadband is sensible in areas where it has already been rolled out, it is likely to be less cost effective than alternative fiber options.

- Fiber. Fiber uses fiber-optic light to transmit much more data than either copper wires or coaxial cable can. The current generation of gigabit passive optical networks (GPONs) is capable of sharing 2.5 gigabits per second (Gbps) over a local loop of neighboring premises. Although fiber transmits data fast, deploying fiber in rural areas is often not a viable proposition for service providers, as the civil costs of laying fiber along long solitary stretches of road can mean the cost per premises exceeds several tens of thousands of dollars.

- Spot Beam Satellites. The latest satellites can provide 100 to 200 Gbps of coverage. Each satellite tends to be configured differently to suit the region it serves. A satellite with 20 to 30 focused or steerable short-wavelength (or Ka-band) beams, for example, and a capacity of 1 gigahertz (which, at 5 bits per hertz, could be the equivalent of 5 gigabits per second per beam), might provide a downlink speed of 10 Mbps and an uplink speed of 1 Mbps (10/1 Mbps) to a thousand premises or more, per beam, depending on the design of the product. More than 500,000 people globally now receive broadband speeds of 10/1 Mbps or better by satellite, but the high cost of this solution means it is suitable only as a last-resort technology for remote, rather than rural, locations. Satellite products, while expensive, also suffer from round-trip delays, or latency, of at least one-quarter of a second, which diminish the quality and speed of video, voice, gaming, and other services.

- Mobile. Users can access broadband using mobile long-term evolution (LTE) Wi-Fi devices or smartphones with Bluetooth or Wi-Fi. In some cases, mobile carriers provide users with a small antenna, which, attached to a hot spot, improves the reception and throughput of a device, or an omnidirectional antenna for their roof. By December 2013, 10 of every 100 inhabitants across all OECD-member countries had a dedicated mobile-broadband subscription, while more than 60 of every 100 inhabitants had a standard smartphone or other mobile device with broadband service. However, in rural areas and inside premises, many mobile users are too far away from a base station to access fast broadband.

- Fixed Wireless. Fixed-wireless solutions use wireless technology that has been tuned or optimized on the assumption that customers are not mobile but are located in one place—their premises. Specifically, base stations attached to fixed-wireless towers are focused on premises, and directional antennae installed on the roof of each customer’s premises point back to the base station.

The main investors in broadband technologies and networks are governments, technology companies, and carriers. Each group stands to benefit from rolling out faster, more reliable broadband to their respective constituencies.

- Governments. Governments are investing in programs, grants, and subsidies aimed at extending broadband to areas not yet reached by the private sector. According to a recent report on the state of broadband, 134 countries now have national broadband plans to provide universal broadband access (of different speeds), up from only

64 countries five years ago.8 8 The Impact of Broadband on the Economy, Research to Date and Policy Issues, ITU, April 2012. Qatar will invest $550 million to deliver fast broadband to homes, businesses, and government. Malaysia is investing $750 million to provide fast broadband to citizens and hopes to increase GDP by 0.6 percent as a result. Spain has set a 2015 target to provide 50 percent of households with a broadband speed of 100 Mbps. In Sweden, 200 of 290 municipalities have received public funding from the state government for broadband, and the country hopes to provide 90 percent of the population with a broadband speed of 100 Mbps by 2020. - Technology Companies. Google, Facebook, and other Internet giants have funded new underground and underwater cables, leased fiber-optic cable, and developed proprietary networking hardware. Google now operates its own fiber network, and Google’s Project Loon plans to float high-altitude balloons so that homes and businesses can connect to the Internet through antennae attached to their premises. Facebook’s Connectivity Lab is exploring high-altitude drones that can fly low enough to broadcast a powerful signal to rural territories. Amazon.com and Microsoft are also investing in their network infrastructure, building fiber networks and leasing fiber routes in various regions of the world. These huge capital expenditures allow technology companies to control their own destiny in terms of bandwidth and managing traffic. These investments also establish technology companies as a new source of broadband innovation and a new source of competition for the telecommunication and cable companies that have traditionally controlled access.

- Carriers. In the U.S., AT&T has announced that it will decommission its copper- based voice and DSL services in favor of a network using the Internet protocol (IP). The wireline U-verse network will expand to cover 75 percent of AT&T’s customer locations, or some 57 million people. In 2012, the company announced an investment of approximately $14 billion over three years: $8 billion for wireless and $6 billion for fixed wire. The Irish government and Vodafone, a global mobile operator, have invested €500 million and €450 million, respectively, to bring fiber to more than a thousand towns and villages across Ireland. Carriers, over the years, have saturated urban and suburban neighborhoods with broadband offers, including fast ADSL connections for those customers close to an exchange; HFC networks, which provide cable television and 100 Mbps broadband service; and LTE networks, which are capable of offering a wide range of transmission speeds (typically 4 to 50 Mbps, depending on cell design and congestion). Rural areas, however, offer a relatively untapped market that is becoming increasingly attractive in the face of a highly contested urban market and the prospect of selling advanced applications to rural customers.

Converting a Telecommunication Gray Zone into a Market Sweet Spot

Up until now, 3G mobile wireless has been the standard broadband solution for rural areas. Although carriers continue to improve their coverage in rural areas, speeds lag well behind those available in urban areas. As carriers build LTE networks, many are planning their networks to ensure downlink speeds of 1 Mbps and uplink speeds of 64 kilobits per second. Although that is adequate for some data services, it does not offer a reliable solution for streaming high-definition video beyond a certain distance—particularly when streaming indoors.

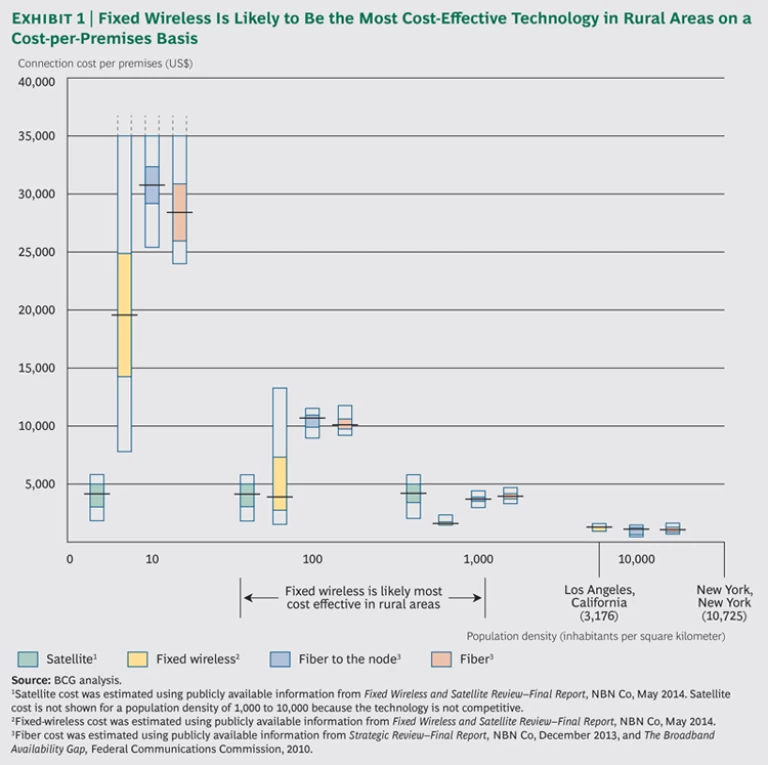

When assessing the cost of rolling out a fast rural-broadband solution, the most important consideration is population density. However, the applicability of different technologies will also depend substantially on revenue potential, local competitive dynamics, terrain, and the availability and cost of spectrum. Carriers and governments should build extensive models for each area to determine the cost or subsidies required. Germany, for example, is currently determining the subsidies that should be provided for fast broadband. In the UK, the superfast-broadband plan will provide subsidies. Any commercially viable proposition will have products that are not as fast as those provided under subsidies. However, to illustrate the variation in costs by technology, we used a particular set of publicly available data for our assumptions and found that when density is less than several hundred inhabitants per square kilometer, fiber is the most expensive technology. Specifically, the fiber cost curve starts to steepen significantly as population densities fall below 300 inhabitants per square kilometer. From $3,500 to $5,500 for 100 to 1,000 inhabitants per square kilometer, the cost rises to $9,000 to $13,000 for 10 to 100 inhabitants per square kilometer, rendering fiber prohibitively expensive at lower population densities.9 By contrast, in remote areas, and even when the population density is below about 25 inhabitants per square kilometer, any broadband other than satellite is unlikely to be commercially viable. Some commercial satellite products with relatively low usage caps per user, such as those recently launched by ViaSat, will remain the most commercially viable for densities of up to 300 inhabitants per square kilometer.

But what about rural areas? For this portion of the population, our analysis has revealed a definitive sweet spot for fixed wireless. (See Exhibit 1.) That is, where the population density is more than 10 inhabitants per square kilometer and lower than 1,000 inhabitants per square kilometer, wireless technologies are likely to be the most competitive. Depending on local factors, such as terrain, average distance of premises to an existing exchange, spectrum allocations and costs, and the cost of a transit network, wireless technologies may be, in many situations, the most cost-effective way to provide broadband, and fixed wireless the most effective of these to guarantee a fast and reliable solution.

The Four Cs Framework

Four criteria—cost, committed rates, customer experience, and contestability—should inform every rural broadband-technology choice.

Cost. Ideally, the total cost of ownership of delivering fast broadband to rural areas should be minimized. The following costs should be considered:

- Network costs, which are incurred by making extensions necessary to a transit network, laying fiber, building towers, and providing equipment to meet the capacity and performance criteria

- Premises costs, which are incurred by installing an antenna or kit in each customer’s home or business

- Customer device and equipment costs (such as the cost of a mobile Wi-Fi modem), which are borne by the customer

Committed Rates. Guaranteed bandwidth over time allows customers to achieve reliable throughput and to access high-value features, such as video streaming and business-grade Ethernet. When establishing committed rates, investors should consider the following:

- Performance standards, which define whether and under what conditions the carrier will commit to certain performance requirements, such as guaranteed uplink and downlink speeds, latency, and jitter

- Various classes of service, which define whether customers can select from a set of different performance bands, such as being able to upgrade or downgrade a service

Customer Experience. Wireless solutions should ideally serve to enhance service, minimize service-related costs, reduce churn, and maximize loyalty. The following points should be assessed:

- The perceptions of network performance—how the network performs under load or during times of congestion—including upload speeds, download speeds, and average retransmission rates (covering various uses, such as video streaming, cloud-based applications, backup, and voice)

- Installation, configuration, troubleshooting, and service recovery

- Customer-based condition monitoring, configuration, diagnosis, and traffic steering

- The longevity of solutions, the need for upgrades, and the effort involved in an upgrade

Contestability. Some solutions can assign different levels of service to various types of traffic—or carry traffic on behalf of multiple service providers, retailers, or customers—and manage each level of service and type of traffic independently. This allows the network owner (perhaps a carrier, wholesaler, or government) to provide a service on top of which others (perhaps business units, brands, or competitors) can provide different, or contestable, services. In some cases, contestable services can be an important economic or market-shaping provision. Considerations around contestability include the following:

- The ability to provide access to more than one service provider or access network

- The ability to segregate or isolate traffic within the total available bandwidth and to commit to information rates per service

How Wireless Solutions Compare on the Four Cs

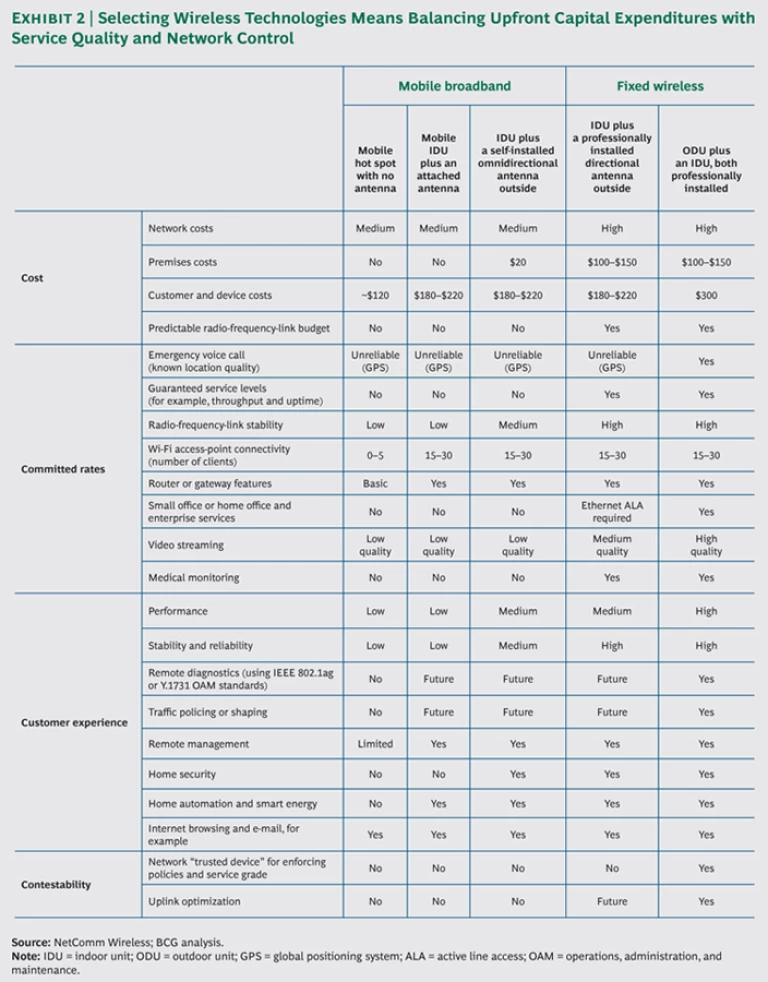

To understand how the Four Cs work in practice, and to determine the most attractive option for rural areas, we compared the various types of mobile and fixed-wireless technologies for each criterion. (See Exhibit 2.)

Cost. Network costs for mobile and fixed-wireless solutions are similar. Both require towers, base stations, connections to the transit network, and active equipment. The main difference lies in where the infrastructure is placed. Mobile-network designers place towers at the centers of populations, radiating out to provide the most coverage to users as they travel. In contrast, fixed-wireless designers place towers on the outskirts of populations so that carriers maximize the number of premises to which each tower has a clear line of sight, thus providing the most capacity to the highest number of premises. With towers and active equipment costing from $50,000 to $300,000, carriers and governments that provide rural broadband services can end up spending, in our view, on the order of one-and-a-half times more if they build these solutions sequentially rather than optimizing for both at the start.

Fixed wireless allows for better utilization of very valuable spectrum-license assets. Lower radio frequencies perform better in rural environments, because lower frequencies are attenuated less by distance, although given the high value of this spectrum, careful management is needed to ensure the best return from this asset. Low-frequency spectrum, however, tends to be scarce in rural areas, as those mobile operators keen to cover the greatest area with a voice service at the lowest cost have already acquired the rights. This problem of scarcity is compounded because providing fast broadband over low frequencies requires wide channels, or more spectrum per bit. Securing adequate rights for a 45 megahertz block in a frequency band below 1 gigahertz, for example, can be expensive enough to make fast broadband uneconomical. Because the installation process and cost is very similar to a satellite TV installation, however, there is no need to hire or train specialist installers.

The cost of customer devices and equipment should also be considered. For mobile broadband in rural areas, customers pay for handsets and mobile hot spots and can also buy antennae to connect to personal hot spots or to attach to a roof to improve reception. All told, mobile broadband devices cost customers about $100 to $300 if bought outright and are usually replaced every two to three years, as chipsets, modulation schemes, and carrier settings change. The cost of fixed-wireless equipment is roughly equivalent to the cost of mobile equipment when the asset life cycle is considered: in some countries, the former is about $200 to install and approximately $300 for the antenna, the receiver, and the equipment to which a customer can connect using Wi-Fi or Ethernet. The life of fixed-wireless equipment is five to ten years and fully managed by the carrier, so the customer does not need to be involved in configuration, modification, or troubleshooting.

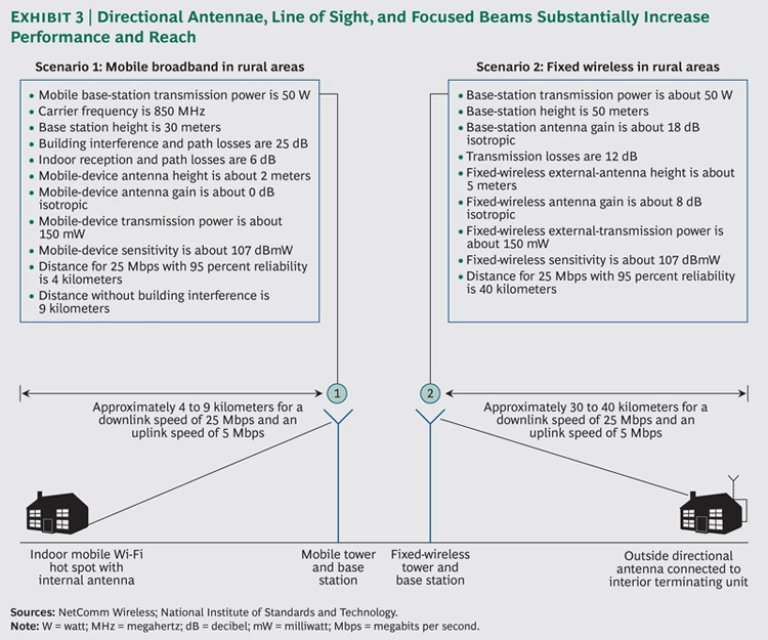

Committed Rates. Fixed-wireless technology relies on the same transmission technology that mobile does, but base stations communicate with fixed equipment at customers’ premises using line of sight. The fixed-wireless equipment installed on a customer’s premises may be customized by the carrier and can be modified to allow the carrier to upgrade and manage it over the air. This means that carriers are able to guarantee throughput and minimum information rates, while managing various types of traffic differently. For instance, carriers can delay backup traffic and prioritize real-time telemetry information. When the network of base stations is designed to do so, fixed wireless can deliver a guaranteed speed of 25 Mbps or better. Some fixed-wireless solutions are based on mobile technology, such as LTE, while others, such as WiMAX, are specifically fixed. Throughput is set to increase as techniques to use spectrum in novel ways evolve (through, for example, the use of multiple antennae, beam forming, and mixed uses of public and private spectrum).

The capacity of base stations is planned to meet the needs of individual premises, and coverage is focused to limit interference. (See Exhibit 3.) This means that homes and businesses can be given an amount of bandwidth that guarantees performance even during peak times of use. The network is designed specifically for the premises it serves. And the equipment installed—the directional roof antenna and LTE modem, as well as the customer premises equipment—can be managed and monitored directly by the carrier. Because fixed wireless is engineered to deliver specific capacity to a targeted premises, carriers can meet their headline-speed claims for various products.

Mobile broadband can deliver cheaper bandwidth-intensive services than fixed wireless—provided that customers have a clear line of sight to the base station, unobstructed by buildings or trees. To deliver these services continuously and reliably, carriers have to invest a considerable amount in mobile base-station capacity and are not always able to guarantee a level of service suitable for long-running streaming connections or a dedicated uplink (which is required for video conferencing, for example) during peak times or poor weather conditions. Fixed wireless, on the other hand, tunes the customer’s equipment to maximize its performance with the base station and connects a set number of premises within a fixed-cell boundary, which enables carriers to deliver a consistent level of service, even at a distance from the base station.

The main difference, then, between mobile and fixed-wireless solutions is that mobile networks end at the base station. Fixed-wireless networks include highly specialized radio equipment connected to a premises, allowing a carrier or service provider to guarantee speeds.

Customer Experience. In rural areas, servicing individual customers can be costly. Fixed-wireless technology allows service providers to remotely and continuously monitor the end-to-end performance of a customer’s connection and throughput and the applications in use. Carriers can tune network capacity, the aperture of base stations, and other operational components to optimize performance.

Since the fixed-wireless equipment is installed professionally on a customer’s premises (by the same crews used to install cable TV, ADSL, or fiber services), and since the end-user equipment is remotely managed, customers need not install, set up, or troubleshoot the solution. Performance degradation is detected by the carrier in real time, so it can swiftly rectify a loss of performance. To put customer experience in context, the demand for high-speed broadband has intensified as the Australian government rolls it out to rural areas across the country. (See “Connecting a Country: A Case Study.”)

CONNECTING A COUNTRY: A CASE STUDY

The National Broadband Network (NBN) in Australia provides a useful case study on how fixed wireless is being used to deliver broadband. In 2009, the Australian government committed $43 billion to the goal of 100 percent broadband coverage of addressable premises by 2021. NBN Co was formed as a wholesale, open-source, government-owned entity and tasked with rolling out the network.

Australia has a highly urbanized population, with 75 percent of inhabitants living in areas whose density is at least 1,000 people per square kilometer. Providing broadband to urban dwellers was a relatively straightforward proposition; fiber would be brought to the premises or a node close by. But the government had committed to delivering broadband on a national scale, particularly to people living outside metropolitan areas. A one-size-fits-all solution would not suffice.

It was quickly determined that the most remote regions of the country would receive satellite services. That left approximately 500,000 homes and businesses in the gray zone—areas not well served by either fiber or satellite. People in this category tended to live in one of two distinct regions of Australia—on the fringes of metropolitan areas or on the outskirts of country towns. After the government reviewed its options, it determined that fixed wireless offered the solution that could best meet the needs of the nation’s rural communities.

NetComm Wireless, an Australian broadband-equipment provider, designed and built the fixed-wireless terminal. The network was designed, installed, and managed by Ericsson, a global telecommunication-equipment provider. A recent review indicated that NBN Co is building 2,000 to 4,000 fixed-wireless base stations with the coverage of a 4G (LTE) network. This will provide service to 500,000 to 600,000 premises in predominantly rural areas by 2020. NetComm Wireless’s outdoor routers, which are attached to individual premises, integrate a modem, a router, Wi-Fi, voice, and a high-gain antenna in one device that can be remotely serviced.

As the rollout moves across rural regions of Australia, the demand for high-speed broadband services has intensified. For the first time ever, there is a 95 percent probability that at any given time, NBN Co will provide rural areas of Australia with a downlink speed of at least 25 Mbps and an uplink speed of 5 Mbps.

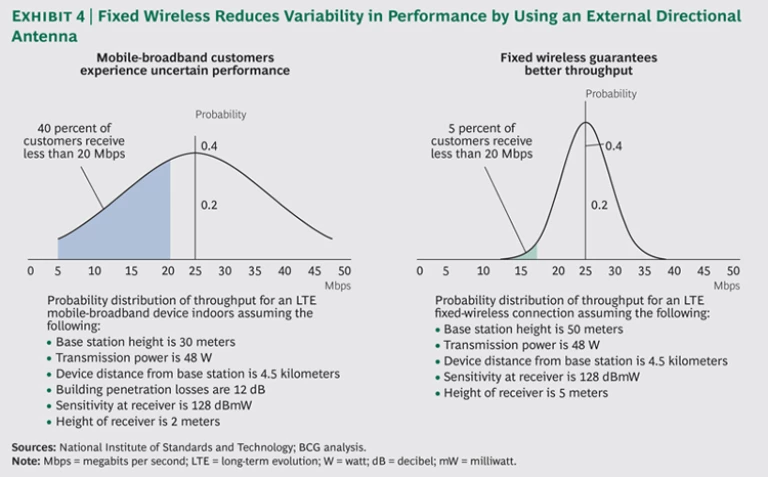

Finally, many high-value applications, including video conferencing and streaming, as well as low-latency applications, such as cloud-based CAD, engineering, and accounting software, simply won’t run reliably over slow broadband networks. Fixed wireless offers a better guarantee of throughput (because its technology is less prone to congestion or interference from buildings) and opens the door to a world of new capabilities for businesses and consumers. (See Exhibit 4.)

Contestability. For carriers, more reliable service results in better customer satisfaction, which leads to better customer retention. By managing the ports and network services, carriers can offer differentiated levels of service and products over the same radio link and end-point equipment. For example, carriers can offer high-definition voice on one port, business-grade Ethernet and virtual local-area networks on another port, and a third, low-cost, high-capacity port for backup traffic. When operators have complete end-to-end control of the assignment of ports and network capacity, different business units, or even retail service providers, can sell different types of products while keeping them isolated. This is not possible on a mobile network, on which all traffic is treated equally until it reaches the core network. With fixed wireless, it would be possible for a consumer’s remote medical monitoring to be provided by one company and access to a streaming-video library or a live sporting event to be provided by another company. This is a terrific boon to carriers that, for many years, have lamented the decline of average revenue per user and the simultaneous increase in capital costs associated with providing mobile data. (See How Telecoms Can Manage the Mobile Data Explosion, BCG article, May 2012.)

After examining how mobile and fixed-wireless technologies measure up against the Four Cs for rural areas, we have concluded that fixed wireless is the stronger fit-for-purpose technology. By navigating the gray zone of rural broadband and overcoming several of the drawbacks of mobile broadband in terms of bandwidth and reliability, fixed wireless provides a formidable solution over long distances and for premises located a long way from an exchange or a tower. By offering a pathway for rural communities to access sophisticated broadband-based services, fixed wireless can join modern fixed-line solutions—such as FTTN, FTTP, and satellite—to drive value in the future and create a true opportunity to connect across the digital divide.

Acknowledgments

This report would not have been possible without the efforts of BCG colleagues Guy Gilliland, Marita Hastings, JT Hsu, Ron Nicol, Amanda Provost, Clement Rispal, and Michael Schniering.