This article is part of a series on autonomous vehicles.

It is no longer a question of if but when autonomous vehicles (AVs) will hit the road. In the auto industry’s most significant inflection in 100 years, vehicles with varying levels of self-driving capability—ranging from single-lane highway driving to autonomous valet parking to traffic jam autopilot—will start to become available to consumers as soon as mid-2015 or early 2016. Development of autonomous-driving technology is gaining momentum across a broad front that encompasses OEMs, suppliers, technology providers, academic institutions, municipal governments, and regulatory bodies.

Related Article

Robo-Taxis and the New Mobility

Autonomous vehicles promise to upend the urban-taxi business, with far-reaching implications for industry incumbents, disruptive new entrants, municipal officials, and—most of all—commuters.

While technological development continues apace, AV stakeholders are also addressing the societal, legal, and regulatory issues that will arise as AVs come to market. We will analyze those issues and possible solutions in a forthcoming report that draws on our collaboration with the World Economic Forum. (See “Not by Technology Alone: The Societal, Legal, and Regulatory Aspects of AV Development.”)

Not by Technology Alone The Societal, Legal, and Regulatory Aspects of AV Development

A forthcoming report by The Boston Consulting Group, in collaboration with the World Economic Forum, examines the societal, legal, and regulatory ramifications of autonomous vehicles (AVs) and the measures that need to be in place to promote their widespread adoption. The following are some of the report’s main messages.

Continued and accelerating technological development is, of course, crucial to the formation of a commercial market for AVs. But it is equally important to ensure that by the time partially and fully autonomous vehicles are ready for launch, international, national, and local laws and regulations are in place to support their operation. So far, pilot tests of AVs have moved forward by means of special permits or legislation. Commercial adoption, however, will require regulators to address three key topics:

- Traffic Regulation. Will an AV be allowed on the roadway if a human being is not at least partially responsible for its operation?

- Liability Laws. Who is liable in an accident or malfunction involving an AV?

- Standards. What performance standards and testing procedures need to be defined to ensure the safety and cybersecurity of AVs?

Governments and regulators in several countries—including Japan, South Korea, China, and in Western Europe—are already considering these questions. But the U.S. is at the forefront of regulatory development, especially in the field of traffic regulation. Five states have enacted laws that allow the use of AVs, and the U.S. Department of Transportation’s 2015 to 2019 research-and-development plan includes provisions for safe and connected vehicle automation.

In terms of liability, factors to be considered include risk-limiting measures for vehicle manufacturers, which might bear a greater share of liability as vehicles become more and more autonomous. Such measures could include, for example, capping manufacturers’ liability exposure if they comply with government-endorsed performance standards. To this end, current automotive standards need to be extended to account for AVs. Standard-setting bodies can employ output-oriented methods, such as digital simulations, test tracks, and real-world pilots to define standards and test procedures.

AVs promise tremendous societal benefits. They could save many lives—the death toll from automotive accidents today is more than 30,000 per year in the U.S. alone—reduce congestion, improve fuel economy, enhance lane capacity, and return hundreds of productive hours annually to commuters who now waste significant portions of their day in traffic.

Because of the enormous potential benefits that AVs offer, regulators around the world are taking a strong interest in AV technology, as evidenced by the many pilot programs under way in municipalities as diverse as Singapore and Gothenburg, Sweden.

At the same time, policy makers are answerable to various stakeholders, including the general public and the business community, and entrenched interests could complicate the transition to AVs, in a manner analogous to Uber’s recent conflicts with European taxi unions. Negatively affected stakeholders—including taxi and truck drivers, insurers, and personal-injury and traffic litigation lawyers—may exert significant pressure on public-policy makers to protect their interests. Authorities may need to develop mitigation strategies to soften the blow on the stakeholders that suffer the greatest disruption.

Societal pressure could also pose an obstacle. At present, the public is generally very enthusiastic about the technology, but that could change quickly. If, for example, a horrible accident involving an AV occurred in the early stages of market introduction, regulators could face pressure to take a tough stand against such vehicles. To ensure strong, sustained public support, the industry will need to engage with the general public and be forthright about both the limitations and the benefits of the technology.

Aggressive players in virtually every segment of the automotive value chain have unveiled, or are conducting pilot programs of, partially or fully autonomous vehicles or enabling technologies in locations around the world. Audi, for example, presented its highly autonomous A7 model, which has highway-driving capability, at the 2015 Consumer Electronics Show in Las Vegas. The car had driven itself to the show from San Francisco—a distance of 550 miles.

BMW has tested its autonomous Series 2 model on closed tracks and city streets. Daimler is testing both highly and fully autonomous vehicles in the U.S. and Germany. Tesla and GM plan to roll out models capable of hands-free highway driving in the summer of 2015 and 2016, respectively. Nissan has already tested its Autonomous Drive technology, which enables highly autonomous functionality, on public roads in Japan. The company plans the commercial launch of a model with traffic jam autopilot in late 2016.

Volvo and various Swedish government bodies in 2014 launched the “Drive Me” initiative, in which 100 self-driving cars navigate public roadways in everyday conditions in and around the city of Gothenburg. The project’s first test cars are already on the road. And the prototypes of Google’s AVs have been widely publicized.

Meanwhile, Wageningen University, in the Netherlands, plans to introduce a driverless taxi later this year. The vehicle, one of the first of its kind, will operate between two campus locations. Milton Keynes, a planned community in the UK, is developing self-driving “public transport pods” for rollout in 2017. Last year, Singapore conducted a two-month test of driverless vehicles, in which 500 people tried out self-driving buggies that plied the paths of the gardens in the city’s Jurong Lake district. Later this year, the city will begin testing AV jitneys that will convey people for short distances at low speeds in another part of town. The object of the test is to observe how AVs perform in real traffic conditions on public roads and how they interact with pedestrians and bicyclists at intersections.

Suppliers are preparing for the AV future as well. Bosch, Continental, Delphi Automotive, Mobileye, Valeo, Velodyne, and Nvidia, to name a few, are among the suppliers that are in the advanced stages of testing the positioning, guidance, and processing technology needed to make AVs a commercial reality.

In this report, we consider and quantify consumer preferences regarding autonomous features and the technological, economic, societal, and regulatory evolutions that must occur for autonomous vehicles to become a commercial reality. We pinpoint the key obstacles to the development of partially and fully autonomous vehicles and identify the likely uses of AVs in both personal and commercial contexts. We also offer a roadmap for the development of the AV market for the automotive industry, technology providers, and regulators, outlining the steps that each stakeholder will need to take for that development to occur.

Autonomy Comes in Several Flavors

The term “autonomous vehicle” describes not a single vehicle with a fixed set of capabilities but a range of possible vehicles with disparate capabilities. Today’s advanced driver assistance systems (ADAS) foreshadow the more robust autonomous technology now under development. ADAS features include the following:

- Adaptive cruise control, introduced in 2006, monitors the speed of the vehicle directly ahead of it and maintains a safe distance.

- Parallel-park assist, also introduced in 2006, uses cameras and ultrasound sensors to guide the vehicle into a parking space.

- Automatic emergency braking, first available in 2008, activates itself when the vehicle risks colliding with another vehicle, a person, an animal, or an object.

- Lane-keeping technology, introduced in 2014, warns the driver when the vehicle risks drifting out of its lane and, in some versions, prevents the vehicle from doing so.

From Partial to Full Autonomy

As soon as late 2015 or early 2016, the first wave of more advanced, partially autonomous features, such as the following, will come on the market:

- Single-lane highway autopilot enables a vehicle to drive in a single lane on a high-speed roadway without driver input.

- Highway autopilot with lane changing enables a vehicle to drive autonomously on highways and change lanes on its own.

- Traffic jam autopilot takes control of vehicle functions in low-speed, stop-and-go traffic conditions.

- Autonomous valet parking enables a vehicle to identify an open parking spot, park itself, and then retrieve itself when summoned.

- Urban autopilot allows the vehicle to drive itself in virtually all urban environments at low speeds and respond appropriately to traffic jams, traffic signals, and intersections.

A fully autonomous vehicle, of course, can drive itself under virtually all conditions without driver intervention, although limitations—most notably, severe weather—are still to be defined, along with protocols for dealing with such situations.

The Timetable for Rollouts

OEMs will roll out vehicles containing one or more advanced autonomous features in stages as the underlying technology reaches commercial grade and its price falls. Precise dates of introduction depend on validation of the technology by OEMs, regulation in each country, and the tests that will be required by safety administrations. Still, we can offer general guidelines based on the likely readiness of the technology and announcements by OEMs.

The first autonomous feature to become available will probably be the single-lane highway autopilot, with Tesla’s planned introduction in mid-2015, followed by GM’s version of the feature, called Super Cruise, which will appear in 2016 on an all-new Cadillac vehicle. By 2017, AVs capable of traffic jam autopilot and autonomous valet parking should be on dealers’ lots, followed by highway autopilot with lane changing in 2018. Vehicles capable of urban autopilot could be ready in 2022, paving the way for fully autonomous vehicles by 2025—the year when Mercedes, for one, will roll out its first fully autonomous model, according to a recent announcement by the OEM. OEMs or new entrants, such as the DriveMe project in Sweden, will likely introduce some or all of these features earlier, on a test basis.

Before then, every player in road transportation will need to ensure that demand is adequate to reach commercial scale, vehicles are secure from cyberattack, regulation is ready for self-steering vehicles, uncertainty over liability is resolved, societal resistance is overcome, and certain critical technologies, such as high-precision maps, are commercially developed.

How We Performed Our Study—and What It Reveals

Our study of the future market for AVs models the most likely paths to autonomous-driving capabilities, as influenced by key enabling technologies, cost dynamics, and consumer demand. We reviewed the technologies required, their availability, and the future evolution of their cost based on likely improvements and scale, and conducted in-depth interviews with experts at OEMs and suppliers, as well as researchers.

To ensure that our projections took a holistic economic perspective, we then combined the forecasts for cost evolution with an extensive BCG survey of more than 1,500 U.S. consumers who had recently bought a car or intended to buy one soon. Prior to conducting the survey, researchers tested respondents’ understanding of AVs and described various autonomous features. Most consumers quickly and intuitively grasped the meaning and implication of autonomous features without needing to actually operate an AV.

Survey questions probed how and why consumers would use AVs and how much they would pay for AV features. We assessed consumer perception of AVs along several dimensions, categorizing responses by parameters such as gender, age, geography, current car ownership, and attitudes toward car sharing. The survey yielded deep insights into how much consumers within those categories would be willing to pay for AV features.

Finally, we reviewed many factors—including the development of new regulations and insurance pricing models—that could have an impact on consumer adoption rates and then teased out their implications for key stakeholders.

Consumers Want Autonomous Features—and Are Ready to Pay Extra for Them

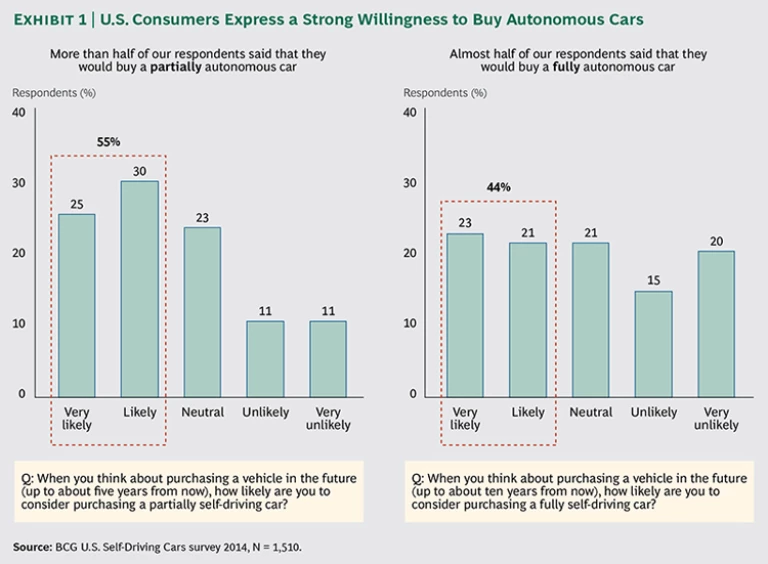

The survey results make clear that drivers in the United States are enthusiastic about the potential of AVs. About 55 percent of respondents said that they would consider buying a partially self-driving car, and some 44 percent said that they would consider buying a fully autonomous vehicle. (See Exhibit 1.) The level of consumer interest in AVs is higher and more intense than it was for electric vehicles (EVs) prior to their introduction and suggests that AV adoption may be more rapid and widespread than the currently slow pace of EV adoption.

Some consumers do have concerns about AVs, however. Given the responses of survey participants who said that they would not buy an AV, the biggest considerations appear to be reliability, cybersecurity, and uncertainty about AV interactions with other vehicles on the road.

No Clear Consumer Preference for Specific Features

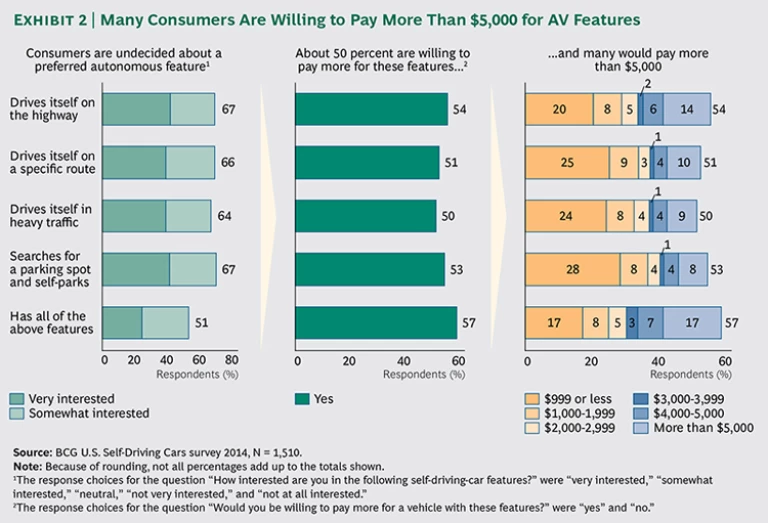

Despite their general enthusiasm, respondents expressed no clear preference for specific features, with about two-thirds describing themselves as very interested or somewhat interested in each of several autonomous capabilities. (See Exhibit 2.) Roughly equal percentages of respondents expressed interest in capabilities such as automated searching for parking spots and autonomous valet parking, as well as self-driving on highways, in heavy traffic, or along a fixed route. And in a striking finding, 51 percent of respondents said that they are very interested or somewhat interested in buying a vehicle that has the full array of autonomous capabilities.

Most interested consumers are also willing to pay extra for autonomous features. More than 50 percent of respondents said that they would be willing to pay extra for each feature individually and for all features together in a fully autonomous vehicle. More dramatically, 24 percent of surveyed consumers said that they would be willing to pay more than $4,000 extra for an autonomous feature, while 17 percent said they would pay more than $5,000 for a fully autonomous car. The lack of a clear preference for a specific feature, however, presents OEMs with a challenge: which feature or features should they prioritize in their research and development?

Premium Vehicles Will Lead the Way

The respondents in our survey who are owners of premium nameplates showed the highest level of interest in—as well as the greatest willingness to pay for—both partially and fully autonomous vehicles. Thus we expect AVs to make their first appearance in the premium segment of the auto market. But consumers in the volume segment also showed significant interest in AVs, with nearly half likely to consider buying a partially autonomous vehicle and 36 percent likely to consider purchasing a fully autonomous vehicle. Given the intense interest across both premium and volume segments, we believe that OEMs with a solid position in both markets—such as Volkswagen, Toyota, and GM—could gain valuable scale by transferring AV technology from their premium nameplates to their volume nameplates as it becomes profitable to do so.

Insurance Costs, Safety, and Productivity

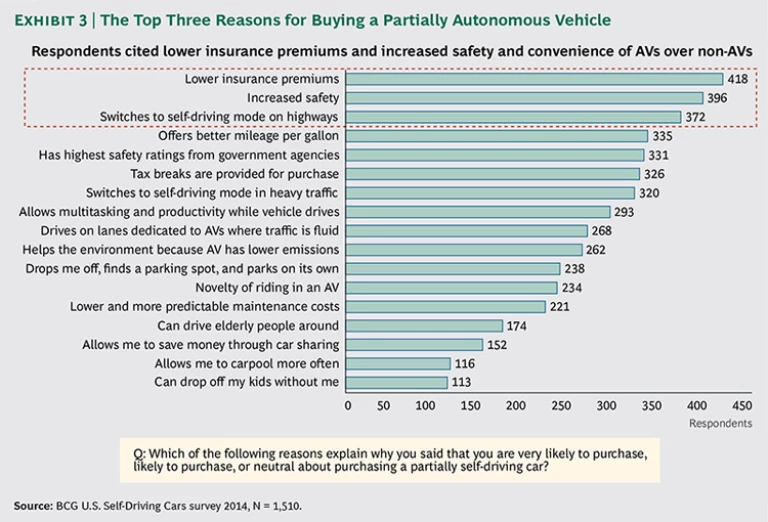

The survey results demonstrate that consumers clearly perceive how AVs could make driving markedly safer and exert downward pressure on their insurance, repair, and maintenance costs. Respondents who said that they’d buy a partially autonomous vehicle in the next five years or so cited lower insurance premiums, increased safety, and hands-free highway driving as the leading reasons for doing so. (See Exhibit 3.)

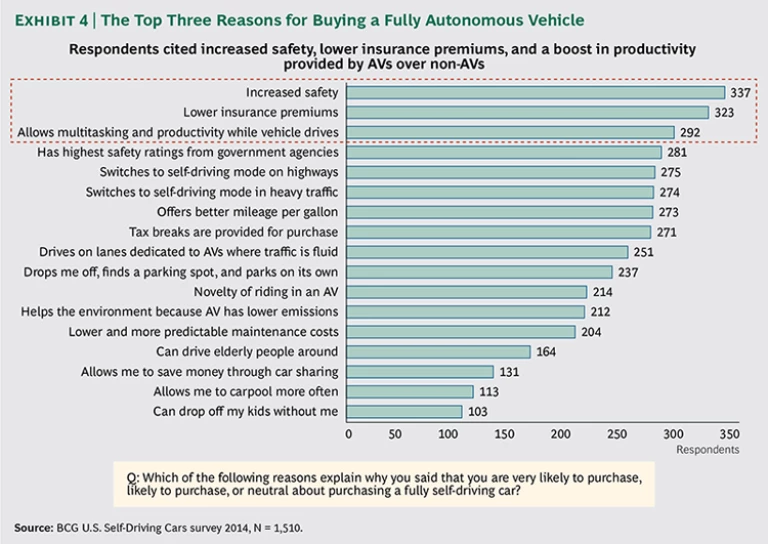

Those who said that they’d buy a fully autonomous vehicle in roughly the next ten years cited lower insurance premiums and increased safety as well. (See Exhibit 4.)

The survey results also suggest that AVs could usher in a second revolution in personal productivity, perhaps one that generates even greater gains than those made possible by home appliances such as washing machines and dishwashers. More than half of respondents who said that they’d buy a fully autonomous vehicle mentioned increased productivity as one of their top reasons for purchase. This seems to suggest that many, if not most, consumers would be willing at times to give up the pleasure of driving for some other activity.

The Evolution of AV Technology

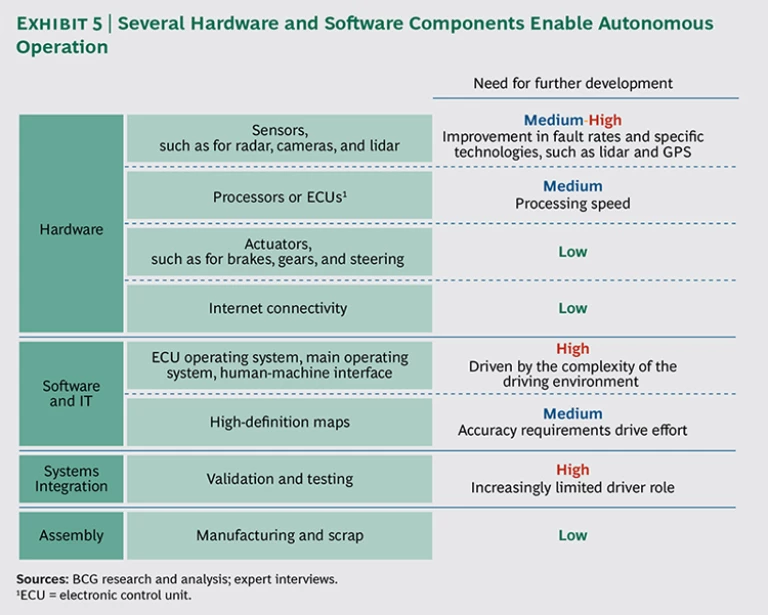

AVs are enabled by multiple hardware and software components, in particular a variety of sensor technologies that assess and react to a vehicle’s environment at all times. The functionality of AVs relies on innovative technologies to process the inputs from sensors and on software to interpret the inputs and translate them into action. Vehicle manufacturers and suppliers will therefore need to invest heavily in hardware, such as sensor technology and processors; software and IT; systems integration; and assembly to produce AVs on a commercial scale. (See Exhibit 5.)

A Crucial Need: Sensor Technology

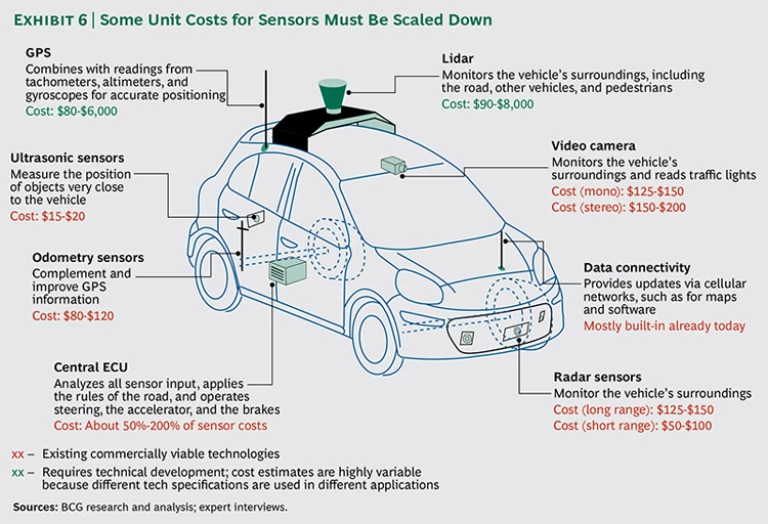

Although some of these technologies are already commercially available, certain critical pieces of hardware—most notably, sensors—will need further development before they can be used commercially. Automotive suppliers and a handful of tech companies have already developed a mix of sensors that rely on radar, cameras, ultrasound, and light detection and ranging (lidar) technology, as well as other computing and positioning systems. But some of the most vital enabling components—specifically lidar sensors and GPS—must be further developed, and their costs scaled down, before OEMs will adopt them. (See Exhibit 6.)

The unit costs of these and other components are highly variable, ranging from the tens of dollars to multiple thousands, because of the wide variance in technical specifications, scale of production, and maturity for each component. For instance, the cost of lidar technology ranges from $90 for a single-beam unit used today in ADAS applications to $8,000 for an eight-beam array that would be better suited to AV applications. OEMs will no doubt use different combinations of sensor components to enable various autonomous features.

Wide Variations in Autonomous Architectures

During the course of this study, we worked with a broad array of OEMs and technology suppliers to identify the various architectures that are currently in play. We found, for example, that different OEMs take different approaches to adaptive cruise control: some rely on a stereoscopic camera, while others use long-range radar in conjunction with a mono-vision camera. Different OEMs are likely to deploy varying configurations of other enabling technologies as well. Some fully autonomous vehicles, for example, may need to use three or more lidars in conjunction with additional sensors, safety redundancies, and GPS to give the vehicle a 360-degree view of its surroundings. Others might not need to use lidar at all, operating with a combination of radar and camera systems instead.

To understand how widely the approaches of different OEMs may vary, consider just two of the many possible sensor-based solutions for achieving fully autonomous driving capability. OEMs that opt to use lidar-based technology to gain a 360-degree view of a car’s surroundings, for example, would focus mainly on supporting the lidar with long-range data collection through long-range radars and mono-vision cameras while using a few radar- or vision-based systems to provide short-range redundancy. OEMs that opt not to use advanced lidar systems to generate a full view around the vehicle, however, would instead employ several short-range radars and stereo cameras. So, to be considered as a viable alternative to short-range radars paired with near-range vision systems, lidar technologies will need to be competitive with those sensor combinations in terms of costs, accuracy, and failure rates.

Whatever combination they choose, OEMs will rely on improved processing speeds to handle the large amount of data from the sensors that enable the car to respond quickly to time-sensitive situations—for example, when road obstacles must be identified and avoided.

The Challenge of Autonomous Software

The other critical technology in need of further development is the software that will interpret sensor data and trigger the actuators that govern vehicle braking, acceleration, and steering. The software will need to be highly intricate to contend with the complexity of the driving environment. To put things in perspective, the software in the latest Mercedes S-class vehicle, which is loaded with several ADAS features, contains roughly 15 times more lines of code than the software in a Boeing 787. The quantity of code required will multiply as vehicle manufacturers move from ADAS to partial autonomy and then full autonomy.

Short-range communications technology—such as vehicle-to-vehicle and vehicle-to-infrastructure communication, collectively referred to as V2X—can be effectively applied to complex driving environments to enhance the safety of AVs. V2X technology can supplement on-board sensors to gather and transmit environmental data, enabling the car to, for example, peer around corners and negotiate road intersections, just as—in fact, better than—a human driver would. Is V2X a prerequisite for AVs right off the bat? There is no consensus on the question among OEM engineers. But there is broad agreement that V2X technologies, which are today being developed in parallel with AV technologies, will enhance AV performance and overall safety.

The complexity of the driving environment will likely govern the launch sequence of partially autonomous features as well. For instance, highways present a less complex driving environment than do urban streets or parking lots, which are replete with nonstandard infrastructure and involve a high level of interaction with other vehicles, pedestrians, and objects. By contrast, low-speed environments, such as traffic jams, may present fewer risks than high-speed driving.

The Price Tag

We estimate that to bring the entire suite of AV features to market, OEMs and suppliers will have to make substantial R&D investments—upward of $1 billion per OEM over the next decade—to further develop sensors and processing technology and integration software, and to perform testing, validation, prototype design, and pilots.

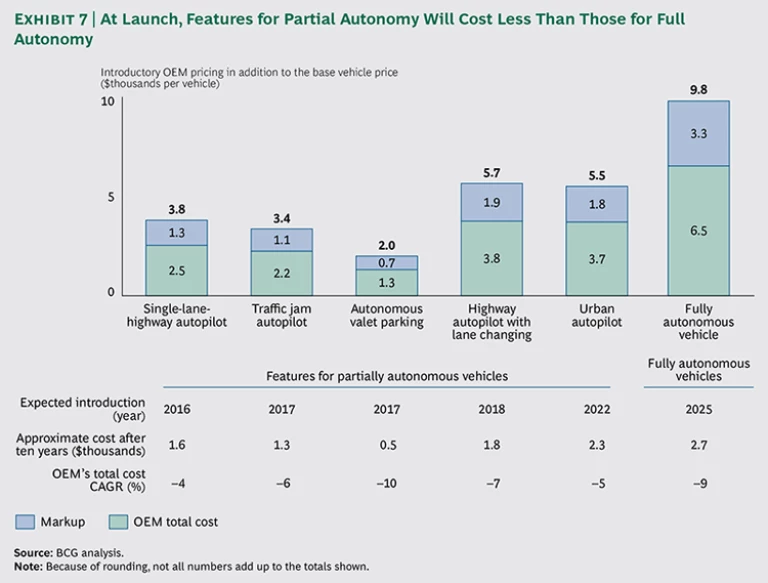

These factors will influence the pace of adoption over the coming years. The technology will not gain commercial scale overnight—and, in fact, it may take several years before OEMs will be able to offer autonomous features at a price that’s both acceptable to consumers and profitable for the manufacturer. We expect that after launch, the cost of individual autonomous features will decline at a compound annual rate of roughly 4 to 10 percent over ten years as component costs are scaled, R&D investments amortized, and assembly costs reduced because of volume increases. (See Exhibit 7.) We expect that by about 2025, the cost of autonomous features initially developed for partially autonomous vehicles will have decreased to the point where adding the sensor and processing capabilities needed to enable fully autonomous vehicles will become economically feasible.

How the Market for AVs Will Develop

AVs will probably emerge in the premium segment of the market first, given the level of interest expressed by current owners of premium nameplates and their ability to pay. The price of autonomy will be fairly high at first, as Ford executives pointed out at the 2015 Consumer Electronics show. The first partially autonomous features expected to be offered to consumers will carry a price tag of around $4,000, equal to a markup of roughly 50 percent over OEMs’ estimated cost. These features, which most likely will include single-lane highway autopilot and traffic jam autopilot, will help OEMs build the scale needed to make future features commercially viable, because many sensors are common across different autonomous features. For example, the sensors for long-range radar, as well as for stereo and mono video cameras—which in combination enable single-lane highway autopilot—are also components of other autonomous features. Those future, higher-priced features include highway autopilot with lane-changing and urban autopilot. We expect that when they are introduced—in roughly 2018 and 2022, respectively—they will be priced from $5,000 to $6,000.

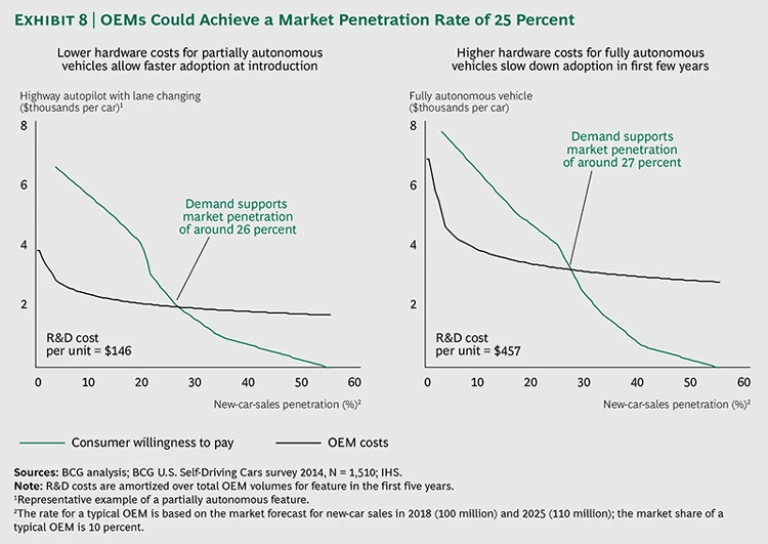

A 20-Year Adoption Curve

As a result of our consumer survey, which indicated high interest and willingness to pay, we anticipate that OEMs will succeed in penetrating the market with AV features, initially by targeting the consumers who indicated that they would be willing to pay more than $5,000 for them. These consumers represent as much as 20 percent of the addressable market. Extrapolating from our consumer price estimates and consumers’ expressed willingness to pay—as well as from the economies of scale for partially autonomous features and historical adoption rates for new technology—we conclude that the combined market for partially and fully autonomous vehicles will develop gradually until it reaches roughly 25 percent of new-vehicle sales. ADAS features, in the meantime, will continue their growth in parallel. The penetration of partially and fully autonomous vehicles will also be influenced by several other factors, including their impact on insurance premiums and safety regulations. (See Exhibit 8.)

As mentioned above, the penetration of these autonomous features over the coming years will allow for the introduction of fully autonomous vehicles by around 2025. And we expect that they will be offered to consumers at a price that is around $10,000 higher than the price of the same model of car without fully autonomous features.

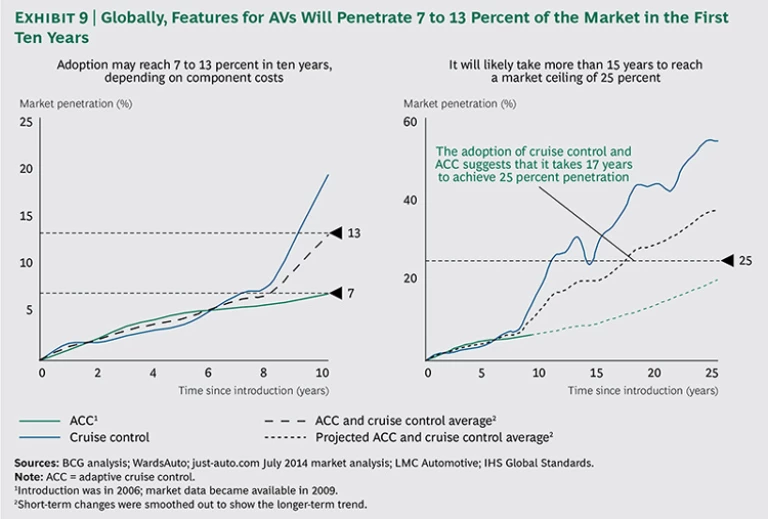

It will take a generation—15 to 20 years after the introduction of the first autonomous features—to reach a global market-penetration rate of 25 percent. (See Exhibit 9.) This rate of penetration aligns with the historical penetration rate of earlier technological innovations, such as cruise control and adaptive cruise control (ACC). Cruise control, introduced in the U.S. in 1967, only slowly won market acceptance in the first five to eight years after its introduction and took an additional ten years to achieve 25 percent adoption. ACC, introduced in 2006, has achieved about 6 percent penetration both in the U.S. and globally after nine years on the market.

High Initial Prices Will Slow Adoption

Although we expect that consumers will be significantly more eager to acquire autonomous features than they have been to acquire ACC in recent years, higher prices are likely to keep the speed of adoption in line with these past innovations. Similarly, the initial $10,000 cost to consumers of full autonomous capability will probably slow the adoption of fully autonomous vehicles in their first years of availability. Overlapping consumer interest in a wide range of features will also create competition among option packages and lead to the cannibalization of partially autonomous vehicles by fully autonomous vehicles as they reach the market.

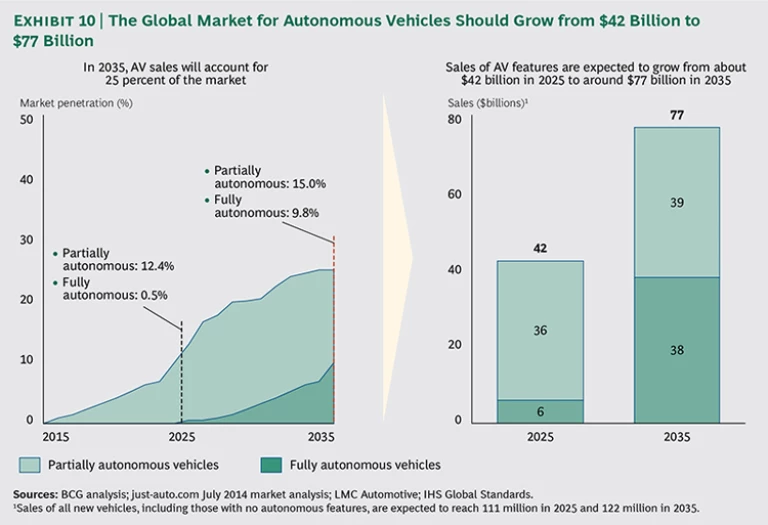

On the basis of these market economics, we estimate that penetration of vehicles with autonomous features—nearly all of them partial—will reach 12 to 13 percent of global vehicle sales by 2025. That represents a market for those features of roughly $42 billion (excluding the base price of the cars), with total annual volumes of about 14.5 million vehicles, including the first 600,000 fully autonomous units. (See Exhibit 10.) By 2035, the penetration of vehicles with autonomous features could reach 25 percent. About 10 percent—or 12 million—of those vehicles would be fully autonomous; the remaining 15 percent—or 18 million—would be partially autonomous. Together they would combine to constitute a market worth roughly $77 billion.

In terms of regional market performance, we expect that consumers in Western Europe and Japan will be among the fastest adopters of these autonomous features. We base this expectation on their history with ACC, which has penetrated about 11 percent of those markets—or roughly twice the global rate of adoption—during the past nine years. The adoption rate in the U.S. has remained in line with overall global adoption throughout this same period, which suggests that BCG’s estimate of consumer demand for autonomous features in the U.S. serves as an accurate proxy for the global market-penetration potential of autonomous features. Counteracting the faster adopters of Western Europe and Japan will be the large percentage of vehicles in China and other markets, which, at 5 percent and 4 percent respectively, slightly trail ACC’s 6 percent global penetration rate.

Multiple Factors May Affect Adoption Rates

Several factors could have an impact on the timing and degree of market penetration that we have forecast on the basis of market economics. These include the following:

- Adjustments to how OEMs update their base-car models and option packages

- The timing and extent of regulatory involvement, especially if AVs are proved to deliver substantial safety benefits

- Insurers’ pricing and marketing strategies

- The intensity and speed with which communities integrate AVs—especially potential “robo-taxis” operated by mobility providers—into the local transportation grid

Several Adoption Scenarios

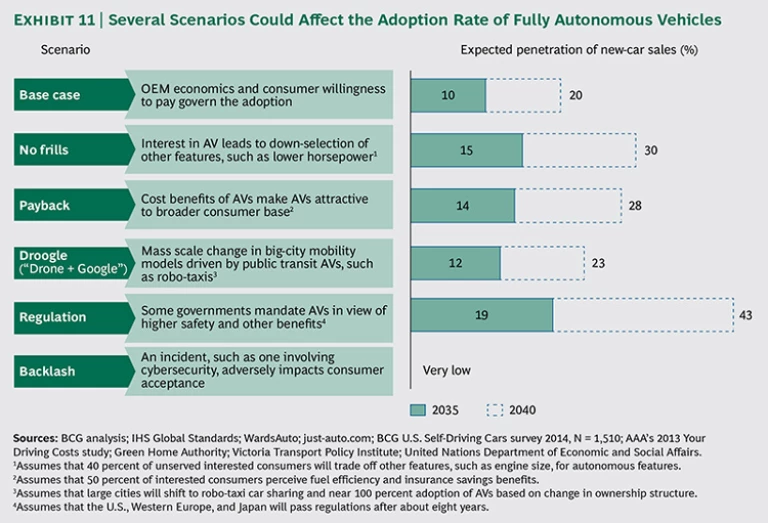

To understand how these factors in various combinations could determine how many AVs, especially fully autonomous vehicles, will be on the road in the years ahead, we have developed a series of several adoption scenarios. The first is the base case, which maps the adoption path on the basis of market economics alone. The remaining we call No Frills, Payback, Droogle, Regulation, and Backlash. (See Exhibit 11.)

No Frills. Under this scenario, consumers interested in purchasing an autonomous vehicle—but only at a fixed price point below the added cost of autonomous features—would be willing to downgrade other features, such as car or engine size and interior appointments, to gain the options they desire. OEMs would begin offering autonomous features and corresponding trade-offs within five years. They would then be able to increase the penetration of fully autonomous vehicles to roughly 15 percent by 2035. The development would have a significant impact on the market landscape as priorities in car design evolve.

Payback. This scenario assumes that more consumers could be persuaded to buy fully autonomous vehicles if the consequent reduction in their fuel and insurance costs would enable them to recoup the price premium they had paid for the vehicle. Our analysis shows that autonomous features could generate at least $2,300 in cost-of-ownership savings over four years, given annual fuel savings of 15 percent through increased efficiency and a reduction in insurance premiums of 30 percent per vehicle as a result of fewer accidents and improvements in overall safety. After three to four years of demonstrated benefits, such savings could help persuade cost-conscious consumers to adopt fully autonomous vehicles at an accelerated rate, amounting to 14 percent of the overall automotive market by 2035, compared with the 10 percent penetration rate suggested by market economics.

Droogle. A third scenario examines how fully autonomous vehicles could impact urban transportation methods. Here, the economics of sharing robo-taxis in cities becomes more attractive than the economics of conventional taxis and even of personal-vehicle ownership. This so-called Droogle scenario (we created the term by combining the words “drone” and “Google”) is an aggressive projection: it assumes that the favorable economics of robo-taxis will lead many of the world’s largest cities to encourage or even mandate the use of AVs for personal transportation. Under this scenario, drivers in urban and near-suburban settings would either choose to give up their personal vehicles or be compelled to do so. This would greatly reduce the total number of vehicles on the road and would spur the adoption of AVs for most personal-transportation needs. The Droogle scenario represents a partial solution to traffic congestion and parking scarcity.

Such a drastic change in many cities across the globe would increase the penetration of fully autonomous vehicles from 12 percent in 2035 to around 23 percent by 2040. (See “Robo-Taxis and the New Mobility.”)

Regulation. The single strongest influence on the growth of the market for autonomous vehicles is likely to be the imposition of regulations mandating autonomy in new vehicles. Such regulations would be spurred by significant potential benefits to society, including reductions in accidents and increased workforce productivity as traffic congestion decreases. Given the historical data on the adoption of front-airbag technology in the U.S. after federal regulators mandated their use, we posit that similar mandates for AV features would drive rapid and almost full adoption of AV technology.

We expect lawmakers to require many years—at least five—of demonstrated safety and economic benefits before they would institute such regulations. They would also allow the OEMs and suppliers a five- to ten-year window to meet those new standards. In estimating the impact of such regulations in this scenario, we have anticipated that the developed markets of Japan, the U.S., and Western Europe could act within roughly eight years after the introduction of the first autonomous features and give OEMs eight years to comply—slightly longer than the six-year window for front airbags in the U.S. Should such regulations be implemented along this time frame, fully autonomous vehicles could reach about 19 percent of the total automotive market by 2035.

Backlash. Our final scenario takes into account the effect that a catastrophic, well-publicized failure of autonomous-driving technology would have on consumers’ and lawmakers’ attitudes and on adoption rates. In such circumstances, it is likely that attitudes toward AVs would turn sharply negative and harden, setting back mass adoption of AVs by several years, if not decades. The impact of such an occurrence on the industry would be severe and widespread, and that possibility underscores the need for rigorous testing and quality control in every aspect of AV design and manufacturing, especially in developing and refining the software that actuates and controls autonomous capabilities.

Sweeping Changes Are on the Horizon

The journey of AVs to market maturity will take 20 years or more to complete. But it is not too soon for the automotive industry, regulators, and all players in the transportation and technology spheres to consider the implications of this revolutionary development and prepare for the changes it will unleash.

OEMs and suppliers will need to decide which features to prioritize and what impact those features will have on the base car. Segmenting the market will be a critical first step: Which features will consumers prioritize, and how will OEMs offer them? Which features will win in the marketplace, and which OEMs and suppliers will be best positioned? These companies will also have to choose among underlying technologies and determine which combinations of lidars and camera, positioning, and radar systems will best enable autonomy and win consumer favor.

What Does “Full Autonomy” Mean?

Additionally, OEMs and leading suppliers will need to invest heavily in the processing power and software architecture and integration that will be necessary to support autonomous driving. The software development will be extremely complex and raise challenging questions. What, for example, constitutes full autonomy?

That’s not just an academic question. There may be situations—a whiteout snowstorm or a sudden, heavy fog—in which safe, fully autonomous operation becomes impossible. How will the vehicle sense such a situation, indicate that it can no longer proceed safely, come to a safe stop, and hand over control to a human operator? And who will be responsible for developing integration technology and its enabling software? Will OEMs take the lead, or will they rely on their suppliers or technology partners?

Strategic trade-offs will influence decisions about whether to make or buy key components. On one hand, by keeping certain technology development—such as sensor fusion and software development—in-house, OEMs can limit their liability exposure and build competitive advantage. On the other hand, partnering with suppliers can be economically advantageous and obviate the need for investments in building internal capabilities. What’s more, changes in liability laws may transfer a greater share of risk to OEMs. Bringing about such changes would require greater coordination among multiple stakeholders, including suppliers, insurance companies, lawmakers, and governments.

New Technologies, New Entrants

The AV revolution also opens the door for new entrants across the value chain, especially considering the potential use of AVs in commercial and urban settings. New technologies will provide opportunities for emerging sensor and processor suppliers, and the need for high-definition maps and data connectivity will create further growth opportunities in the automotive space for technology companies. AVs will boost demand for connectivity and cloud-based data services as well. Telecommunications companies will need not only to plan investments in infrastructure but also to collaborate with automotive players and explore new service models for consumers. OEMs will need to watch for disruptive moves by tech players, such as Google’s and Apple’s forays into the automotive arena.

What’s more, OEMs may be able—or may be forced—to develop new business models to better serve urban markets, in which personal-vehicle ownership is no longer considered desirable or necessary. And what player, existing or new, will develop new models for operating and coordinating safe, cost-competitive commercial-vehicle fleets incorporating AV technology?

Challenges for Policy Makers

AVs also raise urgent questions for public authorities. Regulators—together with OEMs, insurance companies, and safety administrations—will need to design and enact legislation that will define the infrastructure necessary for autonomous driving, allocate liability for accidents and technical failures, and specify minimum technological requirements. They will also need to devise systems for measuring changes in auto safety.

And they may be faced with unexpected trade-offs, such as choosing between autonomy and zero emissions. If autonomous features turn out to improve safety significantly, can regulators require consumers to pay for both autonomy and zero emissions? And if the cost is higher than what the market can bear, will the prospect of reduced emissions lead regulators to encourage the adoption of electric vehicles, or will the safety and productivity benefits of AVs tip the balance in their favor?

Meanwhile, public-transportation policy makers will need to consider the economics of AVs and consumer attitudes toward AVs in their investment plans. Their long-term planning must take into account the possibility that the favorable economics of AVs might lead consumers not only to give up their own vehicles but also to shun conventional mass transit in favor of robo-taxis. This phenomenon could be particularly pronounced in megacities in emerging markets, where public-transit capacity can’t keep up with rising demand. Policies that would nudge drivers to switch to AVs—such as requiring drivers to obtain expensive permits for conventional personal vehicles—could dramatically advance efforts in those cities to emphasize transportation by walking, bicycling, and robo-taxi. The policy ramifications would be massive and far-reaching. One possible consequence: municipal authorities would have compelling opportunities to transform parking structures into more socially and economically beneficial spaces.

AVs will also disrupt business models in the mobility environment and have significant impact across many other related sectors. When robo-taxis are widely and cheaply available, will conventional taxis and car rentals become redundant or converge in a single-service concept? What shift will occur within the insurance business if auto accidents become a matter of product liability rather than personal liability? Will the potential for improved safety lead insurance providers to reward AV owners? How will the anticipated reduction in accidents affect downstream businesses, such as repair shops, towing services, and legal services? Expected traffic benefits and a reduction in the total number of cars on the road resulting from increased car sharing could also reshape parking and infrastructure investments and lower oil and gas demand.

This list only scratches the surface of the changes in store. After all, it is not every day that one of the world’s most important industries is thinking globally about putting someone else in the driver’s seat. Or even no one.

Acknowledgments

The authors wish to acknowledge the valuable cooperation of the World Economic Forum. The authors would also like to acknowledge the contributions of Michelle Andersen, Aakash Arora, Johanna Engel, Lara Koslow, Krisada Kritayakirana, Jan Willem Maas, Sudarshan Mhatre, Jan-Hinnerk Mohr, Mike Quinn, Thomas Steffens, Ashwin Subramani, Henry Sun, Mikael Ternhult, Justin Vincent, and Hadi Zablit.