Good morning. It’s 6:30 a.m. and time to get ready for work. You, representing an ever-growing share of the world’s population, live in a megacity—in your case New York, though it could easily be Shanghai, Paris, or any number of other huge cities. Between you and your office stand several miles of bumper-to-bumper highway traffic, so you reluctantly roll out of the house and into your car at 7:15 sharp, hoping to arrive at the office by 9:00.

Revolution in the Driver’s Seat: The Road to Autonomous Vehicles

Revolution in the Driver’s Seat: The Road to Autonomous Vehicles

The first generation of autonomous vehicles is coming soon to a highway near you. Is the automotive industry ready for a revolution?

Now imagine an alternative. Last night, you arranged for a taxi to show up at your door at 7:45 this morning, knowing as you do that the trip will take less time than it would if you were to drive yourself. Soon after you get in the car, it picks up another passenger going in the same direction, who sits in a separate, private compartment. There are no commuter train schedules to worry about, no parking hassles, and no need to weave through the rush-hour crowds in town. Better yet, your taxi ride is cheaper per mile than the cost of driving yourself. And you won’t have to tip your driver. The car drives itself.

Real-world pilots of these “robo-taxis” are already being conducted to test the use of fully autonomous vehicles for commuting short distances or providing first-and-last-mile connectivity to main public-transportation nodes. Many of these vehicles will likely be owned and operated by mobility providers—taxi service operators, ride-sharing services, new entrants from the technology sector, OEMs—and rented to consumers by the minute or the mile. Robo-taxis would offer commuters door-to-door service, enable them to work or be entertained during the trip, and allow them to share the ride—and cost—with other commuters. The cost of a robo-taxi ride would be lower than that of a conventional cab ride and, depending on the commuter’s annual driving mileage and car occupancy, could be less than owning a vehicle.

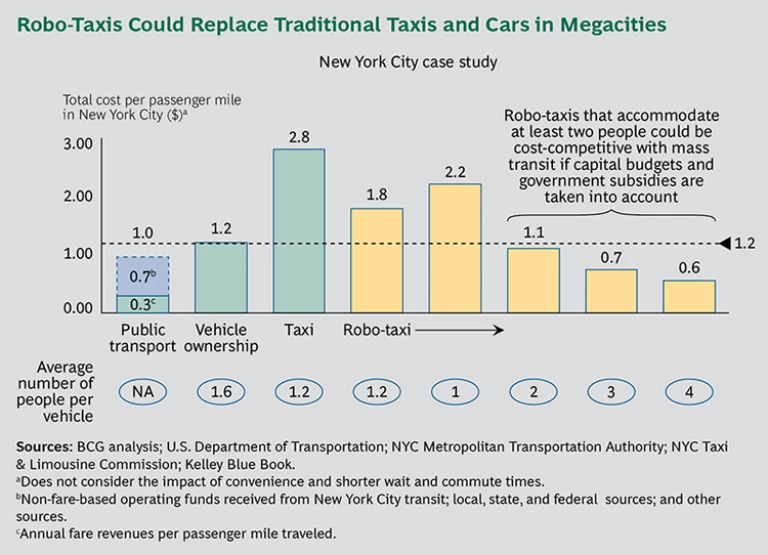

In our New York example, the cost of conveying one passenger one mile by robo-taxi would be 35 percent less than doing so by conventional taxi at the average taxi occupancy rate of 1.2 passengers. (See the exhibit below.) From a provider’s perspective—and factoring in the full cost of public transit, including government subsidies—robo-taxis would become competitive with mass transit at an occupancy rate of 2 passengers.

The cost comparison supports the case for replacing conventional taxi fleets with robo-taxis. AVs could also whittle away at subway ridership if passengers who use the subway mainly for short trips opt to pay a slight premium for door-to-door service. The economics of robo-taxis could even persuade some drivers, especially those who don’t rack up a lot of miles per year and who are open to car sharing, to give up their cars altogether.

AVs could spur mass-market adoption of ride sharing, which could ultimately result in a marked reduction in owned vehicles and in the total number of cars on the road, at least within cities. It could also slow the growth in vehicle sales over time, reducing the total number of cars in cities worldwide, easing traffic congestion, and improving urban land use as parking infrastructure is repurposed or replaced. Congestion and greenhouse gas emissions could be diminished as automation technology, including vehicle-to-vehicle communication, optimizes routes and vehicle flow.

The application of AVs to taxi and car-sharing business models will have far-reaching consequences for mobility players. Public transportation companies will need to reconsider their infrastructure investments as shared AVs blur the frontier between public and individual transportation. What will change when public transportation and mass transportation are no longer synonymous?

Taxi companies will need to anticipate and adjust to a new business model in which times and locations of pick-ups would be optimized centrally and in which municipalities might want to play a bigger role. OEMs, for their part, must prepare to cater to a growing business-to-business customer base. And finally, urban vehicle owners will need to select their next vehicle carefully—it might be the last one they will ever buy.