Management teams at manufacturers of both industrial and consumer goods face a critical question for each of their products’ parts and manufacturing processes: Should we make it in-house or buy it from a supplier?

Although the make-or-buy decision has been on management agendas for decades, the complexity and relative weight of the factors to optimize have changed in recent years. In the global economy’s prevailing atmosphere of uncertainty, the need for resilience to quickly recover from economic adversity—caused by, for example, currency shifts, energy costs, rising wages, and advanced manufacturing technologies—has gained importance relative to shorter-term financial considerations. Manufacturers recognize the benefits of being able to respond rapidly to fluctuations in demand from other manufacturers throughout the value chain and from end customers.

Manufacturers seeking to use make-or-buy decisions to enhance their ability to cope with today’s uncertain and dynamic economic environment must often revisit decisions made years ago under different circumstances. For example, consider the experience of a European automotive manufacturer that we will call AutoCo. A decade ago, after determining that it could not capture significant cost savings through outsourcing, the company decided to keep the stamping and parts-processing functions in-house. In reviewing today’s market landscape, however, AutoCo considered outsourcing arrangements from the perspective of resilience in the face of economic adversity as well as total cost. The company found that by outsourcing to new suppliers in nearby countries, such as Poland and the Czech Republic, it could achieve only small reductions in total cost. More important, however, AutoCo determined that it could increase its resilience during economic downturns. The company recognized that it would benefit from replacing the fixed costs of in-house production with variable costs made possible through outsourcing. Reducing the share of fixed costs in the total cost base decreases a company’s break-even point, allowing it to maintain profitability even if demand should drop significantly. To capture this advantage, AutoCo decided to outsource stamping and parts processing even though the reduction in total cost would be negligible.

In assessing make-or-buy decisions, manufacturers need also to consider the potential for rapid and dramatic changes in the cost structures of their production locations around the world. Companies are producing goods in more locations than ever before, and these locations’ cost competitiveness is continually changing. For example, manufacturing wages in China have been skyrocketing by as much as 20 percent annually, eroding the country’s cost advantage as a sourcing location. (See The Shifting Economics of Global Manufacturing: How Cost Competitiveness Is Changing Worldwide, BCG report, August 2014.)

In this dynamic environment, leading manufacturers are taking a longer-term perspective that assesses how each region’s cost structure (including labor, logistics, energy, overhead, and taxation) will evolve over the next five to ten years. For example, a U.S. manufacturer of consumer durable goods that we will call ConsumerCo considered whether to add production capacity in Mexico or China. In assessing each location’s cost structure, ConsumerCo found parity as of 2015, but by 2025, Mexico would have a clear advantage. Hence, it added production capacity in Mexico. Such insights into how cost competitiveness will evolve over the next decade provide essential inputs for make-or-buy decisions today.

The Scenario-Based Approach

To establish the basis for make-or-buy decisions, manufacturers need to systematically assess each product, part, and process along two dimensions: strategic value and the cost of in-house manufacturing versus that of outsourcing. However, it is also important to take a holistic perspective by considering the full range of implications of all make-or-buy decisions across product lines and manufacturing locations. These decisions can affect, for example, sourcing and logistics costs, capacity utilization, workforce requirements, and investment requirements, as well as entail one-time costs, such as severance payments.

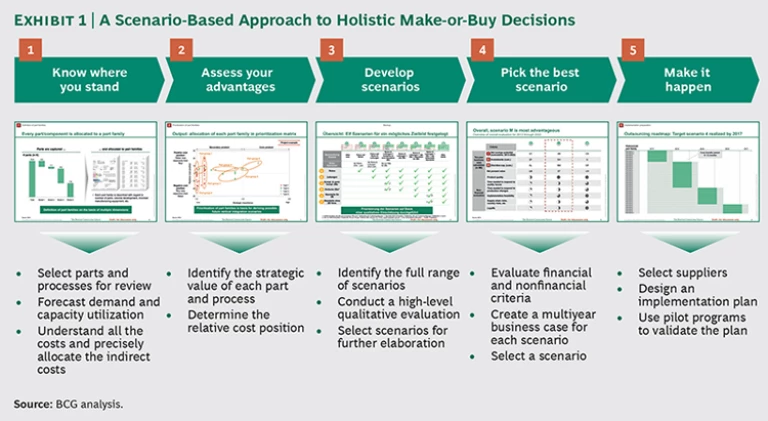

To maximize their advantages, leading manufacturers use a scenario-based approach to simultaneously assess and compare value creation and cost structures for a broad array of sourcing decisions. (See Exhibit 1.) This holistic approach enables manufacturers to develop a comprehensive set of guidelines for make-or-buy decisions companywide.

The scenario-based approach entails the following five steps:

1. Know Where You Stand

The first task in creating the fact base for make-or-buy decisions is to identify the products, parts, and processes—which, in the following discussion are referred to, collectively, as parts—that will be included within the scope of the analysis. The manufacturer needs to thoroughly assess each part selected to learn where it stands in terms of demand, capacity utilization, and costs.

To determine its future production requirements, the manufacturer should forecast demand for each part on the basis of the company’s current strategic plan. Manufacturers typically have a strategic plan that forecasts how many end products (such as cars) they expect to sell during the subsequent ten years. To precisely quantify production requirements, the manufacturer needs to break down this end-product forecast to the level of parts.

To determine future capacity requirements and utilization levels for its equipment at the forecast demand levels, the manufacturer should identify the equipment used in each part’s production process and record production times for each machine. In performing such an assessment, AutoCo found that to meet the forecast demand levels during the subsequent ten years, the company would be required to increase its production capacity by 20 percent more than it had previously estimated. This finding had a significant impact on make-or-buy decisions, as the need for larger-than-anticipated investments in capacity made outsourcing a more attractive option in some cases.

Such assessments allow the manufacturer to determine the full cost of internal production for each part. This detailed understanding is particularly valuable because it allows for the precise allocation of indirect costs to each part, ensuring the manufacturer’s ability to compare the full and accurate cost of producing a part in-house with offers from suppliers. Rather than making this detailed cost assessment, many companies allocate costs for equipment, indirect labor, and overhead to each of their thousands of parts purely on the basis of simple proxies, such as the share of raw-material costs attributable to each part. But these allocation approaches can yield inaccurate cost estimates as inputs to make-or-buy decisions.

2. Assess Strategic Value and Cost Advantages

The manufacturer should use the fact base to assess the strategic value of owning and operating each part’s manufacturing process and controlling the related technology and intellectual property, as well as to determine the company’s relative cost position for each part.

To assess strategic value, the manufacturer should first determine the relevant dimensions to evaluate. These dimensions may include flexibility, structural advantages, innovation potential, interdependencies, customer expectations, and supplier availability.

The flexibility to rapidly ramp production levels up or down allows manufacturers to capture revenue opportunities without risking underutilization of capacity. Flexibility also allows for variable costs, which can preserve profit margins. These benefits should be weighed against the risks related to intellectual-property protection and supply continuity that can arise in outsourcing arrangements. Assessing strategic issues also requires the comparison of the manufacturer’s structural advantages (such as scale in production and procurement, location, and supply chain relationships) with those of potential suppliers. Furthermore, manufacturers should consider whether a product platform might be valuable for future development of product or process innovations before deciding to hand over control to a supplier.

Operational issues—such as those arising when control of manufacturing is critical for differentiation and sustaining competitive advantage—also have implications for strategic value. Products and processes—for example, those involving both engineering and manufacturing—that strongly depend on close internal coordination are typically more valuable kept in-house. In addition, customer expectations for consistently high quality and short supply chains argue in favor of creating value through in-house production. The strategic value of in-house production is also higher if there are only a few qualified suppliers. In such cases, a manufacturer that outsources risks becoming dependent on a particular supplier and giving that supplier strong leverage to negotiate significant price increases.

To determine their relative cost position for each part, manufacturers should first identify potential supplier sites for the comparison, considering the most feasible regions or countries. It is essential to assess the most up-to-date information on suppliers’ capabilities and capacity. For example, in Eastern Europe, suppliers offer advanced technologies today that were not available in that region a decade ago.

Manufacturers can use quantitative models to determine their relative cost position and savings potential. Models compare the cost structure at each manufacturer’s current locations with those at supplier locations in multiple countries and regions—incorporating local parameters for the development of labor costs, productivity, energy costs, and other factors over the subsequent five to ten years. Manufacturers can validate the input parameters for specific locations using offers from two or three suppliers.

ConsumerCo used an analysis of relative costs to determine that it would likely be at a cost disadvantage to suppliers if it were to insource metal-finishing processes. It found that its suppliers’ scale gives them an advantage with respect to fixed indirect costs and bulk purchasing of materials. Moreover, ConsumerCo would need to make a significant up-front capital investment to purchase the equipment required to perform finishing in-house.

3. Develop Scenarios for Sourcing Combinations

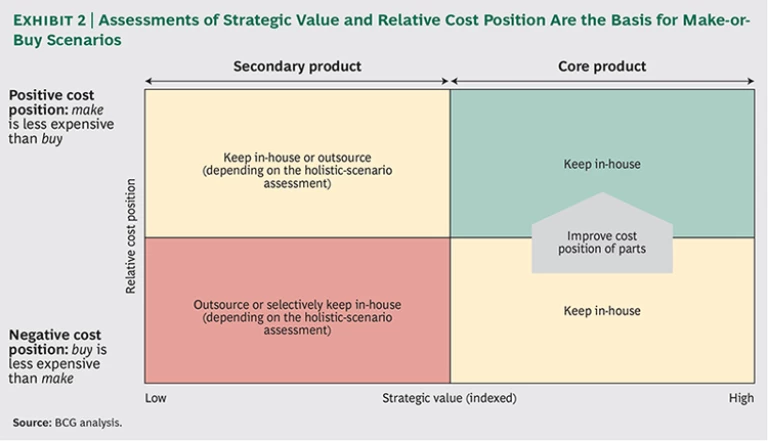

Combining the results of the assessments of strategic value and relative cost position in a four-field matrix allows manufacturers to identify those parts that should be prioritized for in-house production rather than outsourcing. (See Exhibit 2.) The production of parts represented in the exhibit’s upper-right quadrant should be kept in-house: they have high strategic value, and making them is less expensive than buying them. For parts in the lower-right quadrant, the goal should be to improve the relative cost position so as to create more value from in-house production. These items have high strategic value, but buying them is less expensive than making them. Because of their low strategic value, parts in the two left-hand quadrants are strong candidates for outsourcing. Although in-house production of parts in the upper-left quadrant is less expensive, manufacturers should choose in-house production only if they have difficulty accessing suppliers or can realize significant savings without diminishing their ability to focus on core strategic products.

The allocation of parts to specific quadrants of the matrix provides the basis for deriving scenarios for different combinations of in-house production and outsourcing. The scenarios under consideration should cover a wide spectrum that ranges from in-house production of all parts to outsourced production of as many parts as possible. For example, because parts positioned in the matrix’s two left-hand quadrants have low strategic value, a manufacturer should consider a scenario in which production is outsourced for all of these parts.

Holistic scenarios that group parts on the basis of the equipment utilized are crucial for understanding the optimal make-or-buy decision. In some cases, such scenarios may reveal that it is financially optimal to keep production of parts with a negative cost position in-house or to outsource parts with a positive cost position. For example, consider a set of parts that are good candidates for outsourcing because they are positioned in the matrix’s lower-left quadrant (low strategic value and negative cost position). The company needs to evaluate whether outsourcing production of these parts would result in the underutilization of any equipment used also to manufacture higher-value, lower-cost parts whose production remains in-house. If outsourcing would result in underutilization of this equipment, the company should consider whether production of other parts could be shifted to that equipment in order to maintain high utilization levels. If there are no viable alternatives for preventing underutilization, the optimal decision may be to keep production of the lower-value, higher-cost parts in-house or to outsource the higher-value, lower-cost parts so that the underutilized equipment can be taken out of service.

4. Pick the Best Scenario

To evaluate and rank the scenarios according to their potential for value creation, the manufacturer should consider both financial and nonfinancial criteria. Financial criteria include annual cost-savings potential, additional costs relating to equipment and employees, requirements for future investments, and restructuring and one-time implementation expenses (such as for planning, project management, setting up procurement, or redeploying equipment and modifying tools). Nonfinancial criteria include the ability to maintain product quality, availability of suppliers, feasibility of implementation, opportunities for innovation, and supply chain and country risks.

A typical evaluation should consider a wide range of topics that directly affect the financial and nonfinancial criteria, including the following:

- Machine Utilization. How will in-house machine utilization develop over time for each scenario, and which machines will be overutilized or underutilized? The manufacturer should use this information to determine the implications for costs and required investments.

- Workforce Development. How will workforce requirements develop in the affected functions under each scenario? Will positions be available for employees who cannot easily be redeployed to different jobs? This information provides the basis for estimating expenses related to severance payments and to the hiring of additional workers.

- Space Requirements. To what extent will space requirements for plants change under each scenario? If underutilization of plants is expected, it is important to consider alternative uses for the free space, as well as optimization of the overall plant layout.

The evaluation of financial criteria allows the manufacturer to create a detailed business case for each scenario. Such a business case should cover a multiyear period and be based on the scenario’s net present value (NPV). To ensure the stability of results, the manufacturer should perform sensitivity analyses that consider how NPV would be affected by altering assumptions about future production costs, investments, and one-time implementation costs.

By giving appropriate weight to nonfinancial criteria, AutoCo ultimately was able to select a scenario that had a slightly weaker business case than another scenario under consideration. The selected scenario required fewer layoffs and rated more favorably with respect to implementation feasibility, product quality, risks, and time required for responding to production changes.

5. Get Ready to Make It Happen

If the chosen scenario entails outsourcing, the manufacturer needs to select suppliers with the required production technologies and available capacity. In some cases, this can be done within a few months. In others today, however, it can be challenging to find or develop suppliers with the capabilities and capacity to take responsibility for large volumes of production. In these situations, shifting volumes to suppliers is a complex process that can take several years. The process requires close collaboration and innovative ideas, such as the formation of a joint venture in which the manufacturer and another party coinvest in production equipment.

Regional differences are also critical considerations when planning for implementation. The implementation of outsourcing arrangements is significantly slower, costlier, and more complex for companies that operate in Europe than it is for those operating in the U.S. Many European countries impose restrictions on shutting down plants, and they require companies to redeploy workers or pay severance when jobs are shifted to suppliers.

To create a short list of outsourcing partners, a manufacturer should request proposals for services and prices from potential suppliers. Furthermore, it should assess each supplier’s technology, as well as the opportunities to coordinate capacity planning.

After it selected a supplier, AutoCo prepared a detailed implementation plan to help manage the complex process of shifting volumes. The plan defined the outsourcing sequence for parts, established pilot programs on the basis of the negotiated prices, and specified how the parties would coordinate and train employees involved in the outsourcing arrangement. The pilot programs produced the first outsourced parts and served to validate the proposed arrangement and to spotlight any potential problems.

Making the Case for Action

For manufacturers that master make-or-buy decisions across their product lines, the competitive advantage can be significant. In addition to achieving near- and long-term cost savings, companies will be able to align their sourcing strategies with their core capabilities and strategic objectives. Developing and evaluating scenarios as the basis for a holistic decision-making process will be essential for maximizing the benefits of resilience and increasing the breadth of value creation.

To make the case for action, manufacturers should consider the current status of their make-or-buy decisions. The evaluation should consider a number of questions:

- How frequently do we reassess our make-or-buy decisions? Are we up-to-date regarding cost-savings opportunities in the current outsourcing market? Have we recently considered how new entrants to the outsourcing market can help us achieve greater resilience and other strategic priorities?

- Have we assessed the strategic value of all products, parts, and processes? Do we know how our costs for producing parts or running processes in-house compare with outsourcing over both the near and the long terms?

- Do we prioritize parts and processes for in-house production on the basis of their strategic value and relative cost position? Have we used this prioritization to create scenarios that allow us to comprehensively assess make-or-buy options across all product lines?

- Do we consider the full range of implications for make-or-buy decisions in developing a business case and assessing nonfinancial criteria, including equipment utilization, workforce development, and space requirements? Do

we consider how future macroeconomic developments might affect the business case? - Do we systemically create a short list of suppliers for implementing our outsourcing decisions and develop well-designed plans for piloting and launching the arrangement?

For many manufacturers, the answers to these questions will point to opportunities to capture significant benefits by adopting a more rigorous and comprehensive approach to their make-or-buy decisions.