It’s no secret that the gold mining industry has endured a roller-coaster ride since 2004, driven in part by changing economic conditions and price volatility. The industry’s average annual total shareholder return (TSR) has risen and plunged, sinking to new lows recently. While TSR performance has varied across companies, the industry overall has been destroying shareholder value since 2011, erasing gains that had come with a decade-long bull run.

Sluggish Gold-Price Recovery

While many still believe that a near- to medium-term price recovery will revalidate mining companies’ current business models, we have a more bearish perspective, drawn from our proprietary Commodity Market Insights (CMI) forecasting methodology. In CMI, we’ve built gold-price scenarios based on granular analysis of demand and supply fundamentals. On the demand side, we analyzed trends in use of gold for jewelry, investment, and industrial applications. On the supply side, we factored in trends in gold mining, scrap gold, and central banks’ selling and buying of gold. Our analysis also took into account macroeconomic trends, such as demographic developments and gross domestic product (GDP) scenarios and their implications for consumption. In addition, we considered segment-specific insights, conducting comprehensive deep dives on key demand categories and regions.

Our analysis suggests that producers and investors shouldn’t hold their breath waiting for price to recover and restore miners’ margins. In the near term, we anticipate a further price reduction in line with analyst consensus, driven by waning investment demand and a relatively stable economic outlook. In the medium term, however, we expect a more muted price recovery than the consensus view, shaped by continued low investment demand and the “Westernization” of Chinese consumer sentiment, which will increase price elasticity and reduce relative intensity of gold in the luxury segment. In the long run, stable demand and primary supply depletion will likely help prices recover to 2013 levels, but this will take time.

Industry Fundamentals Under Pressure

During the earlier rapid increase in gold prices, deterioration in industry fundamentals (including production profiles and costs) was largely obscured by miners’ continued revenue growth and consequent healthy margins. The recent price decline and sobering medium-term outlook have reminded industry players of the fundamentals’ importance.

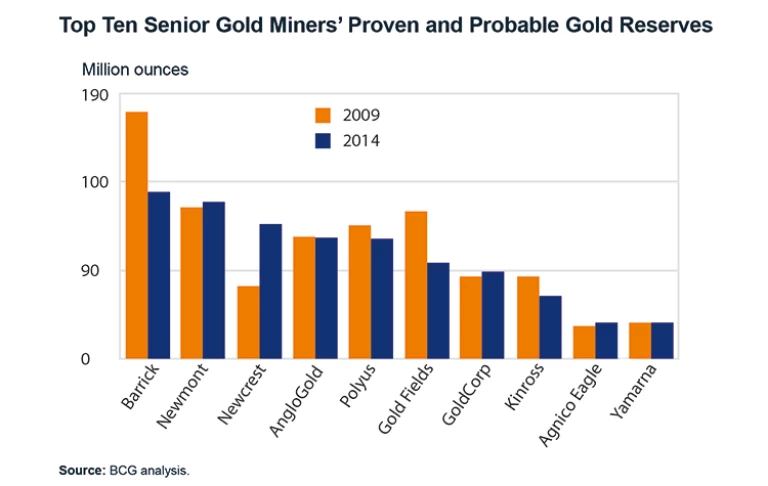

Most producers currently face a flat or declining production outlook, even in the near term. Revised price assumptions have reduced the life of currently producing assets. Reluctance to advance current projects in the face of fading investor appetite, a desire to preserve balance-sheet strength, and the need to preserve optionality have constrained medium-term growth opportunities. Meanwhile, reduced yield from exploration has brought long-term growth opportunities into question. (See Exhibit 1.)

In parallel, production costs have soared in recent years. (The average all-in sustaining costs, or AISC, of about $700 per ounce in 2010 jumped to roughly $1,000 per ounce in 2012.) This was driven primarily by declining ore grades, increased complexity of remaining ore, and rising input costs (such as for labor). Since gold prices have plunged, gold miners haven’t managed to lower their cost base. (The average AISC dropped to only about $900 per ounce in 2014.) Result: their margins have suffered. Going forward, we expect production costs to decrease further. But the important question is how quickly companies can fundamentally rethink their production approach, given that new discoveries tend to be in relatively remote locations, are of lower grade than before, have a shorter life, and/or have higher sovereign risk.

Fixing the Fundamentals

The challenging price outlook we detailed above, combined with pressure on many of the industry’s fundamental value drivers, has reduced gold miners’ asset values and their ability to generate free cash flow. And that has eroded investor confidence. Most players have responded by cutting compressible costs and selling high-cost, short-lived, smaller assets and acquiring low-cost, long-life, large-scale assets in safe jurisdictions. These efforts have helped them considerably reduce their production costs over the past two years. However, the low-hanging fruit has now been largely picked.

At the portfolio-management level, companies have seen mixed results. Not surprisingly, unattractive assets put on the market have found limited buyers. What’s more, narrow supply of low-cost, long-life, large-scale assets in safe jurisdictions can spark a bidding war and a rapid escalation in valuations (as witnessed in the Osisko case). This is a zero-sum strategy, and if the sector continues to pursue it, there will be few winners and many losers.

To avoid this scenario, we suggest that players take a systematic approach to fixing the fundamentals. The following actions could help:

- Go beyond cost cutting and transform your cost base by using all available levers to deliver sustainable performance improvement.

- Prepare for growth by strengthening your balance sheet, tapping alternative financing mechanisms, and/or making targeted divestitures of noncore assets. (We define these as assets that don’t leverage their owners’ competitive strengths and may be of greater value to their “natural owners.”)

- Develop a deep understanding of your competitive advantages, and build on those advantages to shape your strategy. We believe that companies that can do this will continue to outperform rivals by focusing on core geographies and assets that enable them to unlock the greatest differential value.

- Articulate your strategy in clear, concise, and convincing terms to investors.

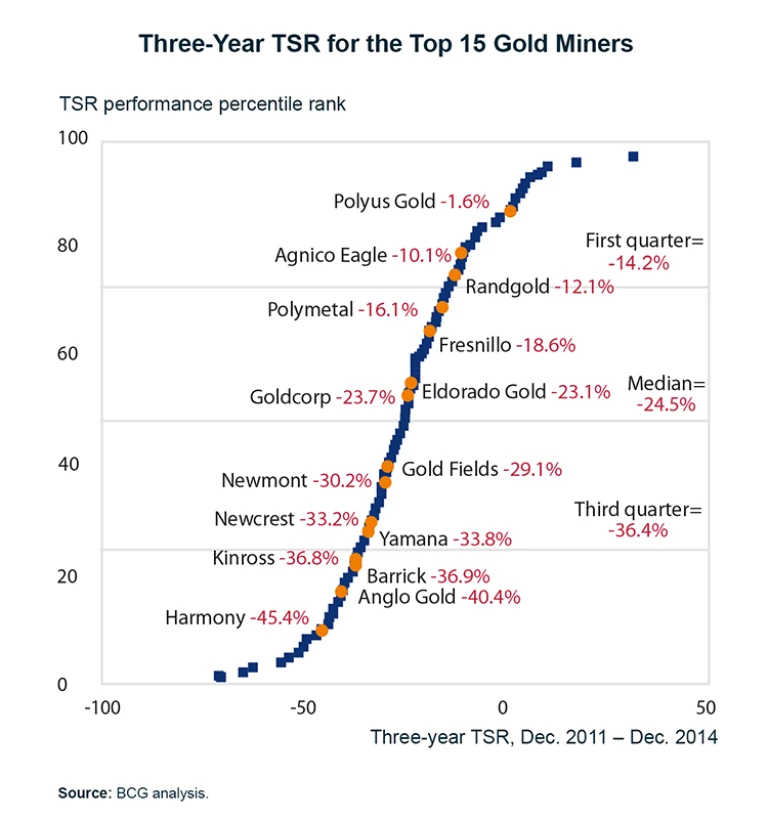

Our recent analysis of TSR for 15 major gold producers between December 2011 and December 2014 suggests that adopting these practices pays big dividends. (See Exhibit 2.) The top three performers in our analysis are Polyus, Agnico-Eagle, and Randgold. With the exception of Polyus, they’ve still delivered negative shareholder return in this difficult trading environment. But they’ve outperformed the rest of the industry in TSR in part because they have crafted, executed, and communicated a differentiated strategy that leveraged their intrinsic competitive strengths.

These companies’ experience also demonstrates that although strategic differentiation can have many different guises, all effective strategies build on companies’ strengths in carefully chosen areas (such as geographies, mineralogies, and operating environments). For instance, while Polyus has a strong jurisdictional focus in Russia, Randgold has a value chain focus in exploration and a geographic focus on West and Central Africa. Meanwhile, Agnico-Eagle leverages its geological knowledge in key operating areas to identify and secure attractive portfolio additions before others become aware of them. Crafting and successfully operationalizing differentiation strategies constitute gold miners’ new imperative. But separating themselves from the herd will take courage. Miners will also need a thorough understanding of how their strengths differ from their rivals’—and how those strengths can translate into new value for investors. Hard work, yes, but work that no miner can afford to ignore.

This article was first published in Mining Journal on May 29, 2015.