Amid the overall decline in print advertising, a few segments of still-robust spending defy digital’s inroads. Fashion and beauty magazines are one such pocket. The number of ad pages in fashion and beauty magazines actually increased from 2011 through 2014, from 18,466 to 19,432. (However, the 2014 total was slightly lower than the 2013 total.) Total fashion-and-beauty ad spending in the U.S. rose more than 20% over the same period, from $3.8 billion to $4.6 billion. Although these magazines’ share of the luxury and affordable-luxury ad segments was flat or down slightly, the share of the largest segment—mass market—rose 4 percentage points from 52% to 56%. (See “Our Methodology.”)

OUR METHODOLOGY

BCG’s analysis of spending trends in advertising is based on data from Kantar Group, a market research firm. The top 100 parent-company advertisers (as determined by 2014 ad-page purchases across the fashion-and-beauty magazine category) were broken into more than 525 brands and classified into luxury, affordable-luxury, or mass-market segments on the basis of brand type, category, and price points of the items sold. The media analyzed do not include B2B or Hispanic media. The magazines included in the fashion and beauty category for this analysis are Allure, Cosmopolitan, Elle, Glamour, Harper’s Bazaar, InStyle, Marie Claire, People StyleWatch, Vanity Fair, Vogue, and W. The categories included in fashion and beauty advertising are beauty, hair, apparel, accessories, jewelry and watches, and ready-to-wear.

Magazines not only remain relevant but also continue to be central to fashion and beauty marketers. They receive the biggest share by far of these advertisers’ money. In more than 25 recent interviews that The Boston Consulting Group conducted with fashion and beauty marketers, media planners and buyers, and public relations executives, respondents spoke of the quality of print, luxurious advertising environment, and authority, which give magazines their cachet.

But these executives also made clear that they have evolving needs. Digital is rising in importance. Video is a complementary capability that print publishers need to develop—especially for reaching younger consumers—and advertisers increasingly demand added-value events, activities, and exposure as part of their print buys. Expectations are high and climbing higher—not only for a publication’s performance with readers but also for the package of benefits that publishers provide to big ad buyers. Publishers are going to have to work harder to maintain their current positions—and harder still if they want to stand out.

A Print-Heavy Media Mix Remains the Norm…

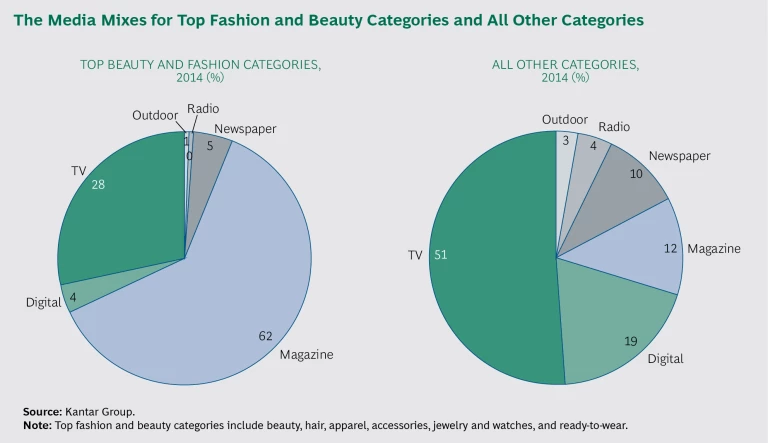

The good and bad news for fashion and beauty magazines is that their advertisers have print-heavy and digital-light media mixes: 62% in magazines compared with only 12% in magazines for all other advertisers. (See the exhibit, “The Media Mixes for Top Fashion and Beauty Categories and All Other Categories.”) It’s good news because demand for the print advertising product remains strong; bad news because print is a big target, and there is plenty of pressure to redirect spending toward digital and other areas in the future.

For the moment, at least, there is no sector-wide trend toward pulling out of print. The ready-to-wear, apparel, and hair segments all increased magazine spending as a percentage of their overall media mix from 2011 through 2014, while accessories, jewelry and watches, and beauty decreased their share by modest amounts. Advertisers say that print still provides an excellent physical and editorial environment for their products and brands: the touch, feel, gloss, and beauty of magazines provides a unique user experience, which is particularly important for luxury advertisers. At the same time, mass-market and affordable-luxury advertisers use magazines to elevate their brand positioning through the proximity of their ads to high-quality editorial content and ads from luxury marketers. One of the ramifications of digital advertising, of course, is an increased emphasis on targeting and measurability in all media. But fashion and beauty brands continue to consider both qualitative and quantitative factors in building their brand campaigns. More so than many other advertiser types, they consider input from multiple stakeholders other than their media agencies—for example, beauty or fashion-house creative directors and public relations practitioners. This is particularly true of luxury brands, over which creative stakeholders have substantial influence regarding brand positioning and development. Luxury and affordable-luxury brands are especially thoughtful about the quantitative-qualitative balance because of their emphasis on premium branding. “A significant part of the [ad buying] decision is qualitative,” one luxury advertiser told us. “We like to look at efficiency but also accept that we want to be aligned with the right brands.”

…But the Market Won’t Get Any Easier

Although magazines still own most of fashion and beauty advertisers’ budgets, from 2011 through 2014, luxury and affordable-luxury companies did decrease their overall magazine spending, while increasing newspaper and maintaining digital as shares of the media mix. (For magazines, luxury declined from 79% to 78%; affordable luxury, from 75% to 72%.) A big issue for many of these companies is their need to reach Millennial consumers (18- to 34-year-olds). This need is shifting marketing spending toward digital channels and social media. More and more, digital and social outlets are focusing on fashion and beauty, and they are both improving their offerings and gaining greater authority with both consumers (especially Millennials) and the fashion industry.

Multiple fashion and beauty bloggers have become well-known, influential figures, for example, building large followings and establishing themselves as regulars in the front rows of fashion shows. These new arbiters of cool and hip are highly adept at leveraging the advantages of digital immediacy, providing a real-time channel for fashion week shows and making their online and mobile followers feel as if they are right there in the front row with them. They also offer personal glimpses into the lives and personalities of their followers’ favorite fashionistas, icons, and insiders. Social-media sites, such as Instagram, with their emphasis on visual presentation, are—much like print—popular resources for consumers looking for fashion aspiration and inspiration, but they have the ability to react in real time to the rapid turnover of trends and ideas in fashion and to go viral.

In addition, advertisers are becoming more sophisticated in e-commerce and in how they leverage the value of their digital and social-media spending. For example, more sites offer a combination of curating and e-commerce capabilities in a high-fashion environment. Advertisers are also developing their own e-commerce sites for direct engagement and commerce with consumers.

There are a couple of significant differences in how these trends play out for individual advertiser segments. Luxury and affordable-luxury companies have been slower than mass marketers to build their own e-commerce channels as they have shifted their print spending toward more affluent titles. For affordable-luxury advertisers, this means advertising in fashion and beauty titles with more affluent audiences, while marketers of luxury goods seek to reach more ultraaffluent consumers through lifestyle-focused publications that they believe can deliver this audience. Meanwhile, mass advertisers, with their larger budgets and more diverse media mix are experiencing more pressure for measurability.

Magazines Can Stand Out

With fierce competition from within and without, magazines have to do more, especially with their best advertisers, than continue simply to put out a high-quality product. On the basis of our interviews, we have identified four ways that magazines can stand out.

Introduce content in new and unfamiliar places. It still starts with the editorial product, of course. But the ability of digital channels to segment their users to an almost infinite degree and speak directly to each segment in a voice users recognize

as relevant has advertisers in fashion and beauty moving away from all-purpose publications. Fashion marketers now want magazines that develop a distinctive brand perspective and editorial voice. They also want magazines that can extend this brand and voice beyond the pages of the publication to digital channels, branded content, and experiential opportunities for consumers and the trade.

Marketers are attracted to publications that understand the strengths of the different offline, online, and mobile channels in conveying and reinforcing the brand. One fashion magazine was singled out by a top agency executive because “it looks at social issues in a way that captures the earnestness of the Millennials.” Another was cited for the way it recognizes “the difference between who is looking at your magazine versus website versus Snapchat and [for] creating content that is interesting for those different audiences.”

Build buzz around editorial talent. “The next-generation editor is balanced between consumer and marketer—running a business in partnership with a publisher,” one agency leader told us. More and more, editors will need to play internal and external roles—and both are evolving. In the former, the editor will be an integral member of a brand team, instrumental in both the editorial and commercial sides of the business. He or she needs to maintain a close relationship with the publisher; together they should present a united front to both the industry and the advertisers by partnering on the development of the editorial environment and acknowledging that it is created jointly by editorial content and advertisements.

Externally, the editor must expand the role of lead ambassador—having the brand include direct outreach to consumers as well as the industry—through interviews and appearances at consumer and advertiser events and in branded social-media activities. “You want an editor who transcends what the brand stands for,” said one advertiser.

Develop ways to integrate advertisers with the brand. The advertisers with whom we spoke all indicated that they value the deeper integration of their brands with the publications they advertise in. One way is through custom content creation or branded content. Another is the creation of high-quality photography or video for use in social media. A third is branded large-scale events. “I build the marketing calendar around events and projects planned with magazines. I’m dependent on them,” said an affordable-luxury advertiser. “We’ve seen magazine brands building relationships with bloggers and others,” said another advertiser. “That helps us get into media in areas where we aren’t as strong yet.”

Most advertisers noted that different publishing houses and titles have different strengths. Some are noted for video, others for native advertising, others for events. Advertisers are looking to publishers to both play to existing strengths and address weaknesses.

Expand marketing offerings. Ad sales are not restricted to pages and placement. More than ever before, it is essential to incorporate innovative solutions—customized marketing activities designed to meet an advertiser’s need by encouraging a specific consumer reaction or behavior—into the selling process. Every solution must be based on a deep understanding of each advertiser’s needs and must leverage the publication’s capabilities across all channels, including sister publications and digital venues—even those not owned and operated by the publisher. Advertisers place high importance on extending campaigns through other mediums: the most desirable extension is video, followed by events. “Extending the life of the campaign is the added value,” said one advertiser. Multiple print publishers have established in-house branded-content-creation capabilities that leverage their editorial and production capabilities to serve this need.

There’s a profitable, but demanding, future for fashion and beauty magazine brands. To outperform with their top advertisers, a brand must excel in all four areas discussed above. Publishers and editors should take note: no one title or publishing house has, as yet, put together the full package of capabilities it will need. The opportunity is waiting for those that get there first.