The Boston Consulting Group’s 2015 M&A report, From Buying Growth to Building Value: Increasing Returns with M&A, demonstrates that M&A can create growth and value—but only when deals are well designed and postmerger integration (PMI) is effectively executed. Companies that make multiple acquisitions are far more likely to get it right, while “one-timers” (companies that make one acquisition in a five-year period) drag down overall averages—thanks to inexperience, exaggerated expectations, and poor processes.

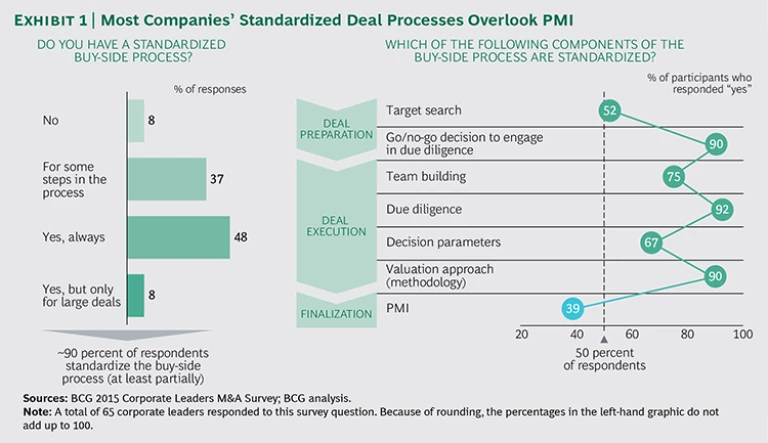

In our 2015 Corporate Leaders M&A Survey, four of the most cited reasons for deal failure (by half or more of the respondents) relate to PMI: poor integration, high complexity, difficult cultural fit, and low synergies. While most companies have standardized processes for such endeavors as target search, due diligence, and valuation methods, less than 40 percent have a standardized approach to PMI. (See Exhibit 1.)

Corporate leaders are clear on the reasons they pursue M&A, and growth tops the list. Asked to rank various transaction rationales on a scale of one to five (five being most important), more than three quarters of respondents ranked product diversification and market share expansion three or higher, and more than two-thirds gave similar rankings to geographic diversification.

Chance favors the well-prepared acquirer. More than 35 percent of all acquisitions result from a window of opportunity created when a specific target becomes available. Another third stems from a disciplined make-or-buy decision. Only 10 percent of deals are triggered by a competitor’s activities or by pressure from shareholders.

When it comes to deal sourcing, almost 50 percent of M&A transactions are the result of an internal strategic portfolio review or target search process. Finding the right target is anything but easy. M&A managers on average screen 20 candidates for each closed deal. Some 60 percent of all opportunities are immediately rejected; due diligence is conducted for only 14 percent. In our experience, the success of M&A strategy is very much the result of its connection to corporate strategy and determined by the successful management of this deal funnel.

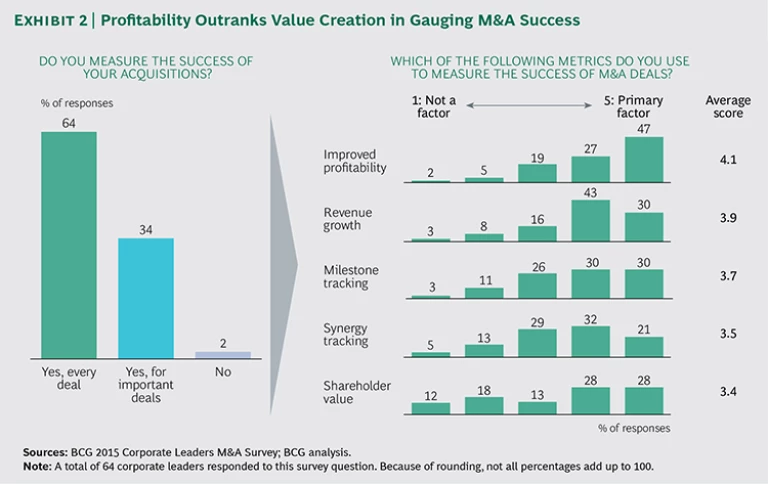

At the end of the day, however, it all comes down to what gets measured. And here is a surprise. Less than two-thirds of corporate leaders said they measure the success of every deal they do, and just over one-third said they only track the success of “important” deals. (See Exhibit 2.) Almost half (47 percent) cited improved profitability as the primary metric, while 30 percent said it is revenue growth. Only 28 percent cited shareholder value as the primary metric, and 12 percent said shareholder value is not an important factor to measure.

Little wonder, perhaps, that only 47 percent of all deals produce a positive relative total shareholder return one year after the transaction date.