Over the past 15 years, Europe’s full-service airlines have flown through turbulent skies as they generally failed to adapt to an increasingly price-competitive short-haul market. Lately, the combination of rising demand and falling fuel costs has lifted profits. But there is more turbulence ahead: Brexit, increasing industry capacity, and competition for long-haul traffic from low-cost and high-service Middle Eastern and Asian carriers are likely to undercut the profitability of European full-service carriers (FSCs).

All kinds of airlines—from legacy FSCs to low-cost carriers large and small—need to come to grips with issues of scale, costs, and operating flexibility in an environment that demands ever more efficiency and agility. To address these issues in a crowded European market, airlines must aggressively pursue strategic alternatives, including collaboration (such as alliances and code-sharing arrangements) and consolidation (through mergers and acquisitions). The financial, regulatory, and political barriers to various strategic scenarios will determine the exact nature of each airline’s options. This article—based on BCG’s in-depth examination of airline strategies, market sizes and growth prospects, and network gaps, as well as an analysis of multiple company combinations—looks at the coming changes in Europe’s skies and the choices these changes present for various European carriers.

Pressures on Costs and Profitability

The growth of price-competitive low-cost carriers (LCCs) has crimped profits at Europe’s FSCs. The performance of these carriers, particularly the midsize and smaller FSCs that don’t fly the more profitable long-haul routes, has been uneven at best. From 2000 through 2014, Europe’s FSCs racked up a total of $1 billion in aggregate profits but also suffered $12 billion in losses. Meanwhile, LCCs have steadily built profitable businesses, even during the post-2008 downturn, taking significant market share (approximately 30% and growing) and generating $11 billion of profits with no loss-making years. FSCs remain structurally disadvantaged by their high legacy costs and their lack of flexibility in adjusting supply to shifting levels of demand. Whatever other steps they take, FSCs face an increasing need to restructure their costs and operations.

While all airlines are currently benefiting from low fuel costs and robust traffic growth, the long-haul segment is coming under significant threat from several directions. For one thing, the industry plans one of the largest capacity expansions in its history. In addition, Middle Eastern and Asian full-service airlines, which have significant advantages in cost and quality of service, are becoming more active in Europe. For example, Etihad Airways has bought stakes in Air Berlin and Alitalia, and Qatar Airways has purchased 15% of International Airlines Group (IAG), parent of British Airways, Aer Lingus, Iberia, and Vueling. Finally, more LCCs, which have historically focused on short-haul routes, are venturing into long haul. Norwegian Air Shuttle already operates long-haul flights to Asia and North America. The CEO of Iceland-based Wow Air told Reuters in March 2016 that he believes LCCs could claim up to 25% of the market for transatlantic travel. His airline already serves four US cities.

The Opportunities and Options for Existing Players…

The fragmented nature of the European airline industry, compared with that in the US, presents an opportunity for airlines to collaborate and consolidate, allowing them to build scale, reduce costs, and, in particular, expand networks to capture additional business as competition intensifies. There are, of course, political, regulatory, and other barriers to contend with, especially in the case of full-scale consolidation through mergers or acquisitions. Deals involving national carriers are often subject to restrictions, limiting in some cases the full synergy realization that could justify a potential deal. With certain concessions, however, airlines can appeal to national interest—by vowing to preserve brand identities, for example. In any case, acquisitions should be carefully assessed and synergies analyzed along different realization scenarios, thereby enabling a measured decision.

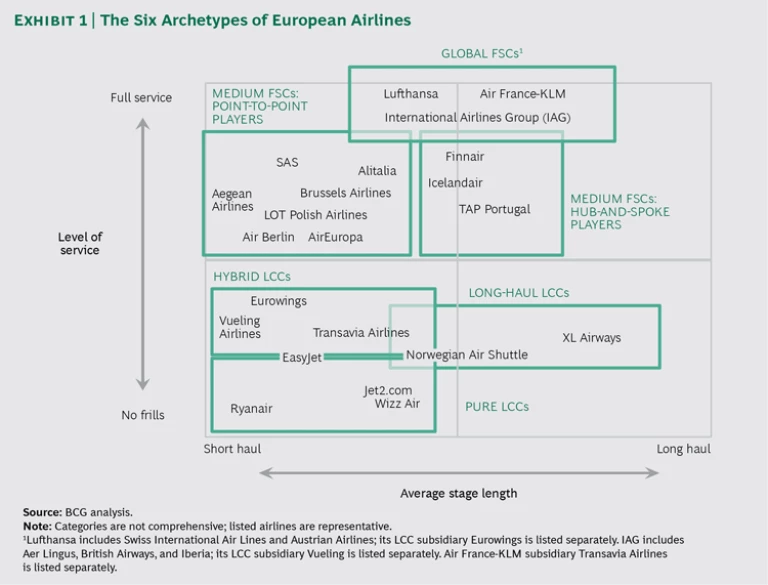

The European market consists of six types of airlines, each with its own strategic strengths and needs. (See Exhibit 1.)

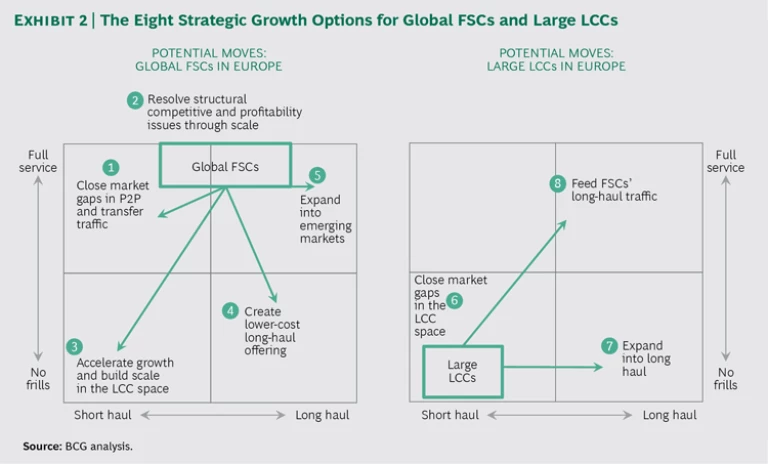

Global FSCs and LCCs can make a variety of strategic moves to address their needs. (See Exhibit 2.)

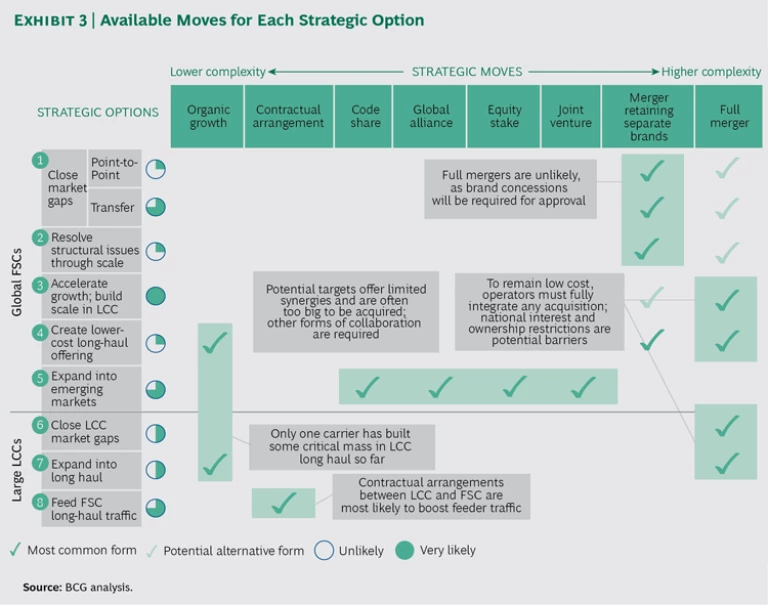

Within each strategic move are various collaboration and consolidation options that range on a continuum of complexity from pursuing go-it-alone organic growth at one end to a full merger at the other. (See Exhibit 3.) In between are such alternatives as contractual arrangements that can boost feeder traffic for big airlines’ networks and code sharing, alliances, and joint ventures that offer airlines big and small many of the advantages of mergers without the challenges and complexities of integrating two organizations.

Each company needs to decide how—and where—it wants to play. With 38 European airlines flying today, there are plenty of scenarios that could play out, but in reality few airlines have a wide menu of choices. Early movers will have more options.

…Determine the Moves Companies Can Make

Because of their size, financial stability, and liquidity, global FSCs and large LCCs are the most likely acquirers and will lead any trend toward consolidation. But FSCs and LCCs have different needs, and within each industry segment, individual airlines have their own priorities and strategies. We see a total of eight potential strategic moves, but each move presents limited actual options because of the paucity of attractive and available partners.

FSCs have a big need to resolve structural competitive and profitability issues; increasing their scale and expanding their networks will help. For these airlines, M&A is the fastest (and perhaps most efficient) way to grow and to build or accelerate scale in the low-cost segment. But mergers can be tough to pull off, in particular with a midsize carrier. Competition review is a possibility, and foreign ownership limits can be a barrier. Integration is always a challenge, and concessions to regulators can lead to parent companies operating multiple airlines and unable to take full advantage of synergies. To persuade the Irish government to sell its 25% stake in Aer Lingus, for example, IAG offered substantial concessions. In addition to maintaining the Aer Lingus brand, these included growth for the Dublin hub and a guarantee to retain the Irish airline’s Heathrow slots for an extended period of time. In lieu of M&A, FSCs can employ a range of collaboration options such as code sharing, global alliances, equity stakes, or joint ventures to expand into emerging markets.

For LCCs, merging with another LCC and acquiring a smaller LCC are two quick ways to close short-haul network gaps, but they are not without hurdles. To maintain a low cost structure, for example, any acquirer will need to fully integrate an acquisition. Fortunately for these carriers, national-identity issues and regulatory impediments are less pronounced.

To expand into the long-haul segment, some LCCs are considering such disruptive moves as establishing long-haul feeder deals with FSCs. There are significant barriers to such arrangements, however, because of the very different business models and interests of FSCs and LCCs. Alliances and joint ventures present risks too: the regulatory hurdles can be as great as those for M&A. Nonetheless, the Financial Times and other publications have reported that both Ryanair and EasyJet, the two biggest European LCCs, are considering feeder deals with FSCs.

There’s plenty of other activity as well. For example, Norwegian Air Shuttle is seeking regulatory approval to fly from the US to Ireland. Also, Norwegian’s CEO has said that his airline is interested in partnering with other low-cost European carriers to extend Norwegian’s short-haul network.

The big issue with any scenario involving another airline is that the number of potential combinations and deals is limited by the pool of attractive and available partners. LCCs and midsize and small FSCs are the most appealing targets because of their limited scale of operations and few financial challenges. Competition for the strongest partners, especially those with attractive home markets, will therefore be intense. The most-sought-after targets will likely find themselves in good bargaining positions, from which they can drive up prices and extract more and better conditions. Larger airlines that wait too long to move may find that few good partners remain or that the price has risen past the point where a deal makes economic sense.

All of which is likely to lead to more turbulence for airlines suddenly worried about being left out. Shrewd carriers will make a sharp-eyed assessment of the industry and their own positions and move quickly to meet their needs through collaboration or consolidation while the pool of available partners gives them the opportunity for the best combinations.