In a sign of their durability, London Market insurance companies are holding on to their share of global premiums and continuing to thrive in the mature markets of the West. But London Market insurers (as the cluster of insurance companies in the UK’s capital is called) have either lost ground or failed to gain it in other areas, particularly emerging markets, reinsurance, and workforce diversity. If unaddressed, these weaknesses could erode the long-term competitiveness of the London Market, according to a study by The Boston Consulting Group and the London Market Group.

The findings of the study, which are presented in a report called London Matters 2017 (a follow-on to a The London Insurance Market’s Historic Role Faces a Tipping Point), provide fresh data that highlights areas of strength for the city’s commercial insurers—and areas in need of improvement. The report also highlights some of the innovation that is taking place in London, which has broader implications for the many global commercial insurance players with operations there.

Traditional Strengths Are Confirmed

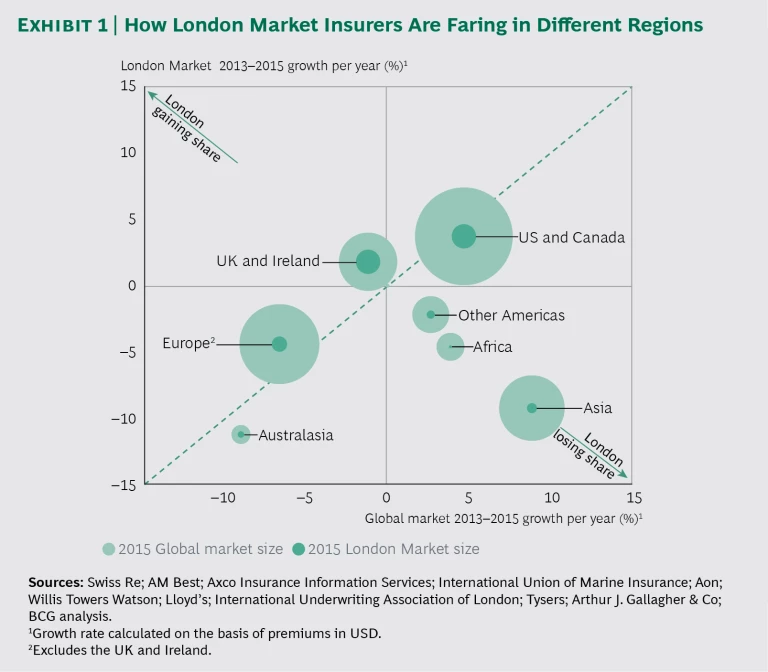

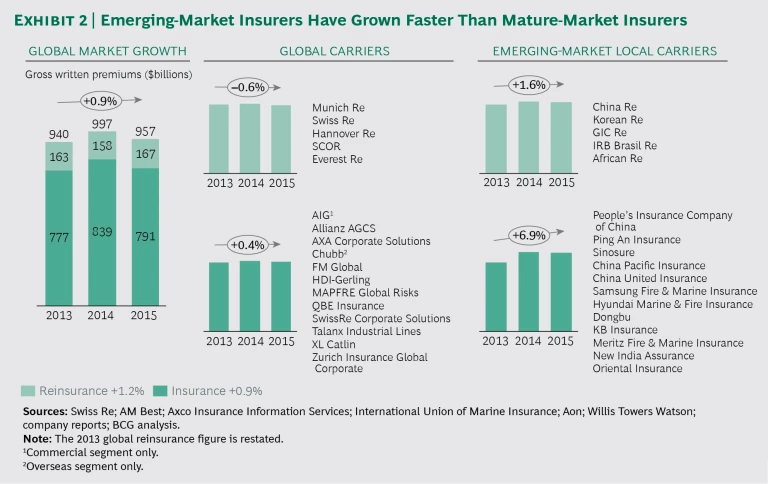

On the positive side, the London Market maintained its share of global commercial premiums: in 2015 (the most recent year for which data was available), its share was 5.8%, the same as in 2013. Growth in commercial premiums globally has been slow, just 0.9% per year, reaching $791 billion in 2015. But London’s continuing strength in the UK and, especially, in North America—the world’s biggest market for commercial insurance—buoyed insurers in the city. Between 2013 and 2015, the London Market held on to its share of premiums in the North American market when that market was growing at an annual rate of 4.6%. That helped London Market insurers overcome slower growth, and some declines, elsewhere. (See Exhibit 1.)

The London Market also continued to do well in traditional specialty lines, increasing its share of marine, energy, and aviation insurance to 40.2% in 2015 from 38.0% in 2013.

Weakness in Emerging Markets

Less positively, all of the major challenges highlighted in the previous report remain. A key challenge is the weak position of London insurers in fast-growing emerging markets. London’s emerging-market premiums fell to $9.3 billion in 2015 from $10.5 billion in 2013.

Emerging-market companies and their brokers often prefer to buy their insurance from local players rather than navigate what they see as the complexities of London Market placement; London Market insurers have also reduced the capacity they devote to emerging-market business or opted not to match local players’ bids.

London’s relatively poor performance in emerging markets isn’t unique; other global carriers have experienced it as well. (See Exhibit 2.)

Reinsurance

Reinsurance is another area in which weakness persists. The London Market’s share of global reinsurance premiums sank to 12.3% in 2015 from 13.4% in 2013. The decline stems from three factors:

- The emergence of reinsurers outside of London (including in fast-growing emerging markets)

- The challenges that London’s relatively high expenses and cost of capital create at a time when market conditions are soft

- The London Market’s limited offerings in some of the fastest-growing areas of reinsurance and related capital vehicles, including large structured-reinsurance programs, insurance-linked securities, and life and health reinsurance

Workforce Diversity

Another area of concern in the London Market is staff diversity. Insurers had a higher proportion of female executive directors in 2015 than in 2013—5% versus 3%—but the numbers are still far too low (the FTSE 100 average is 21% female executive directors). Similarly, the number of non-UK employees trails that in other branches of financial services. If insurers are unable to make faster progress in these areas, they will be unlikely to achieve the diversity in experience and outlook required to meet their clients’ increasingly complex needs.

Innovation

London seems to have retained its knack for innovation—at least in some areas. Cyberinsurance premiums written by London insurers reached an estimated $700 million in 2015, triple the level of 2013. What’s more, London brokers and insurers are increasingly conducting business via specialized structures, which opens up the possibility of more efficient placement for more commoditized risks.

Implications for the Industry

The London Market is facing many of the same challenges as other Western commercial insurers:

- Whether to enter fast-growing but challenging emerging markets

- How to globalize operating models to ensure that more commoditized risks are placed more efficiently and that more specialized risks receive the right expert attention

- How to evolve their distribution models in partnership with brokers to best serve end clients

- How to broaden service offerings to respond to clients’ unmet risk-management needs

Addressing these challenges will require the London Market, and the industry as a whole, to think globally, to build for the long term, and to focus on innovation as part of a renewed commitment to clients.