This is the first of two publications on sustainable financial inclusion. In this publication, we unveil a new way of thinking about and improving inclusion. In the second, we apply our methodology to South Africa, a country whose financial situation we discuss briefly below, and explore opportunities to improve its financial inclusion.

Financial inclusion helps propel socioeconomic development. That correlation is well-known but not well understood. Only by fully understanding and quantifying financial inclusion can stakeholders bring more people into the financial system and raise their overall standard of living and well-being.

The prevalence of transaction accounts, the availability of credit, and the willingness to save and buy insurance products are all positive markers of economic and social improvement. Family prosperity, GDP growth, and reduction of poverty are closely linked to them. On the flip side, too much credit, high fees, and ill-suited insurance products are all counterproductive. Credit, for example, can lead to personal bankruptcy and even financial crises such as the global financial panic of the past decade. Properly assessing financial inclusion calls for balancing extremes.

Financial inclusion is a complex topic. Currently available tools that measure it are either too simple or too academic. At one extreme, benchmarks of financial inclusion track only the share of adults who have opened a basic transaction account. At the other, they explore multiple aspects of inclusion but do not generate quantifiable and comparable findings that can be converted into action. All too often, these tools fail to take into account whether products and services are mutually beneficial for consumers and providers and, thus, sustainable.

Such limitations prevent a full view of financial inclusion from emerging. Seeing only a part of the picture or an overly complex portrait, stakeholders are unable to make the fixes and adjustments that will improve financial inclusion. They need a tool that is comprehensive and insightful. We unveil such a tool later in this publication.

Sustainable Financial Inclusion Matters

BCG’s 2016 Sustainable Economic Development Assessment (SEDA) report identified a “clear and measurable association” between financial inclusion and well-being. The report used the best-known tool in this area, the World Bank’s Global Findex database, which defines inclusion as the share of people aged 15 or older who have a basic banking account. In our discussions of this finding with private- and public-sector clients and officials, it became clear that a more nuanced view of financial inclusion was needed.

In South Africa, for example, 70% of adults have transaction accounts, but more than one-quarter of account holders withdraw their wages as soon as they are deposited. These adults are not actively using the accounts to achieve financial goals, and they are not taking advantage of other financial services. In fact, consumers may actually resent these accounts as conditions of employment or receipt of welfare and other public, or social, payments. Many view accounts as constraints, not enablers.

BCG set out to build a tool that would address three critical dimensions of inclusion. First, we wanted to cover the full suite of basic financial services, including transaction, credit, insurance, and savings. These elements are integral to national and household prosperity. All of these services can promote economic activity, financial security, and well-being. Countries with healthy private credit systems, for example, are most likely to be economically vibrant, while countries with strong insurance and savings penetration have higher per capita GDP than other countries.

Likewise, households with credit, insurance, and savings are also the most likely to have a financial cushion, the capacity to spend in anticipation of future earnings, and the flexibility to adapt to changing life circumstances. Such households are not merely touching the edge of the financial system but are also fully participating and benefiting from it. (See “How Inclusion Creates Opportunity.”)

HOW INCLUSION CREATES OPPORTUNITY

How does inclusion help consumers, financial services firms, and the government? The benefits are both obvious—for example, higher bank revenues—and subtle.

Transaction Accounts. A transaction account can act as a gateway for consumers to other financial services and as a way to avoid the risks of carrying cash, especially in dangerous neighborhoods. Account activity can help banks gain a better understanding of customer preferences. Governments can deliver social payments efficiently through the banking system, reducing fraud and corruption.

Credit. Credit can immediately benefit consumers by smoothing out income fluctuations and helping small businesses expand. Governments have a vested interest in the increased economic activity that credit can stoke.

Insurance. Insurance does not just lower risks for consumers. The more policies insurers write, the broader their exposure. A government with a well-insured population can lower its social payments and emergency spending.

Savings. Deposits provide a stable source of funding for banks and a financial cushion for consumers. That cushion helps lower overall government social spending.

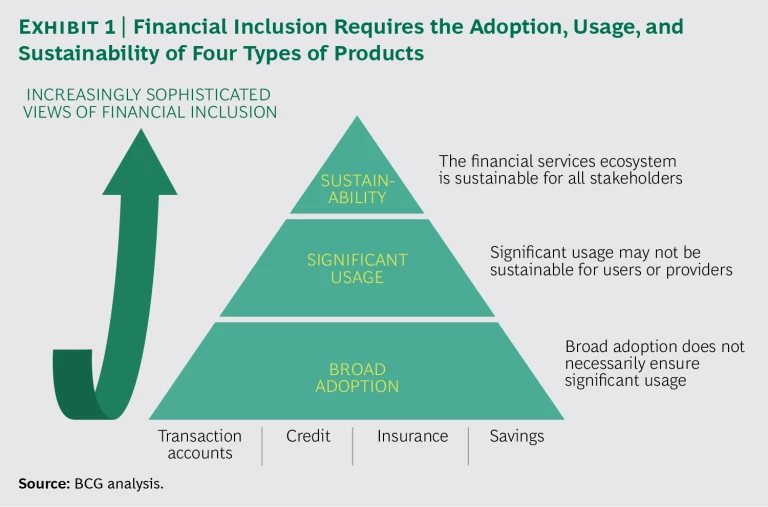

Second, we wanted to measure usage. Adoption without usage is a hollow metric. Third, we wanted to measure sustainability. If usage is unsustainable—either because the offering is unprofitable for the financial institution or too costly or inflexible for the consumer—the benefits of financial inclusion are limited. True financial inclusion must involve ongoing activity that benefits both providers and consumers. This is what we call sustainable financial inclusion. (See Exhibit 1.)

Measuring Sustainable Financial Inclusion

To address these shortcomings, BCG has developed a dashboard that portrays the extent of a country’s sustainable financial inclusion in a way that is more sophisticated than the common benchmarks and is ready for use by policymakers and financial institutions.

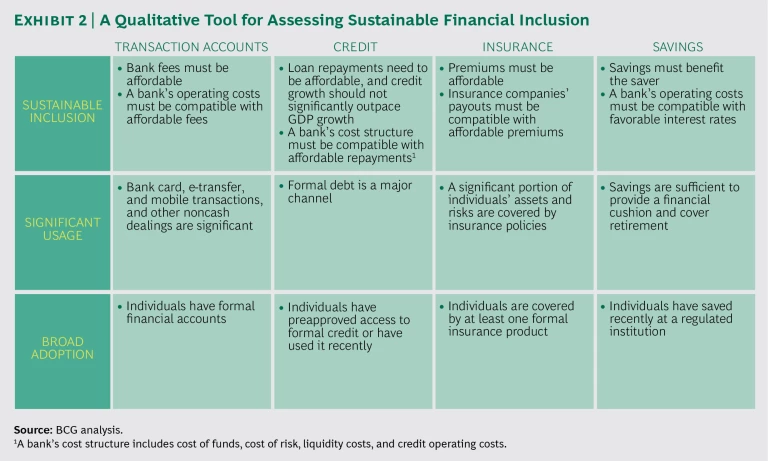

We started with a concrete vision of sustainable financial inclusion—a sort of Platonic ideal that covered transaction accounts, credit, insurance, and savings. This formulation would generate benefits for consumers, financial institutions, and national economies. Accounts would be affordable and beneficial for consumers and—with changes to operating and business models—they would be profitable for financial institutions. Ideally, financial institutions would not be forced to open accounts, extend credit, or write insurance policies that were not economically viable. Exhibit 2 summarizes the qualitative goals of sustainable financial inclusion.

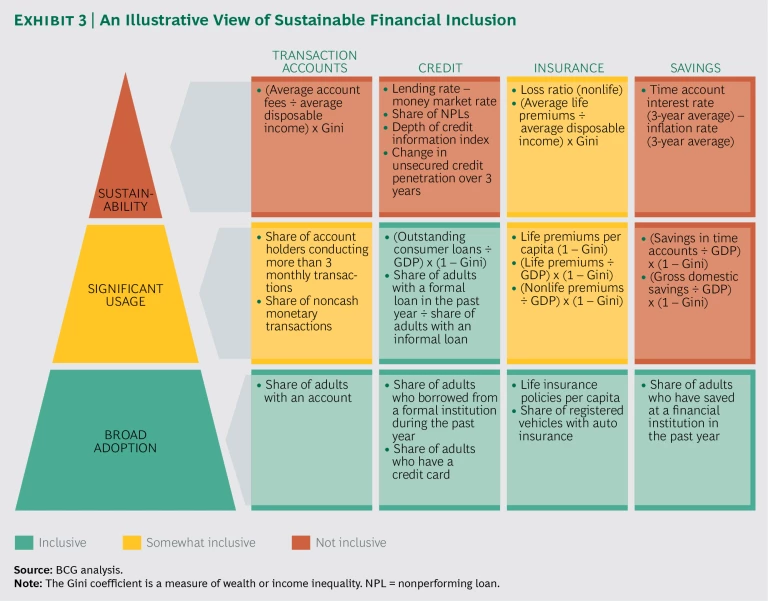

Next, we identified a set of comprehensive and quantifiable KPIs that measure sustainable financial inclusion. For each of the four relevant categories (transaction accounts, credit, insurance, and savings), we bundled KPIs to gauge whether a nation was achieving satisfactory categories, usage, and sustainability. Because most of these KPIs are in the public domain, it is easy for countries to use the tool and draw comparisons.

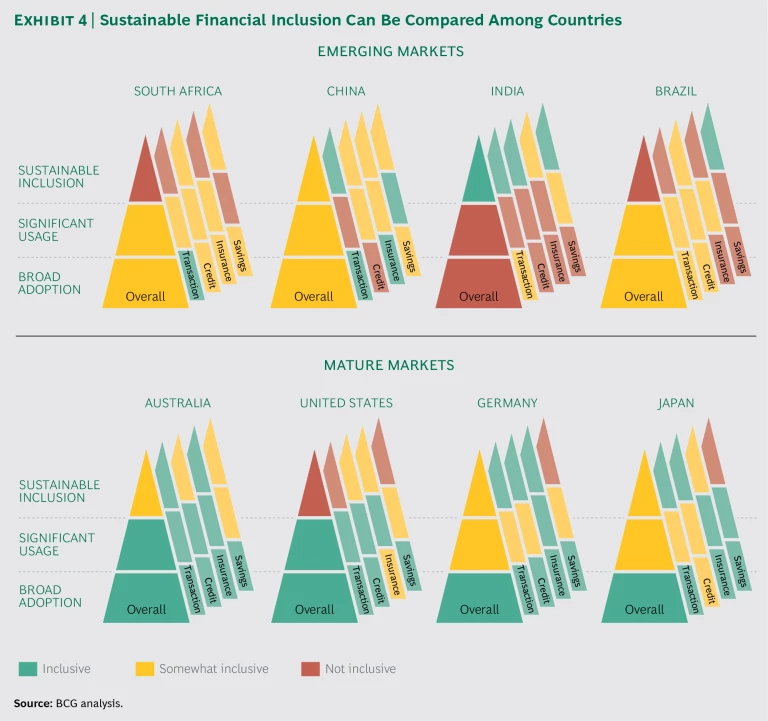

Finally, we tied all these strands together, creating a view that can provide financial institutions, governments, and NGOs with a complete picture of inclusion for individual countries. (See Exhibit 3.) This view can also compare the state of financial inclusion among countries. (See Exhibit 4.)

The beauty of this approach is that although it is simple, it does not sacrifice depth. At the highest level, the components of financial inclusion are visually identified as green (inclusive), yellow (somewhat inclusive), and red (not inclusive).

Without having to dive deep into minutiae, stakeholders can quickly understand the broad contours of financial inclusion. Yet the depth is readily available to executives, officials, and policymakers who want to dig deeper.

It is interesting that no country has solved the financial-inclusion puzzle. Even the most financially inclusive countries, such as Australia and France, do not come up all green in the sustainable-financial-inclusion framework. In other words, there is work to be done in all countries. And the tool suggests where to start.

Understanding Sustainable Financial Inclusion: A South African Example

The ultimate goal of any business framework should be to improve performance, not merely to describe or measure it. That is the true value of this approach. It can help countries, financial institutions, and NGOs create interventions that address fundamental weaknesses.

In order to show how the tool is put into practice, we present a brief look at South Africa. South Africa has higher financial inclusion than its income level would suggest, strong financial regulation, a functioning banking system, and a retail network of money transfer services. But the nation has room for improvement, too.

Transaction Accounts. By looking only at how many adults have a transaction account, executives and officials might be lulled into a false sense of the inclusivity of South Africa’s financial system. More than 70% of the country’s adults have

a transaction account, a high share of the market considering South Africa’s overall economic profile. Usage, however, is below average and unsustainable, given the high fees as a share of disposable income. (See “A Five-Year Drought.”)

A FIVE-YEAR DROUGHT

Lydia, 31, lives in a back room of her mother’s house and supports herself by selling bunny chow, a South African bread and curry dish, to school children. She makes about R500, or less than $40 per month. She has a savings account at Standard Bank, but she hasn’t used it in five years. She would need to take a taxi to the bank and would have to pay fees. Instead, she hides money in her house and keeps track of funds in a small notebook.

Credit. South Africa faces several challenges as it strives to become a more inclusive provider of credit. The adoption of credit in South Africa is on a par with other emerging markets: 13% of adults have a formal credit account. One of the primary challenges will be converting widespread informal credit to formal channels while maintaining overall creditworthiness. Unsecured credit is growing faster than GDP, the cost to consumers is often unsustainable, and the default rate is high. (See “The Loan with a Rate Through the Roof.”)

THE LOAN WITH A RATE THROUGH THE ROOF

Zanele is a 36-year-old who sells vegetables at a stand and makes daily deposits of her cash earnings. She earns about R6,000, or about $440, per month and receives child support payments. She purchased a washing machine and couch, each costing about R2,500, both with savings. But when her roof collapsed, Zanele took out a loan of R3,000 from a commercial lender that did no income verification and made a quick decision. The loan schedule, however, required her to make payments totalling R5,700 over six months, nearly twice the amount of the original loan, or a rate of more than 11% per month.

Insurance. Life insurance is relatively popular in South Africa, although more than 80% of the policies are for covering funeral costs. Premiums as a share of adjusted GDP and per capita are relatively high. Because premiums consume a large share of disposable income, the industry will likely encounter difficulties sustaining these levels. (We have focused on life insurance, as property and casualty insurance tends to be less relevant to low-income segments in South Africa.)

Savings. The nation’s overall savings rate is among the lowest in the world. Only one-third of South African adults are saving formally. Most savings accounts are basic, and the level of understanding in the value of savings and returns is low. Those who do open a saving account find that inflation erodes most of their gains, making such accounts unsustainable.

Fixing Financial Exclusion

Our quantitative findings provide a clear overview of the state of financial inclusion within individual countries. But these findings do not tell the entire story. The numbers do not explain why consumers shy away from various products. They do not explain why financial institutions are not offering a greater range of products that are suitable for meeting the needs of the low ends of the markets.

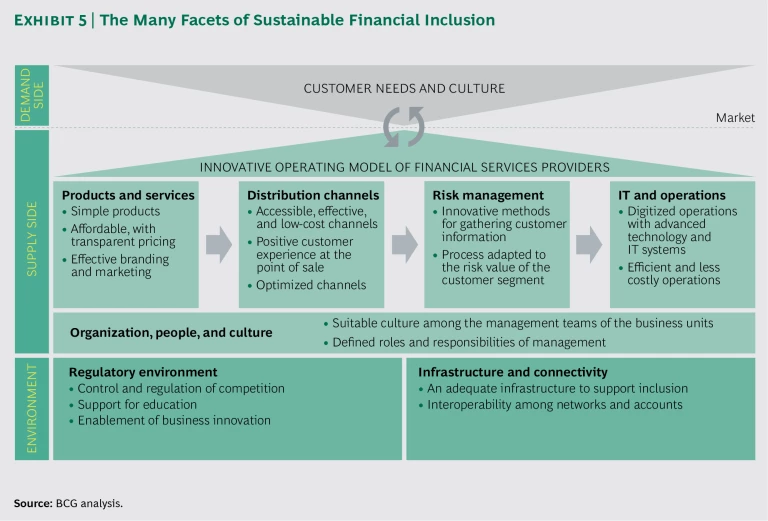

For those explanations, stakeholders need to understand what is not currently working. Sustainable financial inclusion has to address demand (what consumers want), supply (what financial institutions provide), and the environment (how the public sector and other private-sector companies play a facilitative role). Or, to put the challenge in other terms, sustainable financial inclusion is built on operating models, regulation, and infrastructure, as outlined below:

- The Operating Models of Banks, Insurers, and Other Institutions. Products and services, distribution channels, risk management, IT and operations, and governance can all encourage or frustrate financial inclusion. Innovations such as branchless banking, correspondent and agent banking, mobile payments, and flexible loan repayments are all potential solutions.

- The Overall Regulatory Environment. Measures to improve competition at the low end of the market, improve the overall quality of credit information, relax unproductive but costly regulations, and provide financial incentives to save can improve financial inclusion.

- Infrastructure and Connectivity. Many consumers rely on cash because the infrastructure that would support point-of-sale card or biometric transactions is not in place. Partnerships among financial institutions, mobile operators, payment vendors, and government subsidies could all work.

At the same time, stakeholders need to understand the preferences and unmet needs of consumers, as well as the barriers they perceive in accessing financial services. This understanding is derived less from numbers than from qualitative research.

In South Africa, we interviewed about 1,500 consumers in both rural and urban settings and across all low-income segments and major ethnic groups. Without this granularity, stakeholders are not likely to understand the mismatch between consumer needs and current offerings. Across emerging markets, low-income segments have vastly divergent needs, and the industry operating models, regulatory regimes, and infrastructure also vary widely.

What Has Worked

The experiences of countries that have already implemented successful solutions can serve as rough models for South Africa and other countries. Many countries and companies have experimented extensively in this field. Companies and countries can take financial-inclusion interventions from elsewhere and tailor them to their unique situations. We examined more than 30 interventions in a dozen countries.

Let’s see how certain countries have addressed the aspects of financial inclusion outlined in Exhibit 5.

In India and Indonesia, the government is working with banks and other partners to help create no-frills financial services that will appeal to the low end of the market. India, for example, provides five years of matching funds for people who put money into their pensions.

Only about one-third of Indonesia’s 250 million people have a bank account. One of the goals of Indonesia’s branchless banking system is to increase savings by offering no-fee accounts that require no minimum balances. The initiative is targeted partly at children in order to instill the habit and discipline of saving. In its first two years, Indonesia’s Laku Pandai initiative has added 2 million customers.

In many countries, banks do not cater specifically to women even though they have a significant role in generating income and managing family finances. In Nigeria, Diamond Bank partnered with Visa and two NGOs—Enhancing Financial Innovation & Access and Women’s World Banking—to open no-frills savings accounts for women, 40% of whom are part of the informal economy. Agents of the bank can establish these accounts by loading a photo of the applicant and basic information on their phones. The women can earn weekly rewards for meeting savings goals. In the first six months, the product generated $1.5 million in savings in 38,000 accounts, or nearly $40 per account. Considering that most of the account holders have low incomes and one-quarter of them had never banked before, this was a significant achievement.

Products and Services. In India, public and private entities have worked to encourage sustainable adoption and usage. The Ministry of Finance, for example, mandated no-frills accounts, which the government uses to disburse social payments. These accounts come with built-in affordable life and accident insurance.

Distribution Channels. Indonesia is experimenting with a branchless-banking program in an effort to reach more consumers in this archipelago nation. The program relies on more than 100,000 agents, who are subject to regulation and documentation requirements that are more streamlined than those that govern bank employees and who are empowered to transact business using mobile phones. In India, banks have installed 10,000 solar-powered ATMs that process biometric transactions. Within six months, 50 million new customers were actively using new accounts.

Risk Management. An insurer in Kenya has developed an innovative scheme to help farmers manage risk, while limiting fraudulent claims. In exchange for paying a 5% premium on seed, fertilizer, and chemical purchases, farmers get crop insurance coverage from UAP. These policies pay benefits if there is too much or too little rain—as measured by a nearby weather station—to produce a healthy crop. Policies are registered at the time of purchase by scanning a bar code, and the payouts are made through a mobile money payment system. The program, called Kilimo Salama, or “safe farming,” is a partnership of UAP, seed and fertilizer companies, Kenyan telecommunications operator Safaricom, and the Kenya Meteorological Department.

IT and Operations. Equity Bank Kenya offers a 0.1-millimeter-thin card that sits on top of a traditional SIM card and enables its Equitel mobile-banking service. This service grew to 1.4 million customers in just three months. More than eight of ten of the bank’s new loans were processed through Equitel. Equitel is a direct competitor of Safaricom’s well-known M-Pesa mobile-payment system, suggesting that inclusive financial services can be competitive, too.

Organization, People, and Culture. Grameen Bank in Bangladesh, whose founder, Muhammad Yunus, won the Nobel Peace Prize for his championing of microcredit, is probably the best-known example of an organization that promotes financial inclusion. Serving low-income segments is the core mission of the bank. Although Grameen is not a traditional bank, its ability to be both inclusive and profitable can be an inspiration.

Regulatory Environment. In many cases, regulatory relief enables financial inclusion. India, for example, has granted licenses to “small finance banks.” These institutions have lower capital requirements than traditional banks and limits to the size of loans they can underwrite. The government’s Micro Units Development Refinance Agency and Small Industries Development Bank of India also arrange small no-fee loans, with a 7% interest rate, for small and midsize enterprises. Nearly $4 billion in credit has been disbursed under this program.

Infrastructure and Connectivity. Strong infrastructure and connectivity can provide a platform for inclusion. In Mexico, for example, the government worked with the Chamber of Commerce and Visa to put subsidized payment devices in stores. The initiative added 20,000 devices in just three months.

The Path to Financial Inclusion

The examples from other countries reveal both that progress is possible and that traditional approaches will not be productive. Banks in most emerging markets have a long way to go to reduce costs so that financial fees are affordable for low-income consumers.

It is not surprising that our informal analysis shows that government mandates were responsible for about one-third of financial-inclusion initiatives and that legislation was responsible for another third. Only one-third, in other words, were driven purely commercially.

Financial services firms need encouragement and an economic rationale to act. In India and the Philippines, the finance ministry or central bank has taken the lead in pushing financial inclusion through regulation, subsidy, and incentive. As a result, from 2011 through 2014, account penetration increased from 35% to 53% in India and from 27% to 31% in the Philippines. Obviously, governments cannot do it alone, but they alone can catalyze much broader efforts of financial services firms, telecommunications operators, retailers, credit bureaus, financial-technology firms, and NGOs. These organizations can help ensure stronger adoption, usage, and sustainability.

For countries that have not yet embarked on this journey, we also recommend that the finance ministry, reserve bank, or both acting jointly, start a multiyear journey of sustainable financial inclusion. Our work elsewhere suggests the importance of several efforts:

- Setting the context in order to understand the current state of affairs, identifying root causes, and beginning to build support

- Developing a vision for the future that addresses root causes and has broad support among all relevant parties

- Developing a tangible, realistic plan that allocates responsibility and authority for individual initiatives

- Establishing an implementation, monitoring, and feedback system that relies both on a centralized program management office and fast feedback that facilitates course correction

Bringing people into the financial system can quantifiably improve household and national well-being. By acting as catalysts, emerging-market governments and stakeholders can do good for their people and for the overall economy. It’s a noble pursuit that should be on every nation’s economic and social shortlist.

Acknowledgments

The authors thank their colleagues Vassilis Antoniades, Davide Corradi, Dinesh Khanna, Ian Walsh, and Enrique Rueda-Sabater for their thoughtful contributions and feedback.