This article is the first in a two-part series on how big companies can collaborate with entrepreneurs and startups engaged in “deep technology”—developing technologies that advance scientific and technological frontiers in industries as diverse as agriculture, health care, energy, and transportation—technologies that in many cases address the biggest societal and environmental challenges and shape the way we solve the most pressing global issues. This article looks at young companies’ needs with respect to other players in the startup ecosystem, particularly large corporations. The second, “A Framework for Deep-Tech Collaboration,” BCG article, April 2017, considers ways that companies can go about setting up collaborations with deep-tech startups. Both articles are based on research conducted by BCG and Hello Tomorrow, a global initiative that connects deep-tech entrepreneurs with corporations and investors. The research involved more than 400 deep-tech startups. BCG and Hello Tomorrow also conducted in-depth interviews with other key ecosystem players, including investors, support organizations, and mentors. The full results are presented in the report From Tech to Deep Tech: Fostering Collaboration Between Corporates and Startups.

As Cisco’s John Chambers predicted years ago, every company has become a tech company. Affecting aspects of every industry—from the supply chains and processes to customer journeys—digital technologies have revamped virtually every corporate function and activity. But some companies do more than simply apply digital technologies to existing functions or innovative business models that reinvent customer experiences. These innovation leaders seek to develop unique, proprietary, and hard-to-reproduce technological or scientific advances that have the power to create their own markets or disrupt existing industries. Following the past decade of digital innovation, these deep technologies, which will be at the center of the next wave of industrial and information revolution, represent the “next big thing” that venture investors are looking for.

Because of their intense focus on science and technology, deep-tech startups face their own particular set of challenges. An innovation ecosystem has taken root around them, and within this ecosystem, deep-tech companies see large corporations as the partners that can best help their businesses mature and grow.

At the same time, large corporations seeking new sources of innovation are increasingly turning to new-venture vehicles, including corporate venture capital, accelerators and incubators, and idea labs. All these vehicles have soared in number among the biggest companies in multiple industries, as these firms seek new partners and skills that can bring more agility to their R&D operations, disrupt existing business models, provide access to adjacent markets, and help them develop a more entrepreneurial internal mindset. Even though innovation built on deep tech is now a priority, many companies still struggle to work effectively with startups, and the road to productive collaboration is rocky.

BCG and Hello Tomorrow surveyed more than 400 deep-tech startups, inquiring about their needs and their preferred partners. The tech ventures represent ten industries—aerospace, air quality and environmental technology, beauty and well-being, data sciences, energy, food and agriculture, health care, Industry 4.0, transportation and mobility, and water and waste—in more than 50 countries. Our goal was to understand deep-tech startups’ needs and challenges and how they interact with other stakeholders in the ecosystem. In addition, we conducted in-depth interviews with other key ecosystem players, including investors, support organizations, and mentors.

Deep-Tech Startups Seek Corporate Partners

Our research revealed that startups have plenty of choices when it comes to partners but that they, like their preferred partners, struggle to make the relationships work. Corporate partnerships offer lots of advantages—more than most other potential partnerships—but it is difficult to secure and make them successful. While 95% of startups wish to develop long-term corporate partnerships, only 57% of them have done so. There are many obstacles, including the following:

While 95% of startups wish to develop long-term corporate partnerships, only 57% of them have done so.

- Inadequate preparation on the part of the startup, including lack of a clear value proposition, application, and proof of concept

- Failure of both parties to clearly define the relationship right from the beginning, including agreeing on vision, business, knowledge, and HR objectives

- Misalignment of timing and processes, including complex and slow corporate decision making

- Lack of a clear status and role for the startup within the larger company

- No high-level sponsorship for the startup within the corporation

- Lack of buy-in from the business on the corporate side

Large companies that want to bring deep-tech startups into the fold need to consider carefully the particular needs of these young operations, particularly where the startups stand in their development and what type of bets the bigger companies are making. Both sides also need to work out the fit and structure of the collaboration and specify how the two entities will actually work together.

What Makes Deep Tech Different?

Digital innovation is often about speed to market and scaling up fast to seize first-mover advantage. Deep tech is different in several ways: it involves a strong research base, a challenging business model, and large investment needs. Given their ambition—and often their complexity—truly disruptive deep technologies can require considerable development time before being brought to market.

For deep-tech startups, a strong research capability is essential since their innovations rely mostly on fundamental and advanced R&D supported by highly developed skills, knowledge, and infrastructure. New materials that demonstrate promising properties in lab conditions need improvements to meet industrial standards. External factors—for example, clinical trials in the health care industry—mean the need for additional resources and can extend the development process for years.

The business models are challenging because deep-tech startups are creating products that are absolutely new. Entrepreneurs must think not only about the technological development of their product but also about how to jump-start nascent or nonexisting markets. This requires the ability to anticipate and understand customer needs that don’t yet exist, as well as a detailed strategy that addresses the challenges of industrialization and scaling up production. On top of that, some groundbreaking products are based on advanced materials and newly developed resources, so deep-tech startups need sharply honed business skills to work through such challenges as procurement, manufacturing, and achieving scale. Furthermore, there is always the danger that incumbents, feeling the threat of disruption, will actively seek to slow down, or block, new technologies from entering the mainstream.

Because in many cases, expensive infrastructure is required to support development and deep tech generally takes time to mature and reach the market, substantial funding from understanding and patient investors is essential. (More than 20% of the companies in our survey expect to work three years or more before getting a product to market, and 50% of startups underestimate the time that they will need.) Early experimentation and prototyping generally require expensive equipment. Testing and scaling is much more costly when it involves purchasing hardware as well as software, which is available and relatively inexpensive from the cloud. Not only is deep-tech capital intensity higher than that of conventional product development, the payback periods are also typically further in the future because of the longer time to market. Funding is, therefore, a big and time-consuming challenge.

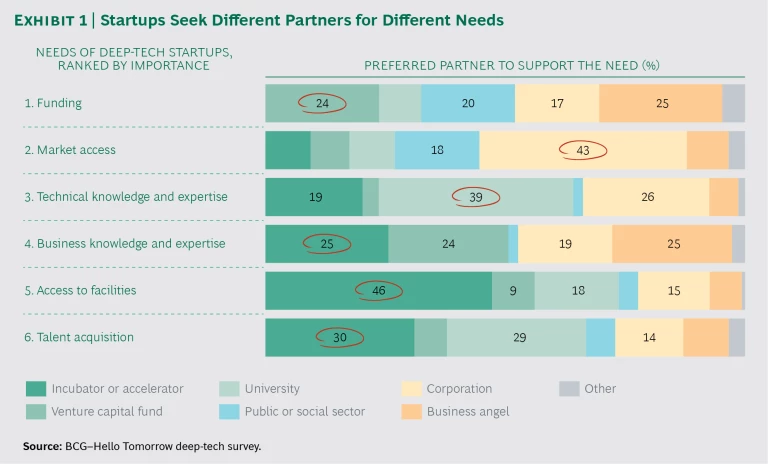

It Takes an Ecosystem—and a Corporation Can Be a Pillar

For all of these reasons, deep-tech entrepreneurs look to a broad ecosystem of organizations, institutions, and individuals for support. The most common top priority is funding: 80% of the startups we surveyed rank it among their top three needs. But it is far from their only need. Startups look to the supporting ecosystem for help with market access (61%), technical expertise (39%), and business expertise and knowledge (26%). Startups are attracted to particular funders by the specific attributes that they bring to the table. (See Exhibit 1.) Startups’ needs evolve as they and their products move closer to market, and the attractiveness of various types of funding partners shifts as well.

80% of the startups we surveyed rank funding among their top three needs. But it is far from their only need.

Our survey found that overall, deep-tech startups target venture capital, business angels, corporations, and the public sector in roughly equal measure, with 15% to 25% of respondents indicating a preference for each. (University grants are generally seen as less desirable: they are preferred by only 10% of startups.) A comparison of historical funding sources and startups’ preferred funding channels for the future reveals the evolution of the funding life cycle. It’s not surprising that friends and family most often provide seed capital: 40% of our respondents benefited from such investments. And, on average, 30% of companies accessed the public sector, but we found wide discrepancies among countries and industries. For second-stage funding, deep-tech startups turn toward so-called professional sources—venture capital funds, business angels, and corporations—which, in addition to being able to provide larger sums of cash, can also provide business intelligence, professionalism, network access, and market credibility. Fear of misaligned vision and objectives is a concern, however. Some 35% of startups that had not yet received venture capital funding considered such misalignment a critical roadblock. However, only 20% of those that actually had venture capital investors reported any friction.

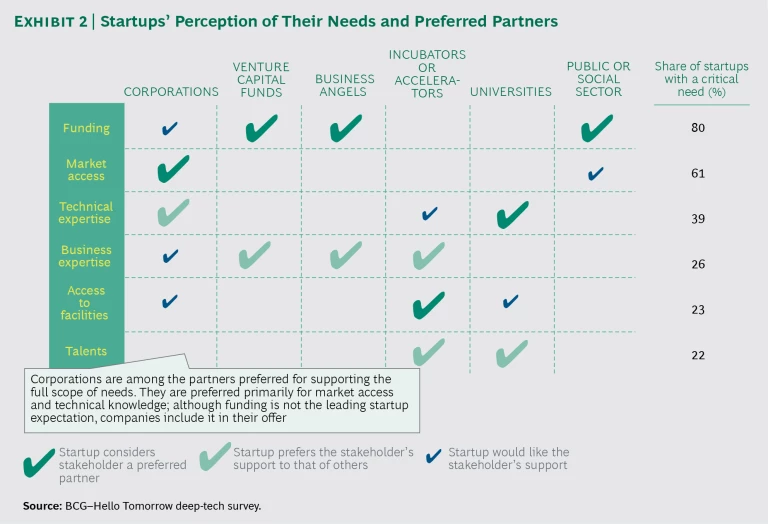

In addition to funding, startups’ preferences for each type of potential partner are shaped substantially by their assessments of their other needs. As a result, corporations are the preferred partners for companies looking to gain access to the market through, for example, access to market and customer data, an existing customer base, or a distribution network. Those that give top priority to technical knowledge and talent acquisition look to universities. Venture capital firms, corporations, and business angels are all seen as desirable for providing business expertise. And it’s no surprise that incubators and accelerators rank high among startups seeking access to facilities such as offices, labs, and testing grounds.

When it comes to partner desirability, corporations have a decided advantage over other ecosystem participants. Corporations are the preferred partners for most potential needs: they are differentiated by their ability to provide market access, technical knowledge, and business expertise, and funding is the icing on the cake. (See Exhibit 2.)

The Evolving Needs of Startups

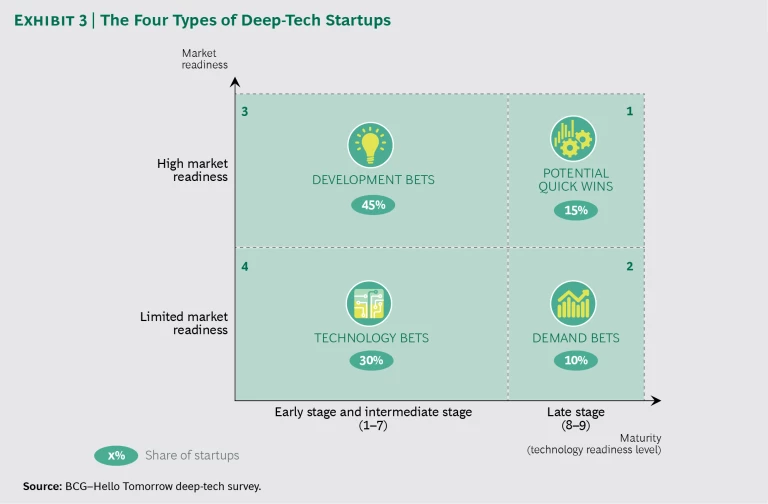

Large companies looking to partner with deep-tech startups need to segment these up-and-comers according to their maturity and market readiness. Sharpening their understanding of startups’ needs and expectations provides a user’s guide to what startups are seeking from other participants in the ecosystem. In Exhibit 3, the maturity axis is the level of development of the technology or product itself. The estimation of maturity ranges from early stage (idea, proof of concept) to intermediate stage (prototype, minimally viable product) to late stage (market-ready product). The market readiness axis indicates whether a product or technology will easily find commercial application and customers. It takes into account customer needs and receptiveness, the regulatory environment, and current innovations in the field.

Applying this segmentation analysis to our sample reveals four categories of startup, each with its own set of needs: potential quick wins, demand bets, development bets, and technology bets.

Potential Quick Wins. These are startups that have a commercially ready product and a market that is prepared to adopt it. The immediate challenge is to achieve scale (initiate large production volumes, for example, or mount a major public-relations and marketing campaign), and for this, they need fresh funding, market access, and talent. Among startups in this group, 40% consider venture capital funds the preferred channel (compared with 25% overall) because venture capitalists tend to offer more generous levels of funding. To develop the customer base and the distribution network, many startups turn to corporations, although only 25% of them expect to get funding out of these collaborations. One-quarter of them do expect to get visibility, and 20% indicated that they expected to gain credibility, business knowledge, or technical knowledge.

Demand Bets. These are startups with a product that is sufficiently mature to be launched but that still has no broad commercial application. Their main challenge is to identify and create a market for their technologies. The two key roadblocks are the lack of a distribution network (42% of startups in this group mentioned this as a challenge, compared with 16% overall) and market resistance to change (37% of them cited this as a challenge, compared with 20% overall). Other than funding, their most important resource needs are market access (a customer base and a distribution network) and business knowledge, for which the preferred partners are, respectively, corporations and venture capital funds.

Development Bets. These startups have identified a market opportunity and defined a value proposition, and they are developing a technology to respond to the opportunity. They have not yet created a market-ready product. They are focused on gaining access to technical expertise (a critical need for half of these startups, compared with 40% overall) and overcoming technological uncertainty (which 25% of them describe as critical). To obtain the expertise they need, they are willing to consider collaborations with companies and universities, but less than half have actually established corporate partnerships (compared with 57% overall). Of the collaborations that the development bet startups have established, 60% are research partnerships that share the costs and risks of R&D and accelerate the product development.

Technology Bets. These are startups that have identified a promising (though not fully developed) technology that lacks a market application. Their objective is to develop a viable product that fills a market need. The two chief roadblocks that these startups face are long development time (a major problem for 30%) and technological uncertainty (noted by 25%). Because the attendant uncertainty makes funding risky, their funding is generally from university and public sources. Obtaining access to corporate knowledge and support is relatively difficult for technology bets owing to the risk factors involved. Survey participants from this group express stronger needs for all resources, as they need to turn a technology into a solution to a problem, and they need to develop a marketable product in order to reach the potential-quick-win stage.

For large companies with big innovation ambitions, picking the deep technologies to support depends on strategic priorities and a strong market assessment. Choosing the right partner, however, is much like a courtship, especially since the relationship is likely to be a lengthy one. In our experience, these arrangements tend to involve significant commitment from both sides—not just in terms of money but also management time, organizational expertise, and resources. Understanding what your prospective partner is looking for, as well as how those needs align with your own ambitions and capabilities, raises the chances for success.

The BCG Henderson Institute is Boston Consulting Group’s strategy think tank, dedicated to exploring and developing valuable new insights from business, technology, and science by embracing the powerful technology of ideas. The Institute engages leaders in provocative discussion and experimentation to expand the boundaries of business theory and practice and to translate innovative ideas from within and beyond business. For more ideas and inspiration from the Institute, please visit Featured Insights.