The smart-home ecosystem is continuing its rapid expansion, exemplified by Amazon’s acquisition earlier this year of Ring, a maker of internet-connected doorbells and cameras, for an estimated $1 billion—the second-largest acquisition in the company’s history. That followed big-dollar purchases of Nest (maker of smart thermostats, smoke detectors, and other products) by Google and of SmartThings (maker of a smart-home platform) by Samsung, as well as Apple’s financial commitment to Echelon, another platform maker. Investments in smart-home technologies are soaring, and so are adoption rates as consumers start to perceive products ranging from voice-activated assistants to smart security systems as standard household items rather than unnecessary luxuries.

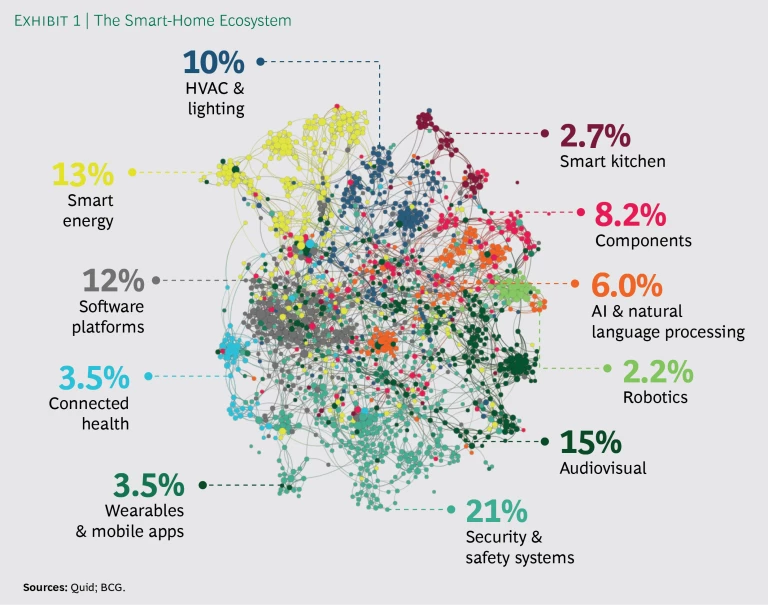

To increase our understanding of this fluid but increasingly significant sector, BCG partnered with Quid, a software and services company whose unique visualization tool (also called Quid) employs artificial intelligence (AI) to draw connections within large sets of text data. For our analysis, Quid identified roughly 1,500 players in the smart-home ecosystem, from Google Nest to Redback, a three-year-old startup that lets users store solar energy for use in the home, and BrainCo, another three-year-old company, which has designed a wearable device aimed at helping people raise their attention level and efficiency. (See Exhibit 1.)

We broke companies in the smart-home universe into 11 sectors, including security, health, and smart energy. Together, they have received nearly $12 billion in investments—and arguably this is just scratching the surface. Quid’s analysis allowed us to identify key enablers in the smart-home market, including investments and acquisitions in each sector and other significant developments. Among our takeaways: so far, no set of dominant players have firmly established themselves as market leaders.

Major Developments in the Smart-Home Market

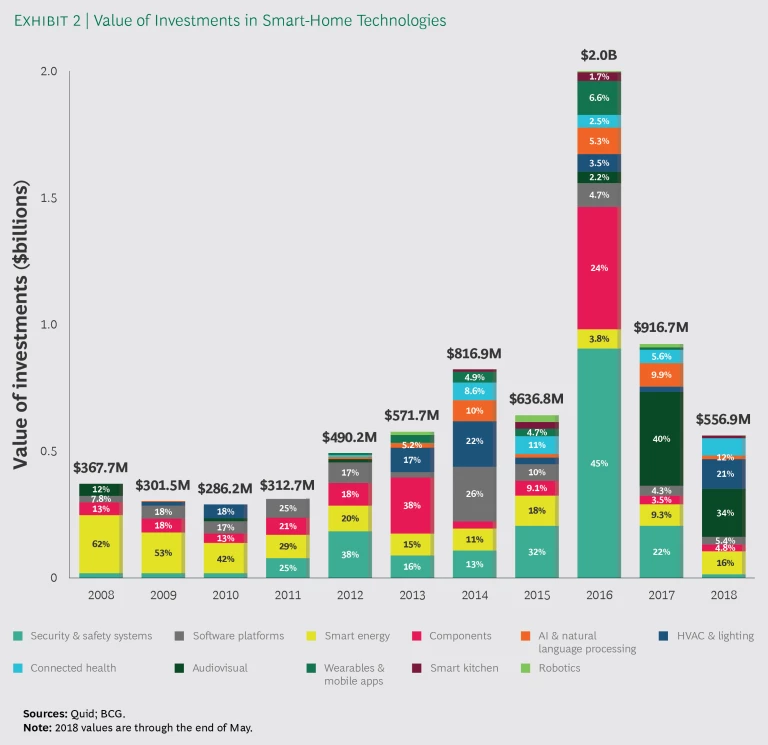

Estimates of the potential size of the smart-home market vary greatly, but most observers anticipate an attractive growth rate. Some estimate that adoption of smart-home devices in the US will achieve a compound annual growth rate of 42% between 2017 and 2022, as consumers embrace a wide variety of devices. Investments in the sector tailed off after the 2008 financial crisis but picked up again in 2012. At $2 billion, 2016 saw the greatest volume of investments to date, but that included a $659 million investment in ADT as part of a buyout. (See Exhibit 2.)

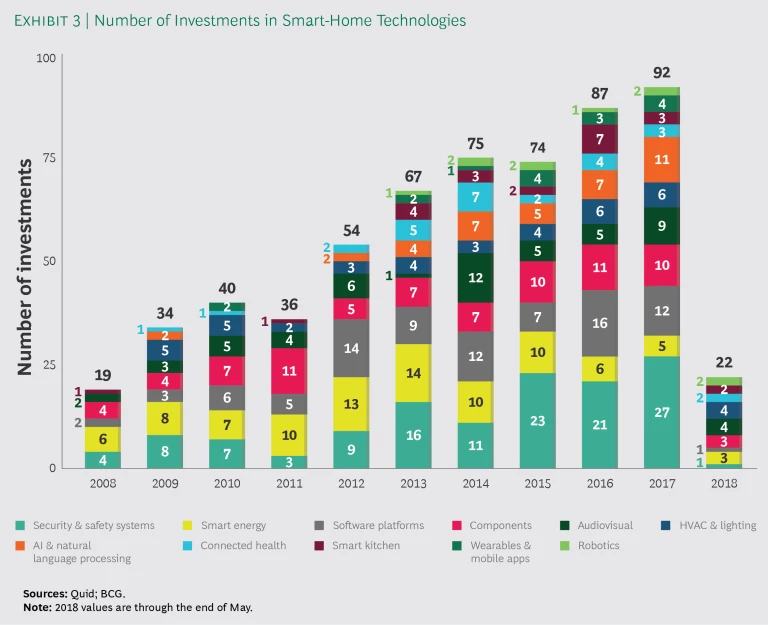

Many observers speak of the smart-home market as if it were a single entity, but analysis of companies in the sector founded over the past ten years shows that subsectors have peaked at different times in terms of investment value and volume. Investment volume in the components sector, for instance, peaked in 2010, while the peak year for smart-kitchen startups was 2015.

Virtual assistants—AI companions in the form of smart speakers—clearly caught on in 2017. This is still an emerging, immature market because use cases are limited and the cost of entry is high. But we anticipate that demand for voice-activated assistants will continue to grow rapidly over the next three to five years as AI capabilities mature. We also expect a virtuous cycle to help drive growth: the more smart-home gadgets connect to these devices, the more popular both the devices and the gadgets they enable will become.

Amazon (with Alexa) and Google (with Google Home) are among the digital giants that recognize that smart speakers and digital assistants serve not only as a gateway into the home but also as a critical control point within the smart-home ecosystem. Moreover, these devices will generate huge sets of data on human behavior, which will prove invaluable to any number of companies. Amazon and Google are not alone, of course. A large variety of players pushing virtual assistants are vying for a piece of this increasingly competitive market.

Because of the growing popularity of AI in the form of smart speakers, the artificial intelligence and natural-language category has seen a marked increase in investment activity since 2012. (See Exhibit 3.) That makes sense given the rising popularity not only of Alexa and Google Home but also of Apple’s Siri and other voice assistants. The single largest investment in smart-home AI technologies so far was the $50 million venture round that Rokid, a Chinese company specializing in AI development and robot research, raised in 2016.

One more active category of investments is the security and safety systems market, which has seen a consistent flow of dollars over the past ten years. That’s to be expected given that home security has always been a consumer priority, and connected devices offer an efficient means of maximizing safety and security.

Audiovisual (A/V) is the second-largest segment of the smart-home sector in terms of the volume of investment and the number of acquisitions. Consumers have been purchasing smart-home theaters and A/V systems that apply touchscreen and voice command technologies to speakers, televisions, and other devices. At the same time, the A/V segment is moving beyond connected speakers and touchscreens. For example, Coocaa, the internet division of Chinese TV maker Skyworth Digital Holdings, has received $44 million in funding to develop a television that protects the eyes by eliminating blue light, which studies indicate affects sleep and can potentially cause disease.

An interesting trend is the merging of the health and well-being sector into the smart-home industry. Everything from urine collection and analysis to routine monitoring will eventually take place in the home, allowing patients to spend less time traveling for the care they need. In this market, even sleep can be “smart”; Eight Sleep, which has raised $33.3 million in venture funding, has developed a mattress that includes temperature controls and a smart alarm that can detect when a person is in a light sleep and modulates itself accordingly. It also communicates with other smart-home devices to turn off lights and lock doors, allowing the user to perform several nightly routines using a single device.

Geography Matters

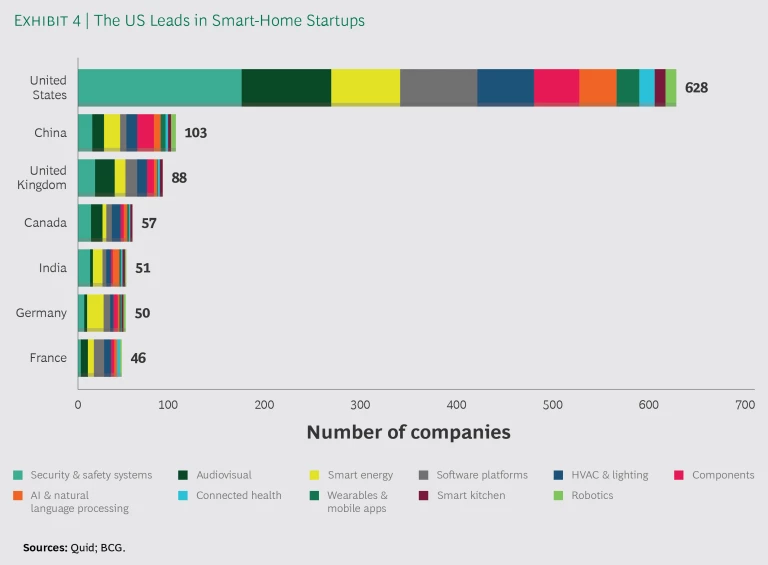

Startups require experienced employees, investors, and suppliers, so the local environment counts for a lot. Startup ecosystems centered on smart-home technologies appear to be forming largely in the US, China (in the city of Shenzhen), and the UK—with the US far ahead at this point. (See Exhibit 4.) Of smart-home businesses founded within the past ten years, most are based in Silicon Valley, London, and New York.

Top Investors in the Smart-Home Market

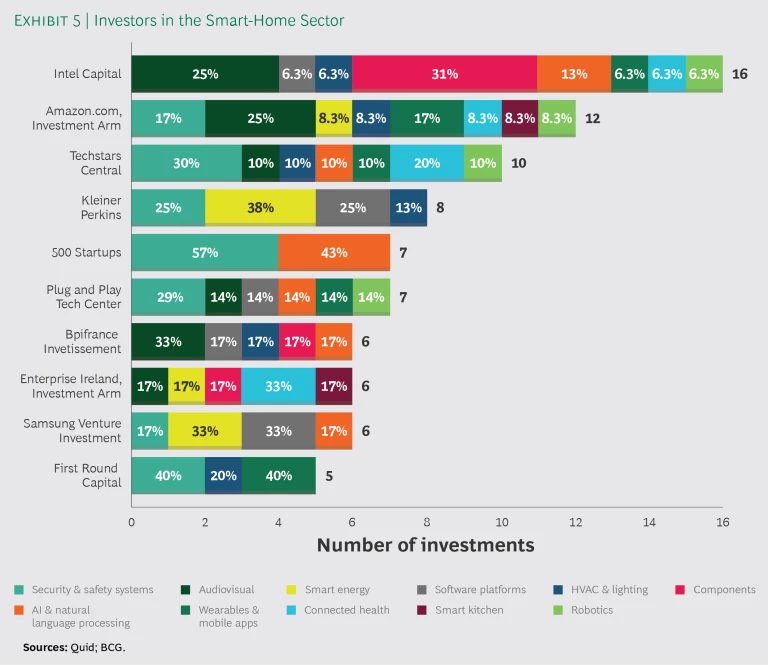

A string of institutional investors and corporations have been investing in the smart-home market. (See Exhibit 5.) By a large margin, Intel Capital is the most active investor, followed by Amazon with investments made primarily through its Alexa Fund, which focuses on companies developing Alexa-compatible technologies across a variety of categories—everything from personal robots to baby socks that monitor an infant’s breathing and heart rate.

Acquisitions by larger companies are another signifier of the growing importance of the smart-home market. Of all companies founded over the past ten years, those in the security and safety segment have had the highest median value, at $1.8 billion—largely because of the multibillion-dollar acquisition by Hellman & Friedman, a leading US-based private equity firm, of Verisure, a smart-alarm company. And the HVAC and lighting market posted a median value of $1.7 billion, largely owing to Google’s acquisition of Nest and Samsung’s acquisition of SmartThings.

Amazon, Samsung, and Alphabet (Google) seem to be the most aggressive investors in smart-home technologies. Amazon paid such a high premium for Ring because of the roughly 1.6 million Ring customers it can now seamlessly integrate with its Echo virtual assistant (Ring is deployed on Amazon Web Services); moreover, Ring adds one more component to the robust smart-home ecosystem that Amazon is building. Samsung, it addition to the $200 million it paid for SmartHome, has also acquired Perch, a company that transforms old smartphones into security cameras, and it is a co-investor (with Intel) in MindMeld, a voice interface company that utilizes natural language processing to create conversational AI. For its part, Alphabet has purchased, besides Nest, a number of remote monitoring companies, including Revolv and Dropcam.

Handicapping Today’s Market

Amazon is unquestionably today’s leading player, at least in the US smart-home market. It has the largest market share in terms of devices sold (roughly 70% of the estimated 25 million unit sales in the US to date), and most reviewers give Amazon products a high score for universal compatibility and their ability to control smart-home accessories. Given the company’s strategy of developing a commercial platform for all third-party devices and apps, it’s no surprise that Amazon’s partnership base is expanding.

More surprising is the fact that Apple so far lags behind other large companies in investments and acquisitions. That’s not to say the company is completely absent from the sector. Apple has a robust lineup of products developed internally through its HomeKit brand, an offering the company augments through partnerships with other manufacturers, including Logitech, D-Link, Nanoleaf, Honeywell, and Kwikset.

Other companies are playing to their strengths in order to catch up with Amazon. Apple, of course, is trying to capitalize on its ability to deliver a great user interface and the superior audio quality of its products, while Google is using its mastery over search engine algorithms. Changing regulations, along with other government policies, could produce advantages for companies based in Europe and Asia.

Playing Catch-Up

One key for new entrants and others needing to catch up is finding that balance between cutting-edge technology and usability: what’s possible isn’t always what’s best for consumers if it adds too much complexity. Another key is demonstrating speed in building an end-to-end solution or a smart ecosystem. A smart ecosystem must provide a fluid customer experience across vendors and devices. Only then will the conditions be in place for explosive growth. The following are takeaways for smart-home vendors that seek to increase market share:

- Build a critical set of compatible devices and applications on the company’s platform. Offer end-to-end solutions rather than just a best-of-breed range of products. Few existing platforms will survive in the medium term as the industry becomes more mature and standardizes across products and categories.

- Harness the power of an ecosystem. A smart-home device becomes powerful when it links together individual systems within the home. Integration with other devices, such as lighting and washing machines, will drive customer satisfaction and vendor stickiness.

- Adopt AI, machine learning, and improved natural language processing algorithms. A true assistant must be fully predictive but in a subtle way, to avoid being perceived as “creepy.”

- Leverage smart-home data. This will help vendors learn about consumer preferences and behaviors and create a more targeted, ultimately superior user experience. It can also provide an important source of additional revenue.

- Find new ways of solving old problems. There will be opportunities in adjacent markets—and in this case, the meaning of “adjacent” is broader than ever. One example is a smart vacuum cleaner, which is essentially a robot with a vacuum system attached. Add a camera and security-related sensors and the adjacent market becomes security systems, with a “security camera on wheels” offered as a service.

- Prioritize device security and consumer trust. A lack of vendor focus on security will lead to privacy issues and negatively affect a brand’s reputation. Expect a high level of scrutiny on this front from both consumers and businesses.

- Clearly define product plans, with a focus on monetization models and operating costs. A smart-home vendor can focus on hardware, data, consumer behavior (advertising), utilization, and optimization of related services, among other areas. A well-defined monetization model will facilitate focused execution.

The smart-home industry will emerge as a robust environment populated by multiple key players in various subsegments, rather than a market dominated by a few large tech giants. True innovation and a strong focus on security, coupled with the latest technologies, will transform the home of the future. Businesses in the industry will need to stay agile and flexible in their strategies to capture and maintain market share. They need to think about partnerships and view themselves as part of an ecosystem that brings real value to consumers through seamless product integration and services.