The economic advantage of using blockchain to unlock the potential of the Internet of Things (IoT) is still evolving. A study conducted by Boston Consulting Group and Cisco Systems explored the ways that these two promising early-stage technologies are being employed. (See Are Blockchain and the Internet of Things Made for Each Other? BCG Focus, July 2018.) Most of the 35 use cases studied are still in the proof-of-concept phase. One exception is the supply chain track-and-trace capability, with which businesses have begun testing the feasibility of scaled rollouts.

The qualitative benefits of a solution that combines blockchain with IoT in operations tracking and visibility have been extensively discussed. However, one seldom sees an exploration of the economic benefits, the focus of this report. A third publication will consider the ways that blockchain, along with IoT, is helping with counterfeit-goods prevention—another use case that is already demonstrating potentially significant business value.

Read more about the promise and impact of blockchain and the Internet of Things

Read more about the promise and impact of blockchain and the Internet of Things

- Are Blockchain and the Internet of Things Made for Each Other?

- Stamping Out Counterfeit Goods with Blockchain and IoT

While supply chain pairing of IoT with blockchain is still in its infancy, the ability of these technologies to help companies reduce their dependence on intermediaries, minimize reimbursement delays, and enable more efficient batching and routing could deliver substantial returns. By adopting blockchain in an IoT-enabled supply chain network, a billion-dollar manufacturer could save many millions of dollars each year—a determination that’s based on an examination that was limited to supply chain logistics and storage and excluded other elements of the traditional supply chain.

By adopting blockchain in an IoT-enabled supply chain network, a billion- dollar manufacturer could save many millions of dollars each year.

Pain Points in a Traditional Supply Chain

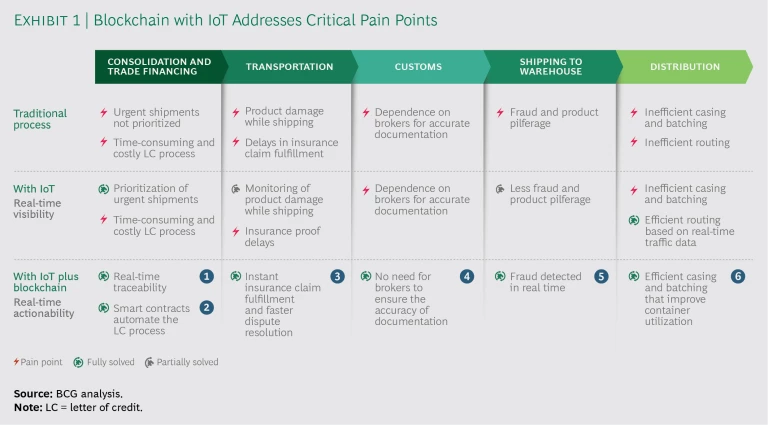

For the purposes of this report, we have focused on those pain points for which blockchain with IoT can generate incremental value. The typical supply chain comprises numerous elements, including planning, procurement, production, logistics and storage, sales, and after-sales service and returns.

Although blockchain with IoT can assist at every point along the supply chain, in this report, we focus on the logistics and storage stage, aware that overall savings across the supply chain could be substantially higher. For example, plurality of interests and asymmetry of information are inherent in ecosystems. Despite companies’ interdependence, each business within a supply chain is optimized toward its own profitability, making opacity an advantage that leads to classic principal-agent challenges. However, this and other similar ecosystem challenges and resulting benefits are not covered in this report.

Six key challenges typically confront those engaged in the logistics and storage phase of supply chain management:

- Inefficient Inventory Management. “Visibility gaps” in the location and status of shipments lead to inefficient routing and inventory management problems, which result in higher costs, shortages, and unhappy customers who expect on-time deliveries.

- A Costly and Time-Consuming Letter-of-Credit Process. Banks—and the fees that they charge—are a supply chain fact of life. Letters of credit—guarantees of payment in return for shipped goods—are needed to establish goodwill between buyer and supplier, but they eat up time and result in additional costs.

- Delayed Reimbursement for Damaged Goods. The inability to track damaged goods and file claims in real time means that working capital is tied up for long periods of time.

- Dependence on Brokers. Regulatory requirements and complex processes gave rise to customs brokers, who help prove the authenticity of documents, mitigate risk, minimize delays, and help businesses avoid fines. Nevertheless, they also add friction and extra costs to the shipping process.

- The Extra Costs of Fraud and Pilferage. Thefts raise supply chain costs. An inability to assign accountability for pilferage can compound the problem and result in significant dispute resolution costs.

- Inefficient Batching and Routing of Goods. Companies’ inability to automatically and efficiently batch products for shipment results in suboptimal container utilization and higher shipping costs.

Blockchain to the Rescue

Some of the challenges we’ve mentioned boil down to a lack of visibility: the difficulty of knowing where a product is at any given moment. IoT solves that problem by providing real-time traceability across the supply chain. Any company with an IoT-enabled network can always know exactly where a product is.

Blockchain helps unlock the potential of IoT by introducing a shared, distributed ledger into the equation.

Still, visibility offers only a partial solution. Device data stored in a central database that is neither accessible to other stakeholders nor trusted by them has limited capacity to ease supply chain pain points and drive economic efficiencies. That’s where blockchain comes in and why it will prove so valuable to a wide variety of businesses. Blockchain helps unlock the potential of IoT by introducing a shared, distributed ledger into the equation. When a product shows up at a warehouse and when it leaves can be recorded in a verifiable event log to which supply chain participants have access. (See Exhibit 1.)

Blockchain’s single, shareable version of truth facilitates trust and promotes the automation of key processes. Vested parties can track critical information, such as the location and quality of goods, more accurately and more securely. These and other advantages that arise when companies pool immutable sensor data among relevant stakeholders will inevitably lead to the elimination of intermediaries whose business models are predicated on leveraging mistrust. Costs fall as blockchain with IoT-enabled validation makes the need for manual checks and independent, outside assurances obsolete.

The Benefits of Blockchain in IoT-Enabled Supply Chains

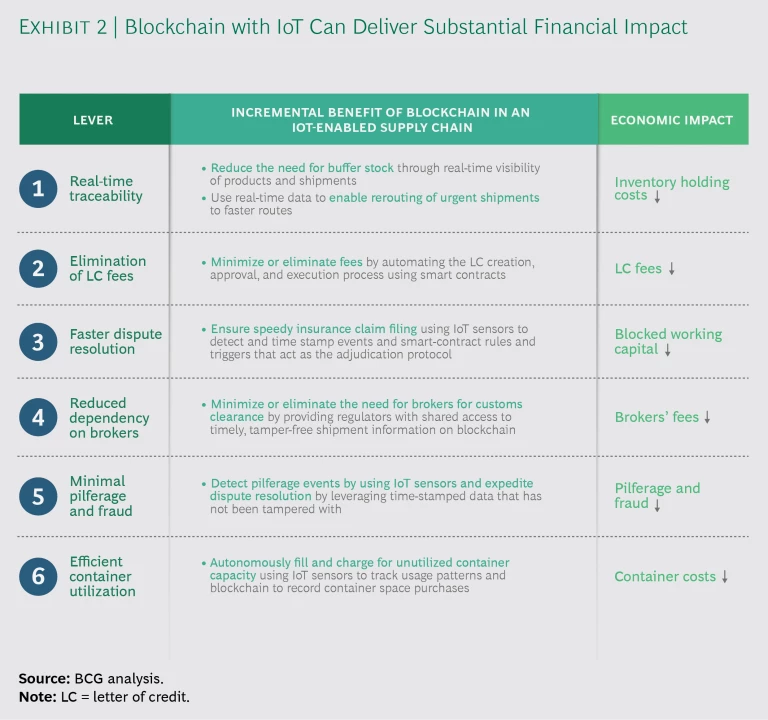

Blockchain is not a panacea for every supply chain issue, but Exhibit 2 illustrates the way that IoT powered by blockchain can address each of the previously described logistics and storage challenges:

- Inventory holding costs are lower. Real-time traceability through IoT devices that is shared through blockchain provides visibility into the status of products and shipments and verification by all stakeholders across the value chain. With this visibility, companies can reduce the stock they hold as a buffer, promote more efficient inventory management, and lower holding costs.

- Letter-of-credit fees fall. Smart contracts that document agreements between importers and exporters, along with automated contract execution and payment, can reduce, and potentially rule out, the need to use banks as intermediaries, thereby reducing, and possibly eliminating, letter-of-credit fees.

- Less working capital is tied up in damaged goods. Prompt detection during transit through IoT sensors, coupled with the accountability that comes through time-stamped ownership data recorded in blockchain, fosters faster dispute resolution and reduces the amount of capital committed to damaged goods.

- Brokers’ fees shrink. Blockchain, which allows regulators to digitally trace shipment movements and other pertinent information (such as invoices, certificates of origin, and clearance documents) can minimize, and possibly eliminate, dependence on brokers for customs clearance.

- There is less pilferage and fraud. Prompt detection of route deviation and product tampering—along with the log of time stamps that blockchain charts—enables real-time reporting of fraud and the possibility of identifying a suspect during shipment so that the responsible party can be charged. There’s also the potential to minimize, if not eliminate, pilferage and fraud by invalidating sales of stolen items at retail outlets.

- Container costs fall. Analysis of container utilization patterns can automatically detect and monetize available space, allowing for more efficient container utilization.

Net Cost Savings of 0.4% to 0.8% of Revenues Are Achievable

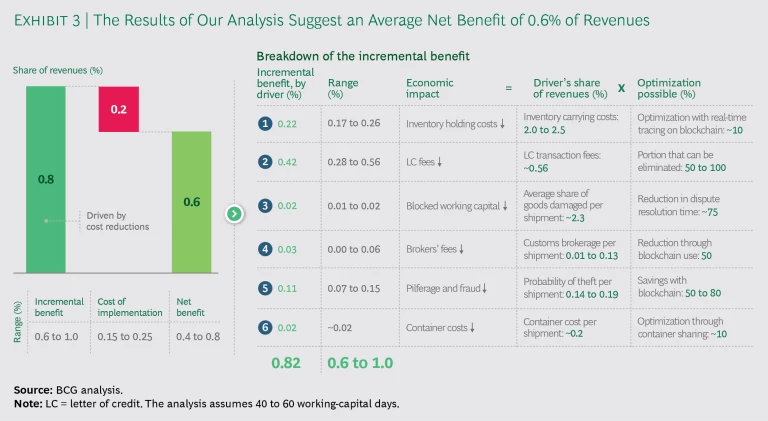

To show how a solution that pairs blockchain with IoT can deliver substantial economic impact in the logistics and storage phases of the supply chain, we created a hypothetical example: a $1 billion electronics equipment company with manufacturing operations in China and distribution centers in the US. We assessed and compared two scenarios for this imagined company: an aggressive scenario in which the company realizes significant economic benefits and a more conservative scenario with less positive impact. We then averaged the results. (See Exhibit 3.) Our analysis estimated the incremental savings from an IoT-plus-blockchain solution and compared the results with the savings from a solution that relied only on IoT sensors without blockchain. Adding blockchain-enabled efficiencies to the logistics and storage aspects of the supply chain, we found that it was possible to achieve net savings equal to 0.6% of revenues. (That’s $6 million in annual savings for our hypothetical billion-dollar electronics company.) We estimate that the overall end-to-end impact of blockchain on a supply chain—factoring in such additional levers as inventory optimization and receivables factoring—would be substantially higher.

Drilling deeper into the numbers shows that companies realize the greatest benefit when they reduce the amounts that they pay banks in fees for letters of credit. Those fee savings can range from 0.28% to 0.56% of revenues. Better inventory management is the other big driver: reducing holding costs and minimizing stock outages can generate an additional average benefit of 0.22% of revenues (in a range from 0.17% to 0.26%).

There are, of course, costs associated with implementing a blockchain solution. In our example, we assumed deployment of a blockchain-as-a-service solution along with a decentralized supply chain track-and-trace application and 30 nodes that share information among key supply chain stakeholders. Factoring in the estimated implementation and integration costs, we estimated annualized expenses equal to roughly 0.2% of revenues.

Results May Differ

Savings vary. For instance, blockchain’s impact is reduced when a high level of trust among stakeholders negates the need for a decentralized ledger.

On the basis of the six levers identified above, we determined that three factors have the greatest impact on total cost savings:

- Product Features. Traceability and fraud-related savings are tied to the “economic density” of a product. The higher the value per unit volume—for example, the value of packages of electronics or pharmaceuticals compared with bags of cement—the higher the potential savings. Container cost savings are related to how easily a product can be “batched,” so companies whose products can’t be easily batched (owing to, for example, regulatory requirements) might be able to achieve only limited savings that are based on container utilization.

- Supply Chain Characteristics. Companies with relatively complex supply chains—those with tier one, two, and three suppliers—can achieve higher value from traceability, reductions in fees for letters of credit, and dispute resolution. Vertically integrated supply chains with a relatively small number of suppliers could see lower savings.

- Disintermediation Possibilities. Supply chains that currently have numerous intermediaries—for example, customs brokers—performing manual processes and charging add-on fees are the most likely to see significant benefits from blockchain through information pooling or automated settlements.

The impact of an IoT solution powered by blockchain is not applicable for every supply chain scenario. To justify the implementation expenses, each enterprise must first formulate a solid business case that reflects its unique situation. Our research suggests that many will conclude that the potential payoff makes it well worth taking the plunge. The possible annual supply chain savings in logistics and storage—on average, 0.4% to 0.8% of revenues—can give businesses the sustainable competitive advantage many are looking to acquire.