Digital technologies are bringing major changes to the testing, inspection, and certification (TIC) industry, with new entrants often leading the charge. Such developments will affect how, where, and when these services are provided over the next decade—and who will provide them—altering revenue streams considerably.

Traditional players that digitize now will be winners, able to outgrow the market.

Traditional players that digitize now will be winners, able to outgrow the market with new digital services—while companies that don’t act will likely be out of the running altogether in the long term.

Changes in Market Demand and Revenue Streams

TIC companies, regardless of sector, work to verify the safety, security, and performance of a product, service, or process. Product verifications fall into two categories, based on when they take place. The first type is conducted before a product launch, while the second is done while the product is in service or in use.

One focus of TIC businesses has been to verify new or installed hardware, such as cars and machinery, which people test at their desk, on site, or in a lab. As global trade, regulatory requirements, and outsourcing have grown, so has demand for these external services. Over the past decade, the TIC market expanded on average approximately 8% annually, and EBIT margins averaged 10% to 15%.

Technology Trends

The role of TIC businesses is about to change, however, as emerging digital technologies assume a larger role in providing TIC services over the next decade. For example, connected devices, mobile payments, and connected cars will become more commonplace, making software testing and inspection as important as hardware testing and inspection are today. In addition, companies will provide TIC services remotely on a daily basis or even continuously. Seven technologies will prove especially important:

- Smart Sensors. Providing a constant stream of data, smart sensors embedded in products enable round-the-clock remote monitoring and inspection capabilities, which can also be used for 24/7 safety and security checks and even for predictive maintenance. As a result, there will be less need for onsite inspections and greater need for secure data generation and analyses. For example, several TIC players are currently experimenting with online monitoring of elevators, pressure vessels, and other hardware.

- Cloud and Cybersecurity. Many things have become possible with cloud connectivity, including instant data sharing, report issuing, and automated certification. In addition, the need for cybersecurity will grow as apps proliferate and the use of cloud storage increases. The growing number of large cyberattacks and the attendant data privacy issues will likely lead to increased regulation and, with it, greater demand for TIC services. Take for example the growing demand for software testing, general data protection regulation, and IT security certification (ISO certification).

The growing number of large cyberattacks will likely lead to increased regulation--and greater demand for TIC services.

- Big Data and Analytics. As the quantity and types of data available for tested and inspected objects grow, so will the need for data management and analysis. In addition to enabling better insights for existing services, big data and analytics will allow TIC providers to offer new services, including predictive maintenance and data-based services in new areas. For example, TIC companies will be able to provide consulting services for oil companies involved in exploratory drilling. If data becomes too big and complex to handle, new entrants with more advanced data-analysis capabilities will have an edge.

- Connected Devices. Thanks to rising safety concerns and regulations, the market for connectivity standards is growing for things like connected cars, smart home networks, and other IoT innovations. This means demand for TIC services will likely grow as well. But if non-TIC companies become gatekeepers to the data generated by connected systems, the opportunity for traditional TIC players could be limited. For example, companies that manufacture and sell consumer products like connected coffee machines or thermostats will be able to leverage the enormous amounts of consumer data at their disposal to provide testing and inspection services.

- Blockchain. Arguably the most important recent invention in computing, blockchain technology and its applications will continue to grow. For example, blockchain can be applied for end-to-end traceability solutions for food and other products. In addition to basic supply-chain TIC services, the demand for TIC services related to blockchain systems will likely rise.

- Next-Generation Automation. As the automation of smart machines advances to the point where software-led objects are all part of an integrated, automated ecosystem, there will be a need for more TIC services. For example, agricultural equipment that analyzes climate and soil data to identify optimal cultivation methods will require TIC.

- Virtual/Augmented Reality (VR/AR). The growing use of VR and AR devices to help people in various activities in real time will likely open up a significant opportunity in product testing. Several TIC players are already experimenting with AR for inspections to improve their service quality and efficiency. But traditional players need to factor in the possibility that for the latest VR/AR technologies, they are likely to be somewhat dependent on Google, Facebook, and other non-TIC players that are developing AR products.

Several TIC players are already experimenting with AR for inspections to improve their service quality and efficiency.

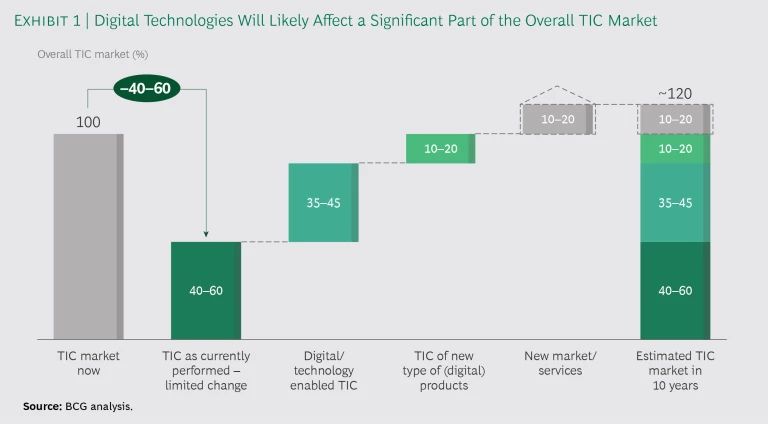

We estimate that over the next decade, the digital technologies just described will concern approximately 40% to 60% of the current TIC market. (See Exhibit 1.) More TIC activities will be performed digitally, and there will be TIC activities for new digital products and services. These digital technology trends will also provide access to more data, which will allow TIC companies to create new value-adding services. Overall, the core TIC market will likely expand.

Generally speaking, revenues from TIC services for legacy products like internal-combustion vehicles and car emissions will drop. But revenues from new digital products like electric and connected cars will likely more than compensate for that decline, as products become technologically more complex and require more frequent and intense TIC, part of which can be provided remotely. In addition, the demand for digital-related services, such as predictive maintenance, cybersecurity, and supply chain integrity, will likely grow.

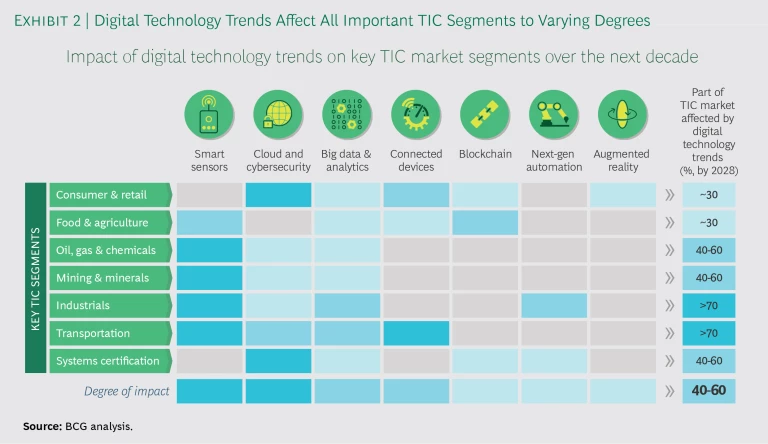

Up to 70% of the industrial and transportation markets will likely be affected by digital technologies.

Every market segment will feel the impact, although the size of the impact and the relevant technologies will vary with the segment. Up to 70% of the industrial and transportation markets will likely be affected, with smart sensors being the biggest driver, as well as about 30% of the consumer and retail market, with a focus on consumer data safety and privacy. (See Exhibit 2.)

A Challenging Competitive Landscape

Seeing the opportunities, companies with strong technology capabilities, such as those in the following list, are contesting traditional TIC companies’ market dominance.

Digital TIC Companies. Traditional TIC players are getting more and more competition from startup and incumbent TIC companies with a digital focus. One example is AsiaInspection, a quality control and compliance company that provides product inspections, supplier audit programs, and laboratory testing. AsiaInspection digitized its customer interface. For example, within 48 hours of scheduling an appointment, the inspection is conducted and a detailed report is available online the same day.

Non-TIC Players. These companies pose a serious disruptive threat in areas such as predictive maintenance, supply chain integrity, data capture and analytics, data-driven services, and cybersecurity. There are three types of non-TIC players:

- Original Equipment Manufacturers. This very broad category includes companies as diverse as elevator, car, and dishwasher producers. They have always been keen to grab a piece of the TIC services pie. ThyssenKrupp Elevator, for example, uses local technicians to conduct inspections and send the data to experts for real-time analysis and support. The company also does its own predictive maintenance.

- Large Consultancy and Accountancy Firms. Players like Deloitte, Ernst & Young, PwC, and Accenture have a reputation for third-party independent judgment and have advanced digital capabilities. They are using these capabilities to get into the TIC of cybersecurity and software products; possibly they will go into other arenas as well.

- Tech Giants. Google and other tech companies have a considerable competitive edge in digital because they have access to enormous amounts of data, which they could at some point use for TIC-related services. They are also developing AR products, which means that traditional players need to factor in the possibility that they will be dependent on them.

Some major traditional TIC companies such as SGS have adopted digital technologies.

Some major traditional TIC companies have started to adopt digital technologies. The top ten companies, each with more than $1 billion in annual revenues, comprise 30% of the market. SGS, Bureau Veritas, and Intertek are prime examples. Midsize companies and a large number of smaller companies focusing on one region or end market have also begun adopting digital technologies. But these efforts need to be significantly increased.

What TIC Players Need to Do to Succeed

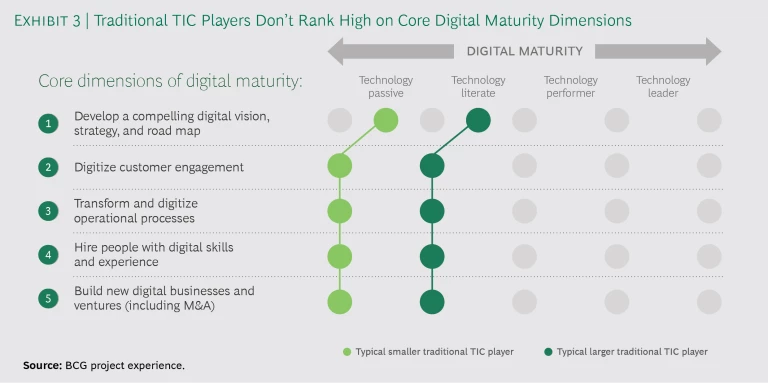

In the years ahead, traditional success factors such as accreditation, track record, and reputation will no longer be sufficient for success in the TIC industry. Advanced digital capabilities will be critical. Because most traditional players are technologically rather immature, especially when compared with the external competition, they will need to make substantial investments in digital capabilities to get up to speed, as suggested below. (See Exhibit 3.)

Develop a compelling digital vision, strategy, and road map. Traditional TIC players need to make digital transformation their top priority. This requires developing a clear idea of the kind of digital value they will provide customers and the strategy they will use to develop the necessary capabilities. A small number of incumbents have already taken steps in this direction. For example, SGS has embedded digital in all of the company’s business lines.

Digitize customer engagement. TIC players need not only to embed digital technologies in their core offerings; they also need to invest in digital apps and platforms that will make customer engagement easier. For example, Bureau Veritas has launched a platform across the globe to help companies improve performance of their management systems to meet ISO standards.

Transform and digitize operational processes. Most traditional TIC players are still using old IT systems—or even pen and paper. To provide competitive digital offerings, they will need to invest heavily in digitizing all core processes. For example, SGS is planning to launch a large IT transformation that will provide self-service technologies for customers, an integrated digital platform for partners, and productivity solutions for employees.

Another example is Bureau Veritas, where experts use an in-house IT tool, G-Inspect, to reduce the duration of certain inspections carried out during major shutdowns of process facilities such as nuclear control centers and refineries. They enter their remarks directly onto a tablet and send out the conclusive report promptly, which allows the client to begin restarting the equipment or to carry out necessary repairs quickly.

Hire people with digital skills and experience. Our research found that currently less than 1% of TIC jobs advertised on LinkedIn include digital or technology-related terms. This suggests traditional players have not yet focused on acquiring people with digital skill sets. It’s critical to have in-house digital expertise as well as senior executives dedicated to digital.

Traditional players have not yet focused on acquiring people with digital skill sets.

SGS, Bureau Veritas, and TÜV SÜD, for example, appointed a senior executive in charge of digital, responsible for coordinating all digital efforts of the companies’ various business units. DNV-GL created a new digital solutions organization, which it staffed with digital experts from across the company. The intent is to leverage its expertise and seize opportunities in data sharing, advanced analytics, automation, and machine learning and deal with challenges related to data quality and security.

Build new digital businesses and ventures, including M&As. TIC players need to create new digital products and services. Bureau Veritas, for example, has launched a traceable label to give consumers insight into a product’s journey through the supply chain. TÜV SÜD launched a project with the German Research Center for Artificial Intelligence to test and certify AI systems used in autonomous driving. And SGS established a partnership with Glenfis, an IT systems and services certification firm.

In addition, TIC players need to make acquisitions and partnerships with companies that already have the needed digital capabilities. We’ve observed that the top five companies are undertaking more M&As than smaller competitors. For example, TÜV SÜD expanded its cybersecurity capabilities by acquiring Acertigo AG, a firm that provides compliance services for the payment card industry.

Digitization is an enormous undertaking, requiring significant investments, hiring, and M&As. We therefore expect larger TIC players will have an advantage making this transformation. But they need to act quickly. Currently, SGS, Bureau Veritas, and TÜV SÜD, which have all made digitization a priority, are leading the way, while companies not digitally focused are lagging behind. If this trend continues, it will open the door to further consolidation, with the larger TIC players getting larger and the smaller ones facing the risk of extinction.

Although the evolution of digital technologies has only just begun, it’s clear that they will exert an enormous impact on the TIC industry as we know it today. The winners of the past will not necessarily be the winners of the future. Only companies that make the effort to digitize strategically will be in a position to succeed.