Over the past half century, the shipping industry has reinvented itself time and again, ushering in containerization, larger vessels, and electronic data interchange. Despite the improvements, aspects of port operations remain firmly anchored in the past, dependent on manual and paper-based systems.

But global trade isn’t standing still. Ever-increasing vessel sizes and cargo volumes continue to pressure ports and terminals, which must keep innovating just to keep up. Operators that want to maintain a competitive edge must adopt a digital mindset and implement smart-port technologies to stay productive, customer friendly, efficient, and competitive. Progressive ports are embracing the same digital breakthroughs that are disrupting other industries. Among those disrupters: connected platforms, cloud-based services, mobile devices and apps, sensors and other Internet of Things technologies, augmented reality, autonomous transportation, blockchain technology, and big data.

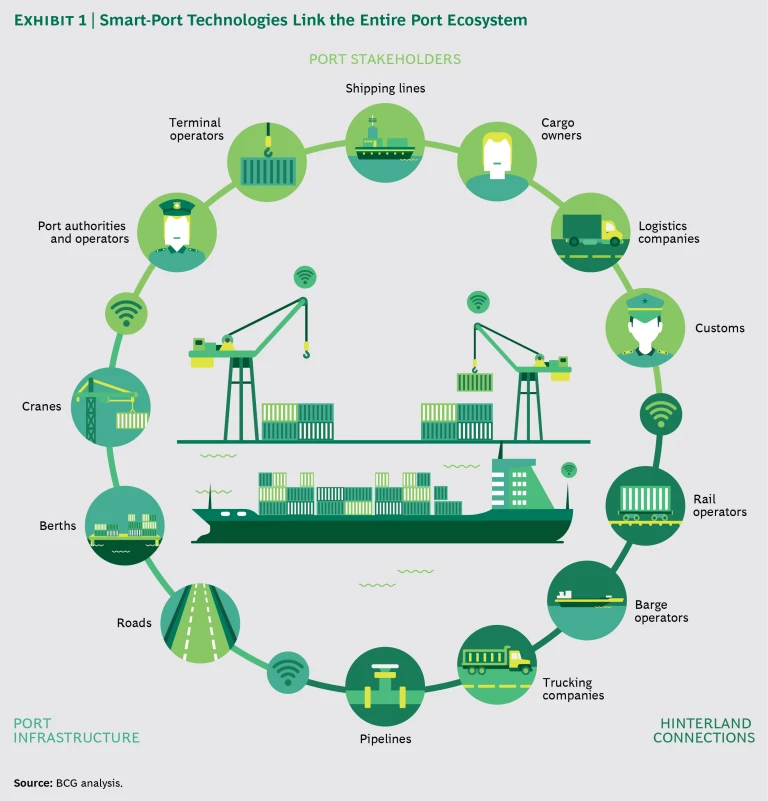

At the same time, port environments have become intricate partner networks that include port authorities, terminals, shipping lines, trucking and logistics companies, and off-dock storage providers. To be truly effective, stakeholders have to do more than simply adopt these technologies on their own. Instead, they must embrace platforms and services that make it easier for stakeholders to work together to promote the efficiency of the overall ecosystem. (See Exhibit 1.) These same platforms and services let individual partners expand their businesses without adding substantial new infrastructure or equipment. In some cases, the multistakeholder platforms also create digital-based services that can be used as new revenue sources.

Smart-port technologies’ impact can be substantial. At Germany’s Port of Hamburg, for example, wide-ranging connected-port initiatives are integral to a plan to double capacity—but not space—by 2025, simultaneously reducing operating costs for operators and logistics costs for cargo owners.

How Digital Helps Transform Ports and Terminals

Smart-port technologies are digital-based, multistakeholder systems. Port stakeholders can use these technologies to reconfigure basic functions and improve existing operations—to reengineer how work gets done—without major investments in new infrastructure and equipment. Accordingly, our review of smart-port technologies does not include traditional IT services, such as data standardization and systems integration, or systems such as terminal automation systems that serve only a single entry.

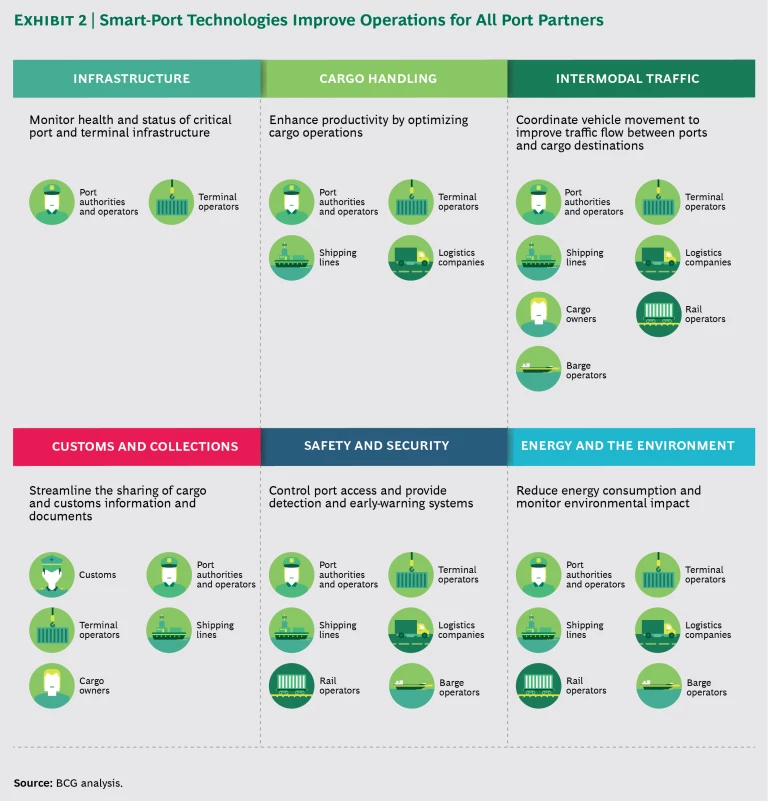

Smart technologies include systems that support basic infrastructure, as well as, for example, tools for handling cargo, managing traffic, dealing with customs, assuring safety, and monitoring energy use. Some benefit the gamut of port partners while others support specific partnerships between, for example, a port authority and terminal operators. (See Exhibit 2.)

Infrastructure. Smart sensors help port authorities and terminal operators track, operate, and maintain the physical infrastructure and facilities they manage. Sensors that are embedded in quay walls, roads, railways, and bridges when they are built can transmit real-time data about operating conditions of berths and other infrastructure. Used in this way, sensors can reduce the need for annual inspections and provide data that helps owners schedule preventive maintenance more precisely. Many sensor-based structural-health-monitoring systems cost a fraction of the structures themselves, and this can mean a relatively fast return on investment (ROI) in countries where the cost of labor is high.

Cargo Handling. Reliable monitoring systems can ensure that cranes and other cargo-handling gear operate at peak efficiency and are properly maintained, helping terminal operators handle increased volumes and improving productivity. Connected cargo-handling equipment does this work in real time. A container terminal at the Port of Valencia in Spain is testing one such network. “Black boxes” that are installed on 200 cranes straddle carriers, trucks, and forklifts in the terminal, collecting information on location, status of operations, and energy consumption. The system analyzes the information in real time and shares it with terminal staff to identify operating bottlenecks and initiate appropriate action. The prototype’s developers estimate that it could shave up to 10% from operating costs by reducing equipment idle time and minimizing energy use.

Intermodal Traffic. Improving cargo-moving efficiency isn’t the only goal. Terminals also need better options for directing trucks and trains through frequently congested areas as quickly as possible. Terminal appointment systems provide one solution that lets trucking carriers reserve specific times for dropping off or picking up freight. By booking time slots in advance, appointment systems help minimize turn times, reducing the time that truckers spend clogging port arterial roads or sitting idle and contributing to poor air quality. The Port of Singapore is testing a GPS-based traffic-monitoring system that tracks truck movements, notifies terminals when vehicles are approaching key facilities, and provides directions on how to proceed. In another application, the Port of Hamburg is testing embedded traffic-monitoring sensors along major port roads.

Customs and Collections. In addition to moving cargo more efficiently, ports need to do a better job of handling cargo information and payments, including the processing of trade licenses, import and export permits, and customs clearances. The leading European ports are experimenting with blockchain technology to reduce costs associated with paper-based cargo documentation and customs payments. Blockchain stores data in multiple locations, accelerating processes and reducing the risk of data tampering. Blockchain can be used to create tamper-proof custody records and replace paper-based bills of lading, thus helping shippers, shipping lines, ports, terminals, and customs authorities save hundreds of dollars per container in labor and processing costs. In Antwerp and Rotterdam, the ports are experimenting with blockchain technology for container security and tracking freight.

Safety and Security. Ports are required to meet minimum safety and security levels for the facilities and assets they manage. They are responsible for monitoring physical infrastructure and ensuring that only personnel with proper authorization and clearance gain entrance to restricted areas. Among the array of smart technologies that ports can adopt to improve security: surveillance systems that use advanced video analytics to detect intrusions on the basis of movement and pattern recognition and then alert security personnel to potential threats. Many ports are upgrading from gate entry systems, adding more protection by requiring employees, truck drivers, and visitors to log in through systems that use networked biometric scanners. To address worker safety concerns, ports are installing sensor-based sys-tems that enforce safe working procedures. For example, they use sensor networks that alert truck drivers traveling on port property to remain within road lines. Similar networks can keep cranes properly aligned during loading and unloading.

Energy and the Environment. Connected technologies help ports reduce energy consumption and waste. One option is a motion-based terminal illumination system that lights up only when vehicles are in the vicinity. A prototype motion-sensitive lighting system installed at a terminal in the Port of Valencia cut energy consumption by 80%, paying for itself in less than two years. To minimize energy use, the Port of Hamburg is deploying similar smart lighting on port roads. Some ports use drones as a low-cost option for inspecting equipment, patrolling waterways for oil spills, and checking on cleanup efforts.

Many facilities have adopted one smart-port technology or another, but leading ports, such as Hamburg, have tied multiple individual systems into a single interconnected port-wide platform. This type of platform integrates data from such sources as sensors, mobile devices, and various stakeholders’ databases. Port authorities and their stakeholders use port-wide platforms that improve internal operations and can collect real-time information on in-port traffic to minimize bottlenecks in yards and at terminal gates. Platforms with geolocation functions can pinpoint incoming trucks and optimize planning for truck traffic volumes.

In addition, interconnected community-wide platforms produce data that ports can sell as new services to customers. Ports with real-time data on hinterland truck movement, ship loading, and yard operations could offer a “late gate,” which would allow a trucking carrier to deliver a container after normal business hours should operations be able to accommodate it. Ports with real-time traffic information can sell the data to trucking and logistics companies seeking to optimize trip planning. Port-wide platforms could serve as the foundation of an equipment marketplace for buying, selling, and sharing equipment.

Although they are removed from day-to-day operations, port authorities are responsible for a port’s strategic development. This responsibility gives them a central role in coordinating stakeholders and bringing them together to drive innovation. Adopting smart-port platforms is critical for ports’ continued success and ability to leapfrog competitors.

Smart-Port Solutions Are Not One-Size-Fits-All

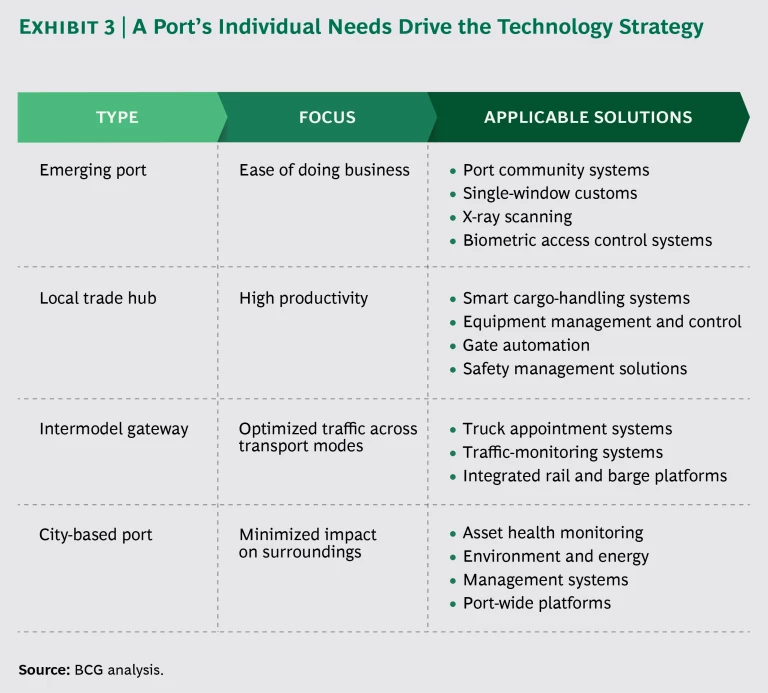

Ports have a wide variety of smart-port technologies to choose from, but the key strategic issues they face should guide the selection process. For example, an individual port’s needs can be driven by its location, role in trade, or level of competition. The needs of local gateway ports whose trade is limited to nearby hinterlands are different from intermodal gateway ports where cargo travels to and from remote areas by rail or barge. The requirements of both differ from those of transshipment hubs, where most cargo stays within the port. Other factors influence ports’ needs, including size, level of maturity, and how much competition they face from surrounding ports. (See Exhibit 3.)

Emerging ports need technology that makes it easier to do business. Rapidly developing economies are building new ports to keep up with strong trade growth. Many of these new ports compete with or aim to overcome limits of legacy ports. Modern infrastructure gives them the chance to offer greater capacity and to incorporate smart technologies while facilities are being built. Because attracting more cargo is a likely priority, these ports would benefit from adopting smart-port technologies that make them easy to work with. Those technologies include port communications systems and single-window customs systems that simplify information exchange among stakeholders. Other systems that make doing business easier include biometric access control systems and cargo-scanning tools that streamline customs processing.

Local trade hubs in rapidly developing economies can benefit from improved productivity. In many parts of sub-Saharan Africa, Asia, and South America, established ports are the dominant gateways for local trade to and from the country or region. It is, therefore, critically important that these ports operate as efficiently as possible to reduce costs and keep local exports competitive. Terminals in these ports must deal with ever-growing cargo volumes and vessel sizes. To stay ahead of demand, they would benefit from smart-port technologies that improve cargo-handling volume and productivity. Some of these technologies include equipment-tracking and control systems, such as the Smart, Energy-Efficient and Adaptive Management System (SEAMS) and black-box solution that the Port of Valencia developed to identify and manage operational bottlenecks in real time. For these ports, maintaining smooth links with the hinterlands is vital to lowering trade costs. Because many of these ports transport cargo by road, gate automation and truck appointment systems can speed up the flow of inbound and outbound traffic.

Large intermodal gateway ports need to optimize traffic across transportation modes. Intermodal gateway ports in developed markets such as China, Northern Europe, and North America convey substantial amounts of cargo to and from distant hinterlands. Most of these ports are located on high-volume trade routes and handle ultralarge vessels whose massive loads can lead to yard and intermodal congestion. These ports can differentiate themselves by using smart-port technologies that manage intermodal traffic effectively to control logistics and associated costs. More and more ports are doing this is by implementing truck appointment systems. While some have created single-terminal appointment systems, ports in Singapore and Australia have found that port-wide platforms are even more effective. Similarly, integrated intermodal systems that encompass rail and barge connections are cost-effective. The Port of Hamburg is creating such a rail logistics platform, embedding sensors that monitor the condition of its rail infrastructure.

Major city-based ports need to operate sustainably to minimize their environmental impact. In addition to dealing with the challenges that confront midsize and large ports, leading global ports located in major urban areas such as Shanghai, Hamburg, Singapore, New York, and Los Angeles must be conscientious stewards of the environment, minimizing the pollution, noise, and traffic they create for their urban neighbors. For a major port and city to coexist as sustainably as possible, ports must monitor and reduce the local environmental impact of moving vast amounts of cargo. Smart-port technologies can help manage the wear and tear and environmental impact of cargo-related traffic on city roads and infrastructure and meet increasingly stringent safety and security requirements. Among the technologies are those that have been adopted by ports in Singapore and Hamburg to monitor traffic on port access roads. Other technologies monitor air and water pollution, employing a network of sensors like the system in the Port of Rotterdam. Still others use drones. Data these systems generate can be fed into port-wide platforms that aggregate and share information among port stakeholders. At ports in Hamburg and Antwerp, for example, such data platforms create additional operating efficiencies across the port ecosystem and are potential sources of data-enabled services for port users.

New Technologies Can Generate New Services and Revenues

Although most smart-port technologies’ benefits are results of helping port authorities and their partners cut costs and operate more efficiently, the systems can also generate new data-based services and revenue streams. Ports and their partners can sell these services to a cross section of potential customers, including trucking carriers, terminal operators, logistics parks, container depots, and commodities traders.

Terminal operators and container depots in Australia were among the first to generate new revenue by offering digital services to, for example, trucking companies that were outside their traditional customer base. Australian container terminals and depots created truck appointment systems that reduced truck congestion and shrank truck turn times from hours to minutes. Because the systems improved productivity, trucking carriers were willing to pay a moderate booking fee to use them. In Singapore, truckers have improved their efficiency by using an in-cabin smartphone system to exchange information with the terminal and container depots. The same system provides port-wide real-time container-tracking services that cargo owners can use to monitor a container’s location anywhere in the region.

Smart-port data is another potential revenue source. When it’s complete, the SmartPORT community platform of the Port of Hamburg will use a network of sensors to track infrastructure, traffic, and vessel and cargo movement data that can be sold to third parties. The Port of Antwerp and a commercial partner created a data exchange platform that compiles and analyzes data from shipping and freight companies, warehouses, customs brokers, and other port constituents. The partners plan to monetize the data, which includes ship arrival times, container weights, collection times, and transport instructions. Such information can help individual users reduce costs through better planning. In addition to providing additional income, the service will improve logistics and lower truck exhaust at one of Europe’s busiest ports: it reduces the number of containers in depots by matching the empties with customers in immediate need of containers for their loads.

How to Implement Smart-Port Solutions

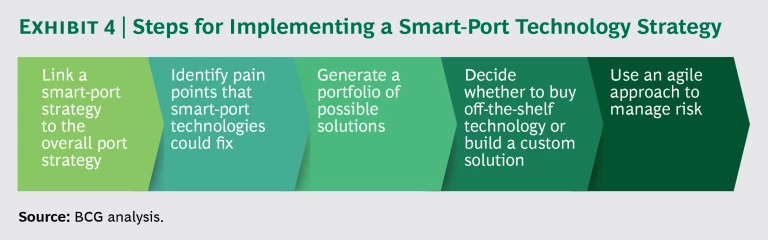

The market is overflowing with smart-port technologies. While many of the technologies seem universally applicable, ports are unique. It is, therefore, critical to choose tools that provide the most value for the investment. To maximize return, investors should focus on a limited subset of applications. We recommend taking the following actions that can clarify which smart-port technologies to choose and how to implement them with the least risk. (See Exhibit 4.)

Link a smart-port strategy to the overall port strategy. Technology strategy doesn’t exist in a bubble. An upgrade needs to dovetail with a port’s larger strategy and goals, whether those goals include finding extra capacity in existing assets, reducing operating costs to improve the bottom line, increasing market share by being more convenient than neighboring ports, or using data-based services to generate additional revenues. Because a smart-port technology plan must be firmly anchored to a larger strategy, top management must spearhead the effort rather than delegate it to the head of the port technology or the IT department.

Ports that haven’t already mapped out an overarching strategy can create one by benchmarking performance against competitors, analyzing operations and market share. This process should include examining such key parameters as total landed cost for trade, total cost of port calls for shipping lines, tariffs, vessel productivity, operating costs, and landside costs. Benchmarks can be applied for comparing the total cost of moving a container, including costs for vessel call, cargo handling, storage, and landside transportation. If the comparison shows cargo-handling costs are driving up overall container costs, the port could adopt technology for improving cargo-handling productivity. If the main difference is in higher costs for storage or landside transportation, the greatest return could come from adding technology that improves yard congestion or truck waiting and turn times.

In addition to gathering data points and modeling economic drivers, ports can ask partners to describe problems that they think should be resolved. Collecting quantitative and qualitative data is time-consuming, but the result can be an overall strategy and smart-port efforts that are headed in the right direction.

Identify pain points that smart-port technologies could fix. After identifying areas that need improvement, pinpoint the sources of problems and gaps. Most problems are either structural, pertaining to some physical operation, or behavioral, caused by port users’ preferences for doing things in certain ways.

Most structural problems are related to inefficient cargo handling. To uncover structural problems, ports need to determine how existing processes are set up. Such diagnostic tools as time and motion studies, bottleneck analyses, and process defect analyses can unearth structural inefficiencies and prompt ideas for remedying them with smart-port technologies.

Behavioral problems are harder to solve because they’re rooted in people’s actions. For example, traffic congestion outside a port could stem from poor coordination of the trucks arriving to drop off or pick up containers and the availability of cargo the trucks will be loading or unloading. Ports can overcome behavioral problems by providing the means and incentives that encourage port users to act differently. In an environment with many users, aligning people’s behaviors with port goals can improve operating efficiency.

Ethnographic research, examining operations through the eyes of various port users, can identify behavioral problems. This research includes communicating with traditional port customers such as shipping lines and cargo owners, as well as logistics companies and trucking carriers. Interviews, surveys, and first-hand observations can help planners understand port users’ perceptions of trouble spots and their actions.

Once problems have been identified, ports need to prioritize them and determine which could be solved using smart-port technologies. To decide which problem to tackle first, ports should identify one for which it is realistic to expect a solution, determine how much value would be created by addressing it, and assess how well the solution aligns with the smart-port vision and strategic objectives.

Generate a portfolio of possible solutions. After identifying underlying structural and behavioral problems, ports should research available smart-port technologies that could fix them. An abundance of possibilities means that there are multiple options for solving every problem. To reduce truck traffic congestion, ports could install fixed road sensors that collect and share real-time traffic flow information and can be used for optimizing algorithms. Alternatively, they could track the whereabouts of individual trucks, using a system that picks up GPS signals from drivers’ mobile devices and have that data feed algorithms. Both options have distinct pros and cons that should be evaluated and tested to determine which approach would be the best fit in a specific situation.

Another example is off-the-shelf license plate recognition technology that automatically identifies trucks as they pass through port or terminal gates. Such technology is widely used in Europe and the US but is not the best solution for other regions, including India, where individual states use different license plate types, and trucks moving goods between ports regularly cross state borders. In such situations, RFID tags would be a better solution.

In researching available smart-port technology solutions, ports should see what other ports have done to solve similar problems. They should, however, be aware that because each port has its own operating models and challenges, solutions that work for one may not work for another.

To increase the chance of achieving a desired outcome, a port should create a portfolio of solutions that address related problems. As mentioned above, the Port of Hamburg is considering multiple solutions for addressing road congestion—including a virtual-depot project to reduce the number of times that trucks move empty containers—and using sensors to measure and provide real-time data on traffic flow and conditions.

Decide whether to buy off-the-shelf technology or build a custom solution. After deciding which issues to tackle, how to approach them, and which technologies could help, a port needs to determine whether off-the-shelf tech solutions meet its goals or if developing a system in-house or with the help of an outside partner is the best way to go. In many situations, existing technology is the fastest option, especially for less technologically advanced ports. But there are tradeoffs, including limits on what off-the-shelf systems can do and how well they can be integrated into existing port applications. Also, because off-the-shelf solutions are widely available, competitors may use the same systems.

To gain a competitive advantage, ports can work with technology vendors and consultants to develop proprietary technology. Creating a custom solution doesn’t necessarily mean writing code from scratch. It’s possible to customize off-the-shelf applications in a way that fits a port’s unique situation but is difficult for competitors to replicate. When deciding which smart-port technologies to build rather than buy, a port should prioritize systems that set it apart from the competition, saving off-the-shelf systems for less critical solutions that bring the port up to par. Acquiring or partnering with small digital startups might also be an option. Rotterdam and Singapore are among the leading ports worldwide that have taken this approach.

Use an agile approach to manage risk. Adopting any kind of a smart-port technology involves risk. Software can be buggy. Once installed, it might not function as expected, or the intended users might resist switching to the new system. Installing it might cost more than expected, and it could fail to produce the anticipated ROI as soon as expected. Implementation of smart-port technologies such as sensor networks, automated terminals, and appointment systems is expensive, complex, and disruptive—a fact that is supported by the experiences of multiple ports whose technology upgrades couldn’t match productivity levels of existing systems immediately after going live. To minimize risk, ports should implement new systems in stages, agreeing to make a formal go/no go decision after each step. It’s a good idea to test the riskiest aspect of a solution first. If it works, it’s a good indication that any additional risks can be addressed, making it safe to proceed to the next stage.

Another way to minimize risk is to use the concept of the minimum viable product to build the smallest possible version of a solution and test it in real time before adding features or users. A small pilot can also test potential users’ willingness to adopt a solution and, experimenting with user incentives, can indicate what works best. A small pilot allows for testing a solution in real time and making sure that everything required for the system or service to function properly is in place.

Just as the Panama Canal revolutionized global trade at the turn of the 20th century and stowing cargo in steel containers ushered in the modern era of shipping, connected smart-port technologies are launching the industry into the digital age. Ports worldwide—from small ports in emerging economies to the world’s biggest trading hubs—must adopt smart-port technologies to become more productive and efficient, provide better customer service, and create new revenue streams. Those that don’t move forward risk being overtaken by competitors that make the most of smart-port technologies. An overabundance of options can make deciding where to start a daunting task. For that reason, identifying gaps and problem areas that need fixing is a good starting point.